US Labor Market Topping: Job Openings Post First Monthly Drop Since Covid Crash

Tyler Durden

Tue, 10/06/2020 – 10:24

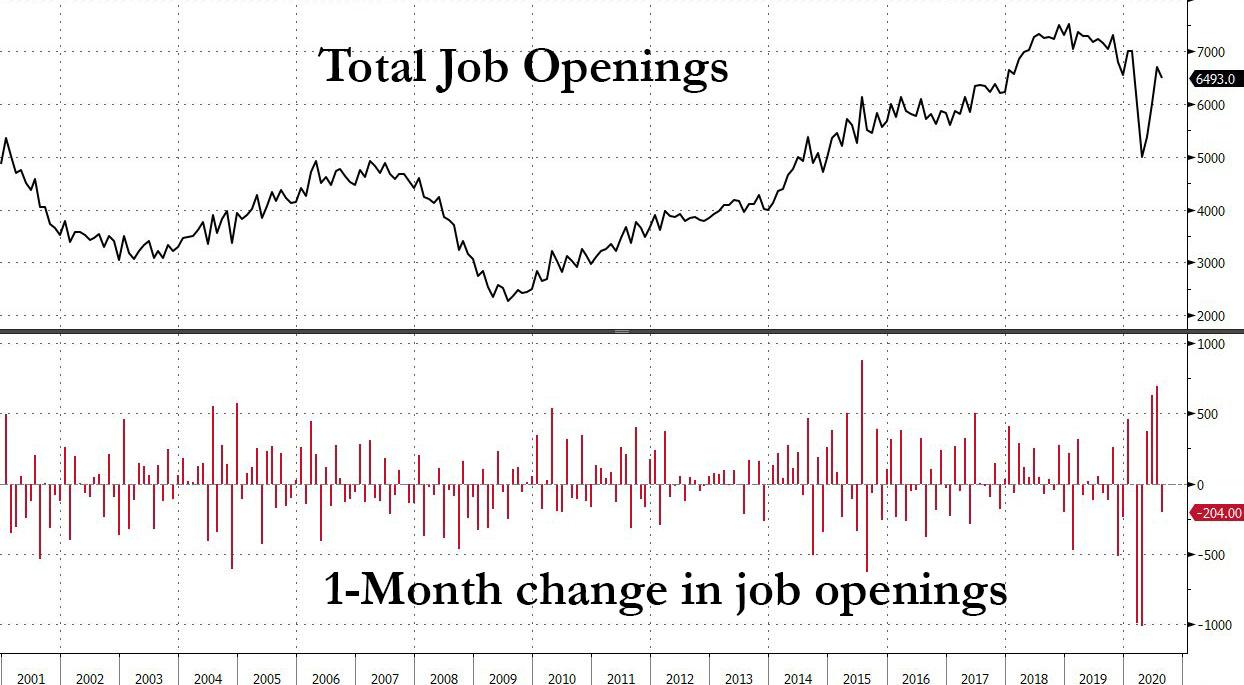

One month after a schizophrenic JOLTs report showed a concurrent surge in job openings accompanied by a record plunge in hirings, things returned somewhat to normal in August (as a reminder, the BLS’s Job Openings and Labor Turnover survey is two months delayed), when the number of job openings dipped dropped by 204K to 6.493 million after posting the biggest two-month increase in the previous two months when US employers announced 1.3 million job openings. This was the first monthly drop in total job-opening since the March/April crash in the labor market, suggesting the recent V-shaped recovery in the labor market may be peaking.

Job openings decreased in construction (-68,000), and information (-25,000). The number of job openings decreased in the Midwest region.

