“De-Dollarisation Theme Is Intact”: Latest IMF Reserve Data Shows Continued Flight From Dollar, Into Gold

Tyler Durden

Thu, 10/01/2020 – 17:00

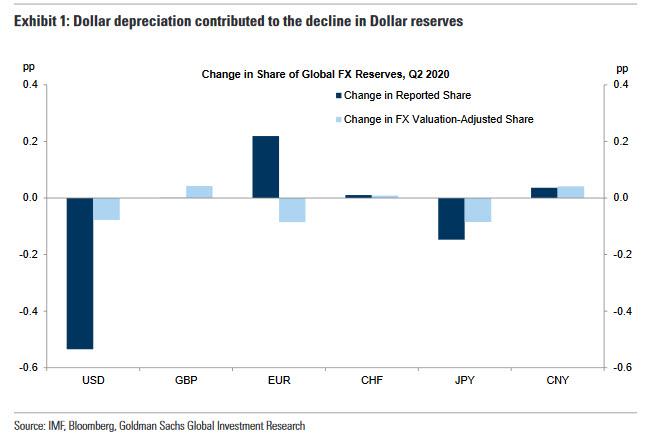

On Wednesday, the IMF released the latest Currency Composition of Official Foreign Exchange Reserves (COFER) report for Q2 2020. It showed that while the Dollar share of global reserves had increased in Q1 2020, likely on a combination of valuation effects and safe-haven demand, trend reversed abruptly in Q2 as shown in the Goldman chart below.

The contraction in dollar reserves is hardly new: prior to the Covid-19 pandemic, the Dollar share of allocated reserves had been trending lower over the past two years (chart below, left), but that trend was interrupted in Q1 2020. However, the market recovery in Q2 helped to reverse most of the increase in the Dollar’s share from earlier this year. At the same time, the share of Euro reserves rebounded somewhat in Q2.

Additionally, the share of Yen reserves declined both on a headline basis and after adjusting for FX valuation changes. Here, Goldman notes that a number of central banks appear to take advantage of the yield enhancement provided by wide cross currency bases, so this likely overstates the demand for JPY reserves on a net basis, and the unwind of this trade has likely contributed to the Yen’s declining share in 2020. Meanwhile, the share of CNY reserves continues to steadily but slowly increase in what may be the most ominous trend in global reserve flows.

From the perspective of reserve holders, BofA calculates that total FX reserves rose to over $12 trillion as global central banks aggressively intervened in FX markets, with more than half of all allocated reserves in US currency. As the next two charts highlight, both Israel and Switzerland added to reserves as a result of significant FX interventions to weaken their respective currencies. Indeed, most major countries experienced a rise in FX reserves through Q2, with the exception of Turkey which continues to bleed reserves in order to stabilize its currency.

Echoing the Goldman observations above, BofA also writes that “the de-dollarisation theme appears intact“, adding that the share of US holdings has declined to 61.3%, slightly more than expected based on FX, bond and equity valuation changes. The next two charts show the divergence vs USD performance, and the theoretical evolution of USD share based on valuation changes since 2014.

This divergence between the level of USD reserves and that of USD TWI is expected to persist, as the world is decoupling from the USD as the notional reference peg.

Combining all the Q2 COFER data reveals some interesting insights regarding what Central Banks prefer at the moment, as alternative to the USD.

Curiously, according to the BofA FX strategists, a deep dive into reserve flows highlights that there was no currency stood out as having benefited from the process so far. Instead, many central banks had turned to Gold. However, it now also appears that the pace of Gold purchases was levellng off.

So, against the backdrop of global yields heading towards zero, the question of what assets/currency central banks would buy next remained open. Some of BofA’s observations:

- The outlook was becoming more balanced in terms of CB demand for EUR bonds. The yield differential vs USTs had reduced, and new supportive factors were emerging – notably the political stability provided by the EU recovery fund and the growth in EUR-denominated Green bonds, but

- The synchronized shift towards QE and further unconventional policy measures would likely focus reserve managers’ attention on a wider spectrum of assets, and, in the absence of a viable alternative to the USD, we might be entering into a multi-polar reserve currency world, with currency dominance det

The IMF’s Q2 COFER breakdown supports both theories:

- The build-up of reserves in Q2 was most significant in EUR, at c. $23bn. This has allowed a slight increase in the EUR share of FX reserves, even as valuation adjustments would have projected a stable share (Chart 7). But, this increase is still extremely marginal. The share of EUR holdings remains indeed well below the pre-Eurozone crisis levels. Similarly, JPY, GBP, CAD, AUD and CHF holdings combined still account for less than 15% of total holdings. As BofA puts it, “the evidence so far suggests that reserve managers do not currently see any of the above as ready-made single alternative to the USD (instead, what was observed is a small build-up in each currency, except the JPY).”

- The “other currencies” component has risen markedly. Q2 saw the largest build-up of reserves in RMB and “other currencies” since 2Q18 (Chart 6, and Chart 8). In fact, together, RMB and “other currencies” now total over 4.5% of FX reserves, surpassing CHF, CAD, and AUD holdings. The IMF does not provide a breakdown of “other currencies” but as with CAD and AUD in 2012, it may not be long before another currency is individually reported. It is likely that this will be an emerging market currency.

One final point: while the accumulation of the Chinese yuan continues, it remains at a very muted pace and hardly a threat to the dollar’s reserve status any time soon. Indeed, as BofA noted above, “the evidence so far suggests that reserve managers do not currently see any of the above as ready-made single alternative to the USD.”

However, it is worth noting at the same time that foreign investor purchases of Chinese government bonds continued to gather pace in 2Q, with an estimated $19bn of inflows. The majority of the foreign bond holdings (66% according to BofA) are attributed to foreign central bank and sovereign wealth funds. Moreover, this pace of buying appears to have picked up in 3Q, with the first two months of the 3Q posting $20bn of inflows.

As shown in the chart below, foreign investors now account for 9.2% of outstanding Chinese government bonds. Foreign central bank buying and diversification into Chinese government bonds will likely gain more legitimacy following the September 24 announcement by FTSE Russell that China will be included into the WGBI next October 2021, after China was awarded a maximum score of 2 for “bond market accessibility” (which is hilarious and is why foreign investors are in for a shock once the next default cycle hits China).

via ZeroHedge News https://ift.tt/2SfVE9J Tyler Durden