Small Caps, Big-Tech, & Bullion Bounce As Dollar Dives

Tyler Durden

Mon, 09/14/2020 – 16:03

The ‘Rick Astley’ market is back… “Never gonna let you down”…

Another day, another short-squeeze (“most shorted” stocks rose 3% on the day, erasing the losses from Thursday and Friday)…

Source: Bloomberg

Which explains why Small Caps outperformed so handsomely. Note how everything went turbo higher at the cash open (interesting that small-caps and Nasdaq diverged notably at the European close). As we neared the close, the ubiquitous buying panic reasserted itself (for absolutely no good reason at all)…

Nasdaq tagged its high stops from Friday then faded…

Nasdaq, S&P, and Russell 2000 all bounced off their 50DMAs…

But, as Bloomberg notes, European equities are waiting for their next catalyst, having been stuck in a tight range since mid-June with the Stoxx Europe 600 Index unable to pierce above its 200-day moving average.

Source: Bloomberg

While the benchmark has stalled below this ceiling, European equities have been relatively immune to the U.S. tech selloff this month. Improvement on the macroeconomic or the virus front may be needed to create momentum.

Exxon is down 10 days in a row…

Very odd day overall with the opening panic being entirely erased in momo/value…

Source: Bloomberg

Seems like the European close triggered an end to it…

Source: Bloomberg

The US Tech sector surged at the cash open, then faded…

Source: Bloomberg

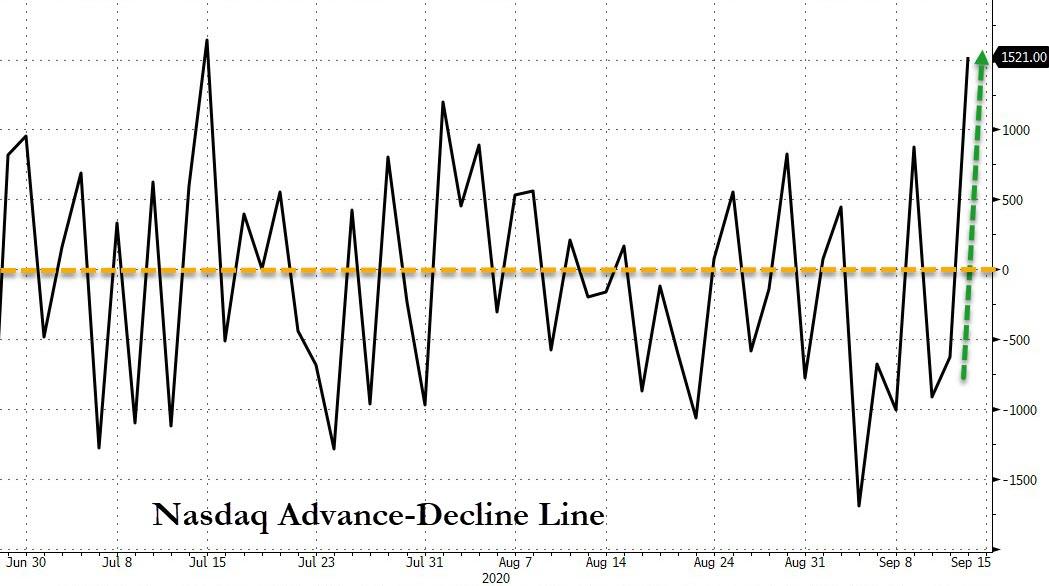

Stocks saw extremely positive breadth today with advancers dominating decliners..

