How ‘Democratization’ Of The Bond Market Killed Liquidity & Forced The Fed To Save The World

Tyler Durden

Wed, 10/14/2020 – 20:25

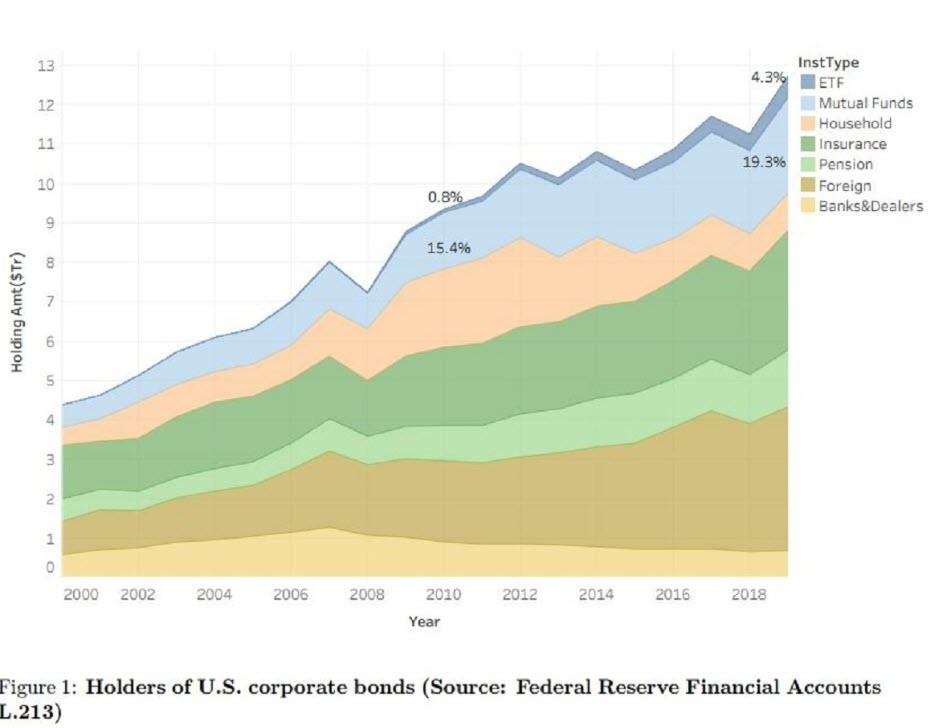

Enabling the great unwashed masses of the world’s modestly wealthy to partake in the global bond market has been heralded as an epochal movement toward the ‘democratization‘ of an arcane asset-class by the creators of Exchange-Traded Funds (and Notes).

Yes, it sparked a massive increase in passive investment-based cash into a relatively illiquid market – hoorah – but, as recent academic report by the Swiss Finance Institute (SFI) found, there are some rather notable ‘unintended consequences’ to this sudden technical shift.

Of course, you will read none of this in the mainstream, or hear these fears raised by asset-gatherers and commission-rakers since, as Upton Sinclair foretold, “it is difficult to get a man to understand something when his salary depends upon his not understanding it.”

But, as Bloomberg’s Katharine Greifeld reports, in the case of the corporate bond market, the boom in credit ETFs has sparked a surge in liquidity risk…(something we experienced in the real world in March) so much so in fact that The Federal Reserve was forced to step in (for the first time – officially – in its history) and intervene to save the world.

The impact was felt across the entire bond market with Treasury liquidity suffering a shock collapse, and huge gaps emerging between the prices of ETFs and the bonds they track.

That chaos quickly spilled over into the corporate bond market and only the Fed’s action restored calm.

Critically, SFI’s Efe Cotelioglu notes that, unlike with stocks, ETF or mutual fund ownership does not affect the liquidity in the underlying bonds

“Higher ETF ownership of investment-grade corporate bonds can reduce the ability of investors to diversify liquidity risk,” Cotelioglu, who is also a PhD candidate at the University of Lugano, wrote in a paper.

Specifically, Cotelioglu puts this divergence in liquidity down to contrasting investor bases and structural differences. For instance, as Greifeld notes, mutual funds have “discretion” in deciding how to meet redemptions, while an ETF can’t choose what assets it sells.

This research confirms the market-wide experience that very liquid funds could become a destabilizing force for their less liquid underlying securities… and, in many cases in March, forced the market for any sizable trades to be done ‘by appointment’ only.

For now, calm has been restored, thanks in large part to The Fed’s buying efforts (and promise to act)

But, as Bloomberg’s Greifeld notes, while the study used almost a decade’s worth of data through to the second quarter of 2019, the market for fixed-income ETFs has exploded in size since then.

Bond ETFs have pulled in about $170 billion in 2020, surpassing equity inflows and already beating last year’s record $154 billion haul.

So don’t be surprised if the next ‘event’ in the markets brings Jay Powell storming back in to save the corporate bond market (and keep the zombies ‘alive’ just a little longer – a bridge to the vaccine?)…

The takeaway – as The Fed’s hidden ‘yield curve control’ has managed the Treasury market in a narrow yield range for months (and its corporate bond buying program), the rising liquidity risk exposed by Cetelgio’s paper (as passive flows continue to flood into ETFs) means any market shocks (cough – the election – cough) will expose the real liquidity-premium-adjusted prices for these bonds, far below NAVs.

via ZeroHedge News https://ift.tt/2SV0KIB Tyler Durden