Trump Agrees With Powell: “Much Higher” Fiscal Stimulus Is Needed… And Why That Could Crash Stocks

Tyler Durden

Wed, 09/16/2020 – 23:18

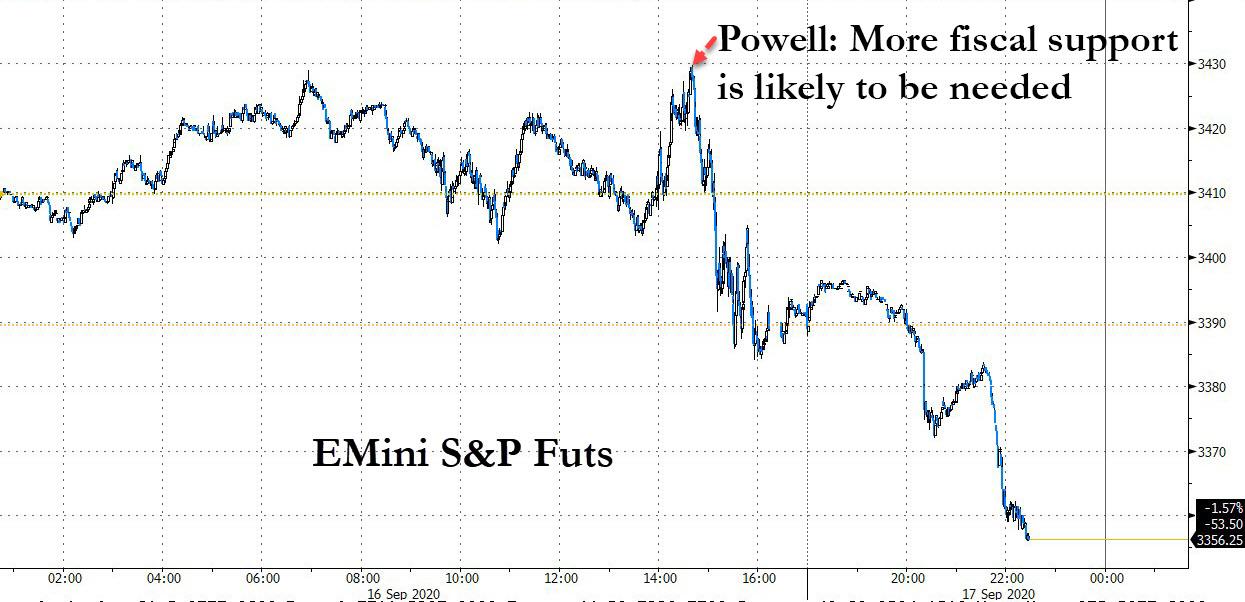

One can clearly see the moment the market’s mood reversed today during Powell’s FOMC press conference: it took place just as Powell warned that “more fiscal stimulus is likely to be needed”, noting that while the recovery has been faster than expected in the past 60 days, “there’s certainly a risk” the economy could slow without more stimulus. After all there are about 11 million people still out of work, small businesses are struggling and state and local governments have seen revenues drop (this is the same Fed that claimed that it is doing $120 billion in monthly QE for the benefit of US households).

Yet this is hardly the first time Powell has made that claim, in fact he has said on countless previous occasions that monetary policy alone would be insufficient (even though for the past 10 years until covid, monetary policy was in fact sufficient if nothing else than at least to push stocks higher), and that the Fed desperately needs Congress to unlock trillions in fiscal stimulus.

Why was this time different? Because in a curious schism within the republican party earlier in the day, none other than president Trump split ranks with the “conservative” republican senators when the White House gave a clear indication on Wednesday that it is willing to increase its pandemic-relief offer in talks with Democrats and that Senate Republicans should go along in order to seal a stimulus deal in the next week to 10 days. After all elections are coming, and Trump desperately needs to talk up the economy – what better way than to flood the middle-class with another trillion. Or $1.5 trillion to be exact.

Trump’s Chief of Staff Mark Meadows said the President is open to the compromise $1.5 trillion stimulus proposal from a bipartisan group of House lawmakers that was an effort to break a months-long deadlock over bolstering the U.S. economy amid the coronavirus pandemic.

Trump himself took to his favorite medium on Wednesday morning, and when he had a clear message for Senate republicans: “Go for the much higher numbers, Republicans, it all comes back to the USA anyway.”

Democrats are “heartless”. They don’t want to give STIMULUS PAYMENTS to people who desperately need the money, and whose fault it was NOT that the plague came in from China. Go for the much higher numbers, Republicans, it all comes back to the USA anyway (one way or another!).

