Time To Go All-In The “Big Short 3.0”? Two-Thirds Of US Hotels Say They Won’t Last Six More Month At Current Occupancy Levels

Tyler Durden

Tue, 09/22/2020 – 14:06

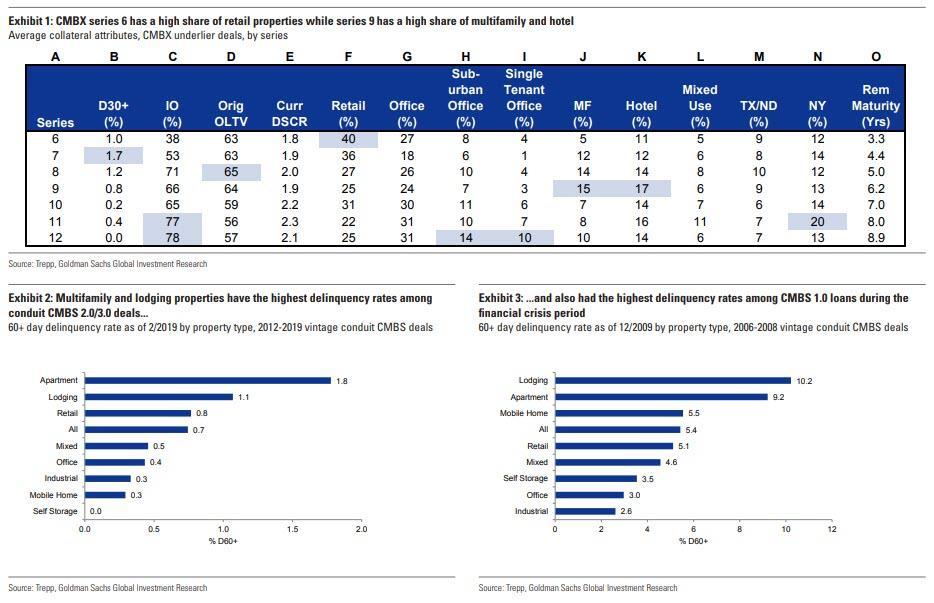

Now that hedge funds have finally started piling into the “Big Short 3.0″ trade, which as we first explained back in June is basically shifting the CMBS short from malls to hotels, every incremental development in the sector is closely scrutinized.

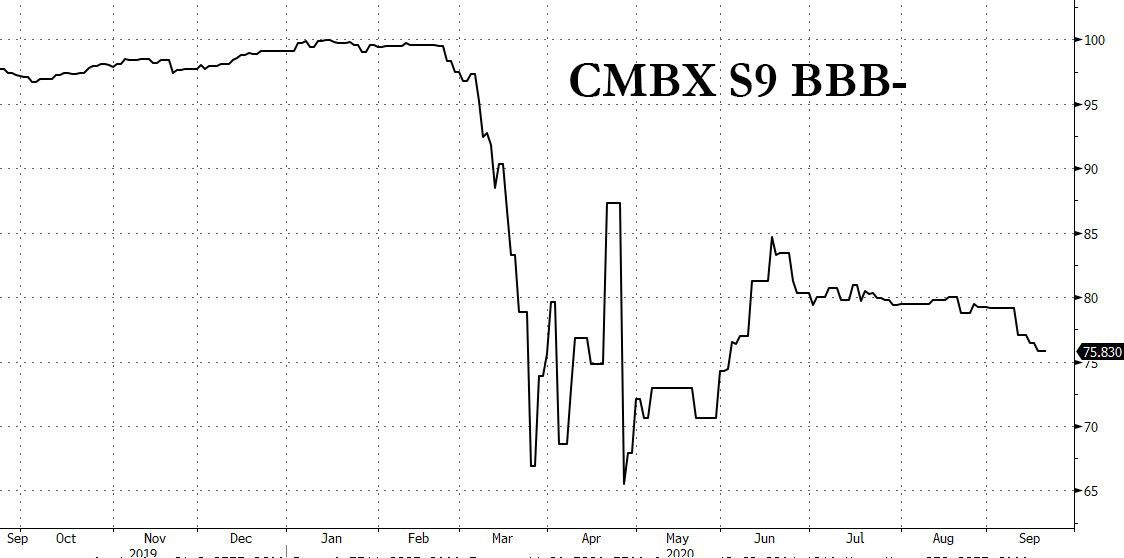

And judging by the continued decline in the fulcrum BBB- tranche of the CMBX Series 9 index which has the highest exposure to hotels, developments continue to be adverse with little sign of recovery on the horizon.

