Key Events This Week: Powell Speaks Not Once, Not Twice, But Three Times

Tyler Durden

Mon, 09/21/2020 – 08:55

Looking at the week ahead, the highlight will be Fed Chair Powell who after last week’s disappointing FOMC meeting will be speaking not once, not twice, but three times before congressional committees (just in case anyone thinks he will let this market aggression stand). First, he will appear tomorrow before the House Financial Services Panel about the CARES Act. Then on Wednesday he’ll be appearing on the House Select Subcommittee on the Coronavirus Crisis, before Thursday sees him speak before the Senate Banking Committee on the CARES Act once again. Additionally, there’ll be remarks from Fed Vice Chair Quarles on the economic outlook, and a total of 13 other FOMC members will be speaking this week. Bank of England Governor Bailey will be speaking twice this week.

Aside from central banks, the flash PMIs on Wednesday will probably get the most attention as it is one of the first glimpses of September economic performance around the world. Meanwhile, as Deutsche Bank notes, economic and social restrictions are mounting again in various places due to the virus but it may be a bit too early to see their impact in these numbers.

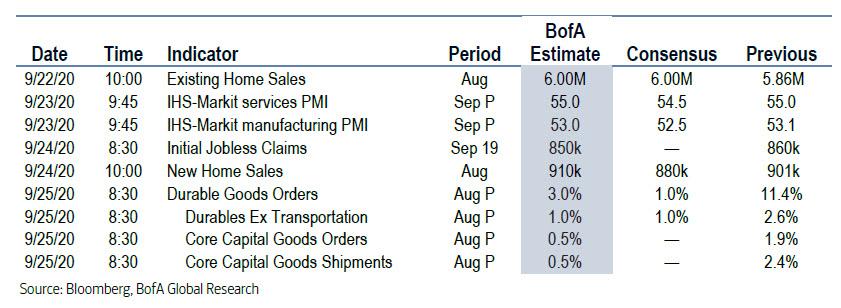

In the US, the key economic data releases this week are the jobless claims report on Thursday and the durable goods report on Friday.

It’ll also be worth keeping an eye on Germany’s Ifo survey on Thursday, which has so far been rising each month since its April low, even as it remains below its pre-pandemic level. The consensus is looking for a further increase to 93.8, which would be just 2 points below its level in February.

There’ll also a special European Council summit on Thursday and Friday. As well as taking stock of the Covid-19 pandemic, the agenda includes a discussion of the single market, industrial policy and digital transformation, along with the EU’s external relations. Brexit may get a small mention as relationships between the EU and the U.K. are just about hanging by enough of a thread enough to merit it. The day by day calendar of the week ahead is at the end.

Courtesy of Deutsche Bank, here is a day-by-day calendar of events:

Monday

- Data: US August Chicago Fed National Activity Index

- Central Banks: ECB’s Holzmann and Fed’s Brainard speak

- Politics: Voting continues in Italian constitutional referendum and regional elections

Tuesday

- Data: UK August public finances, Euro Area advance September consumer confidence, US August existing home sales, September Richmond Fed manufacturing index

- Central Banks: Fed Chair Powell speaks before the House Financial Services Committee on the CARES Act, Fed’s Evans and BoE Governor Bailey speaks

Wednesday

- Data: September flash manufacturing, services and composite PMIs from Australia, Japan, France, Germany, Euro Area, UK and US, Japan July all industry activity index, Germany October GfK consumer confidence, US weekly MBA mortgage applications, July FHFA house price index

- Central Banks: Fed Chair Powell speaks before the House Select Subcommittee on the Coronavirus Crisis, Fed Vice Chair Quarles speaks on the economic outlook, Fed’s Mester, Evans, Rosengren and Daly speak

Thursday

- Data: France September business confidence, Germany September Ifo business climate indicator, US weekly initial jobless claims, August new home sales, September Kansas City Fed manufacturing activity index

- Central Banks: ECB publishes Economic Bulletin, Central Bank of Turkey and Bank of Mexico monetary policy decision, Bank of Japan publish minutes of July meeting, Fed Chair Powell testifies before Senate Banking Committee on the CARES Act, Boe Governor Bailey and Fed’s Bullard and Evans speak

- Politics: Special European Council summit begins

Friday

- Data: Euro Area August M3 money supply, Italy September consumer confidence index, US preliminary August durable goods orders, nondefence capital goods orders ex air

- Central Banks: Fed’s Williams speaks

- Politics: Special European Council summit concludes

Finally, looking at just the US, here is a breakdown of the key US events via Goldman Sachs:

Monday, September 21

- There are no major economic data releases scheduled.

- 12:00 PM Fed Governor Brainard (FOMC voter) speaks; Fed Governor Lael Brainard will discuss the Community Reinvestment Act at a virtual event hosted by the Urban Institute. Prepared text and moderated Q&A are expected.

Tuesday, September 22

- 10:00 AM Existing home sales, August (GS +2.0%, consensus +2.6%, last +24.7%); After surging by 24.7% in July, we estimate that existing home sales increased 2.0% further in August. Existing home sales are an input into the brokers’ commissions component of residential investment in the GDP report.

