Traders Get Whiplash After Fastest Ever Fund Flow Swing From Euphoria To Despair

Tyler Durden

Fri, 09/25/2020 – 13:30

For those following retail order flow as an indicator of how to trade, well… you just got stopped out.

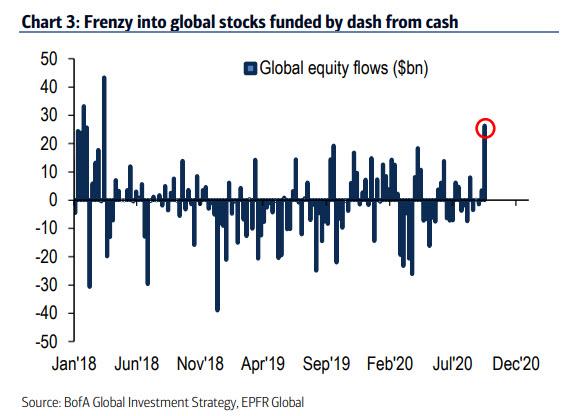

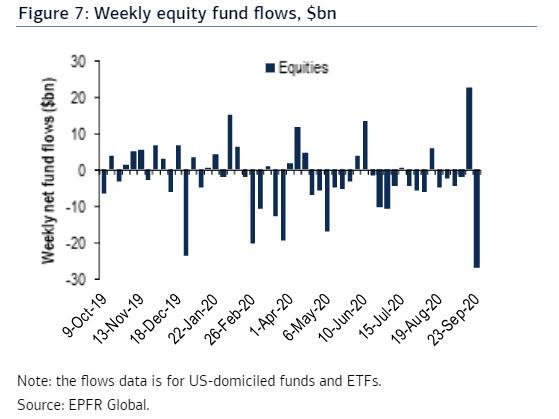

Last Friday we observed that in the week ending Sept 16, which saw $26.3BN of new capital deployed into equities, the largest inflow since March 18…

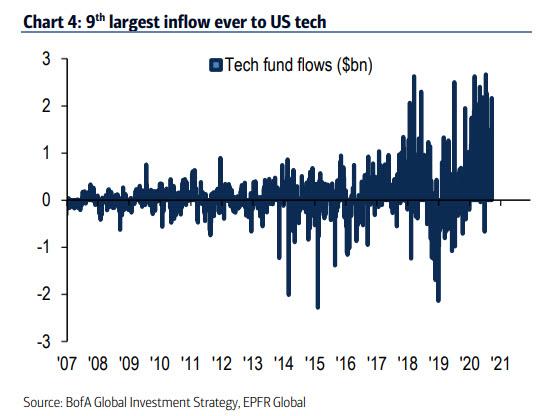

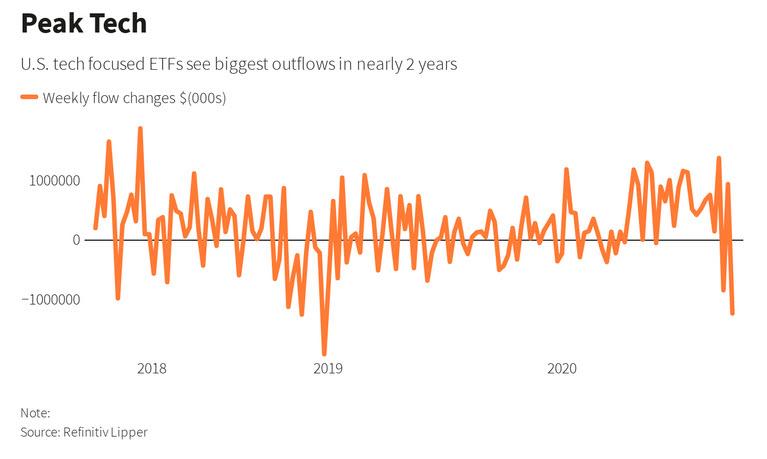

… investors flooded into tech names with the weekly inflow into tech funds the 9th largest on record.

