UK Downgraded To Aa3 By Moody’s

Tyler Durden

Fri, 10/16/2020 – 16:51

Three week after Fitch affirmed its long-term debt rating at AA- (and left the outlook negative), Moody’s has just downgraded United Kingdom’s (and The Bank of England’s) credit rating.

Moody’s Investors Service (“Moodys”) has today downgraded the government of the United Kingdom’s long-term issuer and senior unsecured ratings to Aa3 from Aa2. Concurrently, the outlook has changed to stable from negative.

Moody’s has also downgraded the Bank of England‘s long-term issuer and senior unsecured bond ratings to Aa3 (from Aa2) and (P)Aa3 (from (P)Aa2) for the senior unsecured MTN programme. The P-1 short-term issuer rating is affirmed. The outlook on these ratings has also changed to stable from negative.

The three key drivers for this action are closely related and mutually reinforcing…

First, the UK’s economic strength has diminished since we downgraded the rating to Aa2 in September 2017. Growth has been meaningfully weaker than expected and is likely to remain so in the future. Negative long-term structural dynamics have been exacerbated by the decision to leave the EU and by the UK’s subsequent inability to reach a trade deal with the EU that meaningfully replicates the benefits of EU membership. Growth will also be damaged by the scarring that is likely to be the legacy of the coronavirus pandemic, which has severely impacted the UK economy.

Second, the UK’s fiscal strength has eroded. General government debt, already high and sticky prior to the crisis, has risen further as a result of the pandemic. While the UK’s reserve currency status provides a high capacity to carry debt, the material increase in debt poses risks to debt affordability in future years, particularly in the absence of a clear plan to reduce government indebtedness. Notwithstanding recent statements of intent by the government, it is in Moody’s view unlikely that the government will be able meaningfully to rebuild the UK’s fiscal strength in the coming years given the low growth environment and the likely political obstacles to doing so.

The third driver relates to the weakening in the UK’s institutions and governance that Moody’s has observed in recent years, which underlies the previous two drivers. While still high, the quality of the UK’s legislative and executive institutions has diminished in recent years. Policymaking, particularly with respect to fiscal policy, has become less predictable and effective. Looking forward, the self-reinforcing combination of low potential growth and high debt in a fractious policy environment will create additional headwinds to addressing the economic, fiscal and social challenges that the UK faces.

The stable outlook reflects the UK’s intrinsic economic and institutional strengths as well as Moody’s expectations that the debt will stabilise at its current level.

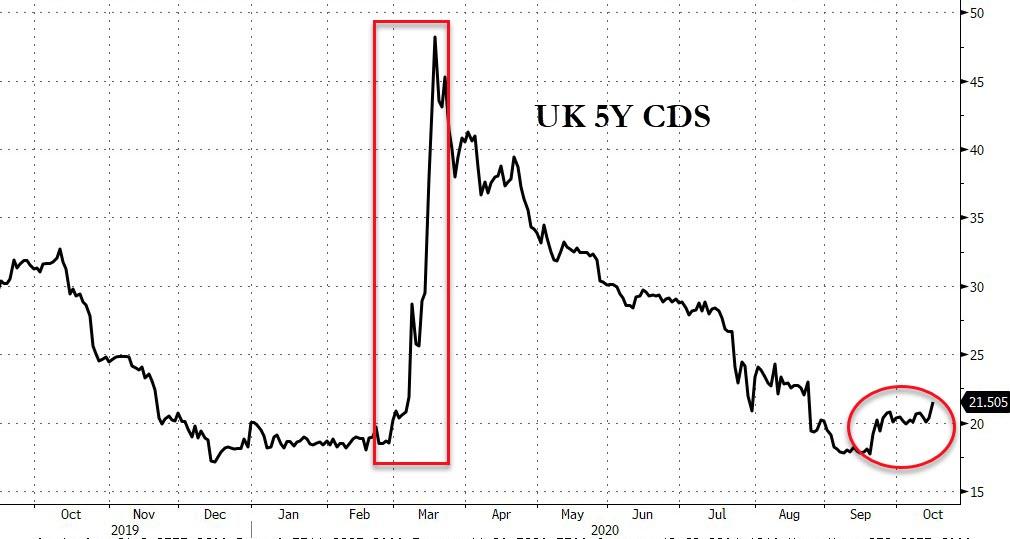

For now, UK’s sovereign credit risk is not showing signs of strain, but as is clear from March, risk happens fast…

via ZeroHedge News https://ift.tt/37jVCGB Tyler Durden