Big Bond Option Bets Against ‘Blue Wave’ Emerge

Tyler Durden

Wed, 10/21/2020 – 11:45

As we have previously noted, the world and his pet rabbit is short US Treasury long-bonds as the US election looms and expectations for stimulus (large or larger) spark a consensus reflation trade…

Source: Bloomberg

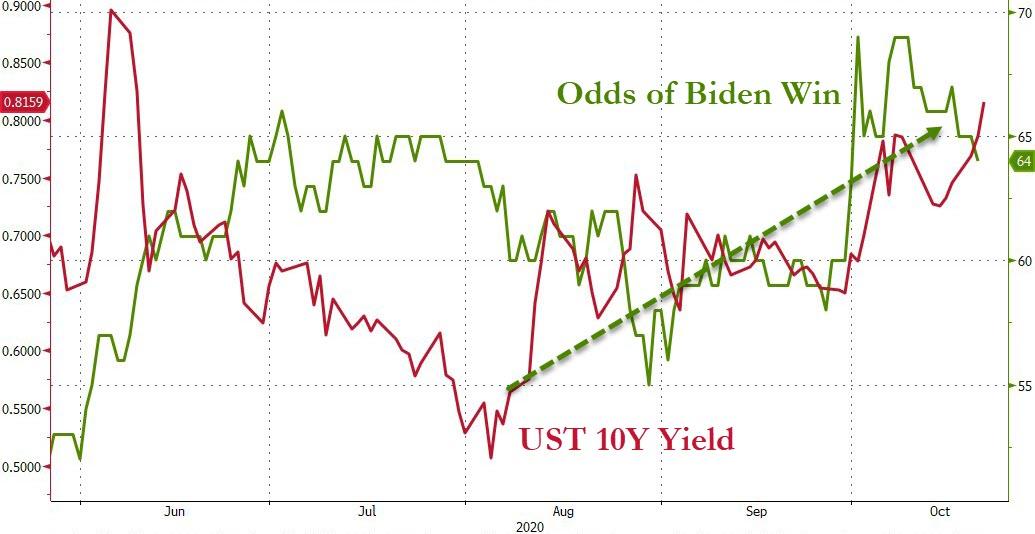

And the higher the odds of a Biden win, the higher rates have pushed in recent weeks…

Source: Bloomberg

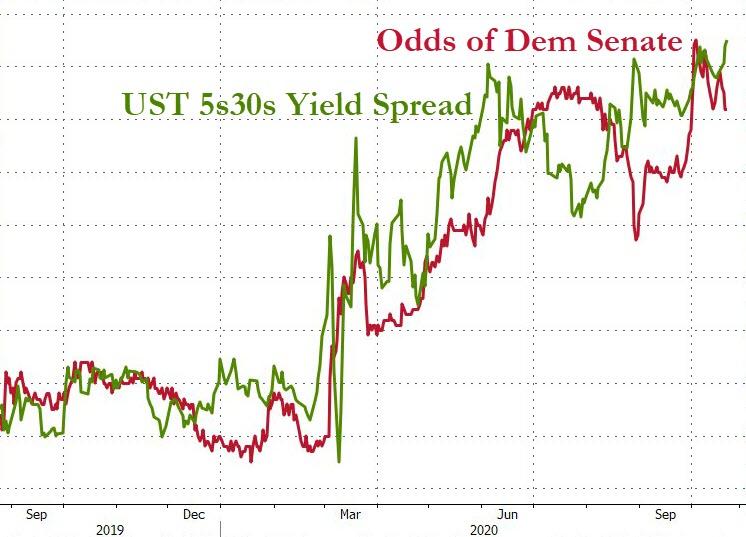

And as the odds of a so-called “blue-wave” grow, the TSY yield curve has steepened dramatically…

Source: Bloomberg

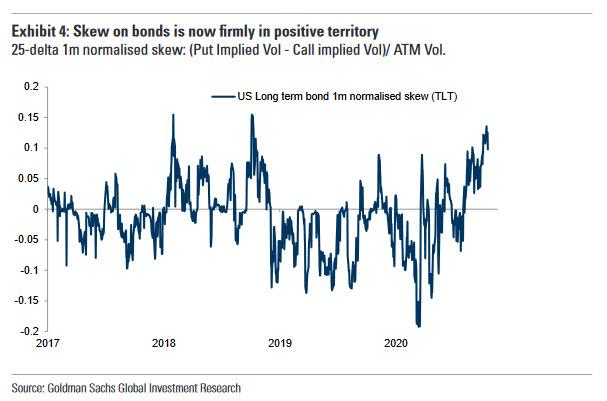

But, as Bloomberg reports, there are some large traders who are betting aggressively against this consensus view.

Strategists have been broadly calling for a possible surge in yields on the chances of a “Blue Wave” Democratic victory, but one trader spent around $2.5 million on Tuesday on a bet that Treasuries will experience just modest declines following the Nov. 3 vote.

The other eye-catching position was a hefty punt on the weeks following the vote, calling for bond yields to remain stuck in a range.

The trades stood out for their size and because they’re against the current run of play.

The first trade is a short volatility position that expires a week after election day, but leaves the buyer exposed to unlimited losses if benchmark yields jump more than around 12 basis points, according to calculations by Bloomberg. The so-called 10-year Treasury put tree takes advantage of the fact that the cost to buy options targeting a spike in yields is high relative to those aimed at a modest increase.

The second trade was a sale of a so-called strangle on 10-year Treasuries — a pair of upside and downside options — which generated over $21 million in premiums. Bloomberg has calculated that the bet will pay out if 10-year yields remain between 0.65% and 1% between the election and the options’ expiry on Dec. 24.

Source: Bloomberg

So while the consensus talking heads are convinced of a Biden win and Dem sweep, as Bloomberg strategist Richard Jones notes, a strong case can be made that the recent bond selloff could be premature, and that selling into this weakness may all end in tears. On the fundamental side, much of this upside in yields is due to market enthusiasm over the reflation trade, driven by an aggressively expansive dose of fiscal stimulus. While hopes are high and anticipation is palpable, nothing has passed yet, and the U.S. Senate remains a likely formidable roadblock to anything substantive getting done pre-election. A longer wait for stimulus will disappoint UST bears.

Additionally, at some stage these higher UST yields will start to weigh on U.S. equities. When that happens, expect flows into bonds to weigh on yields.

via ZeroHedge News https://ift.tt/3jk09Ls Tyler Durden