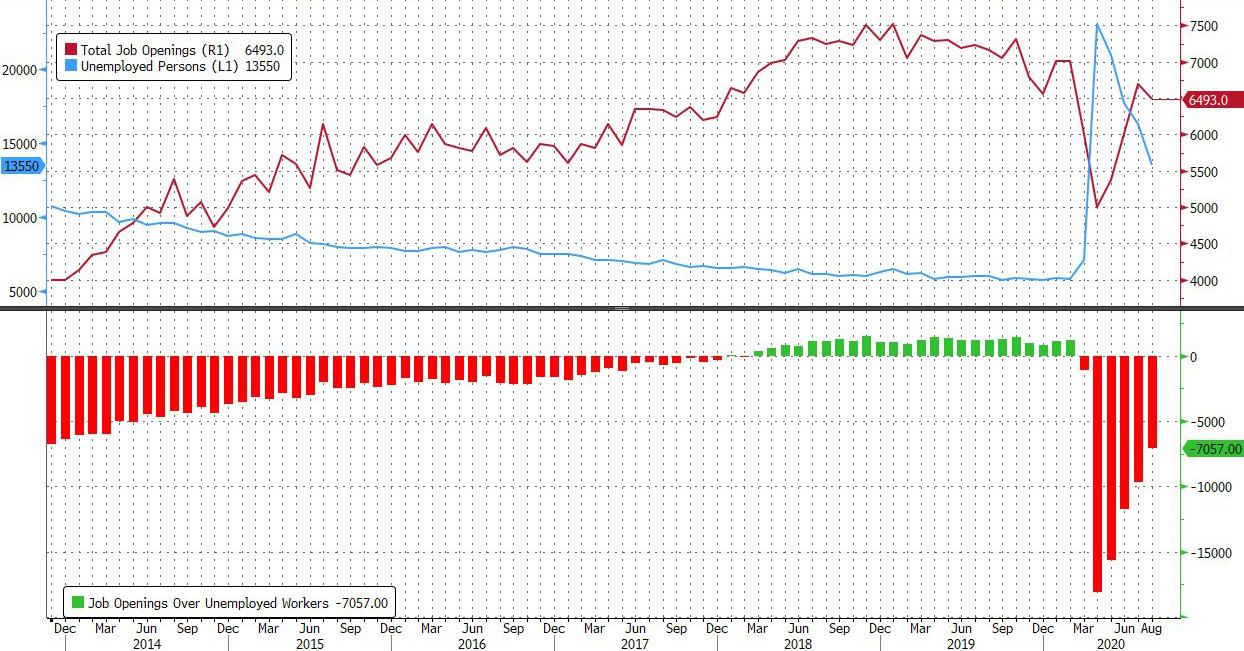

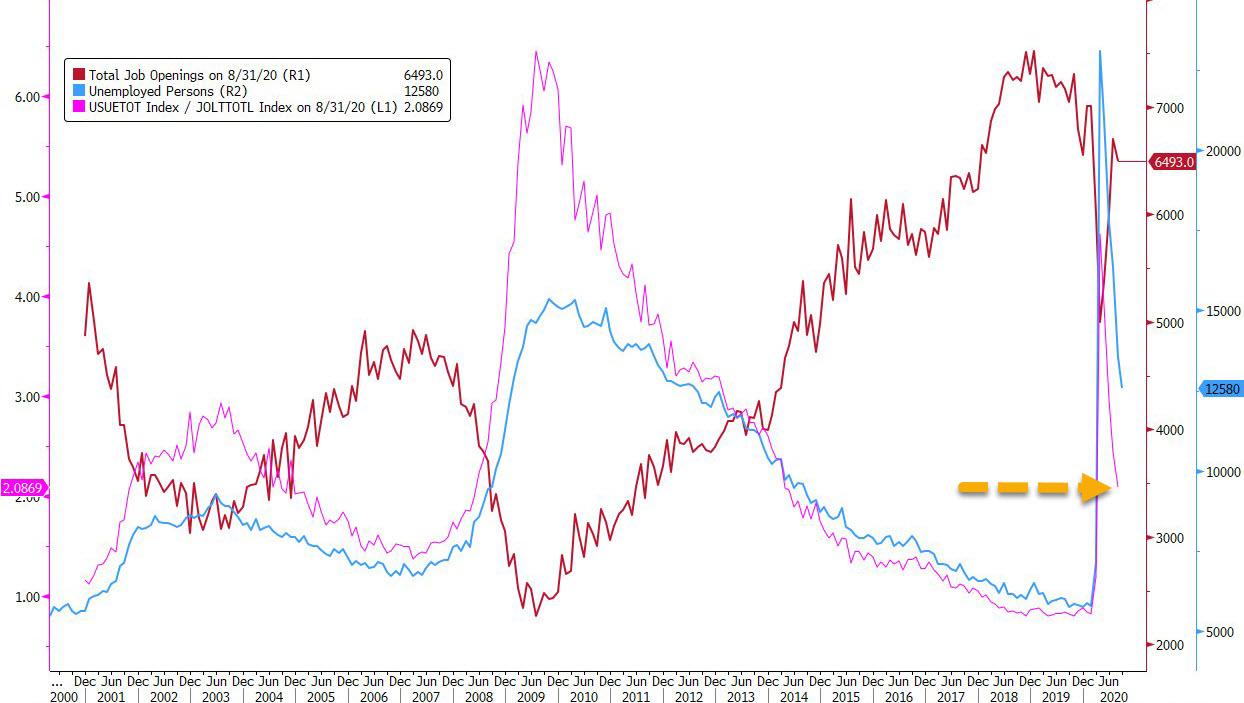

Separately, we already knew that the series of 24 consecutive months in which there were more job openings than unemployed workers ended with a thud in March, in April it was an absolute doozy with 18 million more unemployed workers than there are job openings, the biggest gap on record. Since then the the gap has closed somewhat, and in July, there were 7.1 million more unemployed than available job openings (after 9.6 million in July).

As a result, there were just over 2 unemployed workers for every job opening, down from 2.4 last month.

