Stocks, Bonds, Bitcoin, Gold, & Oil Pop Despite Stimulus Slop

Tyler Durden

Thu, 10/08/2020 – 16:00

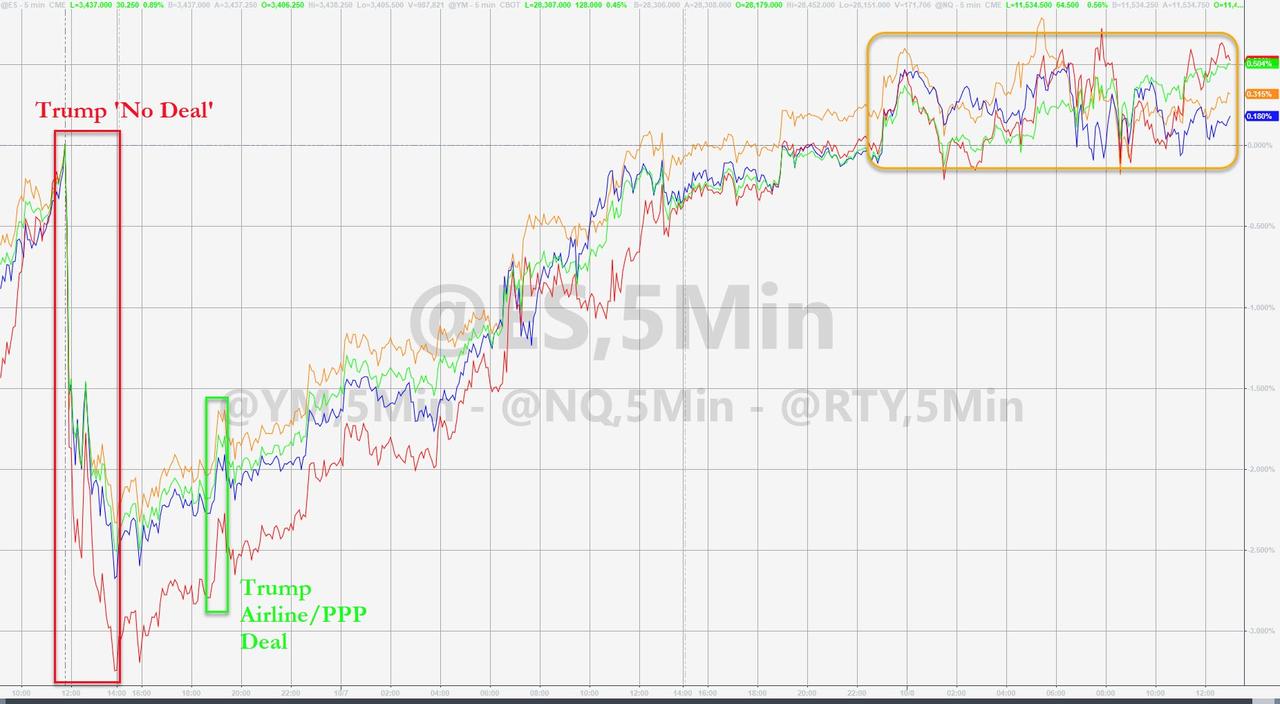

Large stimulus, small stimulus, skinny stimulus, pre-election stimulus, post-election stimulus, state stimulus, airline stimulus, no stimulus… today had everything (well nothing)…

…but it seems the algos are exhausted as stocks generally shrugged along ignoring the headlines and tweets, hovering at the pre-Trump ‘no-deal’ Tweet levels all day…

