VIX & Stocks Rise On Week; Banks Puke Ahead Of Black Monday Anniversary

Tyler Durden

Fri, 10/16/2020 – 16:01

Nothing to worry about… Monday will be the 33rd anniversary of the 1987 Black Monday collapse in stocks…

Source: Bloomberg

Now that would be an ‘October Surprise’…

Excerpted from Art Cashin’s reminisces of that day in 1987 (rings a lot of bells for 2020)…

The first two-thirds of 1987 on Wall Street was nothing short of spectacular… Fear seemed to disappear, and junior traders laughed at their cautious elders. The brash youngsters told each other to “buy strength” rather than sell it, as each buying wave was soon followed by another.

[ZH: Robinhooders?]

One thing that helped banish fear was a new process called “portfolio insurance.” It involved use of the newly expanded S&P futures. Somewhat counterintuitively, it involved selling when prices turned down.

[ZH: Nasdaq Whale buying calls, driving dealer gamma to extremes]

The rally topped out about Aug. 25, with the hitting 2,722 (less than a tenth of its current numerical value). Interest rates had begun creeping up amid concerns of early signs of inflation.

[ZH: Rally topped a week after that in 2020]

…

On Wednesday, Oct. 14, there were widely discussed rumors of a new punitive tax on takeover profits.

[ZH: Worries over Biden’s tax plan?]

Friday the 16th was an option expiration day… selling intensfied into the close.

[ZH: Today is op-ex day.. and selling intensified into the close]

The weekend was a rumormonger’s delight.

[ZH: We will wait and see]

Retail Sales beat but Industrial Production plunged, Sentiment was mixed, and any stimulus deal was pronounced – for all intent and purpose – dead before the election. Guess which one of these ‘facts’ the market decided to ‘act’ on today (until the last hour – was that the op-ex unwind?)…

And don’t forget that we had margin increases across most of the major retail brokerages today.

While most major indices rallied this week, all in the green thanks to today’s op-ex rally, the late-day weakness left Small Caps red…

What is unusual is the coincident rise in VIX also…

Source: Bloomberg

European markets ended the week notably lower as COVID lockdowns re-escalated…

Source: Bloomberg

Two big squeezes this week got us “back to even” but that couldn’t hold this afternoon…

Source: Bloomberg

Big-tech names managed gains (NOTE that buying panic on Monday driven the Nasdaq Whale reappearing and buying calls with both hands and feet)…

