Wall Street Begins Hedging: JPM Says Trump Victory Is “Most Favorable Outcome”, Would Push S&P To 3,900

Tyler Durden

Mon, 10/26/2020 – 10:33

Over the past month, Wall Street’s strategists have engaged in a comprehensive campaign to “ease” client fears that a Biden administration and/or a “Blue Sweep” would be just as good for stocks if not better than a continuation of the status quo, thus avoiding a selloff should Nov 3 prove to be a rout for Republicans, to wit:

- Higher corporate taxes under Biden? No worries, it will be offset by up to $7 trillion in fiscal stimulus under a joint Democratic congress.

- A doubling of capital gains taxes? No worries, it only will affect the super-rich and while it may hit stocks in late 2021, the dip will be quickly bought as, after all, stocks always go up, with Goldman predicting that “regardless of the election outcome, we expect roughly 10% upside to the S&P 500 by the middle of next year.”

- Higher bond yields under a Democratic sweep? No worries, after all we need higher yields to telegraph that the economy is improving and reflation is returning.

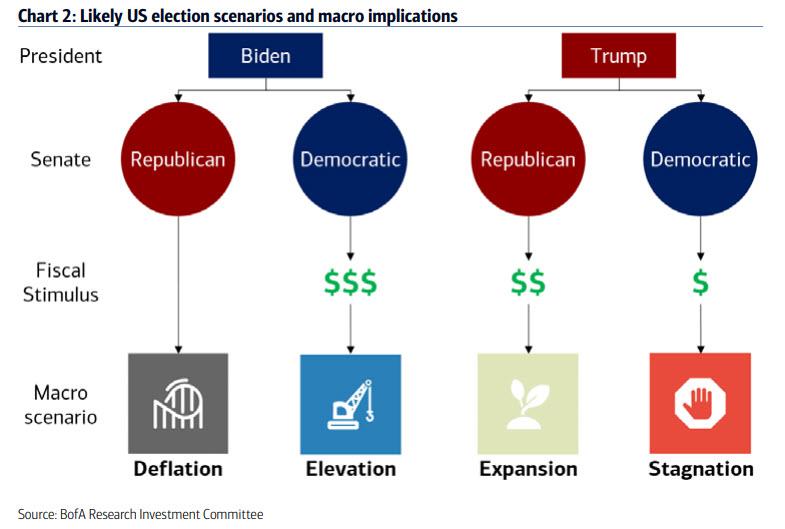

A recent Bank of America analysis laid out the 4 possible election outcomes, which were more dependent on the composition of the Senate than who is president (the worst scenarios for markets were those where “president Biden” faced a Republican Senate and vice versa for Trump):

The bottom line however was clear: the best possible outcome for markets is a Blue Sweep.

However, now that said Blue Sweep scenario has been fully priced in a new risk has emerged: what is polls are wrong – again – and we get either a Trump victory or a mixed Congress? Would that mean that the consensus trade would fall apart, leading to sharp stock market losses as the reflation trade is puked into an illiquid market?

Judging by the latest report from JPMorgan head of global equity strategy, Dubravko Lakos-Bujas – published over the weekend, Wall Street is about to pull a U-turn and begin pre-emptive damage control should Trump win.

Indeed, in a dramatic reversal from the recent narrative which present a “Blue Sweep” as the most beneficial outcome from the election, the JPMorgan strategist writes that he maintains a probability weighted S&P 500 price target of 3,600 for year-end, and sees “an orderly Trump victory as the most favorable outcome for equities (upside to ~3,900).”

Just as amusing, Lakos-Bujas says that he also views gridlock outcomes “as a net positive with market volatility likely subsiding and driving mechanical re-leveraging within equities.”

But the most entertaining spin is that a “Blue Sweep” scenario – which as we noted last night is suddenly looking unlikely with PredictIt odds tumbling, “is expected to be mostly neutral in the short term as it would likely be accompanied by some immediate positive catalysts (i.e. larger fiscal stimulus / infrastructure) but also negative catalysts (i.e. rising corporate taxes).”

