China’s Top Leaders Meets To Set Policy Direction For The Next 5 Years

Tyler Durden

Mon, 10/26/2020 – 23:45

Today China’s top leaders represented by the Chinese Communist Party’s Central Committee started the Fifth Plenum of its 19th Party Congress where they will chart the course for the economy’s development for the next 15 years and set the country’s long-term priorities, with are expected to focus on boosting technological self-sufficiency and domestic demand while Xi cements his influence over the party.

The Plenum will run until Thursday, and will conduct the country’s most important exercise in central-planning: drafting the next Five-Year Plan against the backdrop of a worsening global economy and US sanctions (it’s unclear what if any role the recordings China intelligence has of Hunter Biden will play in this exercise). The plenum will also discuss a broad plan for the next 15 years, with goals that are likely to endure for at least the rest of 67-year-old President Xi Jinping’s rule, who as a reminder made himself ruler for life several years ago.

According to the FT, the process to draft a plan typically reveals the biggest worries and priorities for the Chinese leadership, although these are usually for private consumption and rarely officially disclosed to the public. This year’s meeting comes as the deadline for meeting the previous overarching goal of achieving a “moderately prosperous society”, is due to expire in 2021, the centenary of the founding of the Chinese Communist party.

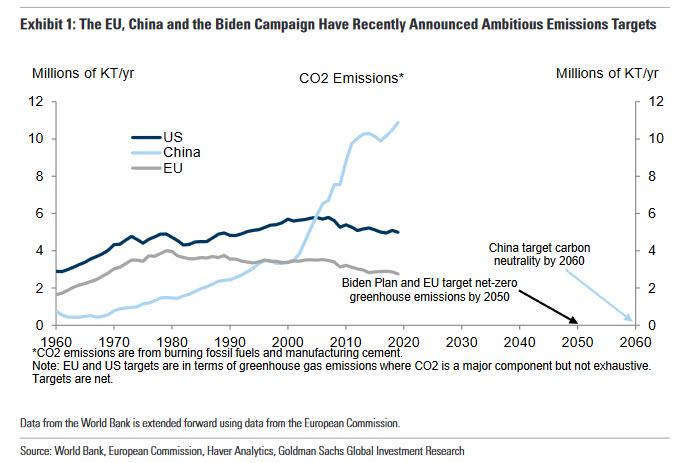

Beijing has recently hinted it would broaden out its focus on economic growth to include targets for environmental protection, innovation and self-sufficient development — such as in food, energy, and in chips. The Planum will also explain how the government will meet Xi’s target of zero net carbon emissions by 2060, which is ironic since China is the world’s biggest emitter of CO2.

Xi is also expected to use the exercise to consolidate his influence over the party and the party’s influence over governance, said Holly Snape, a fellow in Chinese politics at the University of Glasgow. “It’s useful to understand these broad goals in the context of an expression Xi seems fond of: the party, government, military, people, education, east, west, south, north, and centre — the party leads everything.”

At the end of the meeting, China will release a brief summary of the proposals to describe the broader directions of the 14th Five-Year Plan at a high level, including discussions on “dual circulation” – in which China will develop domestic demand and self-sufficiency as the rest of the world remains stalled by coronavirus – strategy, a focus on technological innovation and a push for factor market reform. However, Goldman does not expect a GDP growth target to be announced in either the proposals or the detailed plan when it is released next March.

Below is a preview from Goldman on what to expect from China’s 14th Five-Year Plan:

Main points

The Chinese Communist Party (CCP) will hold the Fifth Plenum of its 19th Party Congress on October 26–29 to discuss the proposals for the 14th Five-Year Plan. The finalized proposals from the party will be released to the public shortly afterwards in a brief summary. Over the next several months, the National Development and Reform Committee (NDRC) will consult specialists and coordinate efforts from other government ministries to prepare a detailed plan draft to be submitted to the National People’s Congress (NPC) for final approval during the “Two Sessions” in March 2021.

Challenging external environment and key domestic development stage

The external environment is likely to get more challenging for China in the next five years, and China’s senior leadership’s view on the external environment has changed significantly. As President Xi has emphasized since the 19th Party Congress, the world is undergoing profound changes , both economically and politically, which are being accelerated by the COVID-19 pandemic. In particular, on the economic front, global growth may be low in the coming years, and trade protectionism, which has increased in recent years may continue, with disturbances to the global supply chain.