Source: Bloomberg

Banks were a bloodbath…

Source: Bloomberg

With Wells Fargo by far the worst and Morgan Stanley the best…

Source: Bloomberg

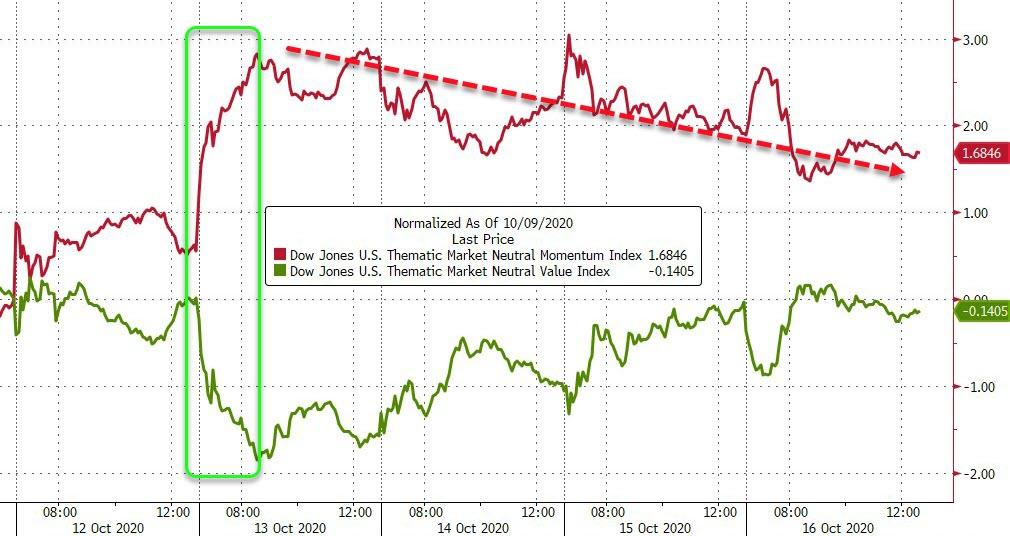

Momo outperformed but again mostly thanks to Tuesday’s opening panic…

Source: Bloomberg

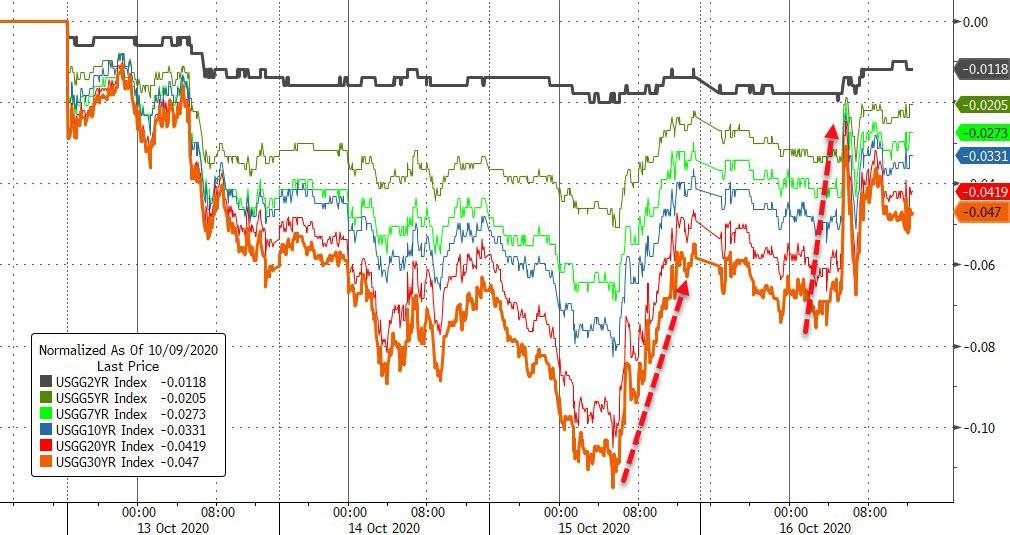

Despite stock market gains, bonds were also bid, led by the long-end…

Source: Bloomberg

10Y yields found support at 70bps and bounced, but ended lower on the shortened week…