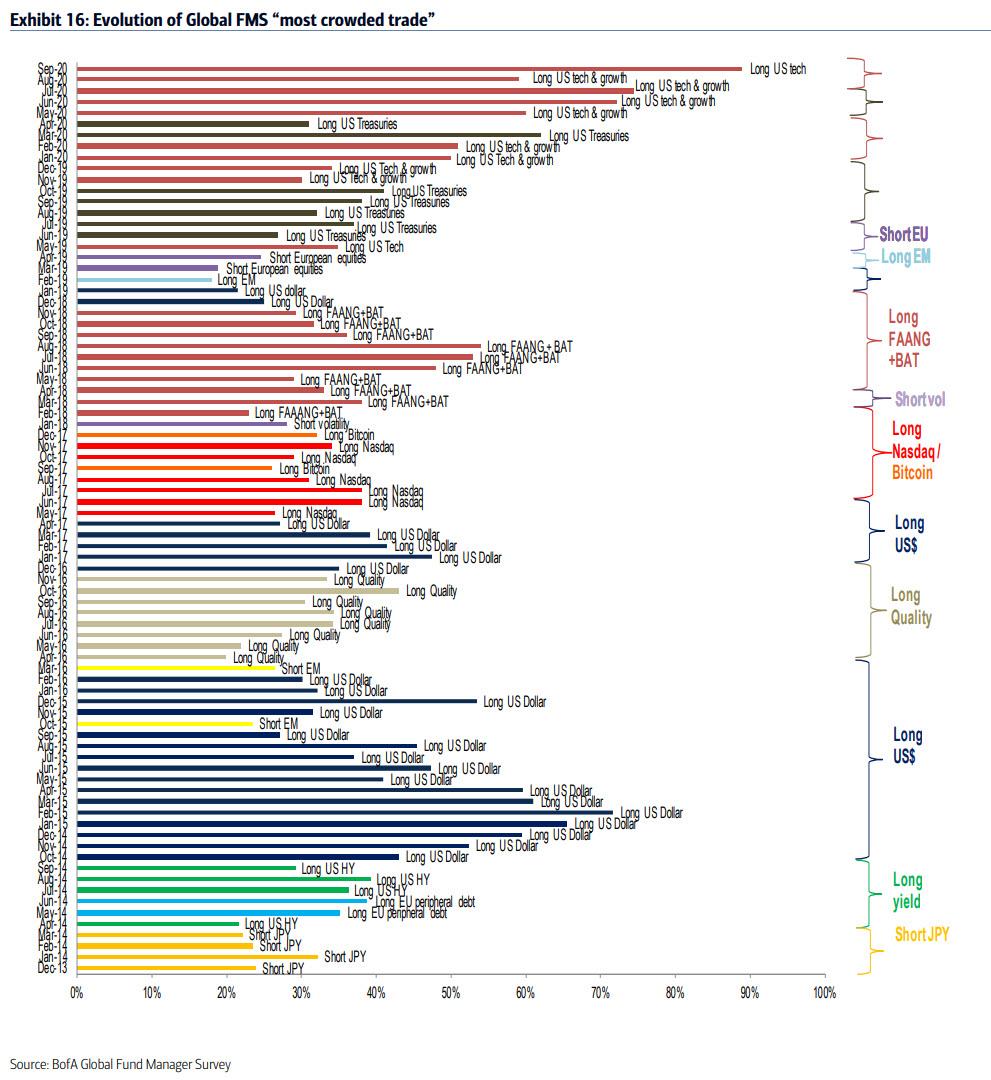

While this may have been sparked by hopes of a BTFD rally following the early September swoon in tech names, we mused that investors are flooding into the very names which according to Wall Street professionals were the “most crowded trade” of all time…

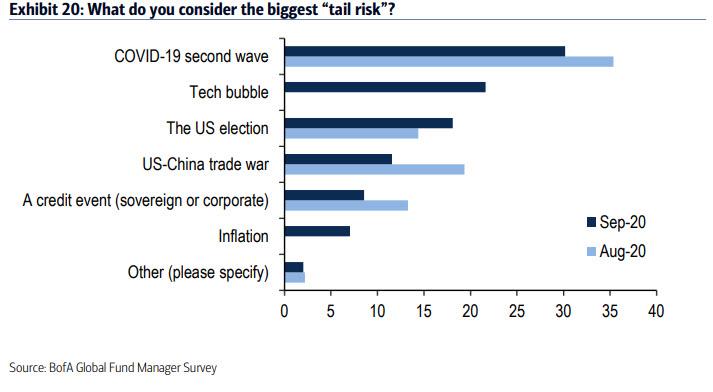

… with fund managers telling BofA in its latest Fund Manager Survey that the “tech bubble” is now the second biggest tail risk for the market after a “second wave” of COVID-19.

Well, maybe someone read our bemused commentary on the persistently schizophrenic state of the market, or more likely, investors were disappointed by the lack of upward momentum in stocks coupled with the whiplash-inducing surge in volatility, because just one week later, EPFR reported that after last week’s near record inflows, US equity funds and ETFs reported $26.87 BN of outflows, the largest weekly outflow since December 2018 and the third largest outflow ever, more than reversing a $22.67bn inflow one week earlier.

This was the biggest weekly swing in fund flows in history, and shows just how extreme market sentiment has become, and how it can seemingly swing overnight from euphoria to despair.

Not surprisingly, tech funds which saw the 9th biggest inflow ever last week were rocked by the biggest redemption since Jun’19, as passive investors – who have been the backbone of the Nasdaq’s rally this year – seem to have lost their nerve according to Reuters, which added that in the week ending Sept. 23, tech-focused ETFs suffered $1.23 billion worth of outflows, the largest since December 2018, when global stock markets tanked, according to Lipper data. September was also the first month of outflows for the tech sector since the March crash.

