Fears Of Biden Capital Gains Tax Hike Spark Avalanche Of Private Company Sales

Tyler Durden

Thu, 10/22/2020 – 08:47

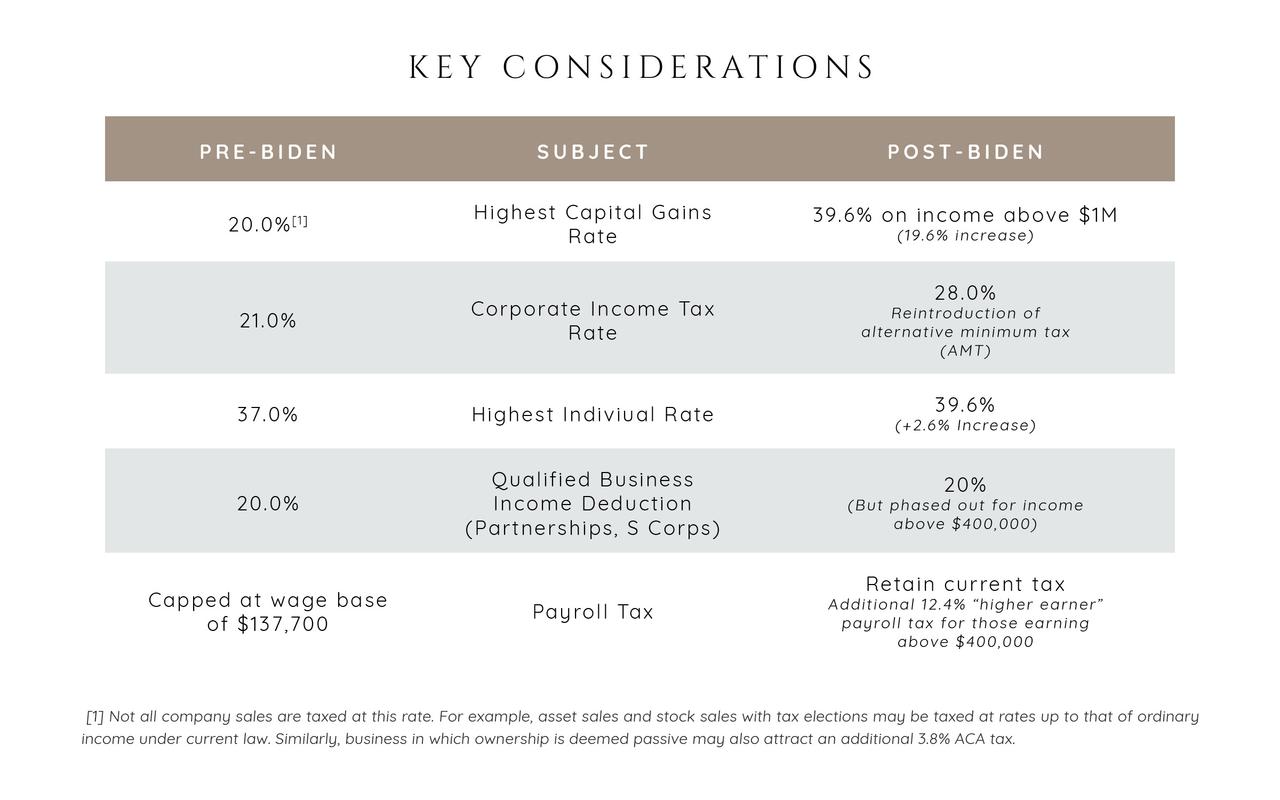

At the start of the month, we reported that as part of his proposed tax reform, Joe Biden would increase the maximum tax rate for long-term capital gains by a whopping 66%, from 20% currently (23.8% when accounting for the additional 3.8% ACA tax) to as high as 39.6%, for those making over $1 million or for proceeds of a business sale over $1 million. A summary of the changes tot he US tax code under a Biden admin is shown below.

