Wall Street Agrees: A Democratic Sweep Is Great For Stocks

Tyler Durden

Mon, 10/05/2020 – 17:00

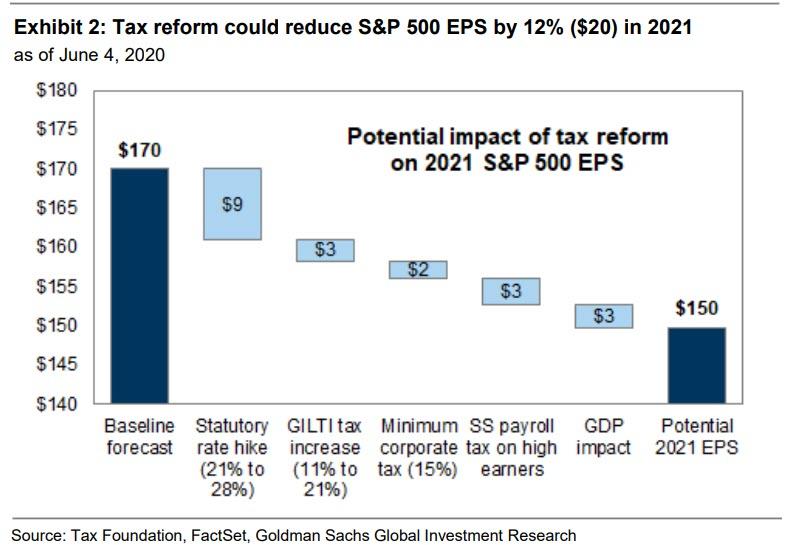

It wasn’t that long ago when Wall Street – when it still seemingly could do simple math – was concerned what a Democratic sweep would mean for stocks: after all, Biden has made no secret of his plan to lift the domestic corporate statutory tax rate to 28% from 21%, reversing half of the Trump cuts, as well as implementing a number of other tax changes including an increased tax on global, low-tax, intangible (“GILTI”) income. In fact, back in June, none other than Goldman’s chief strategist David Kostin observed that what is keeping Goldman’s clients up at night, is precisely the possibility of a Democratic sweep, and Goldman went so far to calculate the $20 hit to 2021 EPS should Biden’s tax reversals pass.

All that started to changed about 3 weeks ago when bank after bank started publishing reports laying out increasingly more optimistic scenarios what a Blue Sweep would mean for the markets. The argument generally ran along the following lines: yes, stocks will suffer a brief hit once taxes jump, but the offsetting massive fiscal stimulus that would be greenlighted by Democrats will more than offset this hit.

The reason for the shift was simple: with poll after (Democrat oversampling) poll revealing a growing Biden lead, Wall Street analysts were given a simple task: prevent a disorderly selloff ahead of or during the elections.

This culminated when none other than Goldman, which just days earlier had hiked its mid-2021 S&P private target to 3,80, said last week that a Biden win would be just as good for stocks, if not better, than a Trump win… and all it would cost would be $7 trillion in extra fiscal stimulus. This is what we said:

… there is one scenario where Goldman’s projections could make some sense: that would be if the Biden tax hikes were accompanied by a new fiscal stimulus wave, one not prompted by another global cataclysm such as a covid pandemic.

It is this massive fiscal stimulus bombshell that Goldman assumes. As Kostin writes, “our political economists outline roughly $7 trillion in gross fiscal expansion spread out over several years that Biden has proposed, including roughly $2 trillion of front-loaded COVID-related stimulus as well as spending on infrastructure, healthcare, and other policies.“

Well… sure. If you unleash an unprecedented, $7 trillion debt-funded spending spree in the US economy when it is no longer crippled by the covid shutdowns, you will certainly see a favorable response in the stock market. You might even get a modest pick up in inflation and bond yields (something which Goldman also opined on recently when it warned of a 50bps spike in 10Y yields should Democrats sweep on Nov 3). What was remarkable is that Goldman admitted that the sugar high from even a gargantuan $7 trillion fiscal stimulus would last at most 2 years, and be exhausted some time in 2023 at which point even more will be needed to keep stocks rising:

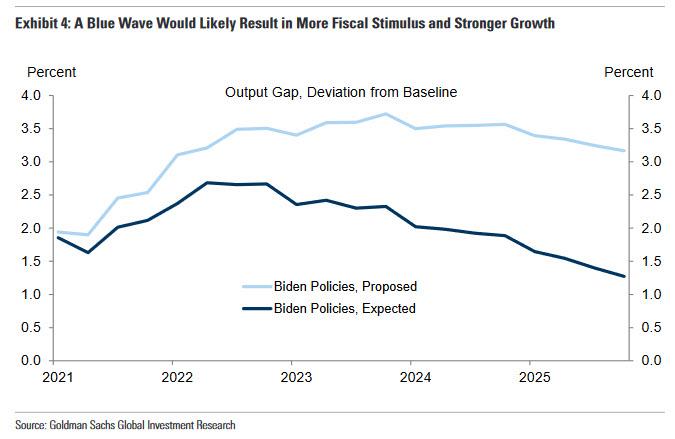

In 2023, however, the impulse becomes negative as the economy grows more slowly than would be the case absent the additional economic acceleration in the first half of the Biden administration.

One thing that few if anyone has touched upon is the US debt supernova that would accompany this historic debt tsunami: as we calculated last week, by 2023 total US debt should be around $40 trillion, while US GDP – thanks to the covid pandemic – will barely be above the 2019 levels, which means that “at some time in 2023 the wheel on the US fiscal bus will really fall off at which point the US becomes fully Japanified, and only full-blown helicopter money coupled with direct “digital dollar” deposits by the Fed into US household accounts, would allow the US to reach the end of the Biden administration in 2024 without total collapse in the process.”

For now, Wall Street’s pros have decided to leave all those considerations for some undetermined, future date, and instead are beating the drum on the markets nirvana that will be unleashed as soon as Biden defeats Trump.

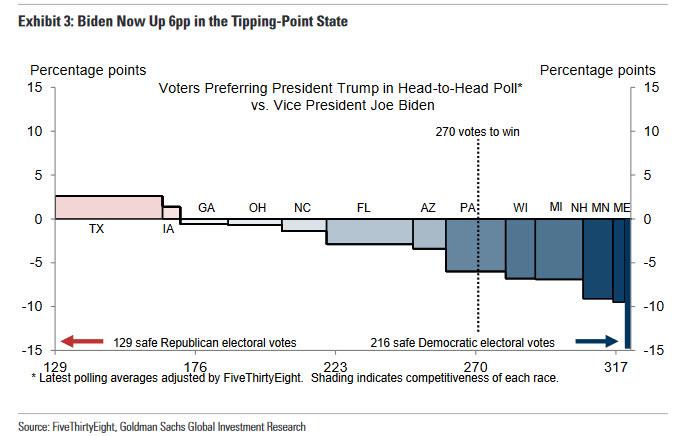

Case in point, yet another report from Goldman’s Jan Hatzius today, in which the chief economist doubles down on a Biden win – using data from that “seer” Nate Silver who was catastrophically wrong in 2016 – and its consequences, and writes that “Tuesday’s presidential debate clearly did not help Trump in the polls. Former Vice President Biden is currently ahead by 8pp in the national polls, 6pp in the most likely tipping-point state Pennsylvania, and 3pp in Florida and Arizona, two nearly must-win states for Trump which—unlike the Midwestern swing states — should finish counting their votes around midnight and could therefore resolve the uncertainty earlier than widely expected. In the Senate, Democrats now lead the polls in enough states to win at least 50 seats (which would leave them in control if Senator Harris wins the Vice Presidency and can therefore break ties). Thus, the polls suggest a “blue wave” in which Democrats gain unified control of Washington is becoming more likely.“

So what would said Blue Wave do? Well, according to Goldman, such a blue wave would “likely prompt us to upgrade our forecasts. The reason is that it would sharply raise the probability of a fiscal stimulus package of at least $2 trillion shortly after the presidential inauguration on January 20, followed by longer-term spending increases on infrastructure, climate, health care and education that would at least match the likely longer-term tax increases on corporations and upper-income earners.”

In short, and as we noted above, yes taxes will go up and spending by the middle and upper classes will be hit, but the trillions in new debt will more than offset any tax-hike driven slowdown. This is shown in the chart below, which compares the impact on the US output gap between expected and proposed Biden policies.