Source: Bloomberg

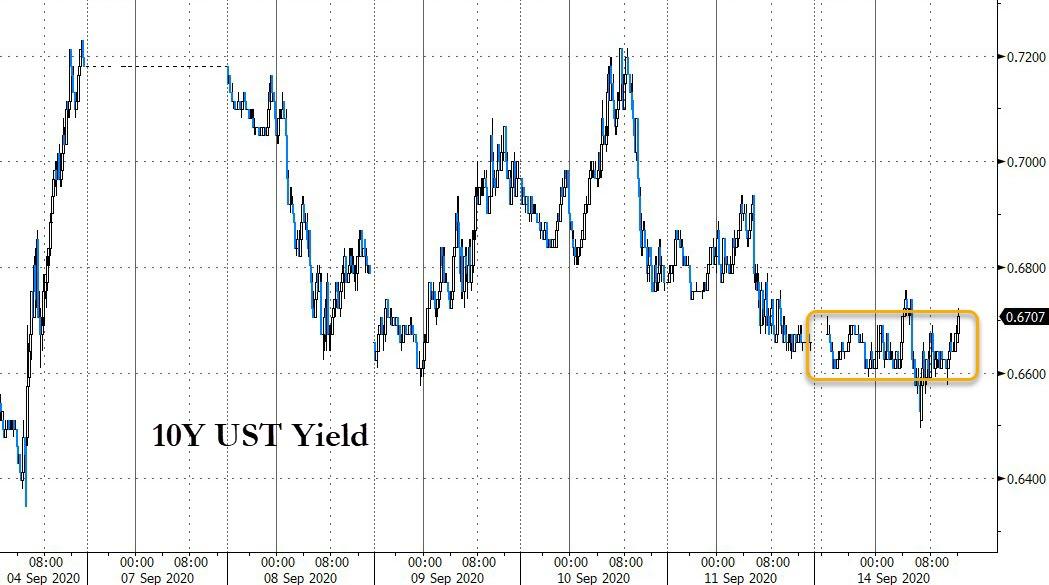

Treasuries traded in an extremely narrow range…

Source: Bloomberg

With 10Y stalled around 67bps…

Source: Bloomberg

The Dollar dived to what appears to be notable support from last week…

Source: Bloomberg

Mixed bag in Cryptos with Bitcoin best and Litecoin underwater…

Source: Bloomberg

Gold futures bounced off $1950 once again…

Silver outperformed, pushing back above $27 once again…

WTI chopped around between $37 and $38, ending the day marginally lower…

Finally, in case you were wondering where the ammo came from to squeeze the shorts, it’s simple. As Bloomberg notes, hedge funds have turned the most negative on U.S. technology stocks in more than a year and half as the sector’s high-flying rally comes to a screeching halt.

Source: Bloomberg

Speculative positions in Nasdaq 100 mini futures flipped from net long to short and slumped to the most bearish since March 2019, according to the latest Commodity Futures Trading Commission data. The tech-heavy gauge just posted its worst week since March amid a recent reassessment of valuations and volatility in the options markets.

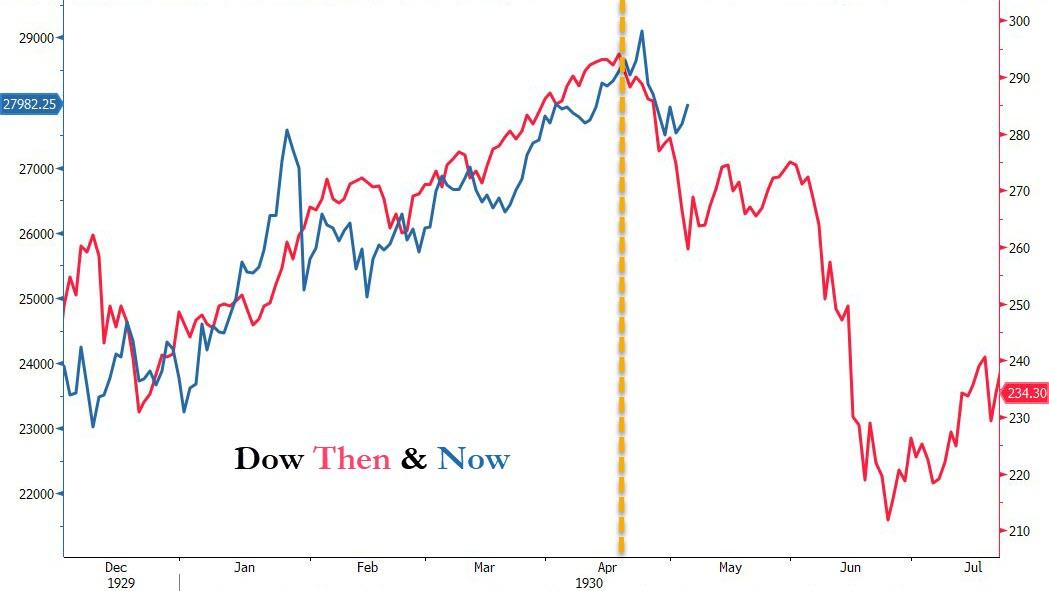

And of course, the 1930s analog remains…

Source: Bloomberg

via ZeroHedge News https://ift.tt/3mhTx2O Tyler Durden