Nasdaq Shorts Collapse By 40% From 2nd Highest Ever After SoftBank-Inspired Squeeze

Tyler Durden

Sun, 10/04/2020 – 19:16

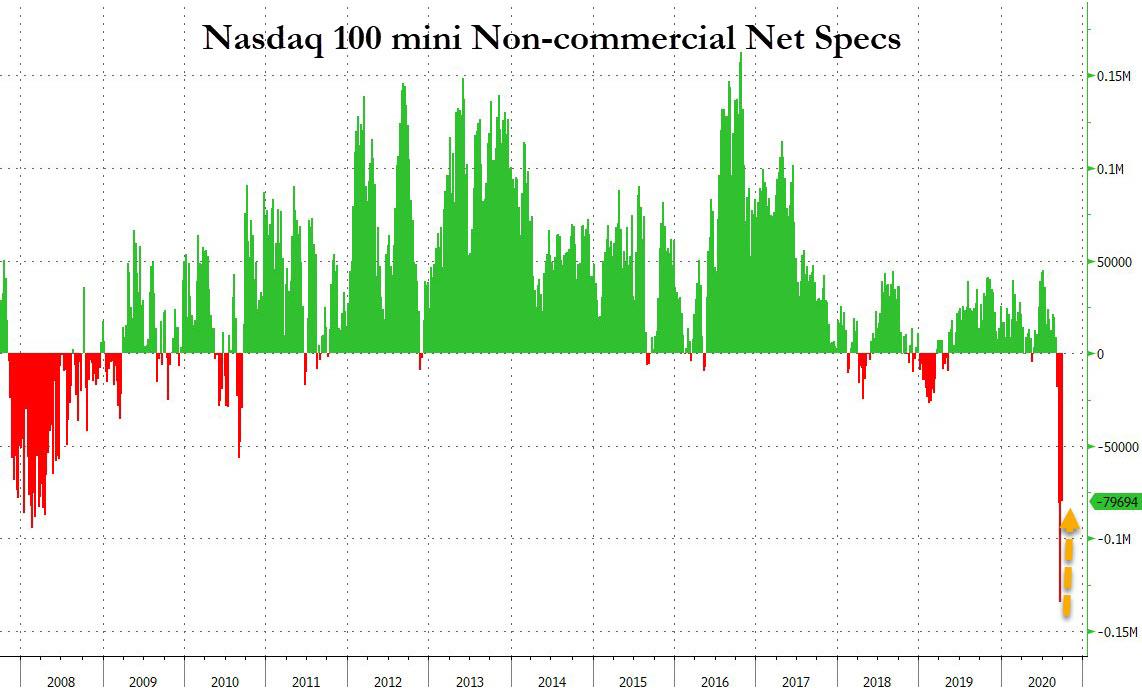

Last weekend, we pointed out following the recent modest correction in the Nasdaq, institutional traders had gone full bear – at least in NQ futures – pushing the net non-commercial contracts to the second shortest position ever, which prompted both us and others to caution that a short squeeze in NQ futs was imminent. This is what the otherwise bearish (on tech) Bear Traps Report said last week after observing our chart:

Nasdaq non-commercial futures positioning is now the shortest since 2008, the index has rapidly blown through the March lows. We are definitely not bullish Nasdaq, but this certainly gives us pause. It is quite possible that this is just momentum players hedging their FANG gains etc, but still quite a move. Keep in mind, that was out a week ago. We’d imagine most dealers and former dealers are bearish risk and are short futures because every piled into puts very quickly (i.e dealers had to hedge themselves on the other side of the trade). Setting up for a squeeze to short into…

A few days later, that’s precisely what happened because according to the latest CFTC Commitment of Traders report, the Nasdaq 100 mini net spec short position in the week ending Sept 29 indeed collapsed by almost 40%, as the net future position shrank from -134.3K to -79.6K.

What happened? Well, as we reported on Friday using both SpotGamma data and a report from CNBC’s David Faber, SoftBank appears to have attempted another forced short squeeze, this time not so much in gamma but in actual future shorts, although it may well have been aiming for both. As SpotGamma observed on Friday, “this chasm between call & put gamma is starting to look similar to that of early August” while CNBC’s David Faber explained what caused it: on Thursday SoftBank bought $200M worth of calls in NFLX, AMZN, FB and GOOGL.

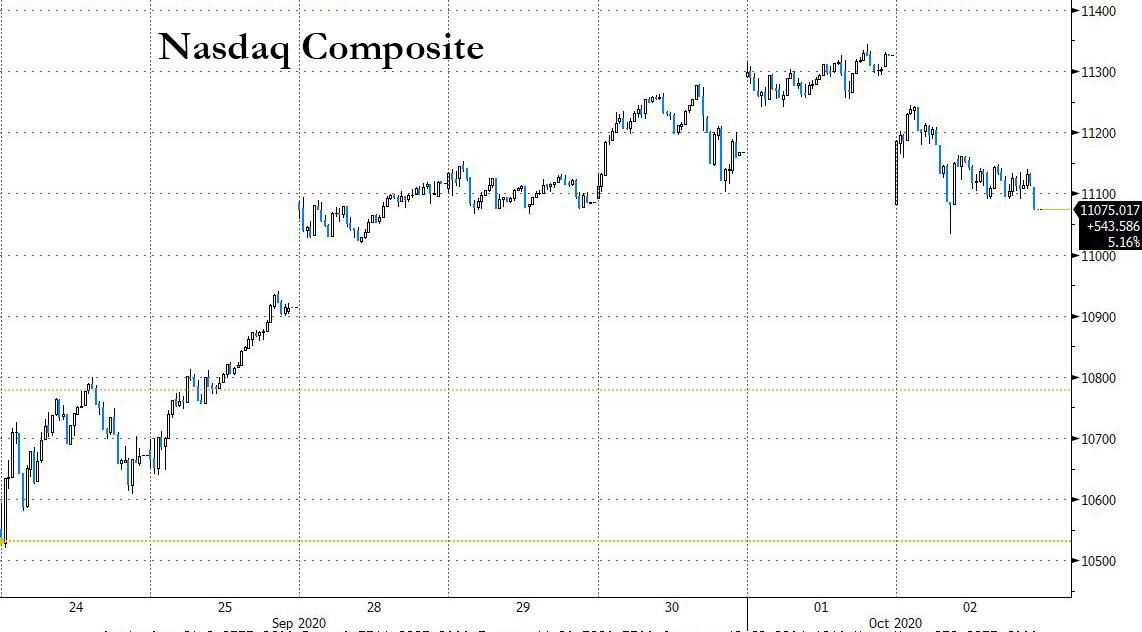

This likely explains why the Nasdaq ripped higher on Thursday after trading water for much of past week…

… however, SoftBank probably did not expect the Friday fireworks, when Trump’s covid diagnosis actually resulted in a pro-cyclical trade sweeping market as traders assumed (perhaps erroneously) that a fiscal stimulus deal (and its associated inflation) is now more likely.

In any case what we find most notable, is that while the Nasdaq indeed rose modestly last week (vs the Sept 25 Friday close), the fact that a whopping 40% of NQ short were covered and the Nasdaq barely rose, likely means that any future attempts by Softbanks to spark a gamma or futures squeeze could have very painful consequences for Masa Son… and potentially all those who furiously keep buying tech stocks and QQQs (and even the 3x levered TQQQ) after every dip.

via ZeroHedge News https://ift.tt/2GC8QDf Tyler Durden