Futures Tumble, European Stocks, Oil Plummet As Europe Imposes Partial Lockdowns

Tyler Durden

Wed, 10/28/2020 – 07:56

U.S. futures continued their slump, hitting a three-week low as shares in Europe and crude oil tumbled after tighter covid restrictions in Germany and France sparked fear of even broader lockdowns. European stocks dropped to a 5 month low with all 20 sectors were in the red, while safe havens such as the dollar and Treasuries rose. Oil and gold slipped, while Bitcoin surged to the highest since January 2018. The VIX Index climbed to the highest level since June, rising as high as 37 overnight.

With hopes for a new fiscal stimulus deal before the election dead and buried and all attention shifting to covid, Wynn Resorts and United Airlines Holdings, companies sensitive to restrictions, dropped more than 1% in premarket trading. Energy firms such as Occidental Petroleum Corp fell 2.8% on concerns over fuel demand. Microsoft’s quarterly results smashed analysts targets, benefiting from a pandemic-driven shift to working from home and online learning. However, its shares fell 2% after rising 35% so far this year after its sales forecasts in key units missed estimates, overshadowing a revenue beat on cloud demand. The other Big Tech companies – Apple, Alphabet, Amazon and Facebook – which are due to report results on Thursday, fell between 0.9% and 1.6%. GE jumped in early trading after posting a surprise profit and positive industrial free cash flow.

Spiraling pandemic, elevated unemployment levels and U.S. lawmakers failing to strike a deal on fresh fiscal stimulus before the Nov. 3 election sent the S&P 500 and tech-heavy Nasdaq to their lowest close in three weeks on Tuesday.

“We’ve been warning investors over the last few days in particular to maybe pare back a little bit of their strong risk position,” Laura Fitzsimmons, JPMorgan Australia’s executive director of macro sales, said on Bloomberg TV. “As you see the odds start to wane a little bit more for Biden, maybe that continues a bit more. We all remember four years ago when markets were very much surprised.”

Meanwhile, surging new cases and hospitalizations set records in the U.S. Midwest, while in Europe, concerns over a national lockdown in France hammered risk appetite. Overnight Germany proposed closing bars and restaurants for a month, while France reportedly favors a one-month lockdown from midnight tomorrow. Turkey barred doctors and nurses from taking leave, resigning or retiring.

Europe’s Stoxx 600 Index fell as much as 2.7%, before trimming its decline to 2%. Earlier in the session, Asian stocks fared better. The MSCI Asia Pacific Index was almost flat on Wednesday, and markets in South Korea and Shanghai posted modest gains. In China, indicators tracked by Bloomberg showed the recovery continued to display mixed signals while remaining broadly steady in October.

On the political front, Trump plans 11 rallies across 10 states in the final 48 hours of campaign travel, CBS reported. The president is also considering issuing an executive order requiring an economic analysis of fracking as he tries to woo Pennsylvania and Ohio.

China’s yuan depreciated as local banks abandoned inclusion of a key factor used to calculate the currency’s fixing. The offshore yuan weakened 0.1% to 6.7211 per dollar.

As reported yesterday, some banks stopped using the counter-cyclical factor in their formulas for the fixing recently, according to an official statement released Tuesday. The removal of the factor, which was first introduced in 2017 to rein in depreciation, suggests Beijing hopes to slow a rapid advance in the currency since May. “The change could increase renminbi volatility ahead,” Citigroup Inc. strategists led by Sun Lu wrote in a note, using the yuan’s official name. “We think the risk-reward for bullish offshore yuan exposure may start to look attractive again” when the currency edges close to 6.75-6.80.

In rates, Treasuries extended this week’s gains with yields as much as 1.5bp richer across 5- to 30-year sectors as S&P futures touch fresh three-week lows. Treasury 10-year yields around 0.753%, lagging bunds by ~1bp as risk-off backdrop supports European fixed income; gilts also slightly outperform. Bunds outperform with euro-area stocks plunging almost 3% amid rising coronavirus infections and toughening lockdowns. Auctions resume Wednesday with $55b 5-year note sale.

In FX, the dollar rose with the yen and Treasuries, amid broad based risk aversion. The Bloomberg Dollar Spot Index rose to its highest level in more than one week and the Treasury curve bull-flattened as a continued rise in coronavirus infections and an approaching U.S. election boosted demand for havens. The euro slipped to a session low of $1.1743, and was set for its steepest three-day decline versus the dollar in five weeks, as Europe’s governments prepared to tighten restrictions due to the rising virus count, which may aslo fuel more dovish rhetoric from the European Central Bank at Thursday’s review. The yen advanced to a five-week high, and was the only Group-of-10 currency to rise versus the dollar while Sweden’s krona and Norway’s krone led losses among peers. The Australian dollar gave up an Asia-session gain which followed a rebound in the nation’s quarterly consumer prices.