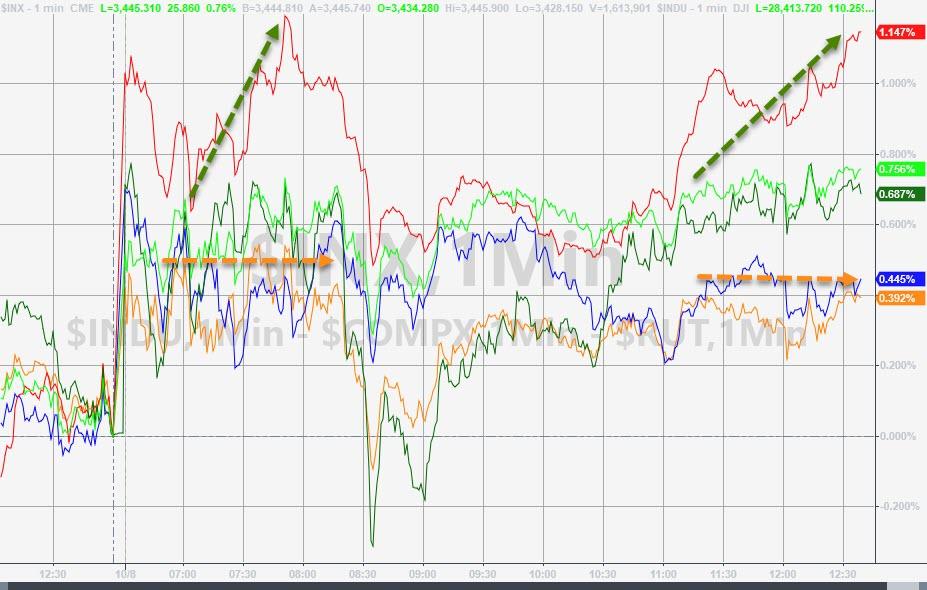

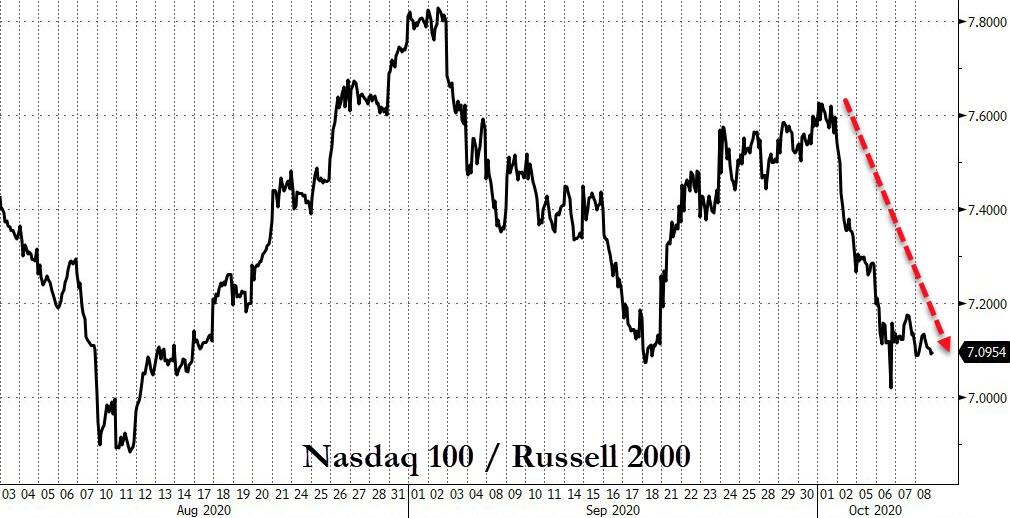

Small Caps (once again) outperformed with Nasdaq lagging…

Nasdaq 100 is at 2-month lows relative to Small Caps…

Source: Bloomberg

One glance at the S&P 500 futures’ intraday price action and you could be mistaken for thinking its just another Robinhood-sponsored penny stock party…

