It Will Take Up To 59 Years For The Fed To Hit Its Inflation Target

Tyler Durden

Wed, 09/23/2020 – 11:23

Two days before Powell unveiled Flexible Average Inflation Targeting (FAIT) as the Fed’s new monetary doctrine on August 27, some analysts were already pricing it in and analyzing how long it would take for the Fed to hit its “target” using conservative assumptions, with BofA concluding that “it would take 42 years to reach the price level target if core PCE remained at 2.1% yoy” but just 2 years if core PCE rocketed to 4.0% (good luck hitting 4% inflation).

And while analysts had no choice but to make sweeping assumptions before AIT was unveiled, they have to do the same now as well after AIT became official, simply because the Fed refused to provide key details about the program it is now operating under, and as Bank of America writes in a post-mortem on FAIT, “The Fed will seek to average 2% inflation over time but specifics around the time frame for averaging and the extent of inflation overshoot were light.“

Still, one can model some scenarios using simple assumptions.

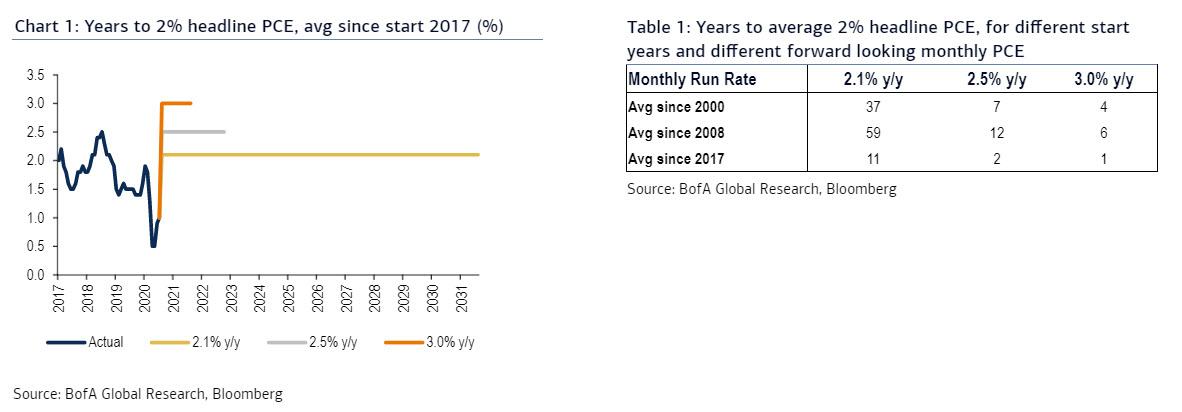

These clearly show just how difficult the Fed’s new inflation objective could be to achieve as the following analysis from BofA’s Claudio Irigoyen shows, using a few scenarios for average 2% headline PCE assuming a non-flexible average inflation target.

To wit: if the Fed began its averaging period at the start of 2017 and monthly headline PCE is equal to 2.1% y/y going forward it would take 11 years to achieve the inflation target. Alternatively, if one uses 2008, or even 2000, as the starting year for the “average period” and the monthly PCE inflation print is 2.1% y/y, then it would take either three generations – 59 years – or two generations of trades, (37 years) to average 2% headline PCE.

Sadly, it’s not starting off well: as the strategist notes, the BofA’s house view is for headline PCE of 1.6% y/y for 2021, “which would mean an even longer time until the target is achieved.”

Of course, the time period would be truncated if the Fed somehow managed to hit monthly headline PCE of 3.0% y/y (or higher): in that case, achieving the target would take about one year. Unfortunately, such inflation – which would only materialize if these was a burst in wages – appears impossible to none other than the Fed: as the FOMC’s latest economic projections show, the max inflation overshoot in the Fed’s 2023 inflation forecasts is 2.1%.

In other words, even the Fed admits that we are looking at decades before the Fed will hike rates, unless of course the Fed is given a greenlight to wire digital money into US households directly… something which the Fed itself admitted is the last-ditch attempt to spark inflation at any cost.

via ZeroHedge News https://ift.tt/2ZZRGWI Tyler Durden