Global Markets Rise Despite Fading Odds Of Stimulus Deal

Tyler Durden

Fri, 10/23/2020 – 08:14

S&P futures and European stocks rose on positive corporate earnings and German PMI data, while Treasurys reversed an earlier loss, even though the rapidly approaching election means the chance of a fiscal deal getting passed by Congress ahead of Nov. 3 now seems increasingly distant.

In pre-market trading, Intel tumbled 9% after a surprise drop in data-center sales. Gilead Sciences jumped after its antiviral therapy becoming the first drug formally cleared to treat Covid-19.

The final debate between Trump and Biden on Thursday presented few surprises for election watchers and if anything, merely reinforced investor caution heading into the Nov. 3 election. While Biden blamed Donald Trump for the deaths of more than 220,000 Americans in the coronavirus pandemic in the debate late Thursday, and Trump accused Biden of corruption in China and Ukraine, their exchanges didn’t move markets much.

While S&P 500 futures dipped slightly after the debate, they were mostly flat by late Asian trade. The underlying index had gained about 0.5% in the previous day on hopes that the U.S. Congress and the White House could soon strike a deal on another round of COVID-19 stimulus, with bank stocks leading gains on the back of a sharp jump in yields.

“The sense I get looking at US futures is that the market, after this debate, does not appear very convinced that Mr Trump was able to increase his odds of winning the elections,” said Chetan Seth, Equity strategist at Nomura in Singapore.

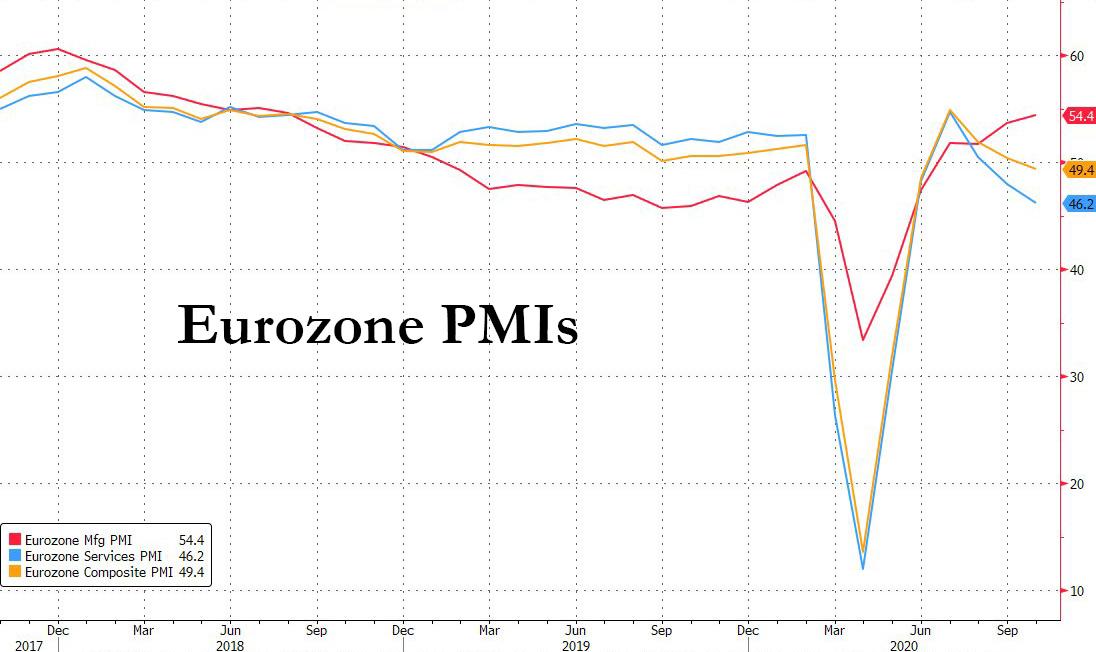

European stocks are expected to claw back some of this week’s losses, with the Stoxx 600 up 0.8% on Friday, headed for its first increase this week. Barclays jumped after reporting improved stocks trading, lifting U.K. banking shares. Carmakers climbed after Daimler AG raised its profit forecast and Renault SA topped revenue estimates, the latest signs the global auto industry is emerging from its worst slump in decades. The euro strengthened as regional manufacturing data also exceeded estimates, even as services PMIs continued to sink: the Markit composite monthly measure of business activity in the euro zone fell to a four-month low of 49.4 in October from 50.4 in September. Within the report is a clear, divergent trend of manufacturing strength being offset by damage to services from the second wave of the pandemic

