Record Numbers Of Companies Drown In Debt To Pay Dividends To Their Private Equity Owners

Tyler Durden

Sun, 09/20/2020 – 19:10

One week ago we used Bloomberg data to report that in the latest Fed-fuelled bubble to sweep the market, now with Powell buying corporate bonds and ETFs, private equity firms were instructing their junk-rated portfolio companies to get even deeper in debt and issue secured loans, using the proceeds to pay dividends to owners: the same private equity companies. Specifically, we focused on five deals marketed at the start of the month to fund shareholder dividends, which accounting for half of the week’s volume, and the most in a week since 2017, according to Bloomberg.

Now, a little over a week late, the FT is also looking at these dividend recap deals which have become all the rage in the loan market in recent weeks, among other reasons because they are “ringing alarm bells since they come on top of already high leverage and weak investor protections and against a backdrop of economic uncertainty.”

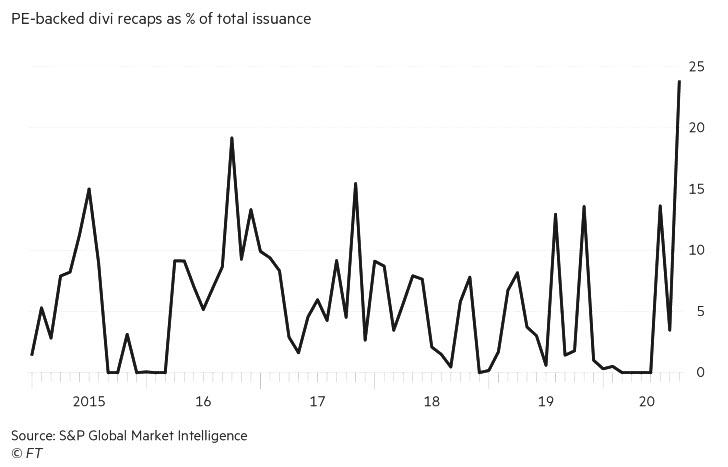

Having updated our calculation, the FT finds that in September a quarter (24% to be exact) of all new money raised in the US loan market has been used to fund dividends to private equity owners, up from an average of less than 4% over the past two years: that would be the highest proportion since the beginning of 2015, according to S&P Global Market Intelligence.

As we wrote a little over a week ago, while the loan market — where PE firms fund the companies they own by selling secured first, second, third and so on lien debt — had until recently not seen the same volume of issuance as other parts of the financial markets. That changed after the Fed stepped into the corporate bond market sending yields crashing to record lows, and forcing US investors into the last corner of the fixed income world to still offer some modest yields: leveraged loans. And since this is the domain of PE firms which desperately need to extract as much cash as they can from their melting ice cubes (another names for single-B and lower rated portfolio companies which will likely all be broke in the next 3-5 years), everyone is rushing to market with dividend recaps to pay as much to their equity sponsor as they can before the window is shut again.

According to Jessica Reiss who heads leveraged loan research at Covenant Review, investors have been accepting divi recaps because “there isn’t a ton going on” while “from the lender’s perspective they are looking for deals, so if sponsors and their companies can refinance and get a dividend up to their owners they will try it.”

In the latest example, cloud computing company ECi Software, which is owned by Apax Partners, will raise $740MM in new loans, of which $118MM will be used to pay for a dividend to its owner.

It follows a similar deal from snack foods maker Shearer’s Foods, which in turn is a portfolio company of Wind Point Partners and the Ontario Teachers’ Pension Plan, which raised over $1BN in the loan market on Tuesday and used more than a third, or $388MM, ro pay for a dividend to its owners. The news deal, which will help its PE sponsors maximize their IRR on their LBO investment, will also accelerate Shearer’s inevitable bankruptcy as its debt/EBITDA will surge from 5.1x to 6.6x. Meanwhile, at ECi, default is not a matter of if but when: leverage there is now almost 10x after the latest debt-funded check to the company’s sponsor.