— Donald J. Trump (@realDonaldTrump) September 16, 2020

Then on Wednesday evening, during a White House press conference on Wednesday Trump repeated that he liked “the larger numbers” in a compromise $1.5 trillion stimulus proposal from a bipartisan group of House lawmakers that tried (and so far failed) to break a months-long deadlock over bolstering the U.S. economy.

“I agree with a lot of it,” Trump said of the plan. “I heard Nancy Pelosi say she doesn’t want to leave until we have an agreement” and “she’s come a long way.” It’s remarkable how quickly Trump ended up siding with “Crazy Nancy.”

However, even that compromise number – which was about $1 trillion more than the latest official republican proposal – was not be high enough for Nancy Pelosi who called it insufficient, while Senator John Thune of South Dakota, the chamber’s second-ranking Republican, said that large a stimulus would cause “a lot of heartburn” among GOP lawmakers.

After initially proposing a $1 trillion stimulus at the end of July, Senate Republicans attempted to advance a bill providing $650 billion in economic aid, without the direct payments to individuals that the president – and Democrats – want. Naturally, getting thrown under the bus by the president, has left quite a few of the Republicans startled and confused, as Bloomberg reports:

Trump’s new push for a deal highlights continuing divisions among Republicans, some of whom are reluctant to spend more money on stimulus with the national deficit reaching $3.3 trillion this year.

Missouri Republican Senator Roy Blunt said a number higher than $1 trillion could be the basis for an agreement, if it can be done quickly.

“I think there is a deal to be had here,” he told reporters at the Capitol. “My concern is that the window probably closes around the end of this month. And we need to get busy finding out what we can all agree on.”

But other senators resisted the idea.

Ron Johnson of Wisconsin said the Senate GOP bill, which costs about $300 billion when its cuts to Federal Reserve loan authority are counted, is the right amount.

“The president has his opinion. We have ours,” he told reporters.

At the same time, Democrats are understandably playing hardball. House Majority Leader Steny Hoyer said on Tuesday that Democrats shouldn’t agree to less than $2 trillion. A group of House Democratic chairmen issued a statement criticizing the Problem Solvers proposal as inadequate. Pelosi earlier on MSNBC Wednesday reinforced her demand for $2.2 trillion.

And at this rate, Trump may demand a $2+ trillion stimulus as well.

Yet even as the Democrats continued the charade – knowing well they won’t concede to a major Trump poll-boosting stimulus just 48 days before the election – Pelosi and Chuck Schumer took a victory lap and released a statement saying they were “encouraged” by Trump’s endorsement of higher spending. “We look forward to hearing from the president’s negotiators that they will finally meet us halfway,” they said.

And so did Powell, who by now has realized that the Fed is hopeless in sparking the much needed inflation (that the Fed needs to inflate away the debt), and instead is punting to Congress, whose direct stimulus funds have a far higher chance to spark the much desired reflationary wave.

The problem, as the market made it very clear, is that whereas continued deadlock in Congress – with Trump backing Republicans – would mean more monetary stimulus, another $1.5 or $2 trillion in fiscal stimulus actually stands a good chance of generating a sharp (albeit fleeting) reflationary episode. And since the Fed will be there to monetize all the newly issued debt to pay for all this stimulus it’s win-win (for everyone but the US debt which is now exploding at a record pace that has surpassed World War II). In fact, as Bank of America’s Michael Hartnett said last week, a $1.5-$2 trillion fiscal stimulus deal, coupled with an October vaccine represents the “most dangerous combo for Treasury and equity bulls” and represents “a messy inflection handoff to higher rates, inflation & inflation assets.” In the process, such deflationary assets as tech stocks and Treasurys would get clobbered, something we are already seeing this evening as the Nasdaq slides amid fears that fiscal stimulus-driven inflation may indeed be coming.

As a further reminder, BofA is merely the latest voice to caution that a transition from a Nasdaq-led market to a “value” driven one will not come without major market turbulence, with Morgan Stanley and Goldman both warning previously that a deflation to reflation rotation would lead to turmoil.

But what we find especially paradoxical is that Trump – who has repeatedly touted the repeated records in the stock market as the most objective scorecard of his presidency – is now pushing for precisely the two events, along with an accelerated vaccine, that could catalyze a sharp market correction, if not far worse. In effect, Trump is willing to sacrifice a major market drop in exchange for direct stimulus handouts and the hope that a covid vaccine is here (which is also paradoxical, since most Trump supporters will refuse to be vaccinated).

We doubt that Trump has realized just what the tradeoffs are in his latest position flip-flop, although if the president indeed sided with the Democrats in seeking a far greater stimulus over that proposed by Senate republicans, the November election outcome will almost certainly be the one that Democrats desire as well.

via ZeroHedge News https://ift.tt/2ZH5NQz Tyler Durden