- EU Markit Services Flash PMI 46.2 vs. Exp. 47.0

- EU Markit Manufacturing Flash PMI 54.4 vs. Exp. 53.1

- EU Markit Comp Flash PMI 49.4 vs. Exp. 49.3

Earlier in the session, shares in Asia hardly moved, with MSCI’s index of Asia-Pacific shares ex-Japan flat while Japan’s Nikkei ticked up 0.2%. Most markets in the region were up, with Hong Kong’s Hang Seng Index advancing 0.5% and India’s S&P BSE Sensex Index rising 0.4%, while China’s Shanghai Composite slid 1%. The Topix added 0.3%, with Nexon and Bridgestone contributing the most to the move. The Shanghai Composite Index retreated 1%, driven by China Life and Kweichow Moutai.

Despite Friday’s stock strength, it now appears a fiscal deal is virtually impossible due to the rapidly approaching election and the lack of deal. Adding to the problem is the increasing resistance from Senate Republicans to voting on the multi-trillion dollar package, with there being a real possibility they would not vote in favor of a package even after the election. House Democrats are starting to say that they would be unwilling to come back to Washington to pass a bill if Senate support isn’t in place.

“The focus is shifting toward de-risking,” said Eleanor Creagh, a market strategist at Saxo Capital Markets, on Bloomberg TV. “There’s a range of outcomes from the elections that could have a huge capacity to change market sentiment and dynamics very quickly.”

Ahead of last night’s debate, investors had fully priced in a Blue Sweep, where Democrats win both chambers of Congress alongside a Biden presidency. While Democrats plan to raise taxes on corporate profits and capital gains could hit share prices, their pledge on large stimulus is seen as offsetting those blows.

“A lot of people are now talking about K-shaped recovery in the economy. My sense is that the money will move around within the stock market, rather than flowing outside under the ‘triple blue’ scenario,” a senior manager of trading at a major Japanese bank told Reuters.

The clean energy sector is seen as a potential winner at the expense of traditional energy firms under a Biden presidency. The Dow Jones oil and gas index is down nearly 49% this year. Biden reiterated his campaign pledge of net-zero-emissions by 2050. Meanwhile, the Nasdaq, which had led the market’s rally, has underperformed lately, having lost 1.4% so far this week also on concerns Democrats could take a harder stance on big tech firms. Investors could also take profits on them before any increase in capital gains tax.

“A blue wave may lead to concerns about the impact on the tech sector, while a Biden win and a split Congress may imply another four years of limited policy changes and politicking,” said Mary Nicola, senior economist at Pinebridge Investments in Singapore.

Expectations of bigger government stimulus have also boosted U.S. treasury yields. The 10-year U.S. Treasuries yield rose to 4 1/2-month high of 0.870% on Thursday and last stood at 0.8615%. Yields were cheaper by less than 1bp across the curve, 10-year yields ~0.86%, testing 200-DMA with curve spreads little changed. In Europe, gilts lagged Treasuries while bunds traded broadly in line; Italian bonds outperform by 4bp after large buying in screens and a 5,120 10-year BTP futures block trade.

