Poor, Tailing 30Y Auction Prices At Highest Yield Since Covid Pandemic

Tyler Durden

Thu, 10/08/2020 – 13:12

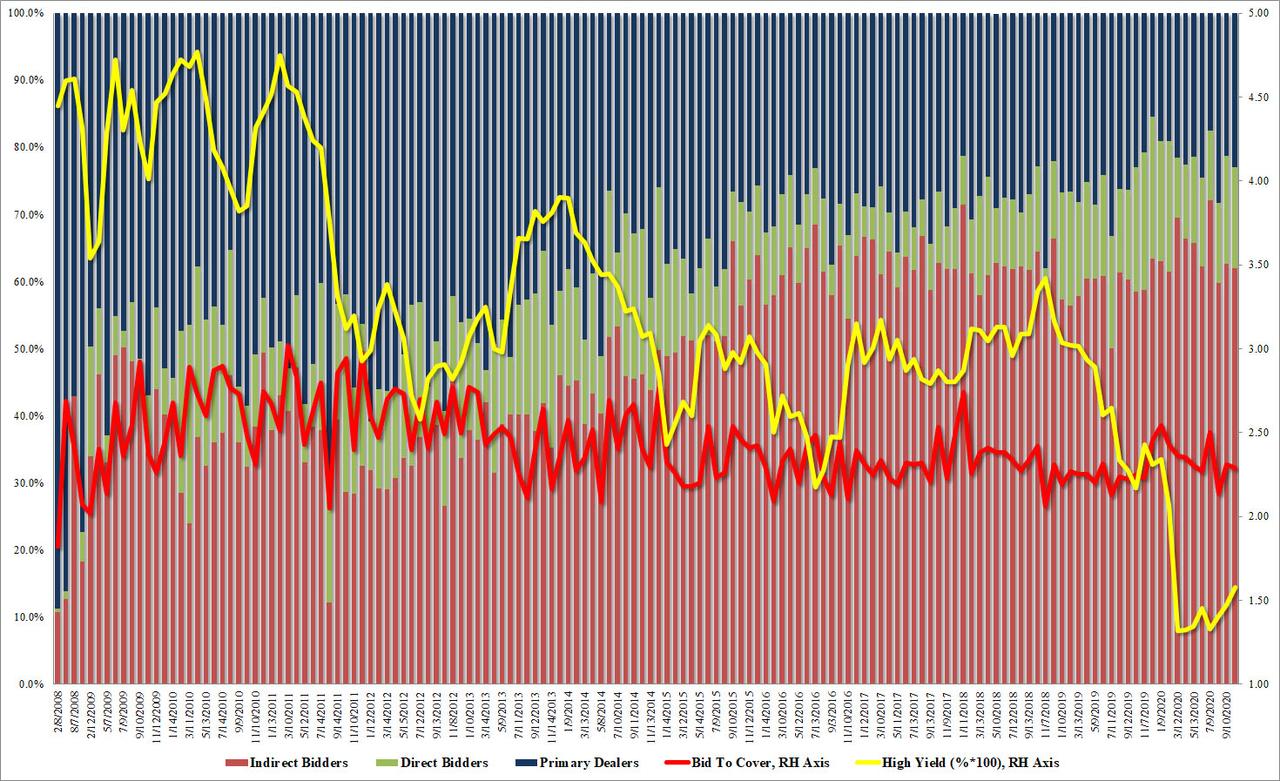

With the yield curve sharply steepening in recent days, it will not come as a surprise to most that the just concluded 30Y auction priced at the highest yield since before the covid pandemic began: today’s 29-year-10month reopening of CUSIP SP4 priced at 1.578%, which was not only sharply higher than September’s 1.473% and also a substantial 1.1bps tail to the 1.567% When Issued, but it was also the highest since the Feb 30Y auction when it prices at 2.068% after it plunged to just 1.28% in March.

The bid to cover also sagged, dropping from 2.308 to 2.288, below the 2.31 six auction average.

The internals were generally in line with Indirects taking down 62.0%, modestly below both last month’s 62.6% and the six auction average of 64.8%. And with Directs taking down 15.0%, Dealers were left holding 23.0% of the auction which they will promptly flip back to the Fed at first opportunity.

Overall, a subpar, tailing auction driven by the recent reflation scare, although if inflation is indeed on its way, coming long-bond auctions will be far uglier.

via ZeroHedge News https://ift.tt/34GCGPn Tyler Durden