Wall Street October Survey: Most Expect A Contested Election, February Vaccine And W-Shaped Recovery

Tyler Durden

Tue, 10/13/2020 – 15:30

Today Bank of America released its latest Fund Mangers Report, which is perhaps best known for capturing the sheer schizophrenia gripping Wall Street professionals (case in point, last month a record majority of respondents said “Long US Tech” was the most crowded trade on Wall Street, even as most professionals admitted to flooding into Long US Tech trades).

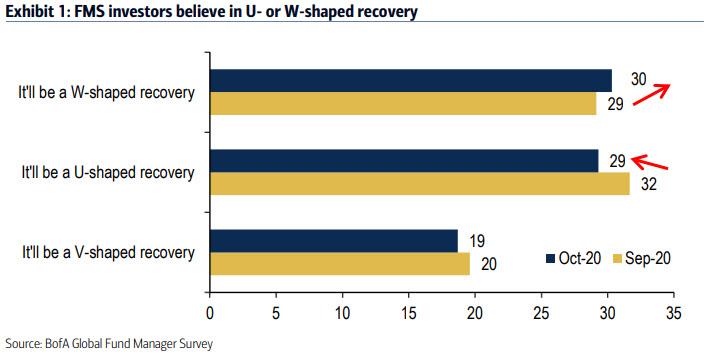

So what is the take home message from the latest survey of 224 pangelists managing some $624 billion in AUM? First and foremost, last month’s consensus that the current recovery is U-shaped (a view held by 32% of respondents in September) giving way to a majority view that the recovery will be a bumpy, double-dip, or W-shaped, held by 30% of respondents while the U-shaped crowd drops to 29%. Meanwhile the V-shaped optimists are far back in 3rd place with just 19% of the responses.

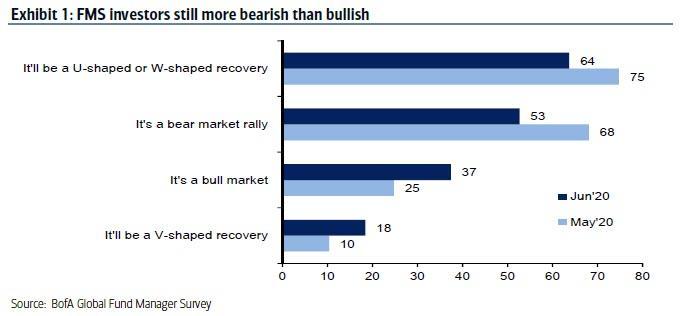

Alas, this question has now become a running joke where the answers are entirely dependent only on the market’s last up or downtick: as a reminder back in May it was nearly consensus that the Fed-inspired ramp in stocks was a bull market rally, while the U and W-shaped crowd was lumped into one category.

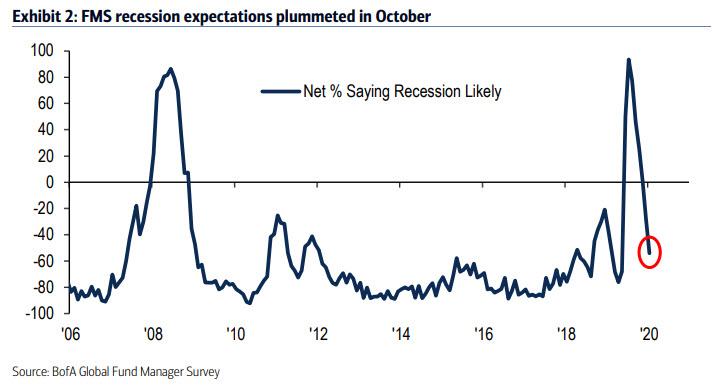

Even poll organizer Michael Hartnett hoped to gloss over these responses, and instead pointed out that the big change in the Oct FMS was a collapse in recession expectations, as the net % of investors expecting recession in the next 12 months plummeted to -54% from -28% in Sept. And to think that this respond hit an all time high back in March and April, shows just how much sentiment is influenced not by fundamentals but by the S&P500, something the Fed knows very well.