In FX, the Bloomberg Dollar Spot Index fell for a fourth day this week, erasing yesterday’s modest rebound, as risk sentiment improved; the euro rose to a session high after a strong manufacturing PMI report out of Germany. Risk-sensitive currencies, such as the Australian dollar and the Norwegian krone, led gains among Group-of-10 peers after rebounding from losses during the Asia session. The pound edged up and was on track for its biggest weekly gain since early October amid optimism Britain and the European Union are edging closer to a Brexit trade deal. U.K. retail sales rose more than expected last month as demand for home improvement products and food contributed to the biggest quarterly jump on record. The volume of goods sold in stores and online gained 1.5% from August. The yen also climbed, adding to an earlier advance, and was on track for a second week of gains

Elsewhere, China’s yuan climbed after an official with the country’s foreign exchange watchdog said Friday the currency’s appreciation has been “relatively moderate.” The Chinese currency traded 6.6767 per dollar in offshore trade, off 27-month high of 6.6278 touched on Wednesday.

In commodities, oil prices eased slightly, giving up part of the previous day’s gains. Brent futures dropped 0.6% to $42.19 per barrel while U.S. crude futures shed 0.7% to $40.35 per barrel. Gold was modestly higher.

Economic data include Markit PMI readings. Scheduled earnings include American Express. Intel slumps in premarket trading after disappointing results, Gilead gains on FDA approval for its coronavirus treatment

Market Snapshots

- S&P 500 futures up 0.2% to 3,455.75

- STOXX Europe 600 up 0.6% to 362.53

- MXAP up 0.2% to 176.31

- MXAPJ up 0.07% to 585.43

- Nikkei up 0.2% to 23,516.59

- Topix up 0.3% to 1,625.32

- Hang Seng Index up 0.5% to 24,918.78

- Shanghai Composite down 1% to 3,278.00

- Sensex up 0.4% to 40,705.02

- Australia S&P/ASX 200 down 0.1% to 6,167.05

- Kospi up 0.2% to 2,360.81

- Brent Futures down 0.09% to $42.42/bbl

- Gold spot up 0.4% to $1,911.18

- U.S. Dollar Index down 0.2% to 92.77

- German 10Y yield fell 0.6 bps to -0.572%

- Euro up 0.2% to $1.1842

- Brent Futures down 0.09% to $42.42/bbl

- Italian 10Y yield rose 2.1 bps to 0.6%

- Spanish 10Y yield fell 1.8 bps to 0.205%

Top Overnight News from Bloomberg

- President Donald Trump and Democratic presidential candidate Joe Biden traded charges of secretly taking money from foreign interests, after the former vice president addressed head-on Trump’s efforts to portray him as corrupt

- European governments began to deploy curfews more widely, as the coronavirus pandemic gained momentum across the continent and France reported more than 40,000 new cases for the first time

- The U.K. signed a trade deal with Japan on Friday, its first with a major economy since Brexit, as the clock runs down on British efforts to reach an agreement with the EU by the end of the year

- The Riksbank governor, Stefan Ingves, fears the economic outlook is deteriorating amid signs the coronavirus pandemic is tightening its grip across Europe, and ensnaring Sweden again too

- The resistance among Senate Republicans to the near-$2 trillion stimulus package under negotiation between House Speaker Nancy Pelosi and the White House has spurred some House Democrats to oppose the idea of a pre-election vote on any bill

- Governments around Europe began to deploy curfews more widely, as the coronavirus pandemic gained momentum across the continent, with France reporting more than 40,000 new cases for the first time

- China mulls further easing limits on cross-border investment by domestic institutions and individuals, with QDII as one of the approaches, State Administration of Foreign Exchange Spokeswoman Wang Chunying says at a briefing

- The U.K. signed a trade deal with Japan on Friday, its first with a major economy since Brexit, as the clock runs down on British efforts to reach an agreement with the EU by the end of the year

- The U.K. is set to sign a trade deal with Japan in Tokyo on Friday, its first with a major economy since Brexit, as the clock runs down on British efforts to reach an agreement with the EU by the end of the year

- Oil headed for a modest weekly decline as fresh optimism that a U.S. stimulus deal is imminent was overshadowed by the threat a resurgent coronavirus poses to energy demand in Europe and the U.S.