On the domestic front, the 14th Five-Year Plan period (2021-2025) will mark the first five years of China’s moves towards its second centenary goal to build a “modern socialist country” after achievement of the first centenary goal of building a “moderately prosperous society”. And as the government has emphasized, China’s development has entered a new stage, focusing more on quality. However, Chinese economic growth has decelerated notably in recent years, with accumulation of many structural issues/imbalances. The contribution of total factor productivity (TFP) to GDP growth has declined notably in recent years. The share of household consumption in China remains low at 39%, compared to 51% for the upper middle income countries and 60% across OECD countries. The share of service sector value-added in GDP has been trending up in recent years to around 54%, but remains below the average level for upper middle income (56%) and OECD (70%) countries. Regional disparity/household income inequality in China has increased or remained large.

Overall, how China can achieve sustainable, balanced and high quality growth in coming years and enter the high income group from the upper middle income group currently is the key long-term question for policymakers in China. Although the Chinese government has been calling for a transition in the development model for a number of years, we think the next five years will be particularly important, both politically and economically.

Growth target expectation

In proposals for prior five-year plans, the government typically mentioned their growth expectation for the next five years, citing “doubling income” goals (except for the 12th five-year plan), and an average GDP growth rate target was included as a key indicator in the detailed plan. These “doubling income” goals were proposed by Deng Xiaoping (for the period between 1980 and 2000) and Jiang Zemin (for the period between 2000 and 2020), with the goal of doubling income between 2010 and 2020 reiterated by President Xi. But for the period beyond 2020, there have been no official comments like these goals so far, and although President Xi mentioned in 19th Party Congress about the second centenary goal beyond 2020, he didn’t make similar numerical remarks on growth.

With the increasing focus on growth quality, we think there is a high chance that the government may not mention growth expectations in the proposals for the 14th five-year plan (and probably the five-year average growth rate indicator could be also missing from the detailed plan released next year). For major indicators in the detailed plan, we think the government may adjust to reflect a focus on quality (there were 25 indicators in the 13th Five-Year Plan, categorized into four groups–economic development, people’s well-being, innovation, resources and environment).

“Dual circulation” strategy to follow in coming years

Against a more challenging external environment, and at a key domestic development stage, recently President Xi has stressed the facilitation of national economic circulation to establish a new development pattern, which takes the domestic market as the mainstay and allows the domestic and foreign markets to boost each other. This has been called the “dual circulation” strategy. There has been a lot of discussion on how to interpret “dual circulation”. Based on President Xi’s remarks, we think there are two key elements:

- First, an emphasis on demand and supply being more domestically driven (“internal circulation”). From a demand perspective, this means growth more driven by consumption and investment. This is consistent with the “expanding domestic demand strategy”. From a supply perspective, this could imply production to rely more on domestic technology and supply chains. In our view, this does not mean “external circulation” is not important, but the way China participates in global trade/supply chain and the role it plays could change.

- Second, an emphasis on supply-side structural reform to facilitate economic circulation and to make supply better match demand. As Chinese policymakers have said, currently the major issues with China’s development are on supply side and are structural. On the top of supply-side reform initiated in 2015 focusing on “five major tasks”, in 2018 the government expanded the content and came up with a more comprehensive strategy—reinforcing previous structural adjustments, energizing micro market entities, promoting innovation and supply chain upgrading; and facilitating economic circulation.