Utter chaos in the VIX complex today…

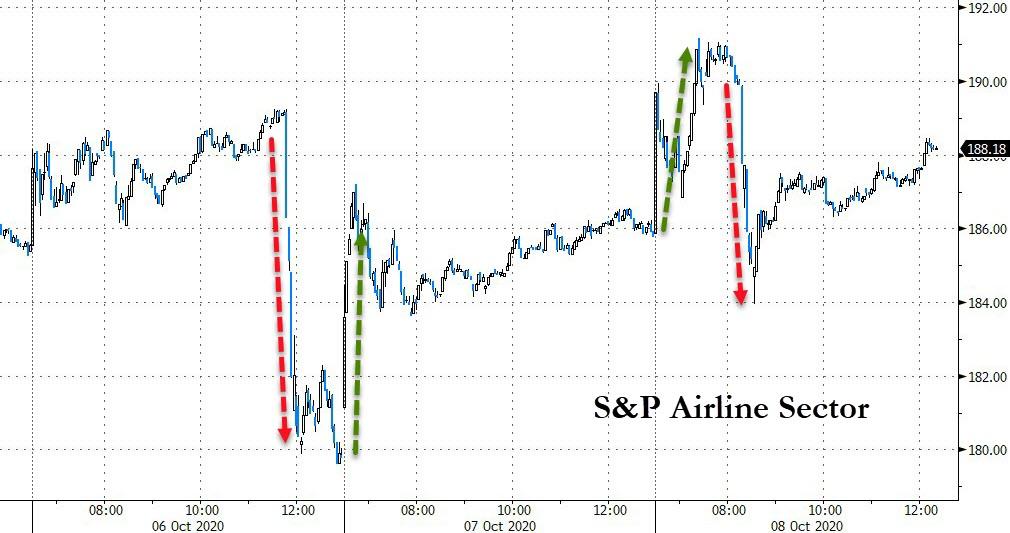

Airline stocks showed where the highest beta is…

Source: Bloomberg

Bond yields drifted very gently lower all day…

Source: Bloomberg

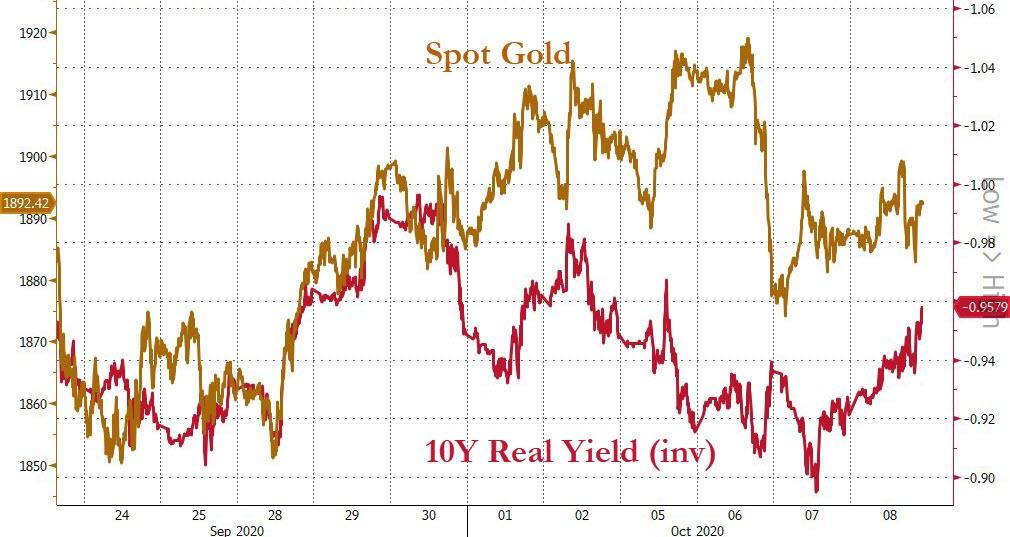