A quick look at global markets courtesy of NewsSquawk

Asia-Pac equities traded mostly higher after a lukewarm handover from Wall Street whereby all three majors closed in the green but the Nasdaq narrowly underperformed amid losses across the tech sector, whilst Intel shares slumped almost 10% after-hours post-earnings amid new weakness in its data center business. US equity futures reopened with mild gains before drifting modestly lower during the Presidential Debate, albeit with no explicit comment driving price action at the time as the two candidates stuck to their respective scripts. Thereafter, following the more sanguine debate, ES, NQ and YM nursed losses to trade higher by 0.1-0.2%. ASX 200 (-0.1%) remained the laggard as the index was subdued by its mining sector. Nikkei 225 (+0.2%) extended on gains despite the firmer Yen, with outperformance in the industrial names, whilst Mitsubishi Heavy Industries stood as the outperformer amid source reports the group is closer to a final decision on freezing regional Spacejet program. KOSPI (+0.2%) traded between gains and losses before gaining a firmer footing in positive territory. Hang Seng (+0.5%) and Shanghai Comp (-1.0%) eked mild amid gains initially another PBoC liquidity operation, whilst comments from Chinese President Xi did little to sway the indices; though this did wane for the Shanghai index as the session came to a close. Finally, 10yr JGB futures continued to track the broader fixed income futures complex.

Top Asian News

- Goldman Admits Role in Record $1.6 Billion 1MDB Bribe Spree

- Japan Maintains Severe Assessment of Economy in October

- Walmart Unit Invests $204 Million in Birla’s Retail Business

- Japanese Stocks Gain on U.S. Recovery Signal Amid Calm Debate

European equities (Eurostoxx 50 +0.9%) trade higher across the board after a pick-up in sentiment shortly after the cash open. It’s been a busy morning of data for the region with French PMIs, highlighting the diverging fortunes of the services and manufacturing sectors with the former extending its advances into negative territory, leaving the composite reading for France at 47.3 vs. prev. 48.5. Thereafter, Germany posted a strong showing for its crucial manufacturing sector (58.0 vs. prev. 56.4) , which helped extend the upside in the DAX (+0.7%), albeit declines in the services sector acted as a weight on the still-positive composite reading (54.5 vs. prev. 54.7). The Eurozone-wide release conformed to the overall viewpoint that despite the manufacturing industry holding up in the early stages of Q4, the services sector is clearly falling victim to the resurgence of the virus. IHS Markit have cautioned that “the eurozone is at increased risk of falling into a double-dip downturn”. Asides from this morning’s macro data releases, there have been a raft of corporate updates with solid earnings from Barclays (+7.3%) prompting outperformance of the banking sector after the Co. reported Q3 profit-before-tax of GBP 1.1bln vs. Exp. GBP 0.5bln amid a notable decline in bad loan provisions and strong performance in its consumer business. Elsewhere, energy names are also firmer in a continuation of yesterday’s advances despite crude prices being relatively unchanged on the session. Earnings from Daimler (+2.0%) and Renault (+1.6%) have supported the autos sector, whilst 9M results from Michelin (+2.6%) have also served as a source of encouragement from the broader industry. In a busy morning of earnings for the CAC 40 (+1.0%), Accor (+4.5%) are a clear outperformer despite results highlighting that impact on activity from the COVID crisis, to the downside in France, Kering (-2.6%) lags amid weak performance in its Gucci division. Elsewhere, notable laggards post-earnings include ABB (-2.8%) and Electrolux (-2.0%) with the former acting as a weight on the underperforming SMI (U/C).

Top European News

- U.K. Regulator Investigating 14 Firms, 6 People in Cum-Ex Cases

- U.K. Recovery Looks Past it Peak as Virus Curbs Erode Growth

- Nordea Soars After Trouncing Estimates and Pledging Dividend

In FX, it remains to be seen whether the Greenback can withstand renewed downside pressure after overcoming several wobbles late yesterday and extending recovery gains overnight, but for now the signs are looking ominous as certain G10 rivals rebound on a combination of fundamental and technical factors. Indeed, the index is beating a relatively hasty retreat from a 93.129 peak to 92.724, thus far, ahead of Markit’s US flash PMIs that may or may not help the Dollar regroup.

