Peter Schiff: Stimulus Doesn’t Help The Underlying Economy

Tyler Durden

Thu, 10/08/2020 – 15:25

Peter Schiff appeared on RT Boom Bust along with Michele Schneider of MarketGauge to talk about market reaction to the stimulus stalemate, the impact of the upcoming election, and the prospects of the dollar.

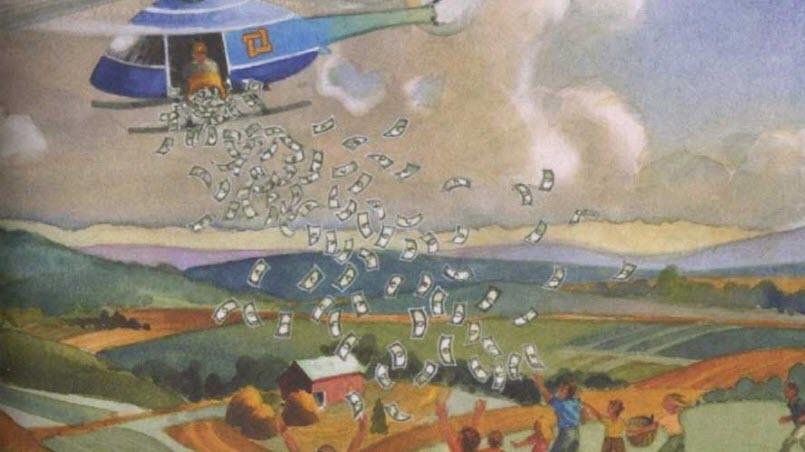

The interview was recorded before President Trump tweeted the rug out from under the hope of a stimulus deal and cut off negotiations with the Democrats. At the time, Peter said it was certainly possible we could get another round of “so-called” stimulus, but none of it actually helps the underlying economy.

It doesn’t do anything to increase productive output of the economy. It does stimulate the markets. It makes stock prices go up. So clearly, there’s an interest for that. But that doesn’t help the actual economy. All it does is debase the value of our money.”

Peter said he thinks the prospects for a Biden victory is decisively negative for both the economy and the stock market.

The only silver lining in that cloud from the perspective of the stock market is since the economy will be so much weaker under Biden, the Fed will be called on to do even more monetary stimulus. So, they’ll be a lot more inflation created, a lot more money printing in a Biden administration than in the Trump administration, although we’re going to get a lot in both regardless of the outcome. But we’ll probably have even more of it if Biden wins than Trump. So, that could provide more fuel for the stock market bubble. But remember, taxes on corporate earnings are going to rise substantially, not only on the corporate level but on the individual level, because corporations are subject to double taxation. So, we’re talking about massive increases on corporate taxes, effective tax rate, that substantially reduces the value of those corporations. So, it’s going to take a massive amount of air to blow up a bigger bubble given that the fundamental value of stocks will be so much lower under Biden than would be the case under Trump.”

Peter also talked about gold and the dollar, saying he thinks gold is building a base of support around the old all-time record high.

We got up to $1,900 back in 2011 and then gold sold off and pulled back down near a thousand. But now, we’ve really broken through those highs, and I think once we finish building this new base of support, gold is going significantly higher. And yes, in that same environment, the US dollar is going to lose a lot of value, not just in terms of gold, where it will lose the most value, but in terms of a lot of other fiat currencies that will lose less value than the dollar.”

Peter said that means we can expect the cost of living in the US to go way up.

People who are staying at home and living off of government checks, those checks are not going to buy nearly as much because the price of everything they need to live is going to be getting higher and higher and higher. So, the value of those benefits is going to go lower and lower until ultimately, if we completely destroy the value of the dollar and we have hyperinflation, then none of it matters. It doesn’t matter how much money the government sends you if you can’t buy anything with it.”

via ZeroHedge News https://ift.tt/3iJPzge Tyler Durden