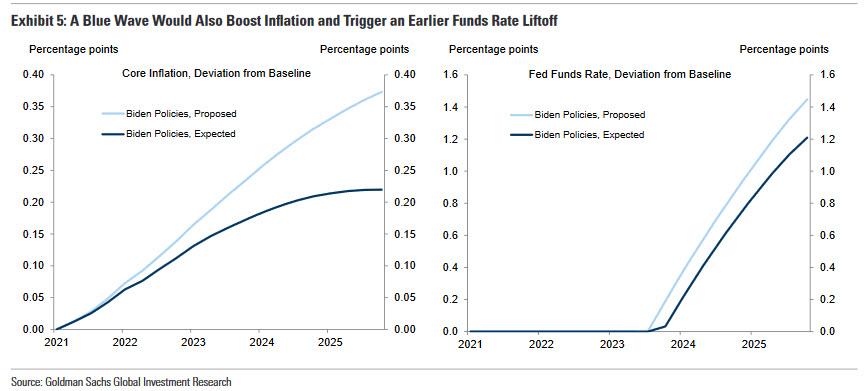

There is one potential drawback from all this ludicrous debt issuance: inflation will make a triumphant return (in fact, as we observed last week, it already has). According to Hatzius, the rising probability of a blue wave “adds to our sense that markets may have become too complacent about Fed policy. Our FRB/US simulations suggest that a blue wave could pull forward the first hike by up to two years, mainly because of the higher inflation path.”

Worse, and confirmed our own observations from last week, Goldman next points out that even before any policy changes, core PCE inflation has already returned to its 20-year average of 1.6%, as the weakness during the spring was mostly driven by temporary covid-related disruptions that have now reversed on net.

In short, if the inflation boost from fiscal expansion comes from a starting point that is closer to 2% than most observers expected just a few months ago, Hatzius warns that “markets may need to build in a risk premium for a more sizable overshoot.” Amusingly, while Goldman has been quick to adjust its near term economy and market forecasts in the case of a Blue Sweep, it has yet to change its baseline forecast of no hikes until early 2025, even though as the bank admits, “most of the risk is now on the side of an earlier liftoff and potentially a steeper path of normalization.”

We don’t need to tell readers what higher rates will do to stocks: for those who need a refresh course, see Q4 2018.

So while a blue wave sets the stage for the next market crash some time after 2023, the good news – per Goldman – is that a Democratic Sweep, despite a sizable increase in the corporate income tax rate by up to 7 percentage points “it would likely result insubstantially easier US fiscal policy, a reduced risk of renewed trade escalation, and afirmer global growth outlook. These shifts should be clearly positive for cyclical sectors, as well as firms that pay most of their taxes outside the United States.”

To be sure, Goldman wasn’t alone in turning bullish on a Democratic sweep. According to strategists from Barclays to Citigroup to JPMorgan, a clear-cut Blue Sweep could avoid a long and messy legal battle and provide certainty to markets that have been nervous about election risks, according to Bloomberg.

“Polls are shifting from a close election and prolonged uncertainty to more a dominant Biden and clean succession,” said Peter Rosenstreich, head of market strategy at Swissquote Bank SA. “That is reducing uncertainty and increasing risk appetite.”

“Markets seem have lowered the chance of prolonged uncertainty post-November 3,” Barclays Plc strategists Ajay Rajadhyaksha and Shawn Golhar wrote in a note Sunday. “Given that Vice President Biden has been ahead in most polls, this suggests that markets are assigning a bit more probability to his win and a bit less to a close and contested outcome.” Barclay’s dollar-neutral Biden currency basket has also risen in recent days, a sign of rising confidence in the former vice-president’s prospects.

JPMorgan’s head equity strategist Mislav Matejka also joined the chorus overnight: “A potential Biden victory should not be seen as a negative for markets, and could in fact lead to an internal rotation.”

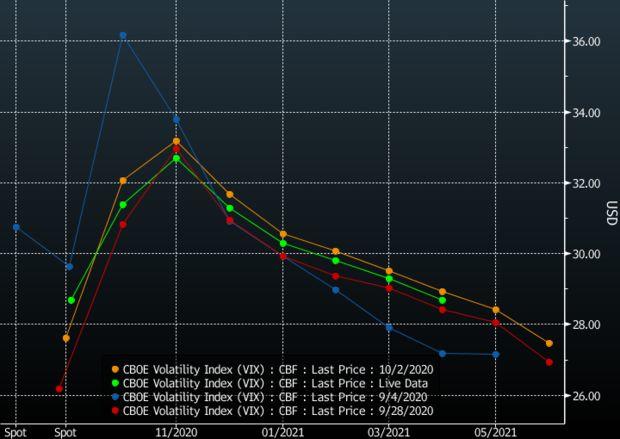

Even the VIX curve, which has shown a remarkable hump around the Nov election date amid fears of a contested election, has since moderated somewhat with October’s contracts, which cover the polling date, are down 2% on Monday after jumping nearly 5% on Friday.