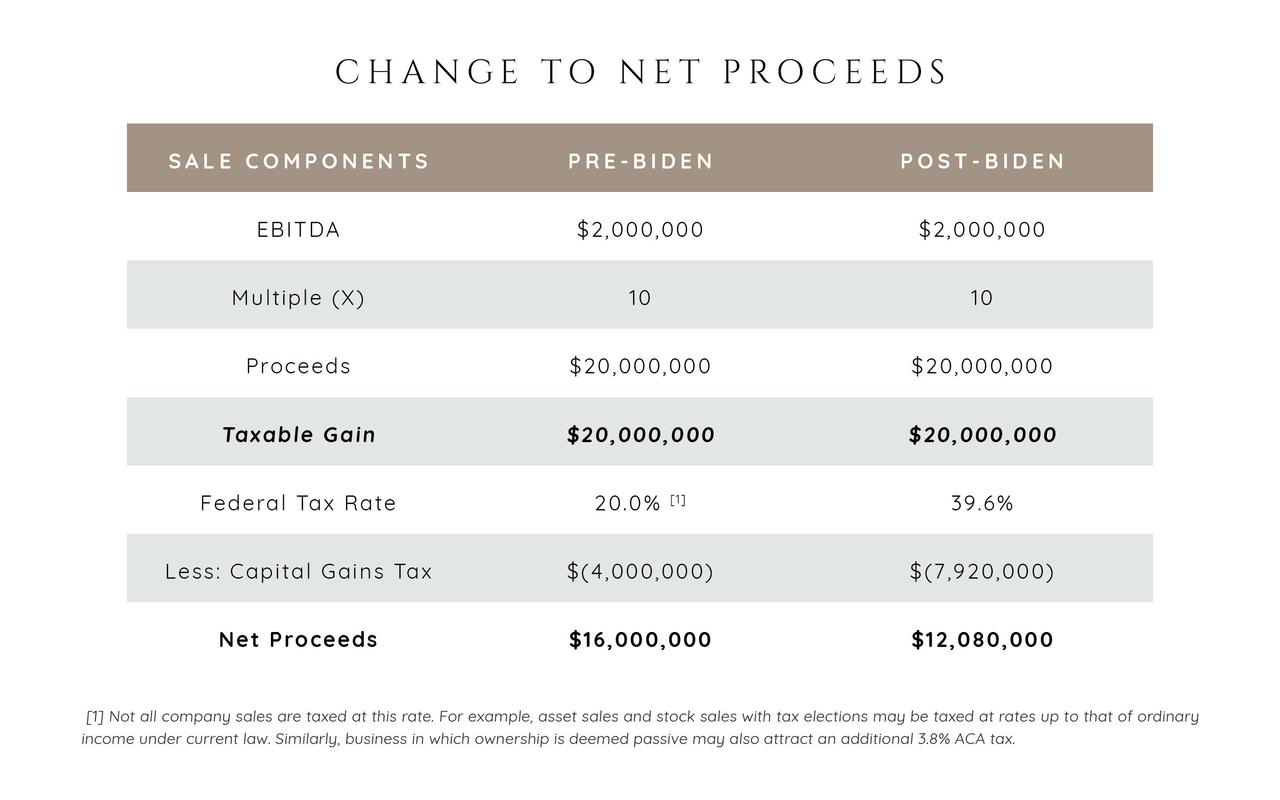

We also observed that while this cap gains increase wouldn’t affect most small-timer Robinhood traders (except for the really talented ones), it would have a drastic hit on major market players and corporate strategies involving exit events that include more than $1 million in proceeds, as the following analysis from Benchmark Corporate showed: assume a $2.0M EBITDA (small or medium) business receives a valuation multiple of 10x for a total transaction value (taxable gain) of $20.0M. Under the Biden Plan, the seller would lose $3.92M in the sale. To receive the same net proceeds, a multiple of 13.2x would need to be secured.

We concluded that “this kind of dramatic revision to post-transaction cash flows under a Biden regime is – to say the least – concerning, although because the media has barely discussed Biden’s tax plan (or any of his other policies for that matter) and instead focusing on Trump, Trump, Trump, the impact of Biden’s tax long-term cap gains will come as a shock to the market.”