- AUD – The Aussie is back in the ascendency and outperforming with some assistance from encouraging PMIs and the fact that it survived a test of support ahead of 0.7100 vs its US counterpart in the form of the 100 DMA (0.7106) and 1.0650 or so against the Kiwi. However, 0.7150 and 1.0700 may cap further upside barring another pronounced upturn in broad risk sentiment.

- CHF/JPY/GBP/EUR/NZD – All firmer vs the Buck, either by default or in their own right, as the Franc revisits 0.9050 from lows not far off 0.9100, Yen approaches 104.50 compared to sub-104.90 and Pound bounces from circa 1.3050 to just over 1.3100 at one stage. Note, Japanese CPI was slightly less deflationary than expected and UK retail sales much stronger than forecast in contrast to rather mixed preliminary PMIs, but none of these macro releases seemed to impact, though Cable may be drawn to unusually large option expiry interest from 1.3090 to 1.3100 in just over 1 bn. Conversely, the Euro appeared to derive some from the Eurozone surveys revealing faster than anticipated activity in Germany’s manufacturing sector that boosted the composite and pan prints to partly offset misses in services vs consensus. Eur/Usd has subsequently accelerated through the 50 DMA (1.1795), 1.1800, a Fib retracement level aligning with the 100 HMA (at 1.1806) to just shy of 1.1850, but could be hampered by circa 1.4 bn expiries between 1.1840-50. Back down under, the Kiwi is inching closer to 0.6700 even though NZ CPI was weaker expected in Q3.

In commodities, WTI and Brent futures have been somewhat choppy throughout the session but largely following the directional performance of the equity complex, albeit with magnitudes more contained and the benchmarks only modestly positive at present. Fundamental drivers explicitly for the complex remain sparse aside from the ever-present COVID-19 demand concerns and OPEC+ related supply issues. Instead, geopolitical reports could draw attention in the sessions ahead with reports today indicating that the conflict in Libya has been resolved with all sides agreeing to a permanent ceasefire – a factor of note given the frequent force majeures for some of the nations most significant facilities. Additionally, tensions are seemingly rising regarding Iranian oil sanctions as WSJ reports indicate that US Officials are frustrated that allies are not taking enough aggressive action to enforce the sanctions; amid reports that Persian Gulf waters are being utilised as a waypoint for smugglers out of Iran. Looking ahead, the session’s only crude event of note is the weekly Baker Hughes rig count which last week saw a 12-rig increase for oil facilities. Action for spot gold has once again been dictated by the USD with the precious metal gleaning support from the DXY’s gradual demise throughout the session. At present, the metal is firmer by around USD 6/oz and in proximity to session highs above the relatively contained levels seen in APAC hours.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 53.5, prior 53.2

- 9:45am: Markit US Services PMI, est. 54.6, prior 54.6

- 9:45am: Markit US Composite PMI, prior 54.3

DB’s Jim Reid concludes the overnight wrap

Global equity markets fluctuated and sovereign bonds sold off yesterday as investors weighed up further positive reports on the likelihood of US stimulus against a further deterioration in the coronavirus situation. By the close, yields on 10yr Treasuries had gained +3.4bps to hit a 4-month high of 0.856%, as Speaker Pelosi said that herself and Secretary Mnuchin were “just about there” when it came to reaching a stimulus deal. By the end of the day yesterday, the Speaker noted three sticking points: aid to state and local governments, school funding and a liability shield for employers. However, there remain questions as to whether the Republican-controlled Senate would pass such a deal, even if it happened after Election Day on November 3. A few senior ranking Senate Republicans are still wary, with Senate Appropriations Chairman Shelby noting that he had not seen any detail yet and that “it’s about two minutes to midnight, and we’re not going to pass anything until we see the particulars.” With all members of the House up for re-election, Speaker Pelosi noted that some are of the party’s lawmakers have said they may not leave the campaign trail prior to November 3 if the Senate does not commit to acting.

