Fed’s Daly Vows To Make The Uber-Rich Even Richer To Avoid “Millions Of Job Losses”

Tyler Durden

Wed, 10/14/2020 – 12:00

In the most dramatic admission yet that the Fed is aware that it is directly responsible for the record wealth gap tearing apart US society even as it virtue signals each and every day about reducing income and race inequality and blames racism for its own catastrophic flaws, San Francisco Fed President Mary Daly, the first openly gay Fed president, acknowledged that the uneven distribution of assets in the U.S. means that when monetary policy action to support economic growth also boosts financial markets, and impacts wealth inequality. Even so, she said the Fed should still act.

“I am not willing to trade millions of jobs for people who need a ladder rung up in order to keep the stock market from going up for a few who have those holdings,” Daly said while answering questions following a speech on – what else – racial inequality at a virtual event Tuesday hosted by the University of California, Irvine.

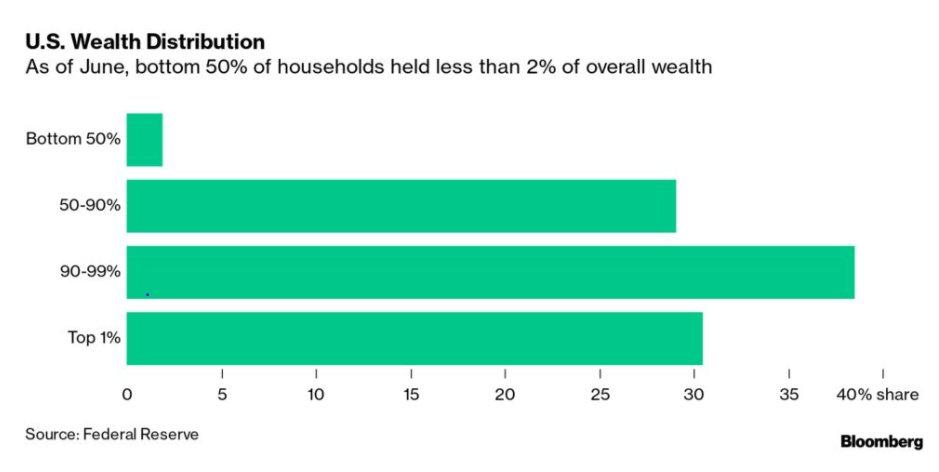

“We can’t wait another decade to reduce the gaps that Covid has caused”, which of course is bullshit, because long before the US economy entered the covid crisis inequality was already at record highs. Don’t believe us? Here is a chart from… the Federal Reserve.

Unconvinced? Here is a report from none other than Daly’s own Federal Reserve which in August explained that wage growth has been an illusion (it appropriately forgot to name the culprit)

Err @federalreserve are you sure you want to go there? pic.twitter.com/xPb2Ced1zq

— zerohedge (@zerohedge) August 31, 2020

And while we can see why the Fed would be absolutely desperate to pass of a decade of its catastrophic monetary policies making the rich richer as the fault of covid – in a time of ad hoc street riots, who knows when the Marriner Eccles building will be next – nobody is dumb enough to believe the Fed’s lies any more.

And speaking of lies, Daly continued: “I think we’ve got the economy and the policy in a good position right now” which of course is dead wrong, as the only reason the economy hasn’t collapsed is because the Fed is engaged in helicopter money, monetizing all the debt the US Treasury is issuing to fund trillions in stimulus payments. If there is even a modest hiccup in this process, and the US economy would slide into a devastating depression overnight, with soaring interest rates to boot.

Which is also why neither Daly, nor any of her peers, can ever stop lying, and sure enough she next said that today’s monetary policy is “appropriate” – here was assume she was envisioning the $120BN in liquidity the Fed injects every month, and added that “I see us as well positioned to weather this storm we’re in. It remains to be seen if more will be needed to be done once we get past Covid and we’re starting to dig back out of this large hole.”

A hole which the Fed dug, by enabling US corporations to issue the most debt in history, and which threatens to drag them all under if the Fed ever steps off the gas pedal.

In any case, the lies continued:

“We need to ensure that we’re fully deploying our macro prudential tool and to build out more macro prudential tools so that we can create a more stable financial system outside of needing to use monetary policy to achieve it directly.” One wonders if these are the same “tools” that sent US GDP plunging more than 30% in Q2 and only a panicked all-in intervention by the Fed prevented an economic disintegration as the asset bubble the Fed has so carefully cultivated for the past decade came this close to bursting.