Finally, broadband company Radiate Holdco was also in the market this week to fund a $500m payment to its owner TPG.

“If private equity sponsors can take money off the table then they are doing it” said John Gregory, head of leveraged finance capital markets at Wells Fargo Securities. “There’s going to be more coming for sure.”

He’s right: as long as the Fed manipulates corporate bond markets by picking winners and losers, deciding whose debt it will buy (and whose it won’t), Wall Street will find ways to maximize its profits and PE firms will make out like bandits even as their portfolio companies drown in so much debt that bankruptcies – and mass layoffs at the company level – are just a matter of time.

In total, a little over a quarter, or $4bn of the $15bn borrowed in the loan market this month, will be paid out in dividends; another $2 billion in divi recap deals are currently in the market and will price before the end of the month.

While the FT tries to mitigate the insanity, noting that “investors, bankers and analysts noted that the opportunity for private equity companies to pull cash out of the groups they control has been limited largely to higher-quality borrowers” we fail to see how a pro forma leverage of 10x is even remotely “higher-quality.”

“You have some very high leverage deals,” said Wells Fargo’s Gregory. “But if it’s a good company that people are familiar with and investors have money that they need to invest then transactions tend to go through. It’s a bull market trade for sure.”

Yes indeed, and all the billionaires currently in charge of private equity firms who are about to get even richer by milking zombies that would be long gone if it wasn’t for the Fed, thank Powell from the borrom of their heart.

However, investors express concern over loose documentation underpinning the loans, offering little protection to investors should a company end up in trouble.

Still, not everyone is acting like a 16-year-old Robinhood trader during a Softbank-fueled Tesla meltup: some are warning that this year’s market turmoil and subsequent debt-issuance euphoria is as a missed opportunity to improve lending standards after years of seeing them whittled away.

“It’s a shame,” said John Bell, a portfolio manager at Loomis Sayles. “I wished this pandemic could have reset the clock for a while but it doesn’t look like that is happening.”

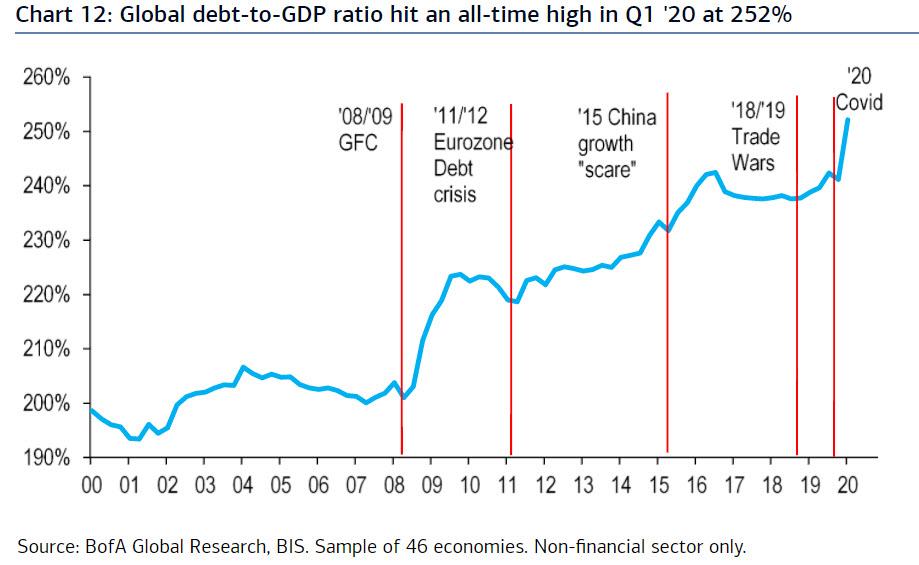

No, it doesn’t, and in fact the opposite is happening as both sovereign and corporate debt is now at all time record highs…

… comfortable with the assumption that when the next crisis inevitably hits, far stronger than what took place in March, the Fed will eventually end up buying it all.

via ZeroHedge News https://ift.tt/2FRbCUO Tyler Durden