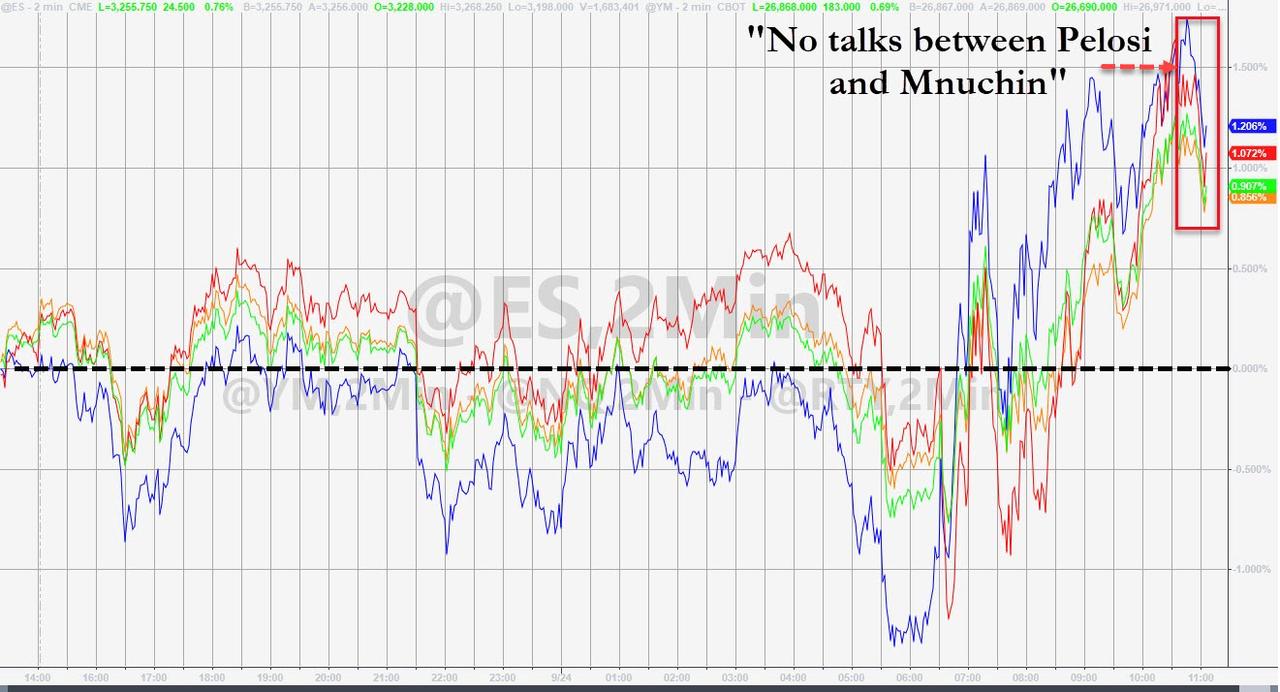

Stock Rally Reverses On Report There Are “No Talks” Scheduled Between Mnuchin, Pelosi

Tyler Durden

Thu, 09/24/2020 – 14:15

With traders (and the Fed) desperate for some fiscal stimulus – now that Powell appears to have tapped out – earlier today stocks hit session highs on speculation that talks about a new round of economic stimulus will resume. As Bloomberg reported, the S&P 500 extended gains after House Speaker Pelosi said she spoke with Treasury Secretary Steven Mnuchin yesterday and expressed hope that there would be another round of negotiations.

This followed Congressional tesimotny from Mnuchin, who earlier on Thursday said that a targeted pandemic relief package is “still needed.”

However, today’s rally peaked the moment Politico’s Jake Sherman reported that “no covid relief talks are scheduled at this time” between Mnuchin and Pelosi…

NEW .. No talks scheduled at this time between @stevenmnuchin1 and @SpeakerPelosi on covid relief.

— Jake Sherman (@JakeSherman) September 24, 2020

… dousing excitement that another fiscal bill may be on deck.

In other words, no change, although with the dollar trading near session lows after it early rampage, it appears that downward momentum has for now been reversed.

Alas, that does not answer the $64 trillion question: who will blink first, Powell or Pelosi, and linked to that: what is the strike price of the Pelosi Put? In other words, does the S&P have to drop much more before the top House Democrat agrees to the republican bid of a $1.5 trillion stimulus, or will she hold out for the $2.2 trillion Democrat ask, no matter where the stock market is. That said, one would assume that Democrats would be delighted to see a stock market crash ahead of the election: after all, Trump has repeatedly confirmed that he views stocks as the only “objective” barometer of his administration, which is Democrats would be delighted if said barometer were to be much, much lower.

via ZeroHedge News https://ift.tt/2FPjBlH Tyler Durden