Real yields tumbled today…

Source: Bloomberg

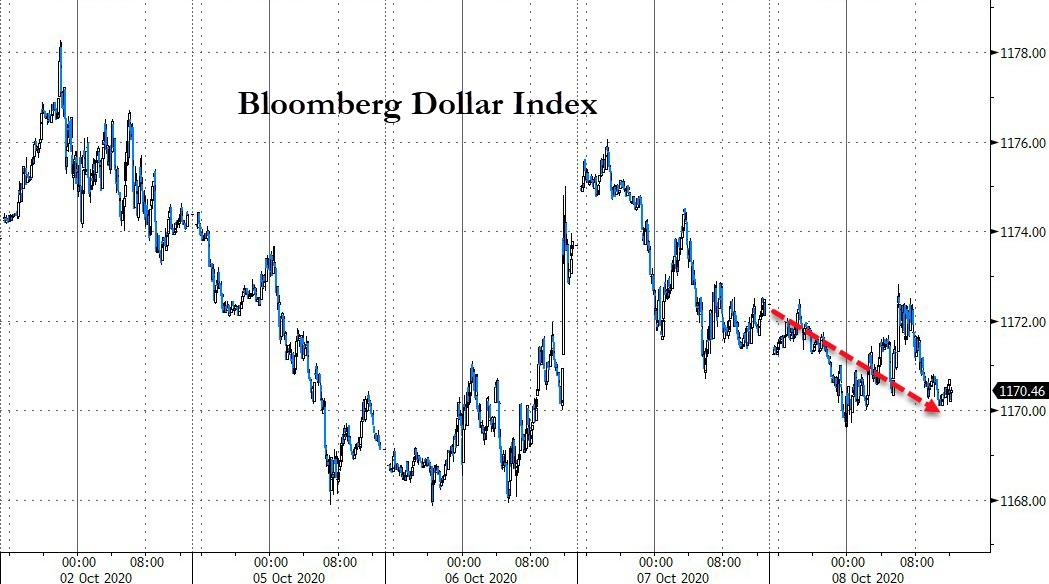

The dollar also fell very modestly…

Source: Bloomberg

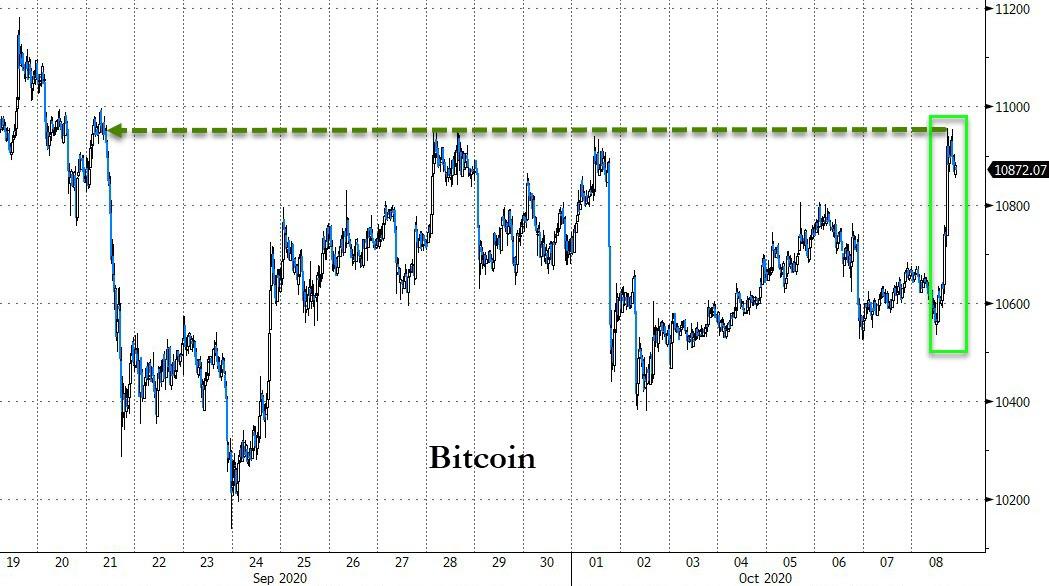

Bitcoin bounced – thanks to news that Square had invested heavily in the cryptocurrency…