The latest tailwind blast for the CMBX 9 shorts came from a report from NorthStar according to which, without aid 74% percent of US hotels said they expect to lay off more employees, with a whopping two thirds of properties warning they won’t be able to last another six months at the current projected revenue and occupancy levels.

Needless to say, should two-thirds of the US hotel industry fold, shorting the CMBX S9 BBB- could well be the most profitable (institutionally sized) short in recent history when the Fed has effectively made shorting impossible.

Here are some more details from the report:

Seven months after the Covid-19 pandemic struck the United States, the hospitality industry is still reeling and the need for federal relief is growing dire. New research from the American Hotel and Lodging Association shows 68 percent of hotels have less than half of their normal staff working full time. In addition, more than two-thirds of hotels said they would not be able to last six more months at the current projected revenue and occupancy levels, and half of the hospitality owners polled said they are in danger of foreclosure. Without government assistance, 74 percent of hotels said they would be forced to lay off more employees.

Another study released by the AHLA last month found that unemployment within the hospitality and leisure sector is at 38 percent, nearly four times that of the national average (10.2 percent). In an effort to the save industry, the organization is calling on lawmakers to swiftly pass additional Covid-19 relief.

“It’s time for Congress to put politics aside and prioritize the many businesses and employees in the hardest-hit industries. Hotels are cornerstones of the communities they serve, building strong local economies and supporting millions of jobs,” said Chip Rogers, president and CEO of the AHLA. “Every member of Congress needs to hear from us about the urgent need for additional support, so that we can keep our doors open and bring back our employees.”

According to the AHLA, urban hotels have been hit especially hard and are seeing occupancy rates around 38 percent. Research from hospitality-data provider STR shows the average occupancy rate for all U.S. hotels in August was 48.6 percent, up slightly from 47 percent in July. This marked the lowest occupancy rate for any August on record (STR was founded in 1985), and the company expects U.S. hotel demand will not fully recover until 2023.

“Our industry is in crisis. Thousands of hotels are in jeopardy of closing forever, and that will have a ripple effect throughout our communities for years to come,” said Rogers. “We need help urgently to keep hotels open so that our industry and our employees can survive and recover from this public-health crisis.”

Rogers recently indicated that more than 8,000 hotels could close in September if business travel does not pick up and funding from the Paycheck Protection Program runs out. According to AHLA, only 20 percent of hotels have received any debt relief from commercial mortgage-backed security lenders on Wall Street. Without aid from Congress, the industry association expects massive foreclosures.

More than half (58 percent) of Manhattan hotels remain closed, according to the latest Manhattan Lodging Index from PricewaterhouseCoopers. Findings from the report show approximately 61,450 hotel rooms in Manhattan had not reopened as of early September. Of these, nearly 2,700 are expected to be shuttered permanently.

“You won’t see meaningful increases in operating metrics for Manhattan hotels until we see a return of the business traveler, and that likely comes after a widely distributable vaccine and therapeutics become available,” said Warren Marr, managing director of U.S. hospitality and leisure for PwC.

Some properties are already closing their doors. Among the hotels lost to Covid-19 are the Omni Berkshire Place, Times Square Edition, Hilton Westchester, W New York Downtown and the Hilton Hotel Times Square, all of which are in New York state. A report from The Wall Street Journal suggests 20 percent of the state’s total hotel supply (about 250,000 rooms) could close permanently.

