See No Risk

Tyler Durden

Wed, 10/14/2020 – 08:01

Authored by Sven Henrich via NorthmanTrader.com,

Amazing times all around. Most astounding perhaps the level of complacency building in markets into the US election and into year end.

Most of the market appears to have adopted a see no risk attitude. Hear of no risk, see no risk, speak of no risk.

No matter who wins the election it’s bullish, no matter what happens more stimulus is coming. And besides, if all else fails the Fed will just print more.

The bull case can be summarized as such:

The bull case: Nothing matters.

Not debt, not growth, not earnings, not layoffs, not valuations, not forward multiples, not tax hikes.

Keep buying historic valuations because the magic money fairy will keep bailing us out.— Sven Henrich (@NorthmanTrader) October 12, 2020

And following a ferocious rally off of the falling wedge we’ve been discussing markets may well be on their way to new highs as there’s a technical inverse brewing that could technically target 3650 as I discussed Friday at the close however with an important caveat:

New quick market update: pic.twitter.com/dd7IzO8cO7

— Sven Henrich (@NorthmanTrader) October 9, 2020

Fast forward to today.

Just shy of all time highs set in September, we can observe a market with the highest valuation in history expressed in market cap vs GDP:

Now as I’ve outlined on Twitter this number will drop once the bounce in Q3 GDP will be accounted for, but that doesn’t change the fact that markets are at record valuations.

Which is kind of ironic as there are some other records floating around, such as record retail participation:

Things you don’t hear at bottoms. https://t.co/yqOD9HkWxC

— Sven Henrich (@NorthmanTrader) October 13, 2020

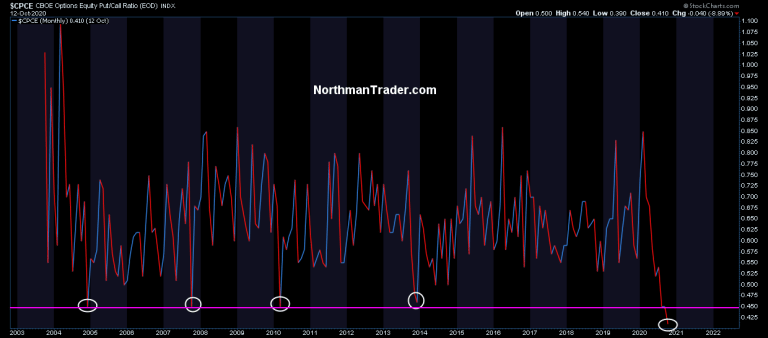

How does record retail participation risk manage record valuations? With record complacency of course as options equity put call ratios have hit the proverbial dust.

Record lows on the monthly chart (month not over yet):

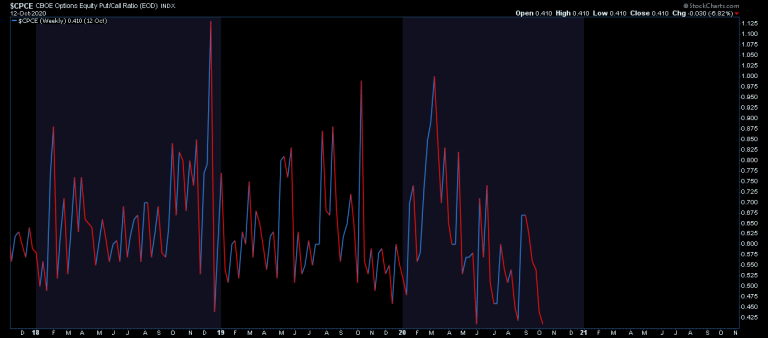

Only matching the weekly low readings we saw in June and in September:

Record valuations, record retail participation and record complacency.

What can possibly go wrong?

According to participants the answer is clearly nothing. Oh kay.

Whether this laissez faire attitude will prove itself to be justified we will all soon find out in the weeks ahead. I won’t even pretend to offer a prediction on the outcome of the election, but since everybody seems to be expecting tons more stimulus no matter what and now a non-contested election let me throw some water on that happy go lucky camp fire.

While markets are presuming a blue wave who can say with certainty that Republicans will lose the Senate? What, exactly, is the prospect of a Republican led Senate agreeing to big stimulus aspirations of a Democratic president and House? I think we’ve seen that movie before and the answer is a big fat No.

And those that presume a blue wave will propel Biden into the White House perhaps they should ask themselves this question:

Who says the electoral college will vote for Biden even if he wins? Imagine a scenario where Biden wins key swing states such as Florida, yet the Republican governor and state legislature there decides to cast electoral college votes for Trump anyways using fraud in the election count (real or not) as an excuse? Who would stop them? The law? There is no such law that says they couldn’t vote for Trump. Would the Supreme Court stop them? Watch the nomination hearings in the Senate right now. ACB will likely pass and then the GOP has a 6-3 majority in the court. I’m not predicting anything, but I’m also not making this up. This scenario was recently outlined in the Atlantic. Via Forbes:

“A jarring new report from The Atlantic claims that the Trump campaign is discussing potential strategies to circumvent the results of the 2020 election, should Joe Biden defeat Donald Trump, by first alleging the existence of rampant fraud and then asking legislators in battleground states where the Republicans have a legislative majority to bypass the state’s popular vote and instead to choose electors loyal to the GOP and the sitting president”.

Can you imagine the storm of uncertainty that would follow?

Markets have been rallying not only on stimulus hope but also on the premise that the risk of a contested election is diminished or so the popular pablum goes. Well, for there to not be a contested election there needs to be a concession speech on the eve of the election. If the game plan outlined above is indeed the strategy then there will be no election clarity until at least December 14 when the electoral college votes. That’s 6 weeks of uncertainty. And what if this gets contested or what if there are legal challenges in between or beyond?

I’m raising these questions to highlight that there are all sorts of risks floating about that this market is not pricing in. At all. Rather the market is making all kinds of positive presumptions in terms of what it appears to perceive as the most positive outcomes. And they may well be correct, but whether these presumptions are correct or not I’m not one to say, but it appears that if these presumptions are wrong then risk is very much under-appreciated. For now this market hears of no risk, sees no risk, and speaks of no risk.

Just remember: Risk happens fast.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/3dqqsxY Tyler Durden