- 10:00 AM Richmond Fed manufacturing index, September (consensus 12, last 18)

- 10:00 AM Chicago Fed President Evans (FOMC non-voter) speaks; Chicago Fed President Charles Evans will discuss the economy and monetary policy at a virtual event hosted by OMFIF.

- 10:30 AM Fed Chair Powell appears before the House Financial Services Committee; Fed Chair Jerome Powell and Treasury Secretary Steven Mnuchin will testify on the CARES Act before the House Financial Services Committee. Prepared text and questions from legislators are expected.

- 12:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks; Richmond Fed President Thomas Barkin will take part in a virtual discussion hosted by the Greenville S.C. Chamber of Commerce.

Wednesday, September 23

- 09:00 AM FHFA house price index, July (consensus +0.4%, last +0.9%)

- 09:00 AM Cleveland Fed President Mester (FOMC voter) speaks; Cleveland Fed President Loretta Mester will discuss payments and the pandemic at the Chicago Payments Symposium. Prepared text and audience Q&A are expected.

- 09:45 AM Markit Flash US manufacturing PMI, September preliminary (consensus 53.3, last 53.1)

- 09:45 AM Markit Flash US services PMI, September preliminary (consensus 54.5, last 55.0)

- 10:00 AM Fed Chair Powell appears before House panel on Covid-19; Fed Chair Jerome Powell will appear before the House Select Committee on the Coronavirus Crisis. Prepared text is expected.

- 11:00 AM Chicago Fed President Evans (FOMC non-voter) speaks; Chicago Fed President Charles Evans will discuss the economic outlook in an MNI moderated discussion. Media Q&A is expected.

- 12:00 PM Boston Fed President Rosengren (FOMC non-voter) speaks; Boston Fed President Eric Rosengren will discuss the U.S. economy at a virtual event hosted by the Boston Economic Club. Text and audience Q&A are expected.

- 02:00 PM Fed Governor Quarles (FOMC voter) speaks; Fed Vice Chair for Supervision Randal Quarles will give a virtual speech on the economic outlook to the Institute of International Bankers. Text and Q&A are expected.

- 03:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks; San Francisco Fed President Mary Daly will take part in a Fed-hosted virtual discussion on the impact of the coronavirus pandemic on the labor force.

Thursday, September 24

- 08:30 AM Initial jobless claims, week ended September 19 (GS 875k, consensus 840k, last 860k); Continuing jobless claims, week ended September 12 (consensus 12,450k, last 12,628k); We estimate initial jobless claims increased to 875k in the week ended September 19.;

- 10:00 AM New home sales, August (GS -2.0%, consensus -1.2%, last +13.9%); We estimate that new home sales declined by 2.0% in August, partly reflecting a drag from less mortgage applications.

- 10:00 AM Fed Chair Powell appears before the Senate Banking Committee; Fed Chair Jerome Powell and Treasury Secretary Steven Mnuchin will deliver their quarterly CARES Act report to the Senate Banking Committee.

- 11:00 AM Kansas City Fed manufacturing index, September (consensus 14, last 14)

- 12:00 PM St. Louis Fed President Bullard (FOMC non-voter) speaks; St. Louis Fed President James Bullard will discuss the economy and monetary policy in a webinar hosted by the Global Interdependence Center.

- 01:00 PM Chicago Fed President Evans (FOMC non-voter) speaks; Chicago Fed President Charles Evans will discuss the economic outlook in a virtual event hosted by the Illinois Chamber of Commerce.

- 01:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks; Richmond Fed President Thomas Barkin will give a speech on inflation and the economy to the Money Marketeers of NYU. Prepared text is expected.

- 02:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks; Richmond Fed President Thomas Barkin will take part in a virtual discussion hosted by the Baltimore City Chamber of Commerce.

Friday, September 25

- 08:30 AM Durable goods orders, August preliminary (GS +2.0%, consensus +1.1%, last +11.4%); Durable goods orders ex-transportation, August preliminary (GS +1.5%, consensus +1.0%, last +2.6%); Core capital goods orders, August preliminary (GS +1.3%, consensus +0.8%, last +1.9%); Core capital goods shipments, August preliminary (GS +1.0%, consensus +0.5%, last +2.4%): We expect durable goods orders to increase 2.0% in the preliminary August report, reflecting improvement in net aircraft orders but a pullback in the defense category. We expect a 1.3% increase in core capital goods orders, reflecting the continued industrial rebound.

- 09:00 AM New York Fed President Williams (FOMC voter) speaks; New York Fed President John Williams will participate in a conference call with community development and nonprofit leaders from the greater Rochester area.

- 03:10 PM New York Fed President Williams (FOMC voter) speaks; New York Fed President John Williams will take part in a virtual discussion on the Covid-19 job market with young adults in the greater Rochester area.

Source: DB, Goldman, Bank of America

via ZeroHedge News https://ift.tt/3iQKDHv Tyler Durden