Nikola Slides On Report SEC Is Examining Hindenburg’s Fraud Allegations

Tyler Durden

Mon, 09/14/2020 – 17:08

In a rollercoaster day for Nikola, the company’s shares slumped after the close following a Bloomberg report that the SEC has started an examination of the company to “assess the merits” of Hindenburg’s allegations that the company is an “intricate fraud.” The news sent NKLA shares down 4% after hours.

Ironically, this means that the company’s founder, Trevor Milton, has gotten his wish: on Monday, Nikola pulled a Wirecard and encouraged the laughably toothless SEC to get involved to settle the report claims, perhaps hoping that the SEC would pull a “Tesla” and find nothing terminally wrong.

As reported previously, the Phoenix-based company said it reached out to the SEC to discuss its issues with the Hindenburg report, and ultimately held a call with agency officials on the morning of Sept. 11. Nikola says Hindenburg was attempting to profit from a “manufactured decline” in its share price.

“Nikola has contacted and briefed the U.S. Securities and Exchange Commission regarding Nikola’s concerns pertaining to the Hindenburg report,” the company said in a Monday statement. “Nikola intends to fully cooperate with the SEC regarding its inquiry into these matters.”

In a lengthy report on Sept. 10 Hindenburg Research compared Nikola to Theranos, calling it an “intricate fraud” which overstated the capabilities of its earliest test trucks among many other allegations. Nikola pushed back, accusing the short seller of making misleading statements that were designed to manipulate its shares.

The feud prompted the SEC to examine Hindenburg’s claims to determine whether Nikola may have violated securities laws, said Bloomberg’s anonymous sources.

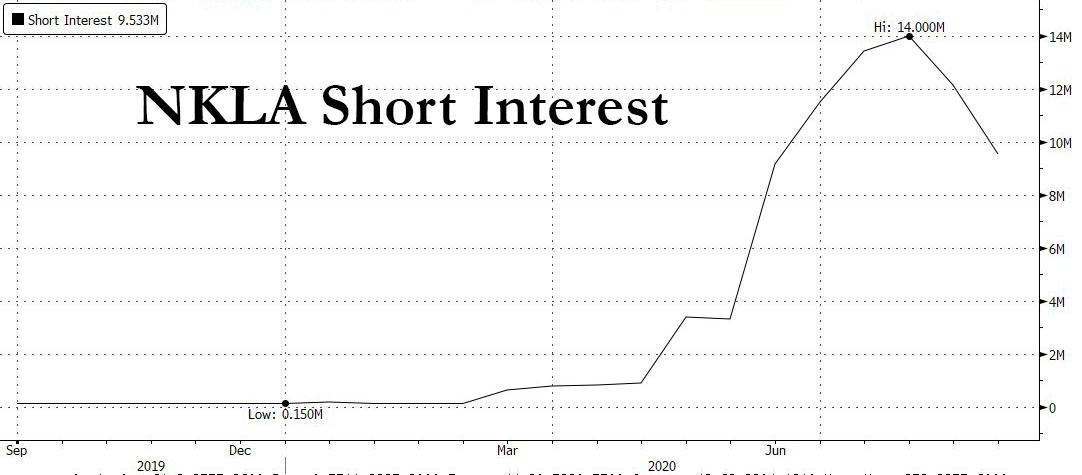

The regulator’s review is preliminary and may not lead to allegations of wrongdoing according to Bloomberg; according to us the most likely outcome – if one judges how the SEC has handled Tesla – is something between Herbalife and Wirecard, where the SEC finds one or more wrist-slappable violations but nothing terminal, “punishes” the company with a modest fine, and everyone moves on sparking a furious short squeeze as those betting on a catastrophic plunge in the stock are forced to cover.

Furthermore, with GM involved and Mary Barra vouching today for the company’s due diligence in Nikola, it is unlikely that the SEC will dare to end Barra’s career, destroy Nikola and ruin hundreds of thousands of Robinhood traders who have been busy buying the dip in the alleged fraud.

The one positive outcome to come from all of this is that if and when the SEC slaps Nikola with a modest fine, it will be officially time to declare that the SEC is now hopelessly captured and will allow frauds to persist with little concern for long-term capital markets implications… similar to what the German regulator Bafin did amid a chorus of allegations that Wirecard was a fraud when instead of ending the charade, Bafin instead lashed out at the shorts and skeptical voices.

via ZeroHedge News https://ift.tt/33tL5EV Tyler Durden