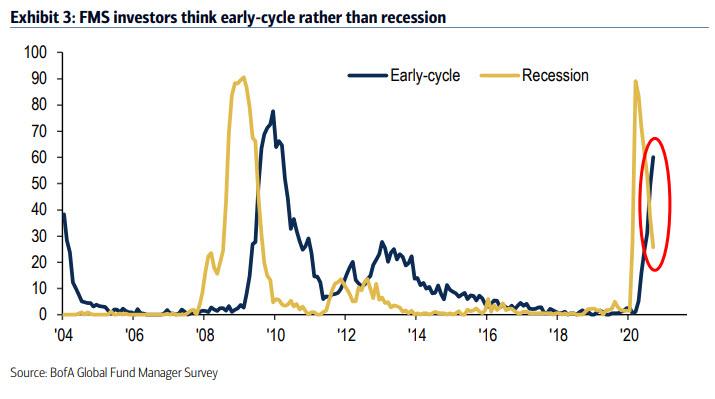

While we expect a prompt and violent reversal in this series as soon as stocks swoon lower, it was amusing to note just how eager Wall Street is to delude itself that all is well with the next question, in which we find that many more investors said the global economy is in an early-cycle phase (60%) as opposed to recession (26%). Just 4 months ago, the vast consensus was just the opposite: recession, with nobody even dreaming of “early-cycle.”

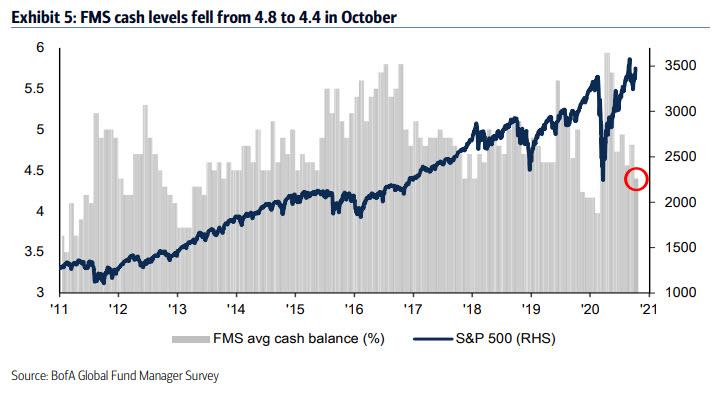

The survey next shifts to cash use, with Hartnett reporting that FMS cash levels fell to 4.4% from 4.8%; As a reminder, according to the BofA model, cash <4% = greed, >5% = fear. As a result, cash levels have collapsed 1.5% in past 6 months, the fastest drop since 2003 as everyone was forced to chase markets thanks to the Fed.

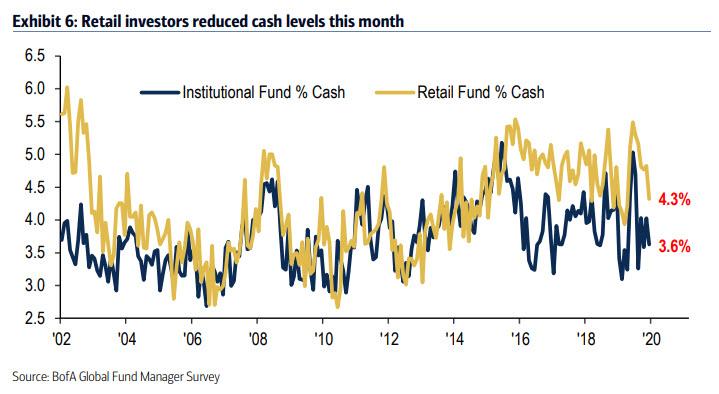

Curiously, there has once again been a divergence between retail and institutional sentiment, with retail funds (i.e. mutual funds) reducing elevated cash levels this month to 4.3% while institutional funds (i.e. pension, insurance) reduced cash levels to 3.6%.

As they turned even more bullish, FMS investors naturally increased their equity overweight to net 27% (from 18%); the net % saying equities markets are overvalued fell to 28% (from 41%) following the September pullback in stock prices. Notably, the October equity overweight of net 27% shows investors are optimistic on stocks but not “dangerously optimistic”, because according to BofA, a net equity overweight of >50% is dangerously optimistic.