Yet while the media may be ignoring the gamut of tax implications a Biden presidency would unleash, bankers have been busy generating fees from the upcoming tax law overhaul, and as Reuters reports investment bankers have a simple pitch to their corporate owner clients: hire us to sell your company now or pay at least twice as much in taxes if Democratic presidential candidate Joe Biden has his way.

Of course, Biden would have to win the presidency and the Democratics would have to gain control of the Senate for his tax proposals to become law. While this is far from certain, this prospect has been seized on by bankers hungry for new business.

“We urge all of our current and potential clients to take note of the potential forthcoming changes, along with their associated consequences, as they consider an exit strategy for their business in the near future,” Houlihan Lokey bankers wrote in a note earlier this month, perhaps after having read our post.

While the bankers’ pitch is geared toward individuals and families, it also targeted private equity firms who control companies and can decide when to sell them. It also targets company founders, who may only sell one business in their lifetime, making it the most important transaction of their lives.

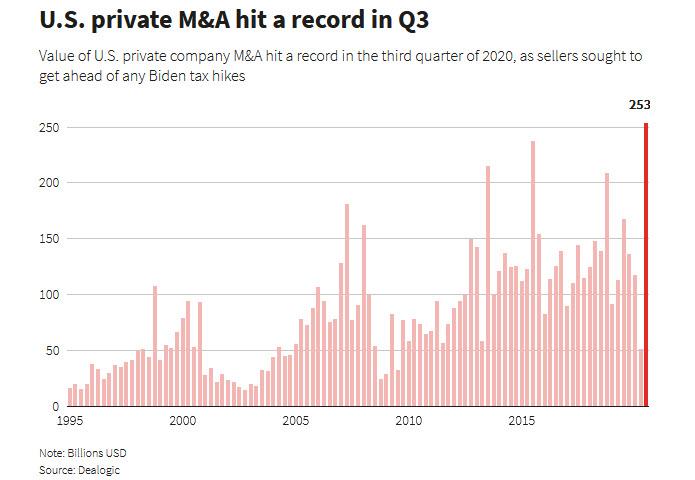

The strategy to rush and sell before a Biden administration arrives appears to be working: according to Dealogic, sales of privately held U.S. companies totaled a record $253 billion in the third quarter, up fivefold from the second quarter and up 51% from the third quarter of 2019. This is despite the COVID-19 pandemic suppressing corporate valuations in some sectors.

“Since the summer we have seen a lot of dialogue from family offices about exploring a sale of some assets. Many of these investors are sophisticated about how they handle their affairs from a tax perspective,” said PJT Partners partner David Perdue.

One of the U.S. companies pursuing a deal because of tax considerations is Asplundh Tree Expert LLC, a family-controlled tree-trimming firm, according to people familiar with the deliberations. According to Reuters, the family that has owned Asplundh since 1928 has been keen to hold onto the company and resisted overtures to sell to private equity firms hungry for a quick flip. When one of these firms, CVC Capital Partners Ltd, convinced the Asplundh family to sell it a minority stake in 2017, it had to use a buyout fund it manages that is dedicated to retaining holdings for a decade or more, rather than cashing out after a few years.

But after decades of holding out, the Asplundh family is now working with investment bankers to cash out on part of its stake, because of its concerns about upcoming changes in the tax system, Reuters reports, noting that the family is seeking a valuation for Asplundh of as much as $10 billion.

To be sure, even if Biden wins and implements his tax plan, corporate owners may still have time to cash out. Most of President Donald Trump’s corporate tax cuts, which were enacted into law in 2017, became effective in 2018, a year after he came into office. Still, the big uptick in the divestitures of privately owned companies shows how some of their owners view Biden’s election victory, and subsequent tax changes, as likely.

And while small and medium business owners of private businesses are the biggest losers as they are now forced to liquidate to avoid a major hit to their equity value, the winner from a potential Blue Sweep is – drumroll – Wall Street, which will collect billions in transaction fees.

Goldman Sachs advised on more sales of privately held U.S. companies year-to-date than any other, followed by Morgan Stanley, JPMorgan and Bank of America. One can almost sense a conflict of interest in these banks relentlessly pushing for a blue wave as the most likely outcome on Nov 3.

via ZeroHedge News https://ift.tt/2Hnhg1W Tyler Durden