As an additional indicator of industry health, U.S. hotel transactions were down 74 percent year-over-year from March through May, according to the latest Hotel Transaction Almanac, produced by STR’s Consulting and Analytics office and CoStar Group. May represented the largest decline in the total volume of hotel deals, falling 94 percent compared with last year. According to STR, only 68 assets representing a combined total of $112 million were sold in the month of May, compared with 329 hotels worth $1.8 billion in May 2019. The number of transactions will likely begin to rebound as investors look for distressed inventory, according to the report.

Economic Impact of COVID-19

Since mid-February, U.S. properties have lost more than $46 billion in room revenue, according to the AHLA. Hotels across the country are on track to lose more than $400 million in room revenue per day due to COVID-19, which equates to losses of $2.8 billion weekly.

As a result, many hotels — 87 percent, according to the AHLA — were forced to furlough or lay off staff members. More than 7.7 million hospitality and leisure jobs were lost at the peak of the pandemic and 4.3 million remain out of work. Even as properties have reopened and occupancy picks up, layoffs continue. In many cases, furloughed employees are now losing their jobs permanently.

In the latest news, Marriott International plans to let go of 17 percent of its corporate workforce. According to The New York Times, the company confirmed that it will lay off 673 people in late October. Marriott had initially furloughed two-thirds of its corporate staff in March. In June, the furloughs were extended until early October. The hotel giant said it does not expect to return to prior levels of business until beyond 2021. Effective Sept. 20, Marriott will no longer be listed on the Chicago Stock Exchange, a move the company said would reduce administrative costs and requirements.

Hotel and casino giant MGM Resorts was expected expected to lay off 18,000 of its furloughed staff, starting Aug. 31. The company had furloughed 62,000 employees in March, according to Reuters.

InterContinental Hotels Group eliminated 10 percent of its corporate staff in July, as part of a $150 million cost-cutting plan that is expected to continue in 2021. Oyo Rooms, which operates more than 43,000 hotels with more than 1 million rooms around the world, announced in mid-July that more than 90 percent of its U.S. workforce would be let go.

Las Vegas-based Boyd Gaming, which owns and operates 29 casino properties across 10 states, many with hotels, announced July 13 that it had let go more than 25 percent of its workers. The cut essentially turns a large number of furloughs into permanent layoffs. According to a company spokesperson, the number of layoffs is “at the lower end” of 25 to 60 percent of the total workforce — the range that the company had warned in May could be affected.

In June, Hilton let go of 22 percent of its corporate workforce. Rosen Hotels & Resorts, which owns and operates nine properties in Orlando, has also announced layoffs. The company implemented a “substantial reduction of workforce across multiple locations” on July 31.

“It is with deep personal regret that I announce a significant downsizing of staff at Rosen Hotels & Resorts. Never in the 46-year history of my company would I have envisioned such a drastic decision,” said Harris Rosen, president and COO of Rosen Hotels & Resorts. “Since the onset of COVID-19 earlier this year, we have maintained as many staff as possible, with the hope of business returning to usual in June of this year. Regrettably, this did not come to pass… This is especially painful for me, as I consider these valued associates as extended members of the Rosen family, without whose contributions our company would never have achieved the success it has through the years.”

Doug Dreher, president and CEO of The Hotel Group, called the effect of the coronavirus pandemic on the hospitality industry “devastating” and expected his company to lay off at least a third of its workforce.

“It is for us the Great Depression, utterly devastating,” said Dreher. “We’ve tried to get ahead of it. We’re working with lenders, but we need help. We need help in every imaginable way. The human toll breaks your heart.”

Reopening Hotel Properties

Many hotels have reopened their doors and are welcoming guests back with new cleaning protocols in place. Omni Hotels & Resorts, for example, has reopened most of its properties which had shut down during the pandemic. At the height of the pandemic, the hotelier had temporarily closed more than 40 of its properties. Only nine have yet to reopen, according to Omni’s travel advisory page.

Gaylord Hotels was forced to temporarily close its five properties in the U.S. Four have since reopened: the Gaylord Texan Resort & Convention Center, Gaylord Opryland Resort & Convention Center, Gaylord Palms Resort & Convention Center and Gaylord Rockies Resort & Convention Center. A reopening date for the Gaylord National Resort & Convention Center has not yet been set.