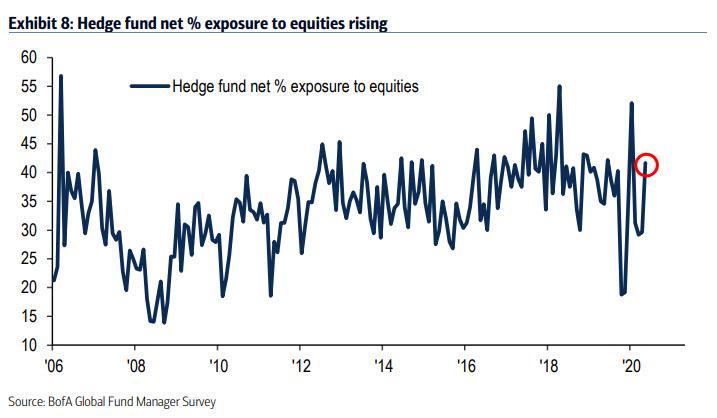

At the same time, Hedge funds appears to be on the verge of “dangerous optimism” as they increased their net equity exposure to 42% (from 30%), the highest level since Jun’20.

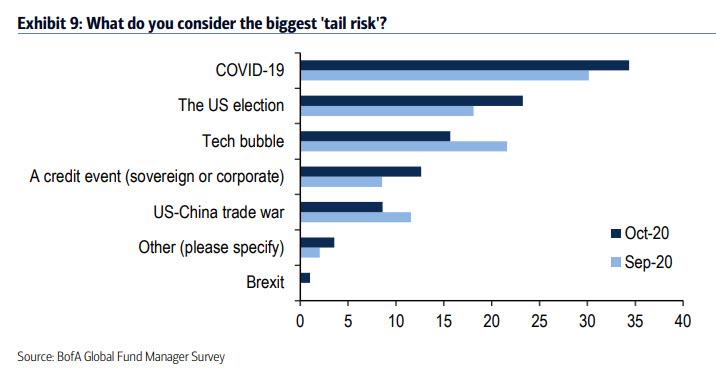

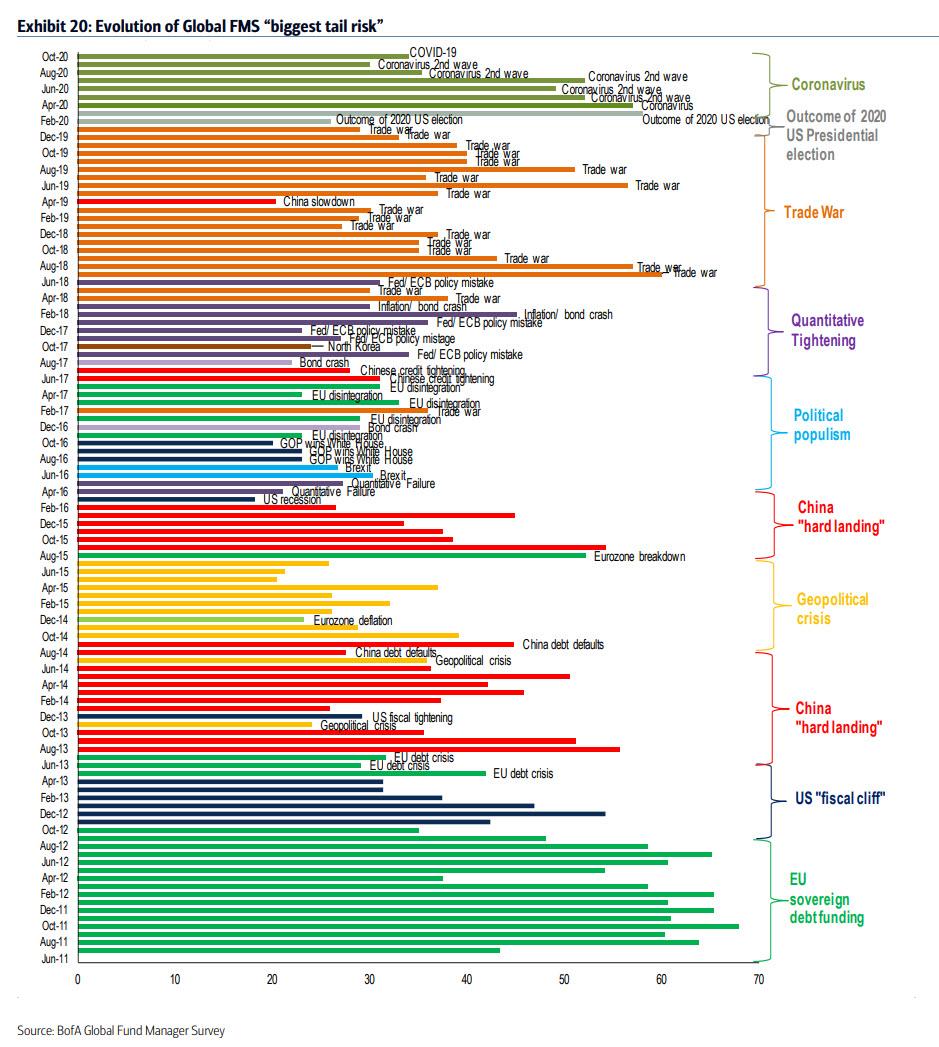

Shifting topics, when discussing COVID-19, the respondents still view pandemic as the #1 “tail risk”…

… while the timing of credible vaccine pushed back from Jan’21 to Feb’21.

