Biden’s Multi-Trillion-Dollar Budget Is The Biggest Increase In Decades

Tyler Durden

Tue, 09/15/2020 – 15:42

Authored by Mike Shedlock via MishTalk,

Biden unleashed his budget plans. Let’s have a look.

Biden Hones Multi-Trillion-Dollar Budget

Biden rejected progressive spending plans but now Hones Multi-Trillion-Dollar Budget

Joe Biden won the Democratic presidential nomination running as a moderate, rejecting the big-government plans of progressive rivals as unaffordable.

The former vice president has proposed a total of $5.4 trillion in new spending over the next 10 years, according to an analysis published Monday by the Penn Wharton Budget Model, a nonpartisan group at the University of Pennsylvania’s Wharton School. That includes historically high allocations for sectors from education and health to child-care and housing.

Mr. Biden’s proposed budget is more than double that of Hillary Clinton, the 2016 Democratic nominee. It is a fraction of the $30 trillion to $50 trillion spending plans that progressive Sens. Bernie Sanders and Elizabeth Warren laid out during the Democratic primary. But since effectively sealing the nomination in March, Mr. Biden’s plan has grown in response to the pandemic, the lockdowns, and the resulting recession.

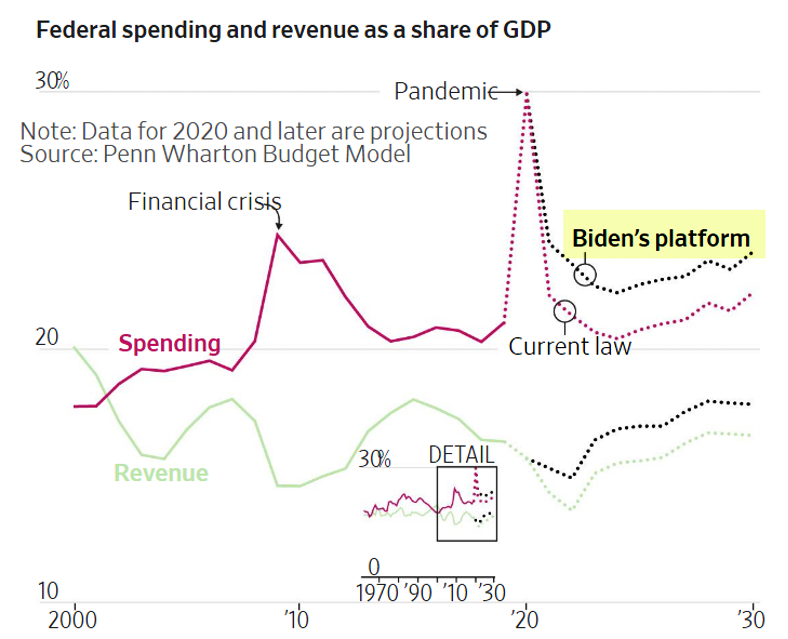

Federal Spending as a Share of GDP

Penn Wharton Budget Model Key Points

-

Over fiscal years 2021 – 2030, the Biden platform would raise $3.375 trillion in new tax revenue while increasing spending by $5.35 trillion.

-

Under the Biden tax plan, households with adjusted gross income (AGI) of $400,000 per year or less would not see their taxes increase directly but would see lower investment returns and wages as a result of corporate tax increases. Those with AGI at or below $400,000 would see an average decrease in after-tax income of 0.9 percent under the Biden tax plan, compared to a decrease of 17.7 percent for those with AGI above $400,000 (the top 1.5 percent).

-

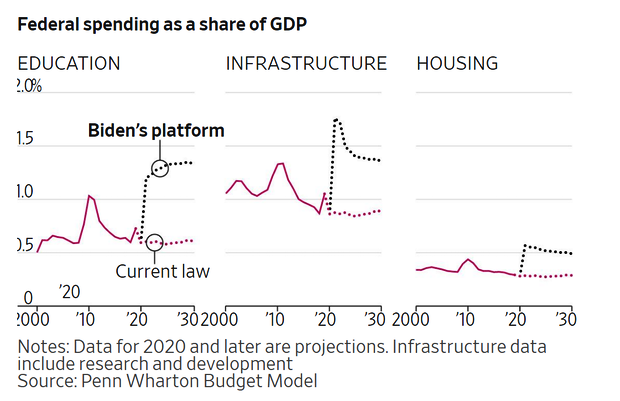

The largest areas of new net spending are education at $1.9 trillion over ten years and infrastructure and R&D at $1.6 trillion over ten years.

In total, including macroeconomic and health effects, the Biden platform increases federal debt by 0.1 percent in 2030 before decreasing debt by 1.9 percent in 2040 and 6.1 percent in 2050; GDP decreases by 0.4 percent in 2030, sees no change in 2040, and increases by 0.8 percent in 2050.

Tax Plan

-

Implement a Social Security “Donut Hole”,

-

Repeal elements of the Tax Cuts and Jobs Act (TCJA) for high-income filers,

-

Raise the top rate on ordinary income,

-

Eliminate stepped-up basis,

-

Tax capital gains and dividends at ordinary rates,

-

Limit itemized deductions,

-

Raise the corporate tax rate,

-

Impose a minimum tax on corporate book income,

-

Raise the tax rate on foreign profits,

-

Eliminate fossil fuel subsidies,

-

Eliminate real estate loopholes,

-

Impose sanctions on tax havens.

Those provisions are described in detail in PWBM’s analyses of the Biden’s original tax plan and his updated tax plan.

Progressives Happy – For Now

Party progressives, meantime, are satisfied—for now. “Where Biden has moved is an important set of steps forward,” says Washington Democratic Rep. Pramila Jayapal, the co-chair of the Congressional Progressive Caucus. “Do we want more?” she says. “Absolutely.”

Regarding point 4 above, rest assured no federal debt decreases will ever happen and the deficit will be worse, no matter who wins.

And the Progressives will never be happy until they turn the US into a socialist mecca like Venezuela.

via ZeroHedge News https://ift.tt/3c2dpCg Tyler Durden