Key Events This Week: Earnings Season Begins, CPI And Retail Sales

Tyler Durden

Mon, 10/12/2020 – 09:17

The biggest highlight this week will be the kickoff of US earnings season with a number of financials reporting earnings this week. As DB’s Jim Reid adds, there will also be some attention on the European Council summit on Thursday and Friday at an important point in the UK-EU negotiations. This meeting has previously been Prime Minister Johnson’s self-imposed deadline to reach agreement on a trade deal. It seems progress has been made and if this continues talks will likely continue beyond that self imposed UK deadline. Mr Johnson held weekend talks with Macron and Merkel so the right people are talking. Bloomberg is reporting that the French are digging in their heels over fishing rights and this is now the main issue.

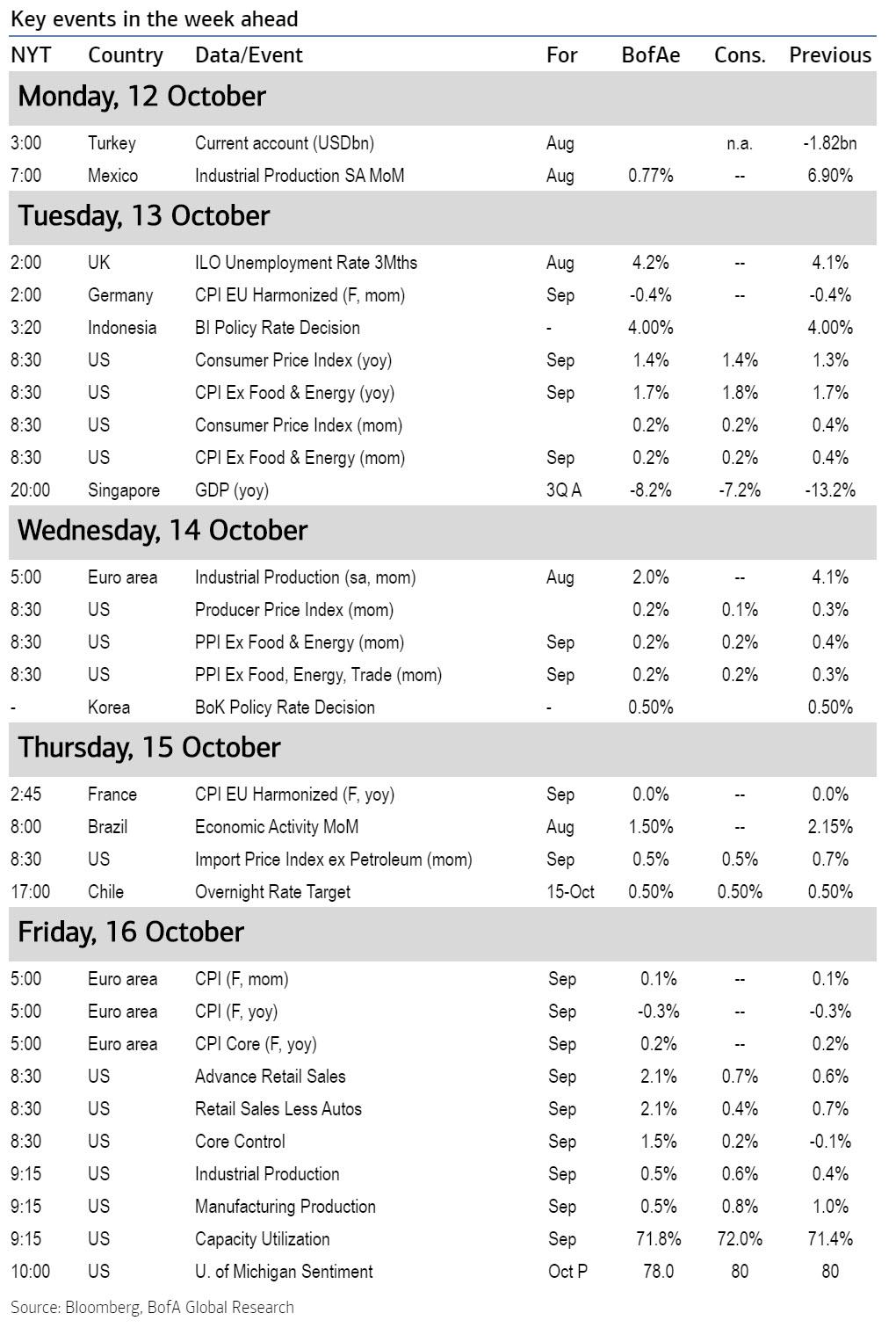

Elsewhere, in terms of the regular data and central bank calendar, this week is a fairly quiet one. On the data side, we’ll start to see some hard data from the US for September, with the release of the CPI (Tuesday), retail sales and industrial production figures (both Friday). China will also be releasing their trade balance for September (Tuesday), and we’ll also get the Euro Area’s industrial production for August (Wednesday).

