Foreigners Dump Record $54BN In Corporate Debt As Japan Treasury Holdings Surge To All Time High

Tyler Durden

Wed, 09/16/2020 – 16:36

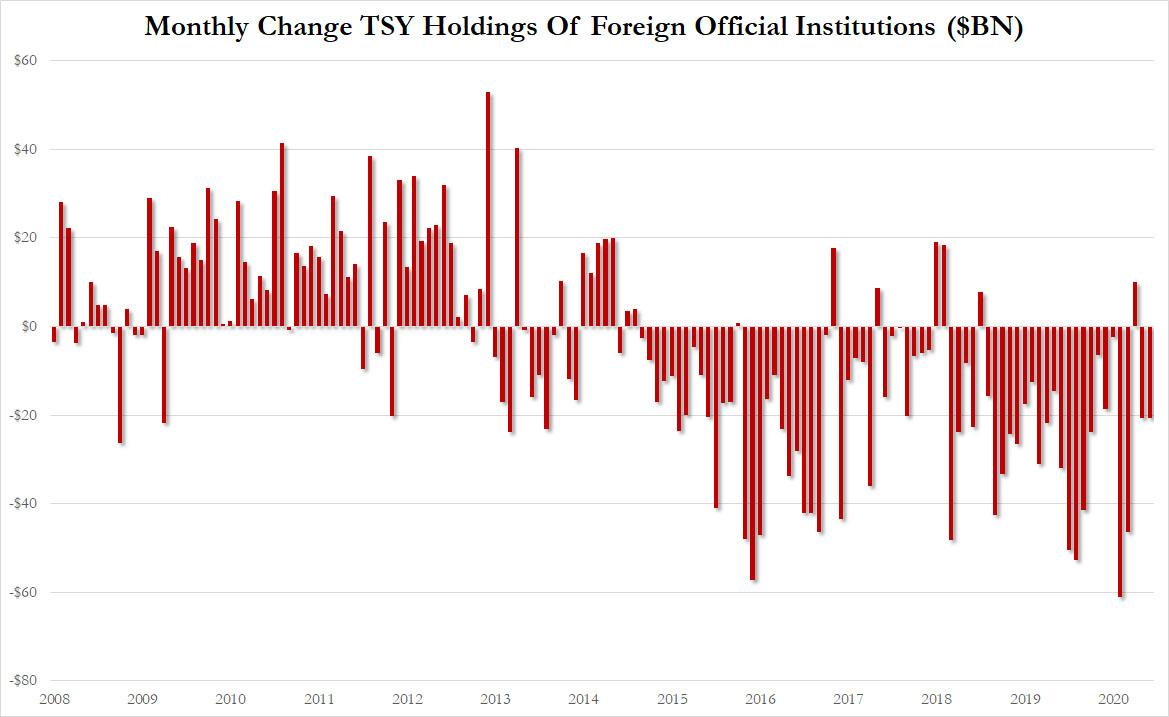

Foreigners resumed selling long-term US Treasuries in July, offloading $22.8 billion (after buying $28.9BN in June), in yet another spending spree led by foreign official institutions, i.e. central banks, SWFs and reserve managers, who sold $20.7 billion in July (as well as another $2.1 billion in private holdings), bringing their selling to 22 of the past 23 months.

Additionally:

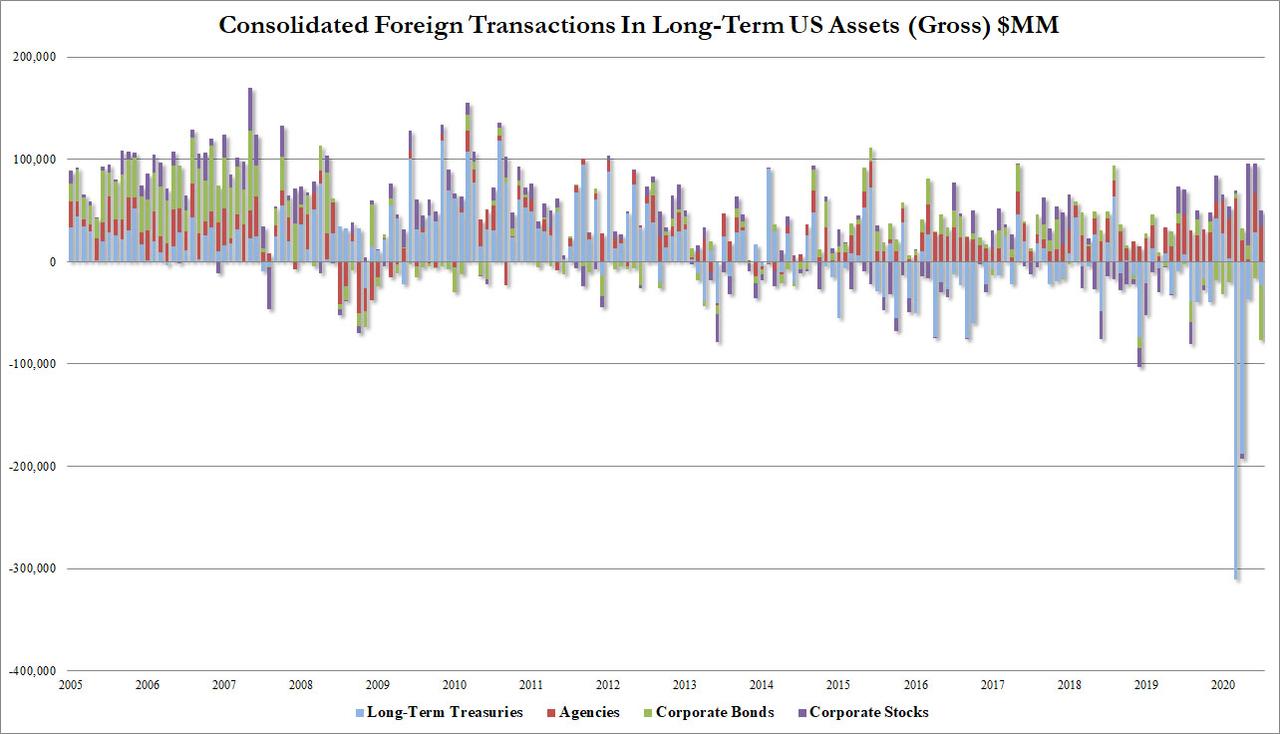

- Foreign net buying of equities eased to $16 billion in July, from $28.5 billion in June

- Foreign net buying of agency debt also dipped to $34.4 billion from at $38 billion