But… but… Wall Street spent so much time explaining just why this scenario is the best possible one, since the “positive catalysts” would greatly outweigh the negative ones. Or is Wall Street only starting to hedge in case the priced-in “sweep” does not happen, and traders need a fall back “narrative cushion” in case of a Trump win and/or Congress gridlock.

Finally, in response to the question of why JPMorgan is suddenly getting cold feet, the Croatian strategist writes that “last week we analyzed voter registration data and their possible implication for State outcomes, while this week we analyzed Twitter sentiment on US election and compared it with the traditional polling data – they all point to a tightening race.” Which of course means that JPM needs to prepare a narrative for why a Biden victory is bullish but a Trump victory is even more bullish: just in case anyone gets the crazy idea of selling on Nov 4.

* * *

While we wait to see if other banks now jump on this “pro-Trump” bandwagon, here is JPM’s update of what market signals it is watching to determine the outcome of the election:

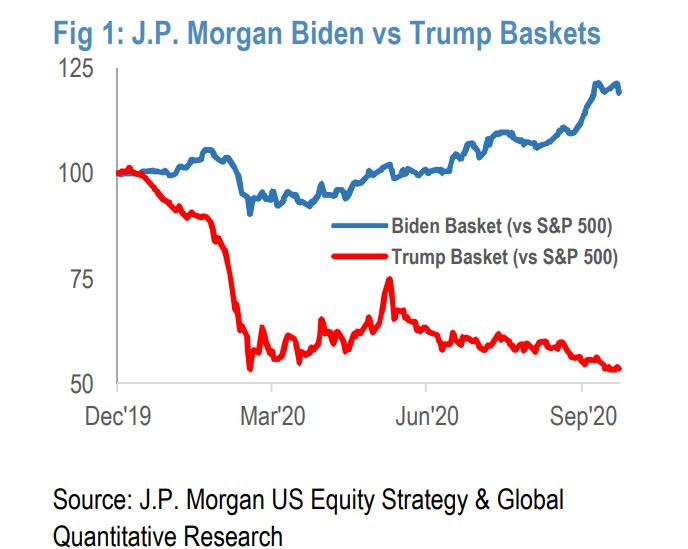

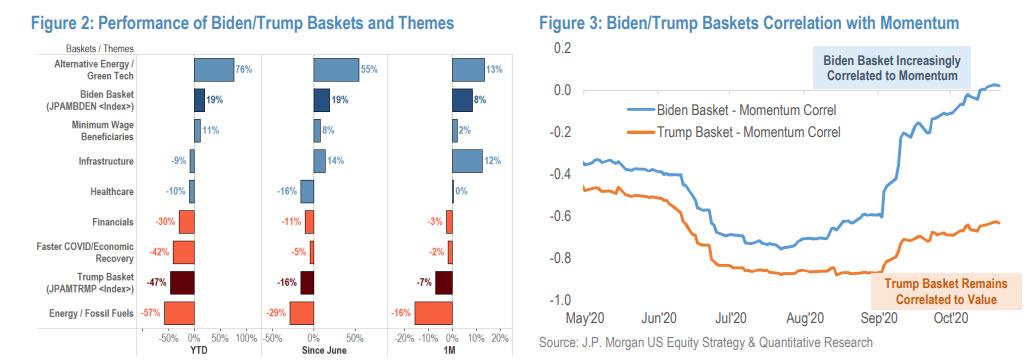

We find that Energy, Financials and Healthcare sectors could likely see the most outsized moves as they have been explicitly referenced by each candidate on the campaign trail. The Biden basket (JPAMBDEN

