BoJo Wins First Vote On Bill To Modify Brexit Deal, Infuriating Brussels

Tyler Durden

Mon, 09/14/2020 – 17:49

Prime Minister Boris Johnson has effectively placed Britain on the path to an “Australia-style” trade arrangement with the EU after his “intermarket bill” – which has been criticized for effectively overriding parts of the UK-EU withdrawal treaty – passed its first important procedural vote in the House of Commons Monday.

Passage has opened the door to a messier exit from the EU for Britain, while also raising the possibility that a “hard” border could return to the island of Ireland separating Northern Ireland from the Republic of Ireland (an EU member state). Many fear that could lead to a revival of sectarian violence in a return to “the troubles”.

Though cable’s reaction to the news was relatively muted, investors are now faced with the likelihood that the EU27 will walk away from negotiations, as they have threatened to do. Brussels has also threatened legal action against London should the bill move forward.

The new bill, which had its first reading on Wednesday, outlines a new “safety net” of rules for trade between England, Scotland, Wales and Northern Ireland to prevent disruption to the internal market inside the UK, even in the event that Britain and the EU do not reach a comprehensive trade agreement by the end of 2020. The bill would ensure there will be no new checks on goods moving from Northern Ireland to the rest of the UK, and gives Parliament the power to “disapply” rules relating to the movement of goods. It also specifically states that provisions in the law will override parts of the withdrawal agreement, where applicable.

The bill will now pass on to its 2nd reading after a vote of 340 vs 263. Following the second reading is the final vote to make the bill into legislation. Though, as ITV’s Paul Brand points out, a large number of abstentions in this vote suggests the bill could face tougher votes in the future.

BREAKING: MPs vote for the Internal Market Bill to progress to next stage, despite concerns it could break international law.

AYEs 340

NOEs 263Seems there were a fair few abstentions – suggests there may be a closer fight over next week’s amendments.

— Paul Brand (@PaulBrandITV) September 14, 2020

Once again, Johnson was credited with putting down a “conservative rebellion” , according to a report published a few hours ago by the FT, as more MPs fret over Johnson’s confrontational style, which has infuriated the UK’s former continental partners.

Source: Bloomberg

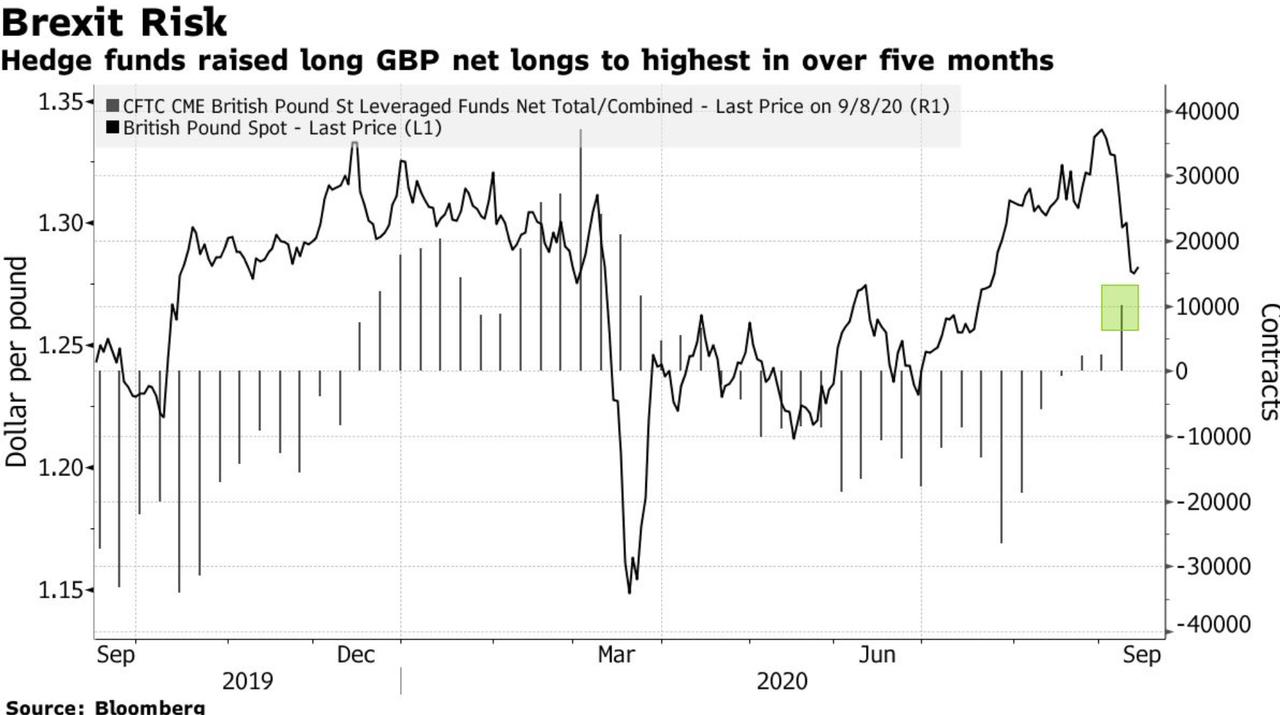

Importantly, the vote comes just as hedge funds turned the most bullish they’ve been in five months, Bloomberg reports.

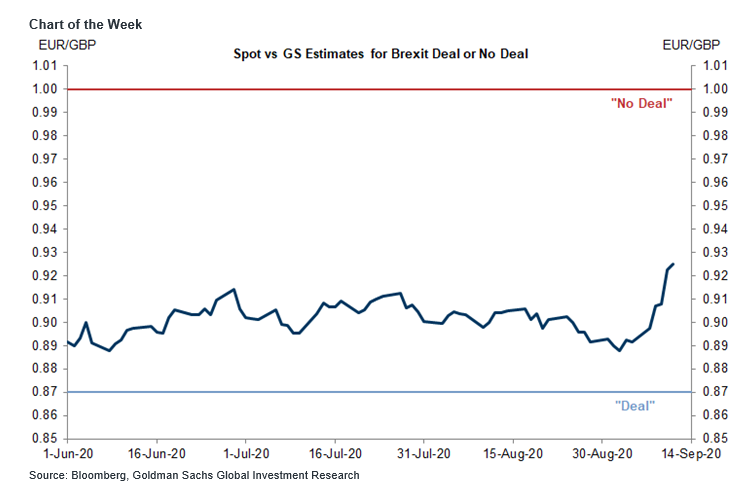

A team of Goldman FX analysts said in a note to clients that the market is currently pricing in a 40-45% chance of the “no deal” Brexit outcome. The team says it sees potential long-term upside for any traders able to persevere through some short-term volatility, since “beyond the very short-term we would see meaningfully lower odds of a ‘no deal’ Brexit than the market appears to be implying,

the bank said.

They argued that while a “no deal” scenario would ultimately be bad for Britain’s economy, Johnson has often favored such tough negotiating tactics in the past. In the end, Goldman believes, a trade deal is still the most likely outcome, which could send the pound to 87 pence to the euro.

via ZeroHedge News https://ift.tt/2Fm5fch Tyler Durden