Dimon Signals The All Clear: JPMorgan Earnings Smash Expectations As Loss Provisions Plummet 94%

Tyler Durden

Tue, 10/13/2020 – 07:18

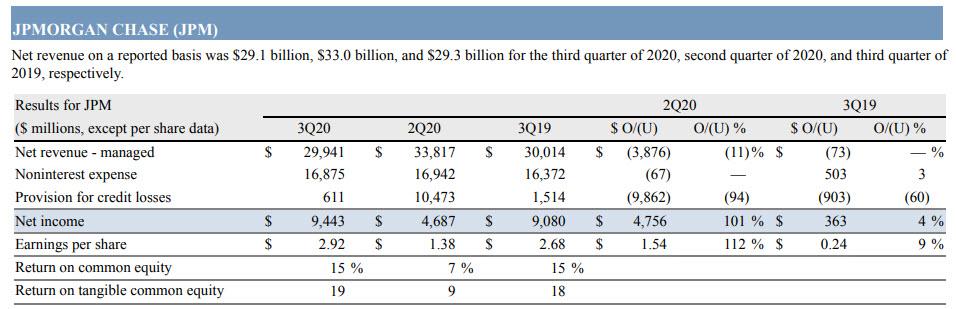

And we’re off… with JPMorgan officially launching Q3 earnings season moments ago, when it reported blowout revenue and EPS which not only beat estimates, but were actually higher compared to a year ago.

The largest US commercial bank reported that in the third quarter (in which it was slapped with a record $1 billion gold spoofing fine) it generated $29.94BN in revenue which while down from the $33.8BN reported a year ago, was a solid beat to the $28.39BN expected.

The resulting EPS of $2.92 was a 9% increase compared to the 2.68 reported a year ago and far above the $2.26 expected. And while a big part of this was the continued strength in the company’s trading revenues, the biggest reason for the surge in EPS was the plunge in loan losses, which crashed by 94% from the $10.5 billion in Q2, and was down by a whopping 60% from the $1.5 billion set aside last year to just $611 million, a quarter of the $2.4 billion analysts had expected JPM to set aside.

This number was a tiny fraction of the $10.5BN in loss provisions taken in Q2 and $8.3BN in Q1, and suggests that – at least according to Jamie Dimon – the storm has passed and JPMorgan is no longer worried about a sharp deterioration in bad loans despite tens of billions in forbearance which JPM just refuses to acknowledge.

On the revenue side, JPM reported Net Interest Income of $13.1BN, which was below the $13.43BN expected and down from the $13.85BN reported a year ago, as a result of continued pressure on Net Interest Margin.

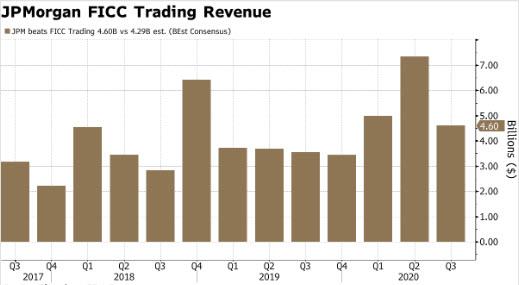

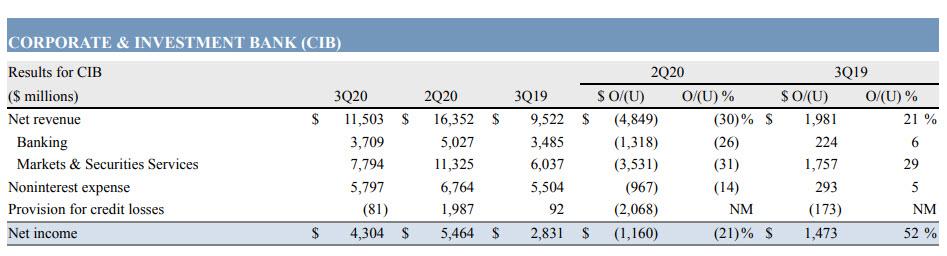

However, the decline in NII was more than offset by another strong quarter in Markets & Securities Services, where revenue soared 29% to $7.8 billion. (Markets revenue was $6.6 billion, up 30%.). Specifically, as noted below, fixed-income trading was up 29% (exp. 20.6%) while stock trading was up 32% (exp. 22.6)%. That was helped by gains across products, with fixed-income trading benefiting particularly from commodities, credit and securitized products.

Some more details:

- Fixed Income Markets revenue was $4.6 billion, up 29%, driven by Commodities, Credit and Securitized Products.

- Equity Markets revenue was $2.0 billion, up 32%. Securities Services revenue was $1.0 billion, flat to the prior year, as deposit margin compression was offset by balance growth. Credit Adjustments & Other was a gain of $169 million largely driven by funding and credit spread tightening on derivatives.

- Investment Banking revenue was $2.1 billion, up 12%, predominantly driven by higher Investment Banking fees, up 9%, reflecting higher equity and debt underwriting fees which were partially offset by lower advisory fees.

- Wholesale Payments revenue was $1.3 billion, down 5%, predominantly driven by deposit margin compression and a reporting re-classification in Merchant Services 12 , largely offset by the impact of higher deposit balances.

- Lending revenue was $333 million, up 32%, predominantly driven by higher net interest income reflecting overall spread widening and higher loan balances.

Commenting on the quarter, Jamie Dimon said “JPMorgan Chase earned $9.4 billion of net income on nearly $30 billion of revenue and we maintained our credit reserves at $34 billion given significant economic uncertainty and a broad range of potential outcomes. We further strengthened our capital and liquidity position, increasing CET1 capital to $198 billion (13.0% CET1 ratio, up 60 basis points after paying the dividend) and liquidity sources to $1.3 trillion. The Corporate & Investment Bank continues to be a big driver of Firm performance with Markets revenue up 30% and Global IB fees up 9%. CIB and Commercial Banking continue to attract and retain deposits given our strong client franchise as our clients remain liquid. Asset & Wealth Management generated record revenue and net income and saw strong net inflows into long-term products.”

Dimon added: “In Consumer & Community Banking, we continue to add deposits, up 28% versus last year – and based on the most recent FDIC data we ranked #1 in U.S. retail deposits for the first time ever as we are investing in the business to better serve our customers’ needs. The Firm recently received approval to open branches in 10 additional states which would allow us to operate branches in all of the lower 48 U.S. states. Home Lending benefited from strong production margins, and combined debit and credit card spend showed positive year-over-year growth in September for the first time since the widespread shutdowns.”

Dimon concluded on a virtue signaling note: “I want to thank our employees around the world for their tireless work in helping our clients and communities impacted by the COVID-19 pandemic over the past several months. Despite significant uncertainty in the environment, the Firm is unwavering in its commitment to drive an inclusive economic recovery, advance sustainable solutions to address climate change and improve the lives of our customers, especially those in underserved communities.”

Developing

via ZeroHedge News https://ift.tt/371VgnI Tyler Durden