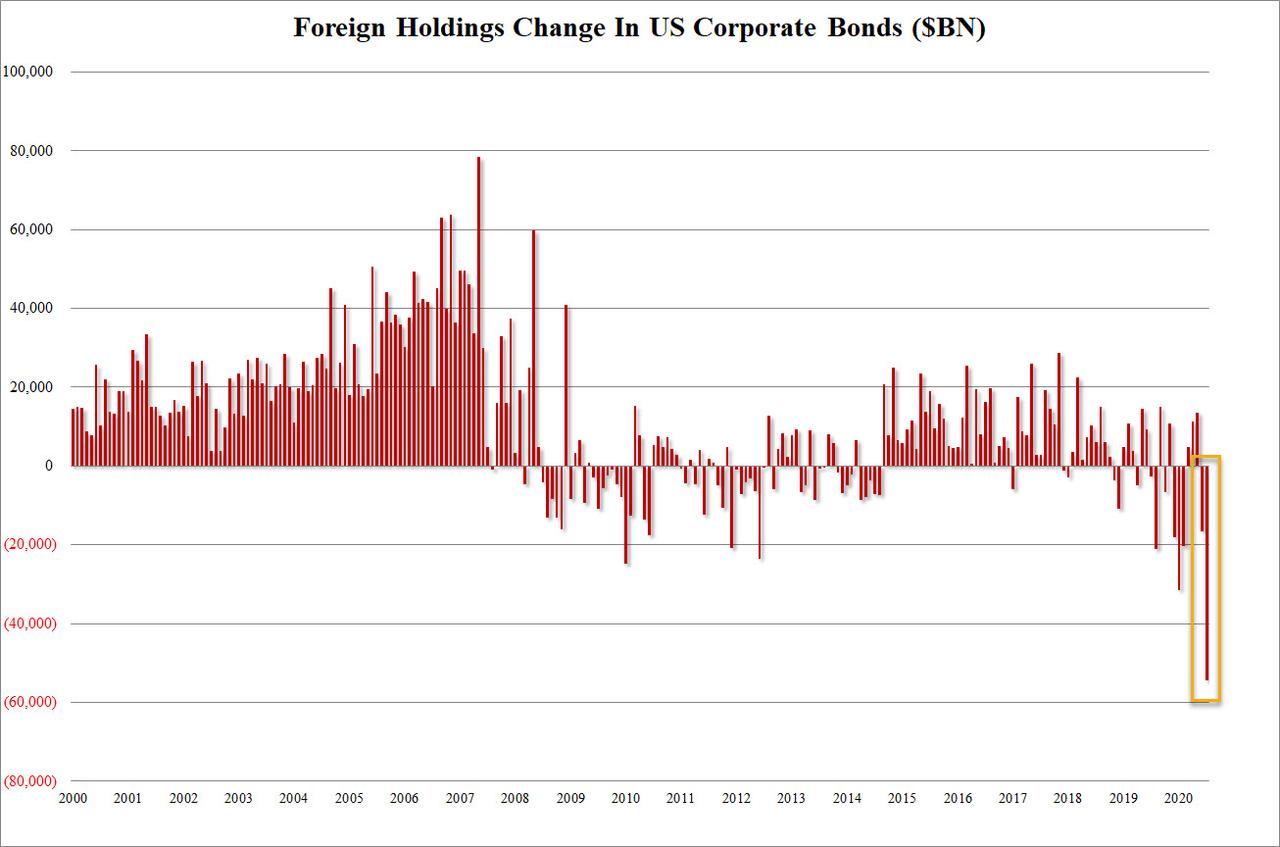

But the big surprise was the puke in foreign holdings of corporate debt, which plunged by a record $54.3 billion in July, the biggest monthly drop on record, following June’s more modest drop of $16.6 billion.

Between this record dump, and the record issuance of corporate debt in the primary market, one almost wonders where corporate bonds would be trading if the Fed wasn’t backstopping them.

In any case, aside from the record corporate bond liquidation, total foreign holdings were relatively stable and a far cry from the record selling in March and April.

Looking at individual countries, China continued to sell US paper, in July selling another $1 billion and bringing its total to $1.073 trillion, the lowest since April in the latest continuation of China’s dumping of US Treasurys.

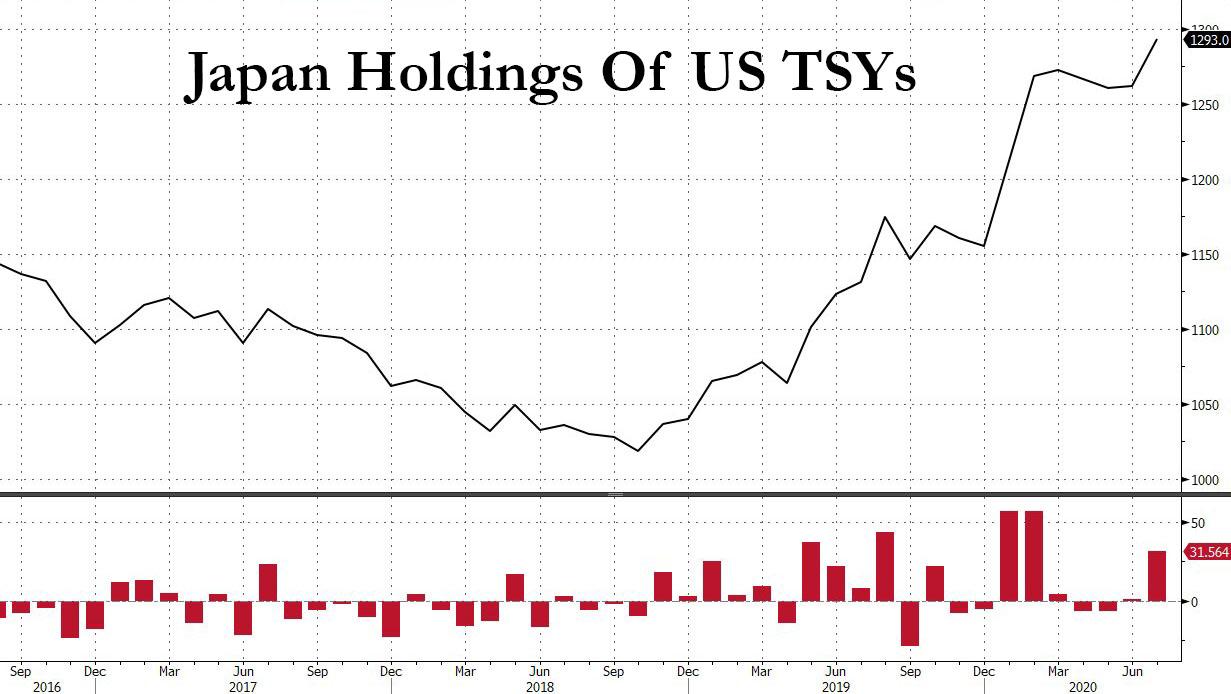

On the other end of the spectrum, Japan – which surpassed China as the largest US creditor last year – continued to buy Treasurys, adding $31.6 billion in July, the most since February, and bringing its total to a record $1.293 trillion.

Some other notable holders included Belgium, whose $211.9bn were a decrease of $6.8b; the Cayman Islands – traditionally a proxy for hedge funds – held $212.9b, a decrease of $9.1b from last month while Saudi Arabia took its $124.6b in TSY holdings $0.3bn from last month.

But the big trend of de-dollarization continues…

via ZeroHedge News https://ift.tt/3iCPoUN Tyler Durden