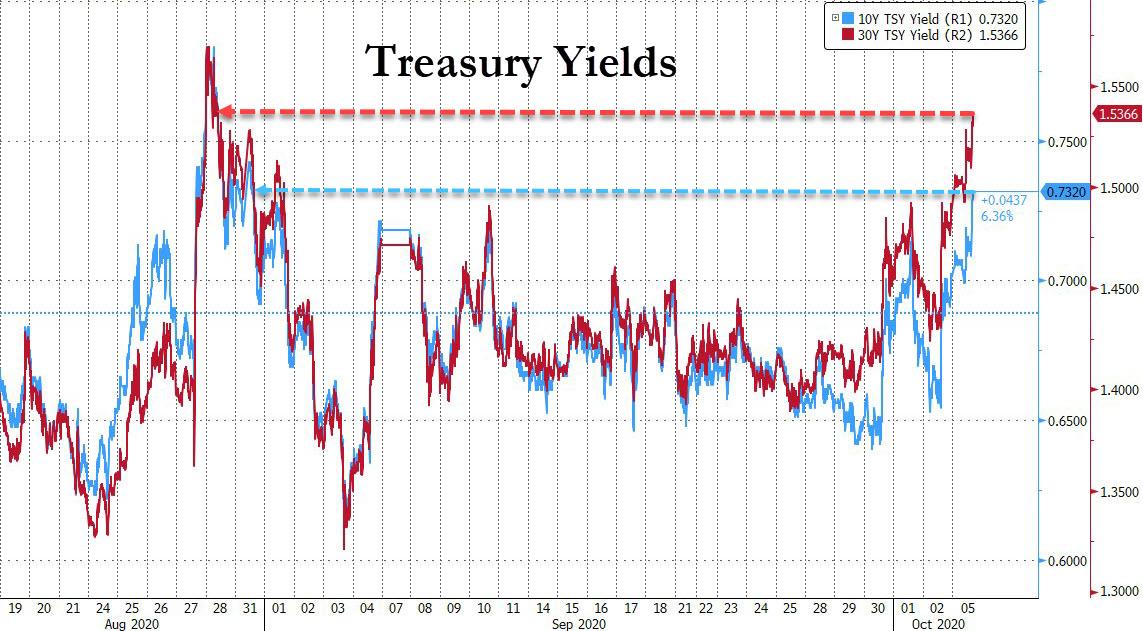

But nowhere was Wall Street’s newly found Biden euphoria more visible than in the Treasury curve, where yields for both 10Y and 30Y TSYs spiked to the highest since late August as noted earlier, while the 5s30s curve steepened to 124 basis points, the widest in more than a month, as investors pared holdings of havens.

That confidence, Bloomberg notes, combined with a continued economic recovery, will help support equity markets – and potentially even a rotation into riskier shares, according to Evercore ISI which decided to echo JPMorgan almost verbatim.

“Passage of fiscal package 4 plus a Democratic sweep would be a significant support for value and cyclicals near term,” strategists led by Dennis Debusschere wrote in a note Sunday.

In perhaps the least provocative hot take of all in the past days, Jefferies merely opined that just having a “clean” election would be bullish for stocks: “We do have sympathy with the idea that a clean election outcome is likely a positive event from here given the “chaos” risk overhanging markets,” Jefferies strategists wrote.

And now that Wall Street has uniformly decided that Biden will win and that Democrats will likely sweep, and that both of those events are bullish for stocks – similar to what virtually every analyst said in 2016 regarding a Clinton presidency, while agreeing that a Trump win would be disastrous for markets – we sit back and watch just how quickly the consensus will change on Nov 4 if and when there is another “shock” that nobody could have possibly predicted.

via ZeroHedge News https://ift.tt/30DlJUJ Tyler Durden