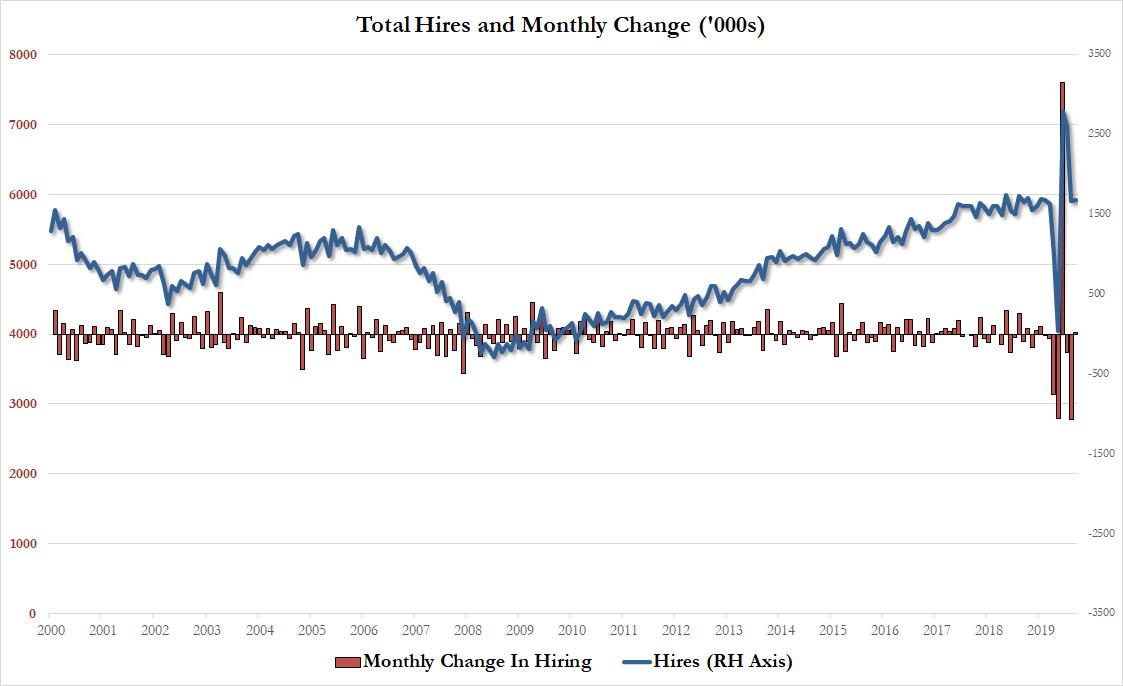

Meanwhile, after a record and unexplained plunge in hiring in July, when the total number of job hires dropped by a 1.2 million to just 5.8 million, in August hiring stabilized modestly, increasing by 16k to 5.919MM from 5.903MM, which still is well below the record hiring pace set in May with 7.2MM.

Hires increased in federal government (+246,000), largely because of temporary 2020 Census hiring. Hires also increased in durable goods manufacturing (+41,000). Hires decreased in accommodation and food services (-177,000), health care and social assistance (-73,000), and real estate and rental and leasing (-28,000).

With hiring relatively flat in August, the number and rate of total separations decreased to 4.6 million (-394,000) and 3.3 percent, respectively. Total separations decreased in other services (-80,000) and in arts, entertainment, and recreation (-56,000). The number of total separations increased in federal government (+13,000).

Of these, the number and rate of layoffs and discharges decreased to series lows of 1.5 million (-272,000) and 1.0 percent, respectively in August. Layoffs and discharges decreased in a few industries, with the largest decreases in professional and business services (-95,000), accommodation and food services (-62,000), and durable goods manufacturing (-42,000). The number of layoffs and discharges increased in federal government (+12,000).

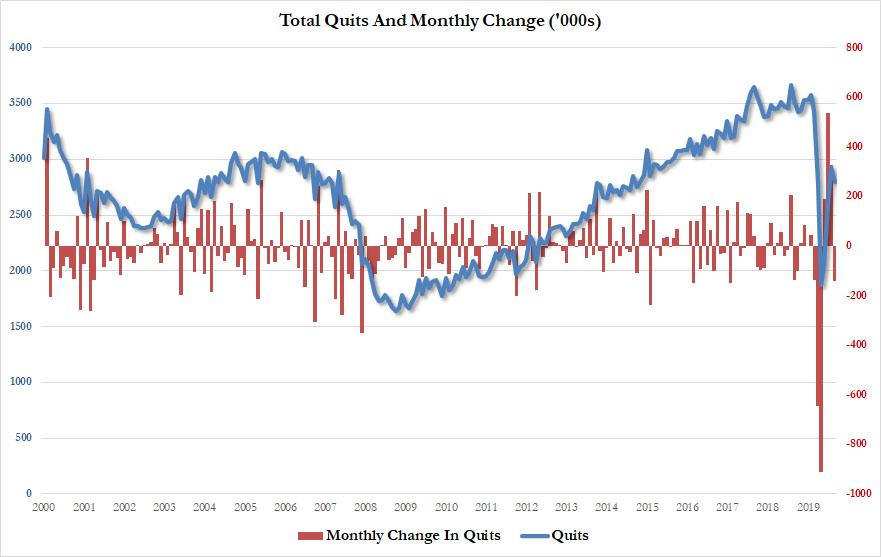

Finally, after the record surge in the number of American quitting their jobs reported back in June, the number of quits edged down to 2.8 million (-139,000) and the quits rate was 2.0 percent. Quits decreased in a number of industries with the largest decreases in other services (-48,000), construction (-40,000), and arts, entertainment, and recreation (-18,000). The number of quits increased in finance and insurance (+36,000).

via ZeroHedge News https://ift.tt/3llXlP4 Tyler Durden