Source: Bloomberg

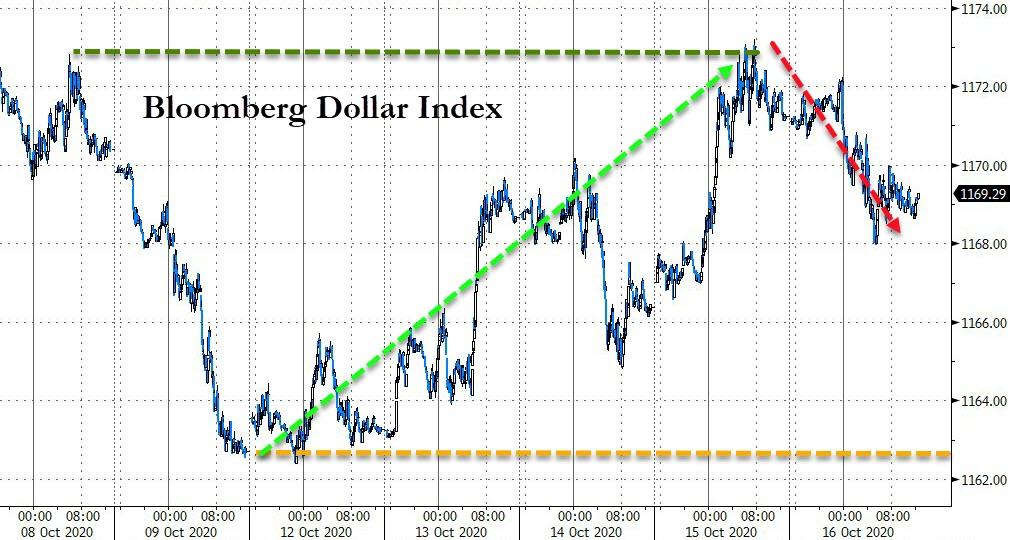

The dollar ended higher on the week but stalled at last week’s highs…

Source: Bloomberg

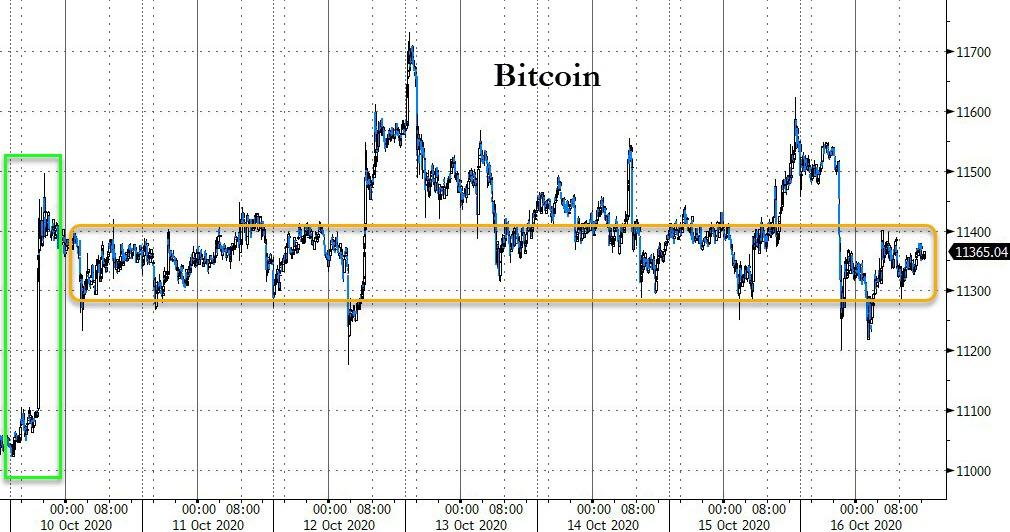

Cryptos rallied on the week but mainly thanks to last weekend’s spike, trading in a narrow range since…

Source: Bloomberg

Despite the dollar gains, oil prices managed to eke out a gain but PMs were weaker led by silver…