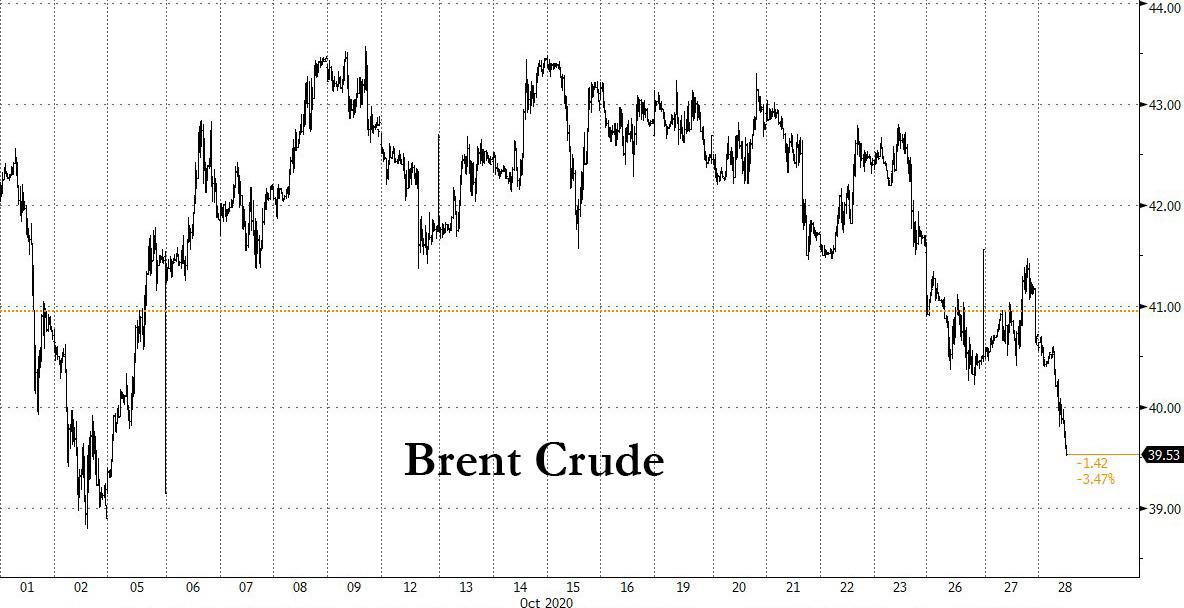

Elsewhere, oil retreated back below $38 a barrel in New york after an industry report pointed to a bigger-than-expected increase in U.S. crude stockpiles. Brent plunged 4%, dropping below $40 for the first time in a month on slowing global demand concerns.

Economic data include mortgage applications, wholesale inventories. Visa, Mastercard and Amgen are among the highlights of a busy earnings day. Earnings season continues, with Visa, Mastercard, United Parcel Service, Amgen, Boeing, GlaxoSmithKline, Ford Motor Company, General Electric and Nomura all reporting.

Market Snapshot

- S&P 500 futures down 1.5% to 3,333.75

- MXAP down 0.2% to 175.60

- MXAPJ down 0.2% to 583.26

- Nikkei down 0.3% to 23,418.51

- Topix down 0.3% to 1,612.55

- Hang Seng Index down 0.3% to 24,708.80

- Shanghai Composite up 0.5% to 3,269.24

- Sensex down 1.8% to 39,790.97

- Australia S&P/ASX 200 up 0.1% to 6,057.74

- Kospi up 0.6% to 2,345.26

- STOXX Europe 600 down 2.6% to 343.47

- German 10Y yield fell 2.1 bps to -0.636%

- Euro down 0.4% to $1.1753

- Brent Futures down 3.1% to $39.91/bbl

- Italian 10Y yield fell 3.8 bps to 0.498%

- Spanish 10Y yield rose 2.3 bps to 0.181%

- Brent Futures down 3.1% to $39.91/bbl

- Gold spot down 0.2% to $1,903.48

- U.S. Dollar Index up 0.4% to 93.32

Top Overnight News from Bloomberg

- German Chancellor Angela Merkel proposed closing bars and restaurants for a month and French President Emmanuel Macron prepared to announce tougher restrictions that may include a lockdown as hospitals fill up across Europe