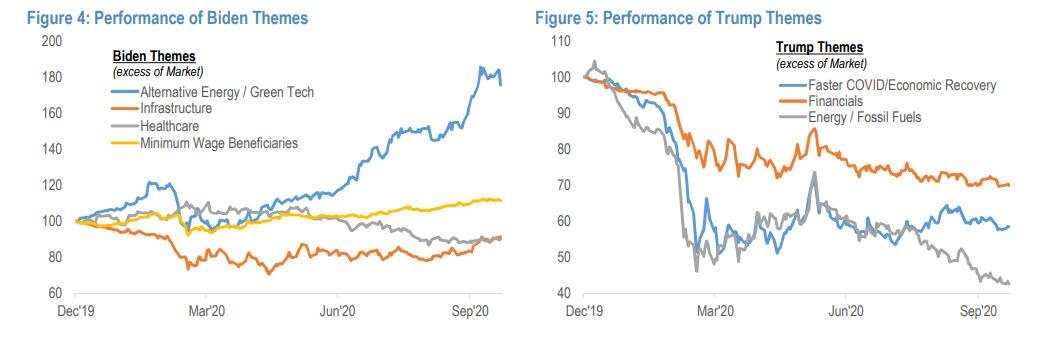

) is outperforming the Trump basket (JPAMTRMP ) by 66%, see Fig 1. At the individual theme level, the performance is even more bifurcated. For example, Alternative Energy / Green Tech stocks (key beneficiaries under Biden basket) are outperforming Traditional Energy / Fossil Fuels (beneficiaries under Trump basket) by ~84% since June, see Figure 2.

The Biden basket also happens to be more aligned with Momentum, ESG and COVID Beneficiaries, while the Trump basket aligns with Value and COVID Recovery / Epicenter stocks. Given the large divergence between these two baskets (i.e. similar to momentum/value), coupled with our expectation that COVID-19 headline risk likely declines post-election, we see an increasingly compelling case for Value in the coming period.

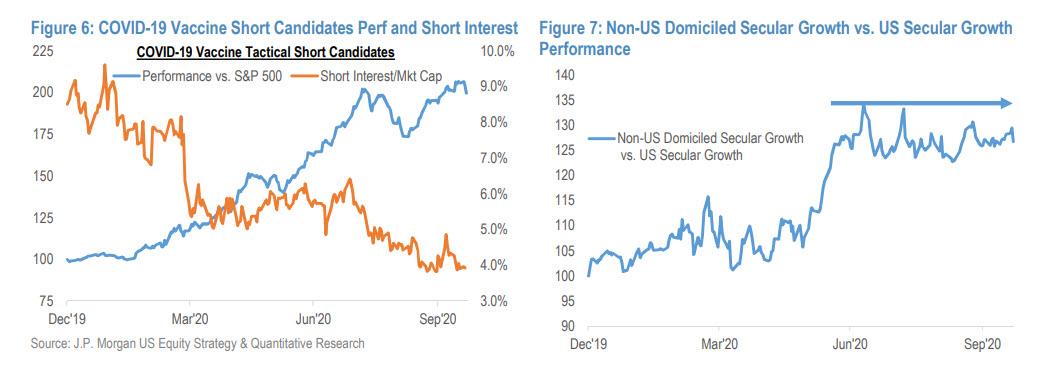

Deep Value, namely Energy and Financials, would likely be key beneficiaries of an ‘orderly’ Trump victory and could see a large short squeeze. Under a Biden scenario we could also see profit taking from high momentum stocks, especially as investors start to price in risk of higher capital gains tax. This could also trigger a rotation within Growth from US-domiciled to non-US domiciled long duration / secular growth equities which could benefit from (1) low-to-no sensitivity to potential corporate tax hikes; and (2) better insulated from capital gains tax increase due to a more diversified investor base.

We are introducing COVID-19 Vaccine Tactical Short Candidates. This is a list of stocks that are in the upper echelon of Momentum and have crowded positioning, that could see the second derivative of their profit growth decrease as consumer / corporate activity normalizes. These screens should be viewed as tactical opportunity to express a view on the catalyst rather than a fundamental call on these companies.

via ZeroHedge News https://ift.tt/37GYopt Tyler Durden