Source: Bloomberg

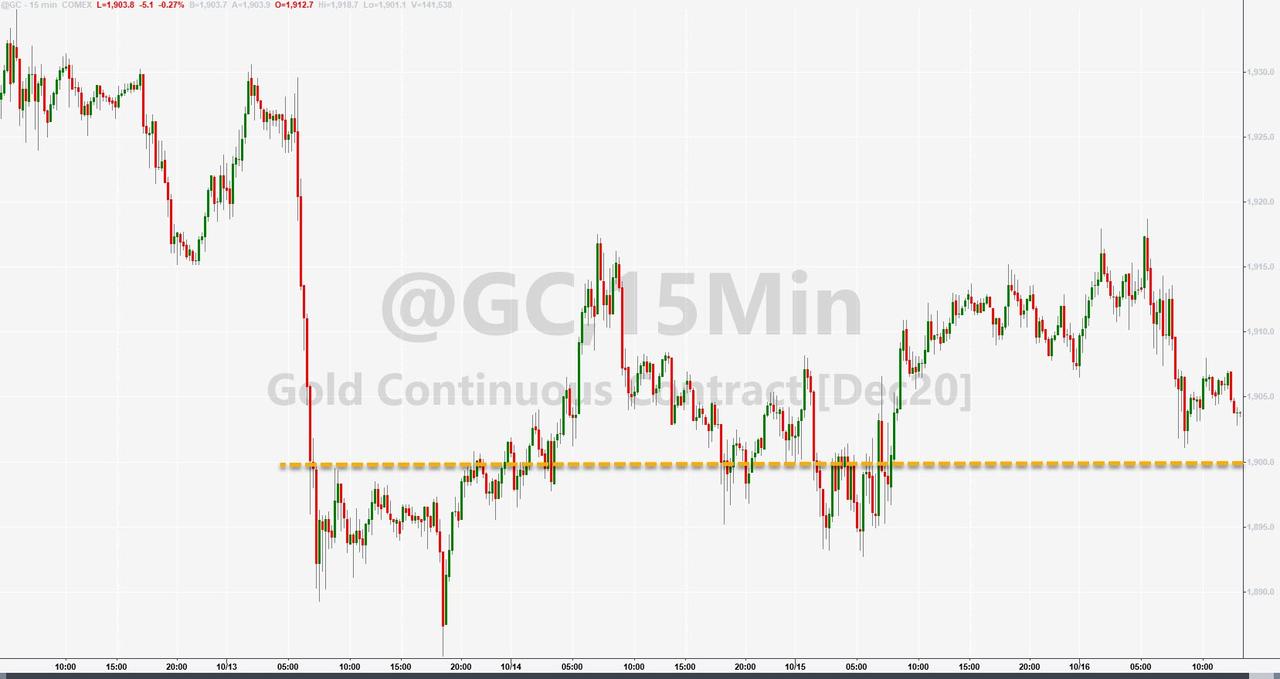

Gold managed to hold above $1900…

WTI managed to surge back to $41 after a decent intraweek plunge…

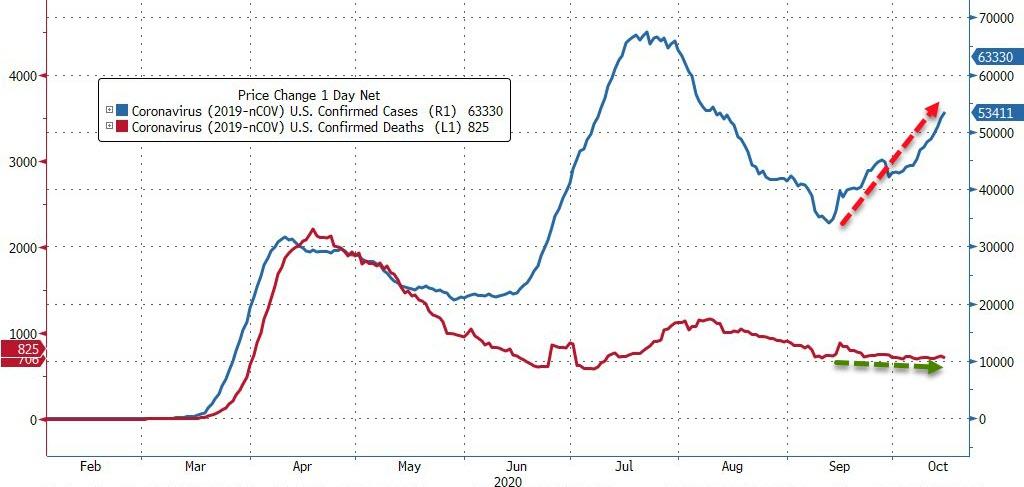

Finally, here’s what the ‘experts’ are worrying about – cases are starting to accelerate (just don’t tell anyone that deaths are stable, suggesting mortality rates are plunging)…

Source: Bloomberg

Time to panic? Well Monday is the 19th of October!

via ZeroHedge News https://ift.tt/37dXb8X Tyler Durden