Nomura Warns, Gamma-Squeeze “Extreme Grab” Could Flip To “Extreme Vomit” By Friday

Tyler Durden

Tue, 10/13/2020 – 09:45

Nasdaq was on a charge again overnight, incessantly bid from the open in Europe, after yesterday’s three-legged meltup – the biggest day in six months – on the heels of what appeared to be the re-emergence of ‘Nasdaq Whale’, which Softbank vehemently denied was them last night (thou doth protest too much?)…

As we detailed yesterday, the combination of extreme short speculative futures positioning and the ‘Gamma-Squeeze’ is driving Nasdaq – and thus the mega-tech names – virtuously higher…

No change to Nasdaq short this week pic.twitter.com/9C1YNcs3Rn

— zerohedge (@zerohedge) October 9, 2020

…the same “gamma squeeze” dynamic we observed in mid/late August when Masa Son’s SoftBank ended up buying billions in call spreads, sparking a meltup in tech names is back and just like in August, liquidity is dismal which likely means that SoftBank is back for round three (after a failed attempt to squeeze the Nasdaq higher two weeks ago).

To this point, JPMorgan strategist Shawn Quigg wrote last week that the market’s low liquidity environment “lays the groundwork for dealer positioning (i.e., gamma imbalances) that can further exacerbate existing market trends, and volatility dynamics (e.g., prices up/volatility down to prices up/volatility up). As such, market participants now closely follow large dealer gamma imbalances ahead of potentially impactful macro events, primarily in options on the S&P 500, to gauge potentially trend accentuating dealer flows.”

But, as someone famous once said, “that which can’t go on forever, doesn’t,” and while Nomura’s Charlie McElligott notes “It’s an Equities world, the rest of us are just living in it,”

…the market “gets” the Dealer “short Gamma” dynamic in mega-cap single-names with very large open interest outstanding (remember, the large Oct expiries from the Aug Calls / Call Spreads were in AMZN, ADBE, GOOG and NFLX) and are in the process of self-fulfilling near or even through the strikes which the Dealer(s) is short and thus forced to aggressively Delta hedge…

McElligott warns that the trick again is that “short Gamma” can cut the spot market both ways, just as experienced in the Aug rally then followed by the Sep swan dive…

…just like the Aug / Sep “pivot” from extreme grab to extreme vomit, if we were to continue rallying into Friday’s expiration, there will continue being a ton of stock to buy for the Dealers to remain delta hedged and extend the melt-up (i.e. late Aug)—but if we roll over and the individual stocks trade well below the strikes and the options again look “worthless” (back to last week’s levels, LOLOL), there then would be a massive puking of all that Dealer delta hedge, just like the Aug turn into Sep expiry (Note: the same thing would occur if the client were to unwind the position)

In my eyes, we are not quite at that same “vol up, spot up” red-flag level just yet as said Aug / Sep swing, particularly bc the delta hedging is still far too “real” here as judging by NQA +103bps early today vs ESA -6bps and RTYA -92bps – there is just too much convexity out there and it is forcing the standard “short Gamma” into a rally perversion of “buying more to stay hedged the higher it goes”

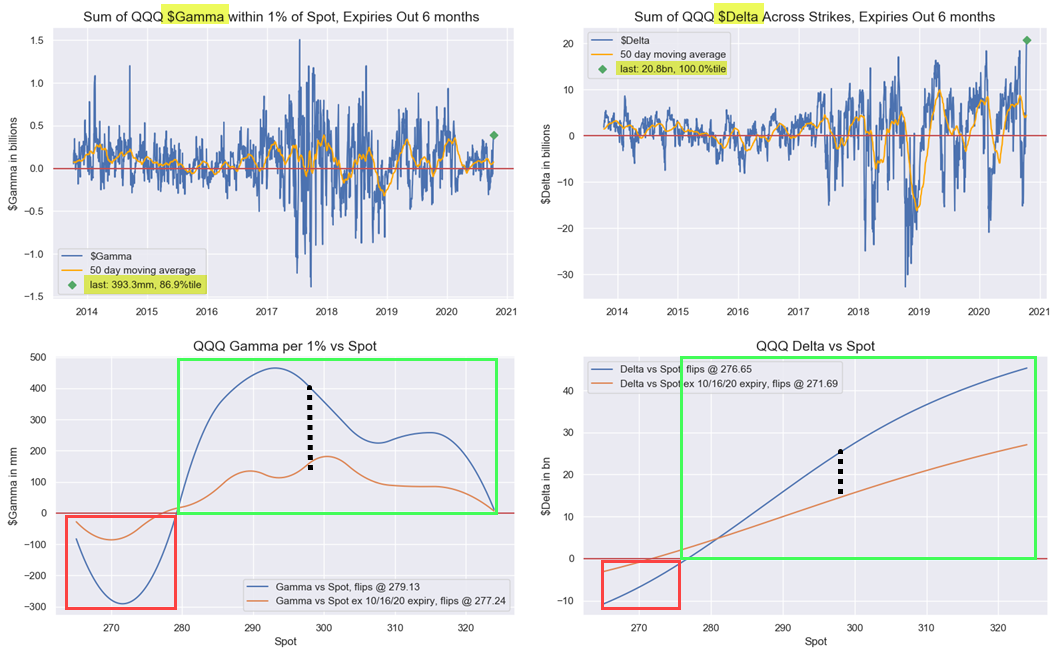

As I said yesterday however, next week – post Op-Ex – could see spot markets get very “binary,” with the latest index-level options analysis showing that 32% of the Gamma in SPX / SPY is set to come off, and an incredible 60% of the Gamma in QQQ set to roll-off after this expiry – and all with $Delta back at historical super-extremes (SPX at $452.2B – 97.5%ile, QQQ at $20.8B – 100%ile).

Will today’s iPhone 12 unveiling be the “sell the news” trigger? Or will we have to wait for Friday’s Op-Ex?

via ZeroHedge News https://ift.tt/2GXZAJR Tyler Durden