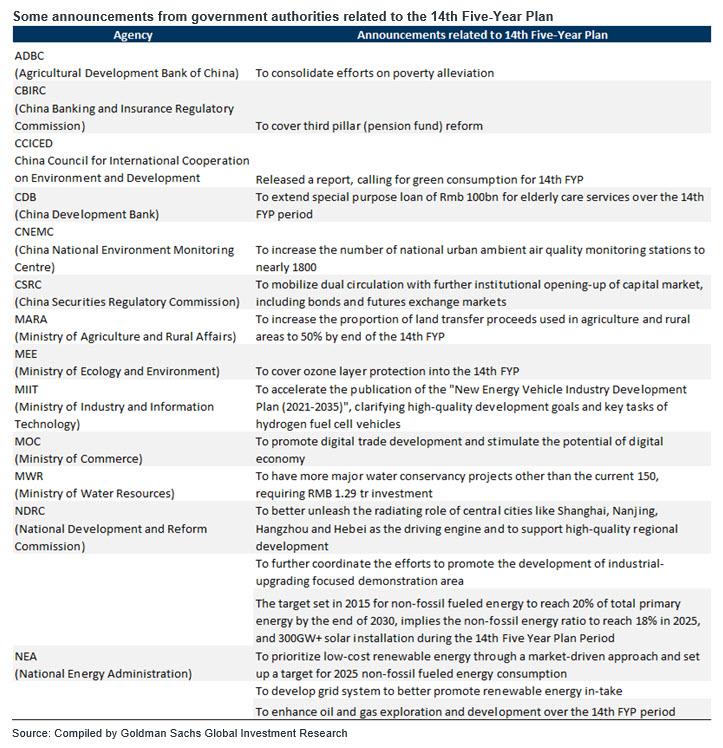

Overall, “dual circulation” is about the long-term development landscape Chinese policymakers would likely to achieve, primarily through supply-side structural reform. The key elements are actually not new and have been mentioned previously by policymakers. From an economic perspective, this means boosting total productivity factor and rebalancing economic development across sectors/regions. But given that the broad external and domestic environment has changed, as we mentioned, we think the government should accelerate the pace of relevant reforms. From a high level, we think the government may stress several key broad areas (the table at the end of this report lists some announcements from government authorities related to 14th Five-Year Plan).

Promoting innovation—key for TFP growth

As President Xi recently mentioned, strengthening innovation capacity and achieving breakthroughs in core technologies is key for the “dual circulation” strategy. The Chinese government has been fostering innovation and industrial upgrading (and development of the digital economy) in recent years, but there remains significant room to improve. R&D expenditure in GDP has been rising and reached around 2.2% in 2019, higher than the average level in upper middle income countries but still well below the OECD level (also likely to fall short of the 2.5% target set in 13th five-year plan). The Economic Complexity Index for China, measuring the capability of a country to produce varied and more complex goods has been trending higher persistently, but still has notable gap with the frontier economy Japan.[1] We have seen strong policy support through measures such as the establishment of government supported funds (e.g., national chip funds) and tax incentives, we believe the efforts would ramp up in coming years. In addition to provide financing support/policy incentive, in order to upgrade supply chain, optimizing industrial allocation across regions based on their comparative advantage would be also key, which is also part of coordinated regional development strategy the government has been pushing.

Factor market reform—key for TFP growth and economic rebalancing

The Chinese government has released two important documents this year aiming to accelerate improving the market economy/allocation, particularly in factor markets (e.g., labor, capital, land, technology, data). One source of slowdown in China’s TFP growth in recent years may reflect misallocation. And distortions in the markets have also contributed to economic imbalances. For instance, regarding the relatively low household consumption to GDP ratio in China, in theory, this could potentially be related to several factors—distribution of national income (between labor and capital), income inequality which is also affected by redistribution effects of tax/benefit systems, and consumption/saving propensity. Distortions in the labor market, such as Hukou system and related regional segregation of the social security system (China’s public spending on healthcare and pension benefits is also quite low as a share of GDP based on international comparisons) has negatively affected household consumption.[2] Spatial mismatch of supply/demand in the land market (undersupply in regions with more population inflow) may have also pushed up housing prices and negatively affected household consumption. As a major part of the “new urbanization” strategy, reform on labor market and land market could accelerate in coming years. Existing regulation on interest rates and SOE privilege in credit availability may have distorted capital allocation and contributed to a high investment ratio in China. Recently, the government released an SOE reform plan for the next three years, as a guide to optimize sectoral distribution of SOEs and improve their efficiency. Further pushes in market reform and reducing distortions will be important to mitigate economic imbalances and boost TFP growth, in our view.

Reduce inequality across regions/households

Less inequality across both households and regions is a focus for the government. China’s Gini index, which measures household income inequality, remains at a high level relative to many other countries and has even increased in recent years, and inequality in wealth is higher still.[3] Regional inequality has also trended up in recent years. On the one hand, these may reflect structural issues/distortions in the economy as we mentioned above, and on the other hand, these may worsen economic imbalances. To address this, the government has been trying to reform the personal income tax system, but in China the share of people paying personal income tax is small. Also, the share of GDP that makes up spending on the social assistance that targets the poor and vulnerable is comparatively low. The overall redistribution effect of China’s tax/benefit systems is pretty limited currently. On a regional basis, the Chinese government has implemented a coordinated regional development strategy, which is also related to factor market reform and could help narrow regional disparity.

Environment

Over the past decades, the Chinese economy has expanded at a very fast pace but at the expense of deterioration in environmental conditions. In recent years, the Chinese government has been increasingly strict on environmental regulations. For instance, ten of the 25 indicators in the 13th five-year plan concerned the environment and resources, with the targets for these indicators all required (in contrast, some other targets are just for guidance, e.g., urbanization ratio). As a key element in high quality growth, we think the government will continue to focus on environment protection in coming years. There might be economic costs incurred by environment regulations — in addition to a short-run shock on growth, environmental regulations might lead to lower long-run growth. [4] But innovation and further market-oriented reforms could help offset.

via ZeroHedge News https://ift.tt/2Ts6TfB Tyler Durden