Another Record Big 2Y Treasury Auction, Another Record Low Yield

Tyler Durden

Tue, 09/22/2020 – 13:13

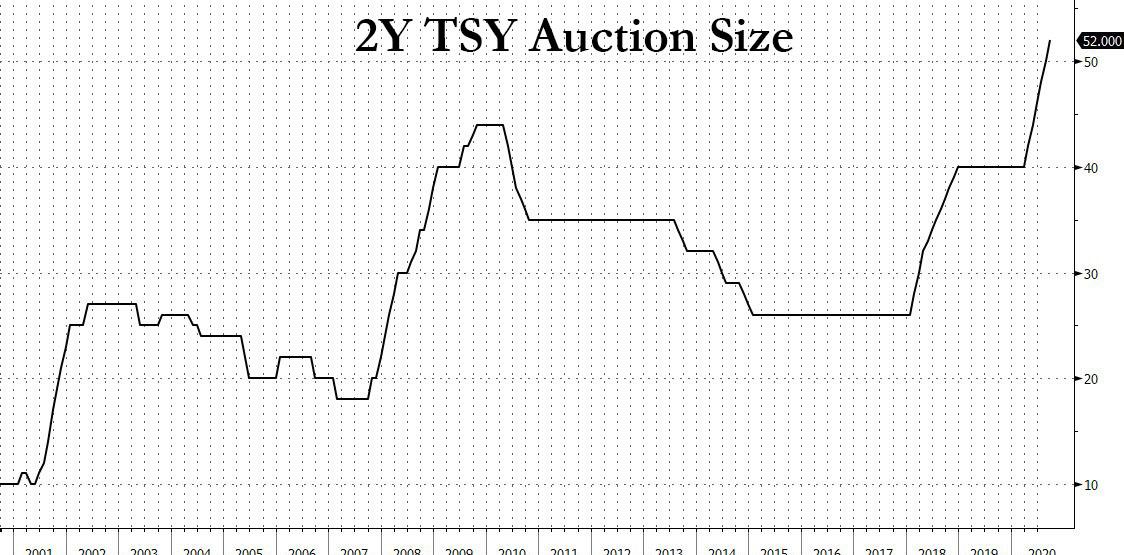

Another month, another divergence – the bigger the (record) auction size, the lower the (record low) yield.

Moments ago the Treasury sold $52 billion in 2Y paper, the largest auction notional size on record, following the $50 billion sold in August.

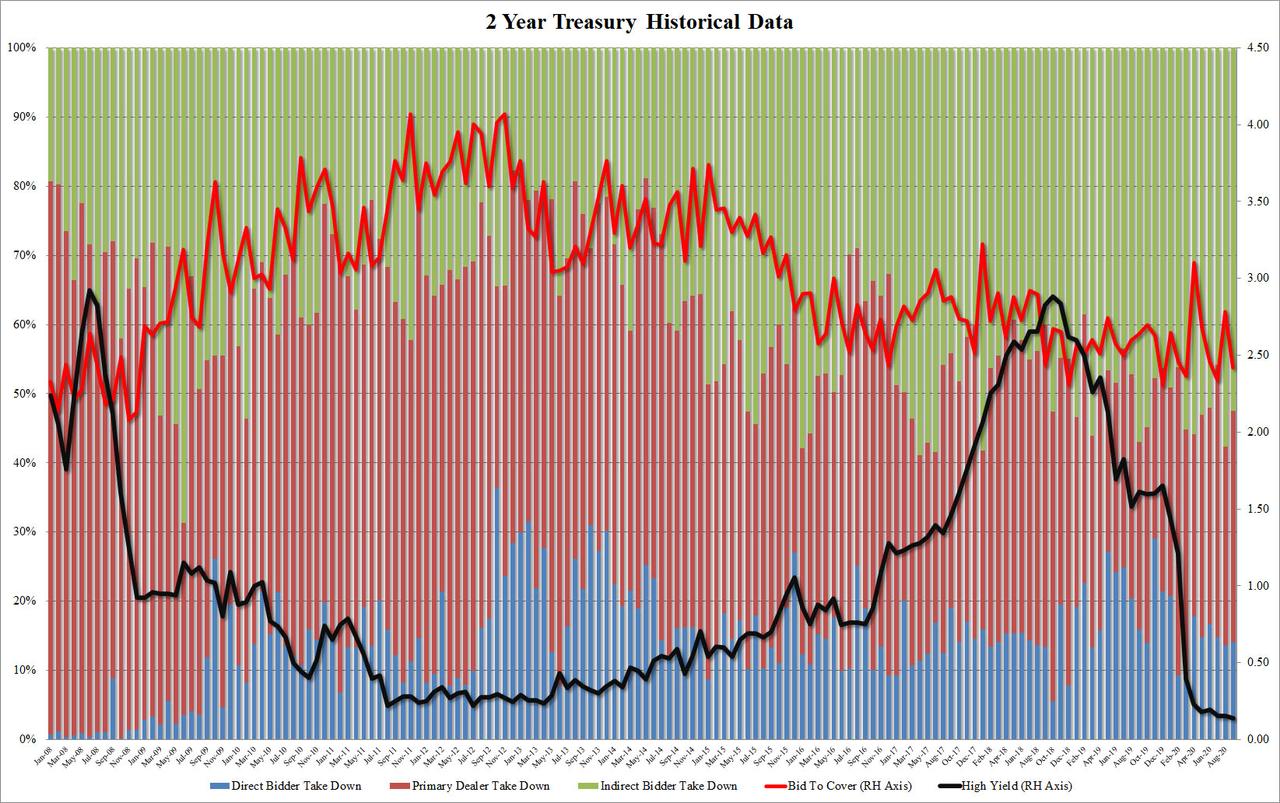

And while the auction size hit a new record high, the yield once again dropped, sliding from 0.155% last month to 0.136% the lowest yield on record, even if it tailed the When Issued 0.134% by 0.2 bps.

Aside from the record low yield, the rest of the metrics were mediocre at best, with the Bid to Cover sliding from 2.782 to 2.421, below the 6-auction average of 2.62.

The internals, likewise, left much to be desired, with Indirects taking down 52.53%, which was both below the 57.63% in August and the recent average of 53.26%. And with Directs taking down 14.06%, in line with recent averages and just above last month’s 13.7%, Dealers were left with 33.4% of the auction, just above the 32.3% last month.

Overall, an average auction… if of course one can call selling $52 billion in 2 year notes at a yield of just 0.136% average.

via ZeroHedge News https://ift.tt/2ROEfof Tyler Durden