Millionaire Tax Coming To New York Next?

Tyler Durden

Tue, 09/22/2020 – 09:22

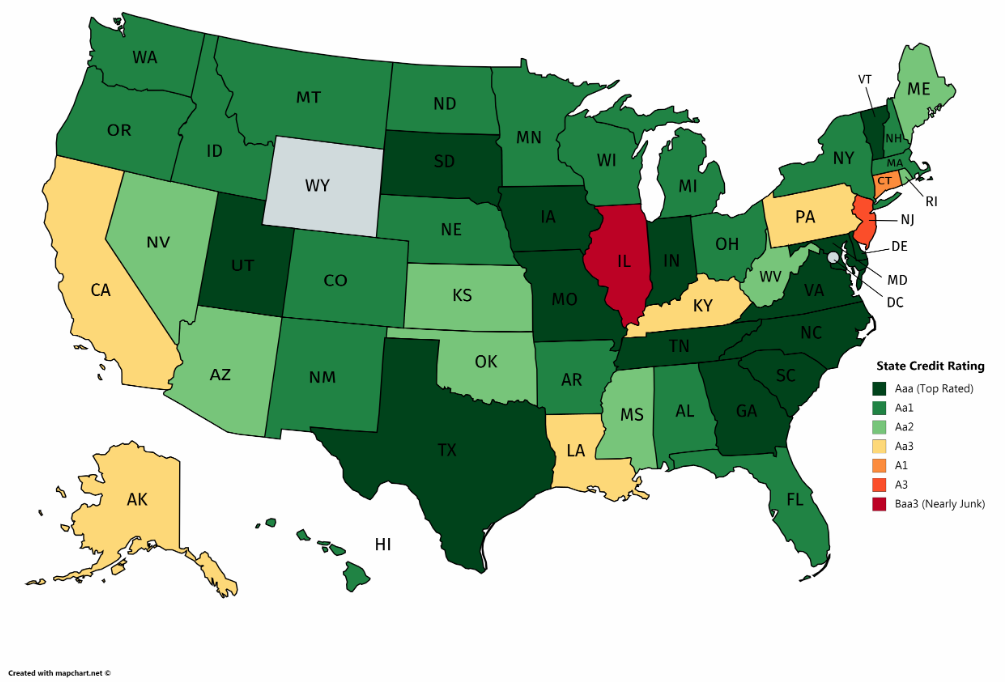

Last Thursday, after a grueling three year crusade to make life for taxpayers in the second-lowest rated US state even more unbearable…

… New Jersey finally passed a tax on millionaires fulfilling a long-running dream of governor Phil Murphy and Democratic leaders.

Facing a fiscal crisis of epic proportions, Murphy finally convinced holdout lawmakers to raise the tax rate on earnings over $1 million to 10.75%, up from 8.97%. As we noted last week, it remains unclear how quickly this decision will prompt an exodus of the state’s richest residents. What was clear, however, is that it was only a matter of time before other Democrat-run, fiscally-irresponsible states would follow NJ’s lead now that the seal has been broken. After all, progressives in Albany have already been pushing governor Cuomo to consider a variety of bills, including one to raise the tax rate on those earning more than $100 million to almost 12%.

So just a few days later, the same progressives have lowered their sight on what the “fair” wealth redistribution cutoff should be, and as the WSJ reports, New York legislators said New Jersey’s agreement to increase taxes on millionaires should be matched in New York, and are pushing the state Legislature here to convene soon to consider a revenue package.

To make sure they are heard loud and clear, a coalition of advocacy groups called #FundExcludedWorkers, which includes unions representing nurses and auto workers, is planning a Friday protest along Park Avenue to call for taxing the income and wealth of billionaires.

Just like New Jersey, which was hit hard by the coronavirus pandemic, New York has seen a $14.5 billion decline in state revenues, but so far Gov. Cuomo has pushed off negotiations on adjusting the state budget in the hope that Congress will appropriate additional aid. The Democratic governor said last week that might mean a delay until after the November election.

Of course, for some progressive lawmakers such a delay is unacceptable and pointing to New Jersey, they say that the passage of the millionaire tax undercuts Cuomo’s argument, and they will increase pressure for action.

To be sure, they’ve already done the math: New York State currently taxes income over $1,077,550 at a rate of 8.82%. If New York matches New Jersey and income over $1 million is taxed at 10.75%, the state could generate an additional $5.28 billion a year, according to the Fiscal Policy Institute, a labor-backed think tank.

“While New Yorkers bore the brunt of Covid-19 in lives lost and economic disruption, our state leads the nation in income disparity, and that is reflected in our tax code,” said Jonas Shaende, the organization’s chief economist.

For now Cuomo – who understands the migratory mechanics of a tax hike all too well, and realizes that in the long run it would cripple the state’s tax revenue – is still resistant to the idea, desperately hoping for a Federal bailout instead. His budget director, Robert Mujica, said after the New Jersey announcement that most of New York’s top earners live and work in New York City, where the top combined city and state income tax rate is 12.6%. Mujica has frequently said that the highest-earning 2% of New York tax filers account for a majority of income tax receipts.

“There is much discussion about the state and nation’s economic condition and the options available to New York state. Let’s make sure the discussions are informed,” Mujica said.

Meanwhile, Republicans argue that New York should first look to reduce spending before increasing taxes, but of course that argument won’t get them anywhere at least not for a few more years, before the state implodes after taxes on the rich become unbearable and the entire state suffers a fiscal collapse. Only then will conservative policies re-emerge but until then, New York – like New Jersey – should brace itself for an even more dire budget picture as the rich flee.

“I’ve never been jealous of Jersey before,” said New York Assemblywoman Yuh-Line Niou, a Democrat from Manhattan who would be much less jealous if New York also agreed to pass a law taking from the rich. “It goes to show something, and means we can’t use the excuse that people will go to Jersey if we raise taxes.”

No, but the same millionaires and billionaire you are targeting can just easily leave the tri-state area for good – especially in this age of working for home – and head for Florida or any other state that will gladly accept New York’s wealthiest.

via ZeroHedge News https://ift.tt/32Ro6o9 Tyler Durden