And then, in another desperate attempt to deflect attention from the Fed’s own idiotic actions, she blamed it all… on racists:

“Systemic biases related to race, ethnicity, gender, and class have led to unequal access to education, jobs, income, and wealth,” Daly said, adding that “these inequities have compounded over generations, as children born into poverty or low income households carry that disadvantage through to adulthood and pass it on to their children.”

Great… and now do the Fed, whose premeditated policies – where no crisis ever goes to waste – of making the rich even richer “have compounded for generations” resulting in “unequal access to education, jobs, income, and wealth”, “as children born into poverty or low income households carry that disadvantage through to adulthood and pass it on to their children” and ultimately led to the following outcome:

“50 Richest Americans Now Worth More Than Poorest 165 Million.”

And no, that’s not Covid’s fault, it’s all the Fed.

* * *

At this point it is probably worth a quick reminder that since its inception, this website has preached that at the root of all evil in US – and frankly any other society which prints its own currency – is the central bank. Month after month, year after year, we have warned that the Fed, which Thomas Jefferson among the founding fathers prophetically warned against in a warning that carried all the way until 1913 when, following a secret meeting at the aptly named Jekyll Island, the Fed was sprung into existence, just in time for the first World War.

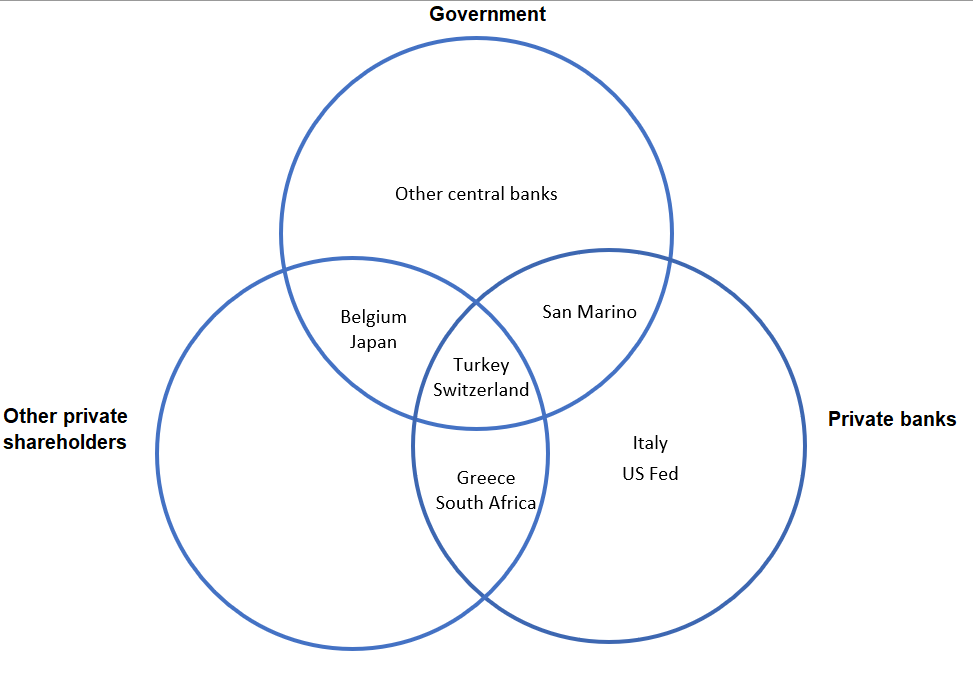

And while superficially the charter of the Fed – which to this day remains a fully private institution unlike most of its peers…

… has operated under the superficially noble mandate to “promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates”, yet by constantly prompting a inflationary mandate and debasing the dollar, has spawned a series of boom-bust cycles, which have resulted in an unprecedented wealth (and income) divide, with a handful of people owning the vast majority of financial assets, while the rest of the population – including the vast majority of the middle class – has seen its purchasing power decline year after year.

Yet despite, or perhaps due to the Fed’s bubble-blowing powers which have now culminated in the Fed effectively nationalizing the bond market and going so far as purchasing corporate bonds from such companies as Apple, Berkshire Hathaway and Intel (implicitly funding their shareholder friendly actions), and terminally breaking price discovery in the process, few among the establishment – either financial or political – have ever dared to join our crusade against central banks.