Gaming resorts, which were among the first to suspend operations en masse, are also reopening their doors. A Covid-19 Casino Tracker from the American Gaming Association reports that all 989 casinos in the U.S. were forced to close due to the pandemic. Of these, 901 have since reopened.

MGM Resorts and Wynn Resorts, for example, suspended operations at their Las Vegas properties on March 16. The companies, along with other Nevada gaming powerhouses such as Caesars Entertainment and Las Vegas Sands, reopened select casinos on June 4 in accordance with the state’s reopening plan. The companies are reopening more Nevada properties as demand rises. On Sept. 30, Park MGM and the NoMad Las Vegas will be the last MGM properties to begin welcoming guests again. Both will be smoke-free.

“Opening Park MGM and NoMad represent significant milestones, as they are the last of our properties to welcome back employees and guests alike,” said Bill Hornbuckle, CEO and president of MGM Resorts. “The last six months have presented extraordinary challenges and I could not be prouder of the MGM Resorts team for the tireless effort required to get us here. There is much work ahead as we remain focused on the health and safety of our employees and guests, but this is an important moment for us.”

Meanwhile, other hotels might be closed for good. This includes four Station Casino properties in Las Vegas that might never reopen, according to Frank Fertitta III, CEO of Station Casinos’s parent company Red Rock Resorts. Texas Station, Fiesta Henderson, Fiesta Rancho and Palms Casino Resort have all been closed for months and might never welcome guests back. “We don’t know if — or when — we’re going to reopen any of the closed properties. We think it’s too early to make that decision at this time,” said Fertitta during the company’s Q2 earnings call on Aug. 4.

In Connecticut, two tribal casinos reopened on June 1. The Mohegan Sun and Foxwoods Resort Casino released detailed reopening plans with new safety protocols to keep guests and staff members safe. Atlantic City casinos reopened on July 2, and Massachusetts casinos also welcomed guests back in July. Plainridge Park was the first to reopen on July 8, followed by the Encore Boston Harbor on July 12 and MGM Springfield on July 13. Meanwhile, New York’s Resorts World Casino and Jake’s 58 Casino Hotel reopened on Sept. 9 and the Empire City Casino is scheduled to reopen on Sept. 21.

Despite a surge in new coronavirus cases in the state of Florida, Orlando’s Walt Disney World began a phased reopening of its theme parks and resort hotels on July 11. Disneyland, in Anaheim, Calif., had announced a July 17 opening but has postponed that as the state has yet to release reopening guidelines for theme parks. A new date has not been set.

A COVID-19 hotel-status directory from EproDirect, a hospitality industry marketing agency, indicates whether more than 4,000 hotels are currently open, and if they are accepting individual reservations and group bookings. While most of the properties listed are in the United States, hotel reps from any destination worldwide can list their hotel’s status for free.

New Openings and Renovations Delayed

The pandemic is also affecting properties in the pipeline. The Langham, Boston was due to unveil a multimillion-dollar renovation this fall. However, the completion date has been pushed back to early 2021 due to a local halt on construction.

The grand opening of Universal’s Endless Summer Resort – Dockside Inn and Suites has also been postponed. The resort was scheduled to open in mid-March; a new date has not yet been announced.

Marriott is expecting to open and sign fewer hotel deals in 2020 than anticipated. In addition, the company has temporarily deferred most brand standards to help owners and franchisees, including delaying renovations due in 2020 by one year, according to Marriott president and CEO Arne Sorenson.

“The coronavirus is fast becoming the most significant event to ever impact our business; that includes the 12-month period after 9/11 and the financial crisis of 2009,” said Sorenson during an investor update on March 19. But he noted that the development pipeline has not ground to a complete halt. “We’ve been signing deals and we have development committees that are meeting monthly. The volume is lighter and the numbers will be lower than we anticipated but they won’t be zero.”

via ZeroHedge News https://ift.tt/35YATaD Tyler Durden