- As the European Union seeks to disburse funds from its 750 billion-euro ($888 billion) recovery program as soon as next year, some of the countries hardest hit by the pandemic are struggling to work out how to best keep their finances in check once they take on billions of euros of new loans

- Data due Thursday are forecast to show U.S. gross domestic product surged an annualized 32% in the third quarter, almost double the previous high. That figure will reflect activity switching back on across the country after Covid-19 fears and government stay-at-home orders ground the economy to a halt in April

- China’s economic recovery displayed mixed signals while remaining broadly steady in October, with small businesses turning more cautious and the property market weakening even as car sales soar. The aggregate index combining eight early indicators tracked by Bloomberg was unchanged from the previous month

A quick look at global markets courtesy of NewsSquawk

Asian equity markets lacked firm direction following the mixed performance of stateside peers as earnings season and the upcoming election provided a cautious setting, while US stock index futures were further pressured after-hours on European shutdown concerns after reports stated that France and Germany were both mulling nationwide lockdowns. ASX 200 (+0.1%) was indecisive with initial declines due to underperformance in the energy sector amid weaker oil prices and with financials also subdued after ANZ Bank flagged a AUD 528mln hit to earnings, although the losses in the index were eventually pared by ongoing tech resilience. Nikkei 225 (-0.3%) and KOSPI (+0.6%) were varied as participants reflected on quarterly results and with the BoJ kickstarting its 2-day policy meeting where no major fireworks are expected. Hang Seng (-0.3%) and Shanghai Comp. (+0.5%) conformed to the choppy price action amid earnings and with Hong Kong resuming the underperformance against the mainland, despite the continued rally in tech heavyweight Tencent which extended on record highs and flirted with the HKD 600 level after it having recently averted a US WeChat ban. Finally, 10yr JGBs mildly extended above the psychological 152.00 level as prices benefitted from the cautious risk tone in Japan and following recent upside in T-notes, but with gains capped as the BoJ began its 2-day policy meeting where the central bank is widely expected to hold off from any policy tweaks.

Top Asian News

- The Pessimist’s Guide to Jack Ma’s Record-Breaking Ant IPO

- Bharti Airtel Jumps After 14 Million New Users Boost Sales

- Korea Consumer Confidence Jumps Most Since 2009 as Virus Eases

- Nomura’s Overhaul Pays Off With Help From Traders, Dealmakers

European equities (Eurostoxx 50 -2.5%) trade with heavy losses as the prospect of further lockdown restrictions in the Europe triggers investor concern over the region’s recovery prospects. In Germany, the DAX (-2.7%) is enduring significant downside amid reports that German Chancellor Merkel is pushing for tougher restrictions which would see the closure of restaurants and bars and limit people’s movements until the end of November. Losses for the index have also been exacerbated by Beiersdorf (-6.2%) and BASF (-4.0%) post-earnings with the former unable to reassure investors despite posting an encouraging performance in Q3. Delivery Hero (+4.4%) are the only gainer in the DAX after Q3 orders reached a new record, with the Co. also likely to benefit from any restrictions that limit seated restaurant bookings. CAC 40 (-2.7%) is also lagging its peers amid reports that the French government may impose a month-long national lockdown to combat the COVID pandemic which could take effect from midnight on Thursday. From a sectoral standpoint, losses are hitting some of the more cyclically exposed sectors hardest with laggards comprising of autos, banking and oil & gas names. Of note for the banking sector, Deutsche Bank (+1.9%) have seen shallower losses than peers after posting a Q3 profit of EUR 128mln (vs. a prior Y/Y loss of EUR 942mln) amid strong performance in its investment banking division with the Co. also upgrading its FY20 revenue outlook. Elsewhere for the industry, Danske Bank (-1.1%) raised its FY20 net profit outlook alongside Q3 earnings with the Co. citing more favourable market conditions. In what has been a particularly downbeat session thus far, bucking the trend are the likes of Next (+4.4%), Carlsberg (+1.6%) and Morphosys (+0.8%) post-earnings.

Top European News

- Aston Martin Soars After Securing Mercedes’s Help Out of Crisis

- Novachuk, Kim Agree to Buy KAZ Minerals for 640 Pence/Share

- European Stocks Dive Again With More Lockdowns Piling Up

- Johnson’s Unhappy Tories Fight Each Other Over U.K. Virus Plans

In FX, the Buck has reclaimed its safe-haven mantle and is firmer vs all G10 peers, bar the Yen amidst a severe downturn in risk sentiment on heightened concerns about the exponential 2nd coming of COVID-19 that is threatening to shutdown several European economies, while forcing others to reimpose stricter measures to combat the pandemic. The index has duly rebounded above 93.000 after an agonisingly close test of Monday’s low yesterday, and has registered a fresh w-t-d peak at 93.401 to expose half round number resistance at 93.500 that is arguably only being protected by the fact that Usd/Jpy has retreated further from recent highs and further towards 104.00.