Meanwhile, the US election is viewed as the 2nd largest tail risk, and when asked what outcome causes volatility 74% say “contested election”, 14% “blue wave”, 8% divided Congress, 4% say Trump victory.

Oddly, even though most investors are bullish, with the US election now just 4 weeks away; 61% of FMS investors believe the US election result will be contested.

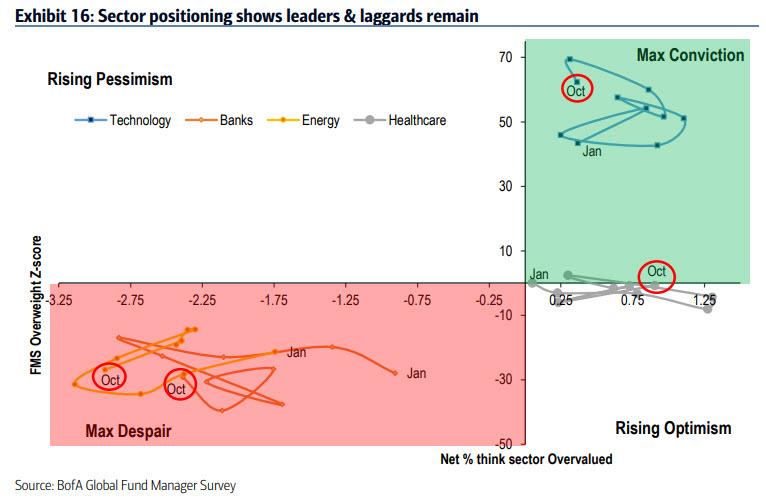

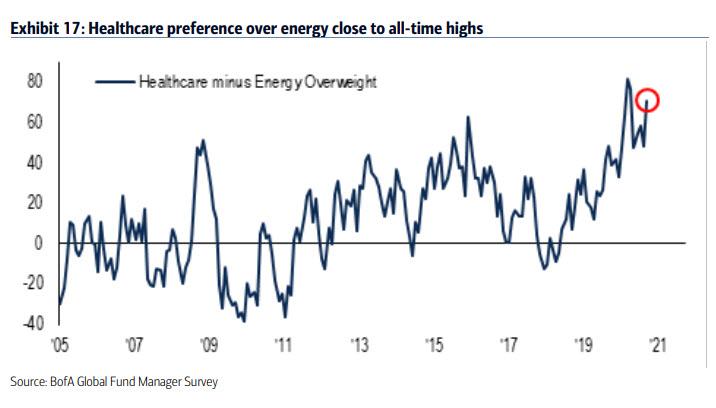

Finally, when looking at positioning, BofA finds the 5th largest short in energy in 20 years; while healthcare overweight surges to #1…

… as FMS investor preference for healthcare over energy is close to all-time highs (high was Apr’20). The spread was net +41% overweight for healthcare and -30% underweight for energy.

… even as long tech is still deemed #1 “crowded trade” by big margin;

Separately, the “cyclical rotation” paused in Oct due to a “sellers strike” in tech, “buyers strike” in energy & banks. As shown below, there was a big increase in exposure to healthcare, staples, stocks & Japan; at the same time, a big reduction in expsoure to energy, REITs, bonds, banks.

Oct FMS contrarian trades: long UK, energy, bank stocks, short US, healthcare, tech, and consumer discretionary stocks.

In other words, one of these days, Exxon may even go up, although if it is red on the day Goldman upgraded it, we wouldn’t get our hopes up too high.

Hartnett’s bottom line: “respondents in our October Fund Manager Survey (FMS) said the recession is over, reduce cash, pause cyclical rotation, and price in contested election & February vaccine; we say sell SPX >3600 and cyclical rotation via banks/energy to resume in Q4.”

via ZeroHedge News https://ift.tt/3dnMVff Tyler Durden