US equities rallied later in the session, and the S&P 500 posted a gain of +0.52% as cyclicals led the index higher, with the NASDAQ seeing a slightly smaller advance of +0.19%. As bets on the likelihood of further stimulus gathered pace, there was another bear-steepening in US Treasuries, with 10yr yields up as mentioned (though down -0.8bps this morning) while the 2s10s curve steepened +3.0bps to reach its steepest level in over 2 years, and the 5s30s reached its steepest in 3 years. In Europe, there was a similar cyclical outperformance with Autos (+0.65) and Banks (+0.55%) leading the way but the STOXX 600 finished down -0.14% for its 4th consecutive decline. In fixed income, yields on 10yr bunds (+2.1bps), OATs (+2.4bps) and BTPs (+2.1bps) all moved higher.

Staying on the US, overnight the second and final US Presidential Debate took place and was far a more orderly one than the first. While the question of foreign interference and contacts was once again raised, the majority of the debate focused on the pandemic, the economy, race relations and climate change. Early indications are that both candidates more or less held their own, which would be good news for Joe Biden who came into the night leading by high single digits in national polling averages.

For those interested in more election content, our US economists here at DB put out a note yesterday (link here) looking at the economic implications of the different potential outcomes. Their view is that a blue sweep where Biden wins the presidency and the Democrats take the Senate would provide the most fiscal stimulus to the economy in 2021, whereas the second most likely outcome (a Biden presidency along with a Republican Senate) would be the most negative for growth next year. Though we’ll obviously have to wait and see if last night’s debate has any impact on the polls, the FiveThirtyEight and RealClearPolitics averages currently show a Biden lead of 9.9pts and 7.9pts respectively.

Overnight, equity markets are trading higher in Asia, with the Nikkei (+0.44%), Hang Seng (+0.61%), Shanghai Comp (+0.13%) and Kospi (+0.44%) all up, though S&P 500 futures are broadly flat. Looking at the flash PMIs that are out so far, Australia has seen an uptick in its composite reading to 53.6 (vs. 51.1 previously), while Japan has seen a smaller rise to 46.7 (vs. 46.6 previously). Attention will remain on the European and US releases today, as they represent one of the initial data points we have on economic activity into October, particularly in Europe where fewer high frequency indicators like jobless claims are available. For the Euro Area, there has been a weakening in the mobility indicators since late September, so the question will be whether this translates into reduced economic activity as well. The consensus expectation on Bloomberg for the Euro Area composite PMI is that it’ll fall back to 49.2, which would mark the first time since June that the composite PMI has been below the 50-mark that separates expansion from contraction.

In terms of the pandemic, yet further rises in coronavirus cases continued to dampen investor sentiment, with the number of new cases continuing to escalate in Europe in particular. In the last 24 hours, the continent saw a record number of daily cases reported in numerous countries, including France, Italy, Poland, the Netherlands, Romania, Slovenia, and Denmark. Unsurprisingly, there’ve been more moves to impose restrictions, and yesterday France (which reported a record of more than 40,000 cases) announced an extension of its curfew to cover an additional 38 departments, while in the UK, Chancellor Sunak announced that the government would increase its levels of financial support to those affected economically by the pandemic. In the US, cases rose by over 68,000 with daily records in Illinois and Ohio. According to the mayor, Chicago will put a night-time curfew for non-essential businesses in place starting Friday for at least two weeks.

In terms of yesterday’s other data, the weekly initial jobless claims from the US came in at a lower-than-expected 787k in the week through October 17, which itself was a decline from the previous week’s downwardly revised 842k reading, as well as being the lowest number since the start of the pandemic. The continuing claims number for the week through October 10 also fell to a post-pandemic low 8.373m (vs. 9.625m expected), though with both the initial and continuing claims, it’s worth bearing in mind that both are still above their peak levels following the global financial crisis, so there’s still some way back to anything like normality in the labour market. Otherwise, the European Commission’s advance consumer confidence indicator for the Euro Area fell back in October to -15.5, which was its worst reading since May.

To the day ahead now, and the release of the aforementioned flash PMIs from around the world are likely to be the main highlight. Otherwise, the Russian central bank will be deciding on rates, BoE Deputy Governor Ramsden will speak, and American Express will be releasing earnings.

via ZeroHedge News https://ift.tt/3krKA5Q Tyler Durden