Another Record Big 5Y Treasury Auction, Another Record Low Yield

Tyler Durden

Wed, 09/23/2020 – 13:15

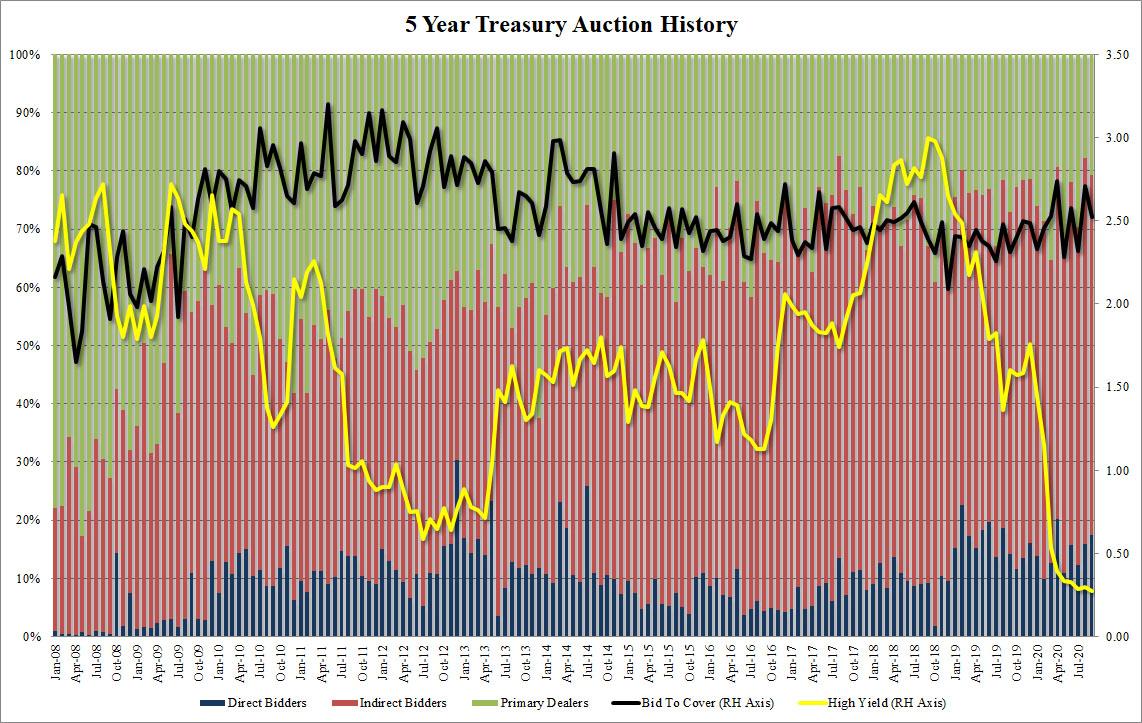

Yesterday when addressing the latest (relatively mediocre) 2Y Treasury auction, we titled it “Another Record Big 2Y Treasury Auction, Another Record Low Yield.” Well, not much has changed today, because moments ago the Treasury sold a record amount of 5Y Treasurys, or $53 billion up from $51 billion last month, which also priced at the lowest yield in 5Y auction history.

The yield on the paper dropped to 0.275% from last month’s 2.98%, stopping through the When Issued 0.285% by 1 basis point.

Just like yesterday, there was some weakness in the Bid to Cover – which dropped from 2.72 to 2.52 and just below the recent average of 2.53 – and the internals, where Indirects took down 61.9%, a drop from the 66.2% in August if above the 59.4%. And with Directs taking down 17.4%, the most since April, Dealers were left holding on to 20.7%, one of the lowest Dealers take down on record.

Overall, a stronger auction than yesterday’s average 2Y, and while foreign demand could have been stronger, the trend of ever bigger auctions and ever record lower yields continues uninterrupted.

via ZeroHedge News https://ift.tt/33NWvni Tyler Durden