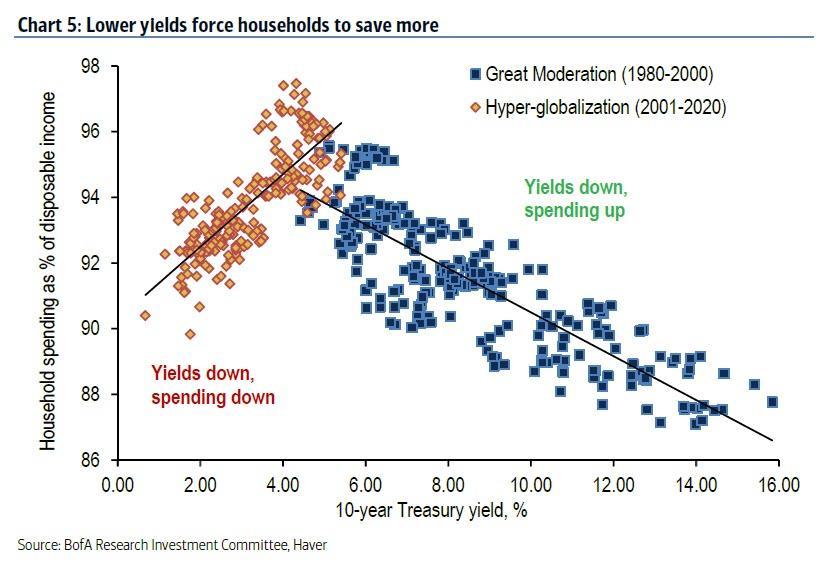

Which is why we were surprised when two months ago none other than Sheila Bair broke ranks with the establishment, and made a mockery of Mary Daly’s lies, when the former bank regulator dared to say the unspeakable: the truth about the Fed, and that it’s policy of “sustained low interest rates help the big get bigger, stifling innovation and productivity, while inflating the value of financial assets overwhelming owned by the rich.”

Bair started off innocently enough, commenting on a recent Princeton research paper, which came to the “shocking” conclusion that low rates are deflationary (i.e., “aggregate productivity growth declines as the interest rate approaches zero”), something we first pointed out months ago…

… when she said that she is “all for robust antitrust enforcement. Markets don’t work without competition. Yet, overlooked is the role of low interest rates in driving market concentration.”

And not just “concentration” – which can readily be seen in the handful of megatech stocks such as Apple, Amazon, Google and Microsoft whose market caps are on either side of $2 trillion – but as Bair warns, the Fed’s actions have led to such “side effects” as “yawning wealth and income inequality, sustained low interest rates help the big get bigger, stifling innovation and productivity, while inflating the value of financial assets overwhelming owned by the rich.”

As with the related “side effects” of yawning wealth and income inequality, sustained low interest rates help the big get bigger, stifling innovation and productivity, while inflating the value of financial assets overwhelming owned by the rich.

— Sheila Bair (@SheilaBair2013) August 23, 2020

And in a stunning follow up which exposes just how deep the institutional rot has spread, her next tweets hits right at the $64 trillion question: “no one in either party talks about this.” In fact, “if there is bipartisan consensus on anything, it is to rely more, not less, on cheap debt to fuel economic growth.”

Yet, no one in either party talks about this. If there is bipartisan consensus on anything, it is to rely more, not less, on cheap debt to fuel economic growth.

— Sheila Bair (@SheilaBair2013) August 23, 2020

The piece de resistance was her final tweet, in which Bair dared to call out the naked emperor, and asked – why, in a world where even “the general public gets it”, is our political leadership so “unwilling to fundamentally rethink the role of monetary policy in our economy.“

Ironically, I think the general public “gets it”. But our political leadership seems unwilling to fundamentally rethink the role of monetary policy in our economy.

— Sheila Bair (@SheilaBair2013) August 23, 2020

While Bair failed to follow up on her own rhetorical observation, and we know that neither Daly nor any of her peers ever will, we are happy to do so: the reason our “political leadership” refuses to address the fundamental driver of inequality in the US, the bubble-blowing machine behind the stock market, and the primary driver for growing class, ethnic and race hatred within the country’s population, is because US political ceased to matter long ago.

In fact, one can argue that both parties only exist to stoke even greater polarization within society which serves as a convenient smokescreen to deflect attention from the true source of most things that are rotten in US society: the Federal Reserve.

Meanwhile, the Fed’s money printing merely enables the existing flawed system to get even more entrenched while enriching the Top 1% even more, with consequences which have led to a nation that is on the tipping point – and in some cases beyond – armed violence with itself.

And unfortunately, since there is nothing that will force this “political leadership” to take any measures to fundamentally restructure the role monetary policy plays in our economy, the greatest catastrophe in US history awaits.

via ZeroHedge News https://ift.tt/3lIfSFJ Tyler Durden