On the central bank side, the two G20 decisions expected next week will come from Bank Indonesia on Tuesday and the Bank of Korea on Wednesday, with the consensus expecting rates to stay on hold in both cases. Otherwise there’ll be a number of speakers, including Fed Vice Chairs Clarida and Quarles, and Bank of England Governor Bailey. We will also see the IMF/World Bank annual meetings taking place as well with the latest forecasts out tomorrow.

Going back to the main event – this week’s start of earnings season, a number of financials will lead the way. We’ll hear tomorrow from Johnson & Johnson, JPMorgan Chase, Citigroup and BlackRock. Then on Wednesday, we have UnitedHealth Group, Bank of America, ASML, Wells Fargo, Goldman Sachs and United Airlines. Thursday sees releases from Morgan Stanley and Walgreens Boots Alliance. And on Friday we’ll get earnings from Honeywell International and BNY Mellon. A summary of this week’s reporters is below courtesy of Earnings Whispers:

As Goldman’s David Kostin writes, the consequences of the semi-frozen economy on an uneven road to recovery will be visible in 3Q results: consensus expects 3Q S&P 500 EPS will decline by 21% on a year/year basis, following a 32% drop in 2Q and a 15% fall in 1Q. Including the anticipated 14% fall in 4Q, our full-year 2020 EPS estimate of $130 reflects a 21% year/year decline from the 2019 level. Looking forward, Goldman projects 30% earnings rebound to its baseline 2021 EPS forecast of $170, followed by 11% growth to $188 in 2022. Good luck with that.

Below is a day-by-day calendar of key events courtesy of Deutsche Bank:

Monday October 12

- Data: Japan September PPI, August core machine orders

- Central Banks: BoE’s Bailey and Haskel speak

- Other: IMF/World Bank Annual meetings begin, bond market holiday in the US and Canada

Tuesday October 13

- Data: China September trade balance, UK August employment, Germany final September CPI, October ZEW survey, US September CPI, NFIB small business optimism index

- Central Banks: Bank Indonesia monetary policy decision

- Earnings: Johnson & Johnson, JPMorgan Chase, Citigroup, BlackRock

- Other: IMF release latest World Economic Outlook

Wednesday October 14

- Data: Japan final August industrial production, Euro Area August industrial production, US weekly MBA mortgage applications, September PPI

- Central Banks: Bank of Korea monetary policy decision, Fed’s Clarida, Quarles, Kaplan, ECB’s Lane, Villeroy and BoE’s Haldane speak

- Earnings: UnitedHealth Group, Bank of America, ASML, Wells Fargo, Goldman Sachs, United Airlines

Thursday October 15

- Data: China September CPI, PPI, Japan August Tertiary Industry Index, France final September CPI, US weekly initial jobless claims, October Empire State manufacturing survey, Philadelphia Fed business outlook, September import price index

- Central Banks: Fed’s Quarles, Bostic, Kashkari, BoE’s Cunliffe speak

- Earnings: Morgan Stanley, Walgreen Boots Alliance

- Politics: European Council meeting begins

Friday October 16

- Data: EU27 September new car registrations, Italy final September CPI, Euro Area final September CPI, August trade balance, Canada August manufacturing sales, US September retail sales, industrial production, capacity utilisation, August business inventories, foreign net transactions, preliminary October University of Michigan sentiment

- Earnings: Honeywell International, BNY Mellon

- Politics: European Council concludes

* * *

Focusing on just the US, the key economic data releases this week are the CPI report on Tuesday, jobless claims on Thursday, and retail sales on Friday. There are several speaking engagements from Fed officials this week. Below is Goldman’s US week ahead preview:

Monday, October 12

- There are no major economic data releases scheduled.

Tuesday, October 13

- 06:00 AM NFIB small business optimism, September (consensus 100.9, last 100.2)

- 08:30 AM CPI (mom), September (GS +0.27%, consensus +0.2%, last +0.4%); Core CPI (mom), September (GS +0.22%, consensus +0.2%, last +0.4%); CPI (yoy), September (GS +1.46%, consensus +1.4%, last +1.3%); Core CPI (yoy), September (GS +1.77%, consensus +1.8%, last +1.7%): We estimate a 0.22% increase in September core CPI (mom sa), which would boost the year-on-year rate by a tenth to +1.8% on a rounded basis. Our monthly core inflation forecast reflects further price increases in new and used cars, apparel, hotel lodging, and airfares. While we believe the trend in healthcare inflation is starting to slow, we expect inflation to rebound in the health insurance subcomponent. On the negative side, we estimate another decline in education prices reflecting tuition cuts at some universities. We also forecast lackluster shelter inflation (+0.10% mom sa for both rent and OER) reflecting continued rent freezes and a drag from rent forgiveness in some areas. We estimate a 0.27% increase in headline CPI (mom sa), due to higher food and energy prices.

- 12:25 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will participate in an online event hosted by the Virginia Chamber of Commerce and the Virginia Early Childhood Foundation.