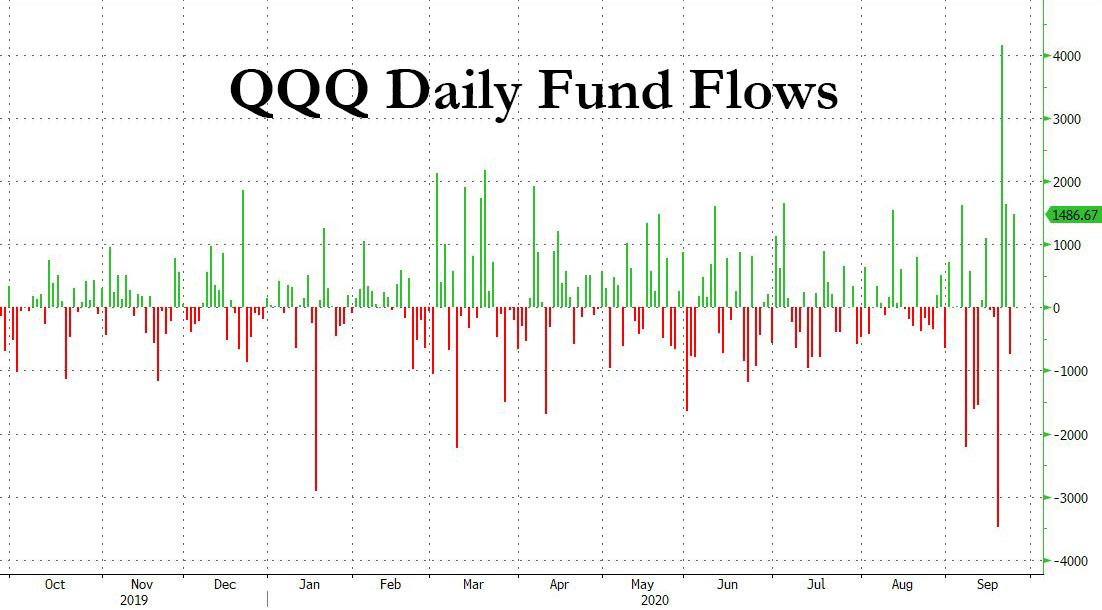

The figures are significant because ETFs such as the QQQ Nasdaq tracker have taken some $20 billion between January and July, however in recent days we have seen some rather massive swings in QQQ flows: for instance, the QQQ fund posted record $3.5 billion outflows on Monday amid a Nasdaq slump, then got $4 billion the following day as sentiment recovered.

“We think the latest pullback in U.S. equities, from frothy levels, is a chance for investors to diversify their allocation to those parts of the equity market so far left behind, which could benefit Europe,” said Maneesh Deshpande, a U.S. equity strategist at Barclays.

According to Saxo Bank’s Peter Garnry, QQQ volatility pointed to “widespread speculation in U.S. technology stocks and that this is increasingly becoming the leading index for sentiment.”

Other ETF service providers also showed outflows. On a three-month rolling basis, the most active ETFs tracking the U.S. technology and growth sectors saw $1.7 billion of outflows, the first negative reading this year, according to Wisdom Tree.

To be sure the reversal is long overdue: for much of the past 6 months, money has poured in to chase the outperformance of technology shares. Total net assets for a group of technology focused ETFS nearly doubled to $113 billion at the end of August from $64 billion a year ago, according to Morningstar data.

The whiplash has been painful: the giga techs are down more than 13% from a September peak and account for nearly half of the S&P 500 decline over that period. Even with that correction, valuations remain in nosebleed territory, near 22 times forward earnings for the S&P 500 index, the highest since the dotcom bubble in early 2000. Multiples of some tech stocks are as high as 100 times forward earnings.

For many, however, this is just another opportunity to buy the dip: Sumant Wahi, a portfolio manager at Fidelity International, said this is just a temporary correction: “I think the market is digesting some of the large flows we have seen in recent weeks and this is a temporary correction. “Big tech is here to stay.”

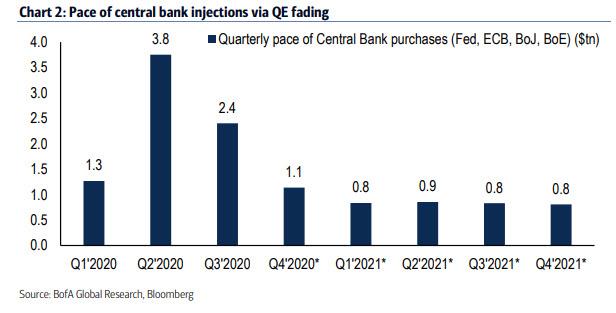

Sumant is probably correct: with central bank liquidity injections tapering, Congress gridlocked over fiscal stimulus and stocks sliding, it is only a matter of time before the Fed is forced to launch another market bailout.

via ZeroHedge News https://ift.tt/332pVyV Tyler Durden