Source: Bloomberg

And oil prices jumped on Saudi/OPEC optimistic jawboning (WTI topped $41)…

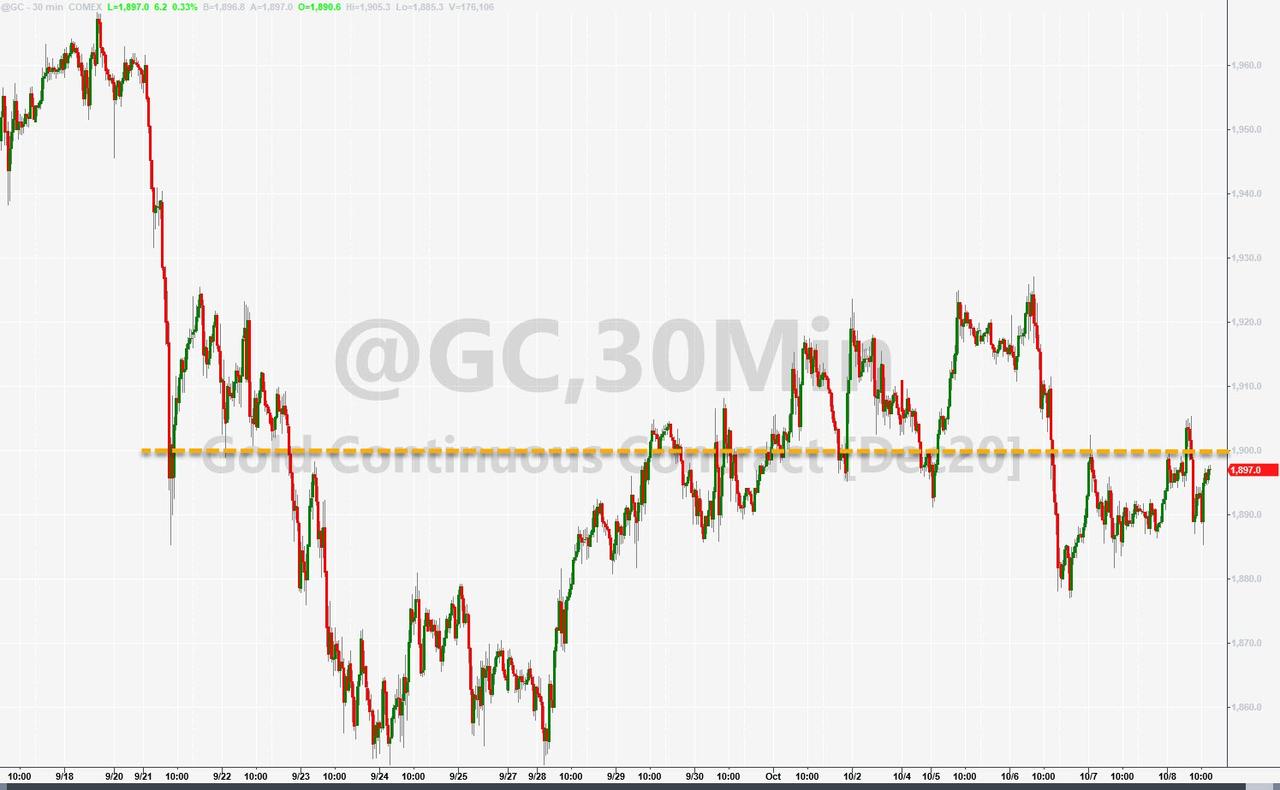

Gold futures rallied back up near $1900 once again…

Finally, you just have to laugh at the run on “Most Shorted” stocks (squeezing higher for 9 of the last 10 days)…

Source: Bloomberg

We’ll leave you with Boston Fed President Rosengren’s warning today:

“Abnormally low rates for a long period during times when economic slack is no longer a concern can result in excessive risk-taking, as businesses and firms take on additional debt and accumulate more risky assets in search of better returns – potentially bidding up asset prices to unsustainable levels. The financial pressures associated with such behavior build gradually, and only become clear in the next economic downturn.”

“In the United States, we do not have a cohesive set of regulatory and supervisory tools to moderate risk build-ups. And while we do have the Financial Stability Oversight Council, we do not have a regulatory and supervisory body endowed with tools and structures that can be deployed to limit financial stability risks.”

So we should probably ignore this…

Source: Bloomberg

via ZeroHedge News https://ift.tt/36MGDVm Tyler Durden