Wednesday, October 14

- 08:30 AM PPI final demand, September (GS +0.2%, consensus +0.2%, last +0.3%); PPI ex-food and energy, September (GS +0.2%, consensus +0.2%, last +0.4%); PPI ex-food, energy, and trade, September (GS +0.2%, consensus +0.2%, last +0.3%): We estimate that headline PPI increased 0.2% in September, reflecting weaker energy prices but stronger food prices. We expect a 0.2% increase in the core measure excluding food and energy, and also a 0.2% increase in the core measure excluding food, energy, and trade.

- 08:35 AM Richmond Fed President Barkin (FOMC non-voter) speaks; Richmond Fed President Thomas Barkin will speak at an online event hosted by West Virginia University.

- 09:00 AM Fed Vice Chair Clarida (FOMC voter) speaks; Federal Reserve Board Vice Chair Richard Clarida will speak on the economic outlook and monetary policy at an event hosted by the Institute of International Finance.

- 10:30 AM Fed Vice Chair for Supervision Quarles (FOMC voter) speaks: Federal Reserve Board Vice Chair for Supervision Randal Quarles will participate in a moderated discussion on levered markets and shadow banking at an online event hosted by the CFA Institute.

- 02:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will participate in an online discussion at the Economic Club of New York.

- 03:00 PM Fed Vice Chair for Supervision Quarles (FOMC voter) speaks: Federal Reserve Board Vice Chair for Supervision Randal Quarles will speak on financial stability at a virtual event hosted by the Hoover Institution.

- 03:00 PM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will discuss the outlook for central banks at a virtual event hosted by the Hoover Institution.

- 06:00 PM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will participate in a virtual town hall on the economy and monetary policy moderated by the Texas Tribune.

Thursday, October 15

- 08:30 AM Initial jobless claims, week ended October 10 (GS 830k, consensus 820k, last 840k); Continuing jobless claims, week ended October 3 (consensus 10,400k, last 10,976k): We see two-sided risks around this week’s initial claims forecast as California starts to accept new online applications after a two-week pause and revises estimates of initial claims processed during this period. We estimate initial jobless claim decreased to 830k in the week ended October 10.

- 08:30 AM Philadelphia Fed manufacturing index, October (GS 12.0, consensus 14.5, last 15.0): We estimate that the Philadelphia Fed manufacturing index declined by 3pt to 12.0 in September, reflecting a pause in the exports recovery and a pullback in the ISM measure in September.

- 08:30 AM Empire manufacturing index, October (consensus +14.0, last +17.0)

- 09:00 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak at a virtual conference hosted by the Atlanta Fed.

- 11:00 AM Fed Vice Chair for Supervision Quarles (FOMC voter) speaks: Federal Reserve Board Vice Chair for Supervision Randal Quarles will speak on the pandemic response at an event hosted by the Institute of International Finance.

- 11:00 AM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will speak at a virtual event hosted by the US India Chamber of Commerce, a Dallas-based nonprofit focused on bilateral trade with India.

- 05:00 PM Minneapolis Fed President Kashkari (FOMC voter) speaks: Minneapolis Fed President Neel Kashkari will speak on the economy at an event hosted by New York University.

Friday, October 16

- 08:30 AM Retail sales, September (GS +1.5%, consensus +1.0%, last +1.2%); Retail sales ex-auto, September (GS +1.2%, consensus +0.9%, last +1.9%); Retail sales ex-auto & gas, September (GS +1.2%, consensus +0.9%, last +1.5%); Core retail sales, September (GS +1.0%, consensus +0.3%, last +1.4%): We estimate that core retail sales (ex-autos, gasoline, and building materials) increased by 1.0% in September (mom sa). Credit card and other high-frequency data indicate that consumer spending picked up following the disbursement of the $300 supplemental unemployment benefit provided by executive order. We also expect another gain in restaurant spending and auto sales, and we estimate a +1.5% increase in the headline and a +1.2% increase in the ex-auto measure.

- 09:15 AM Industrial production, September (GS +0.3%, consensus +0.6%, last +0.4%); Manufacturing production, September (GS +0.6%, consensus +0.8%, last +1.0%); Capacity utilization, September (GS 71.6%, consensus 71.9%, last 71.4%): We estimate industrial production rose by 0.3% in September, reflecting weaker auto manufacturing and utilities production. We estimate capacity utilization rose by 0.2pp to 71.6%.

- 09:45 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will participate in a moderated event on culture and community at the New York Fed.

- 10:00 AM University of Michigan consumer sentiment, October preliminary (GS 80.0, consensus 80.5, last 80.4): We expect the University of Michigan consumer sentiment index declined by 0.4pt to 80.0 in the preliminary October reading. Our Twitter Economic Sentiment index retrenched moderately over the last two weeks.

Source: DB, BofA, Goldman

via ZeroHedge News https://ift.tt/2STpyR7 Tyler Durden