- AUD – Aside from the generally deteriorating tone, fractionally firmer than forecast q/q inflation in Q3 has partly countered more dovish overtones from the RBA to keep the Aussie afloat on the 0.7100 handle, albeit some distance from 0.7150+ highs due to headwinds from weaker PBoC midpoint Cny fix without the counter-cyclical quotient (6.7195 vs 6.6989 previously).

- GBP/NZD/CAD/EUR/CHF – Sterling has finally succumbed to what seemed like the inevitable as clearly substantial support and bids around the 1.3000 mark in Cable has yielded to a breach of DMAs sitting on top of 1.2990 stops that have now been triggered to a circa 1.2964 trough. Similarly, the Kiwi has relinquished 0.6700+ status vs its US counterpart, while running into offers in Aud/Nzd ahead of 1.0600 and the Loonie has lost underlying support from crude prices as the clock ticks down to the BoC, as Usd/Cad rebounds from around 1.3178 to 1.3240. Elsewhere, the Euro is sub-1.1750 as the coronavirus cases mount, but could yet be drawn back to decent option expiry interest between 1.1750-60 (1 bn) and the Franc has fallen beneath 0.9100 following a near miss on Tuesday.

- SCANDI/EM – No shock that the Nok is also tracking the reversal in oil and unwinding outperformance vs the Eur from 10.8000+ at best this week so far to under 10.9000 again, but the Sek has gleaned some encouragement from relatively upbeat Swedish retail sales, in contrast to Norway’s much weaker than expected consumption, plus improvements in consumer and industrial sentiment, with Eur/Sek holding below 10.3500 and well away from very large expiries at 10.4000 (2.2 bn). Conversely, not even a rise in Turkish economic confidence to compliment an upturn in consumer morale or the CBRT flagging a V-shaped GDP rebound in Q3 have rescued the Try from more pronounced depreciation as President Erdogan sticks to a tough line on defending its border with Syria. Hence, the Lira continues to sink and is now eyeing 8.3000 vs 8.2920 at worst, so far.

In commodities, WTI and Brent front-month futures succumbed to the early pressure in sentiment around the European equity cash open (see equity section); fresh fundamental drivers were lacking but the move was seemingly driven by intensifying COVID-19 concerns with various areas considering/to implement lockdowns. Alongside having a broad sentiment effect such newsflow would have directly impacted crude prices given the demand-side implications that further lockdowns would likely entail. At present, WTI and Brent Dec’20 & Jan’21 respectively are posting losses in excess of 3% and are in proximity to session lows with Hurricane Zeta unable to offset the decline via its supply-side implications; particularly as a number of rigs have indicated they will continue operations through the storm. The most recent BSEE update showed just shy of 50% of oil production shut-in for the Gulf of Mexico, with the survey encapsulating a much more representative 38 companies compared to the 7 in the initial report for Hurricane/Strom Zeta. Data wise, the private inventories showed a build of 4.58mln last night and expectations for today’s EIA’s are for a slightly more modest build of 1.23mln. Moving to metals, spot gold is subdued this morning in-spite of the risk tone as the metal succumbs to pressure from the DXY which has continued to print highs throughout the morning; at present, spot gold is in proximity to the USD 1900/oz mark.

US Event Calendar

- 8:30am: Advance Goods Trade Balance, est. $84.5b deficit, prior $82.9b deficit

- 8:30am: Wholesale Inventories MoM, est. 0.4%, prior 0.4%

- 8:30am: Retail Inventories MoM, est. 0.5%, prior 0.8%

DB’s Jim Reid concludes the overnight wrap

The pandemic has interfered with my once in every five year trip to the theatre. We were going to see Hamilton this past weekend but of course it was cancelled some time ago. However after buying a subscription to Disney+ for the children we stumbled across their exclusive film recording of the show over the last two nights (too long for one sitting). I must admit for someone who doesn’t really like musicals I was seriously impressed.

Given the mounting covid restrictions our family may be getting good value out of our Disney+ subscription over the coming weeks. France and Germany look set to move towards some form of “lockdown lite” over the next 24-48 hours with more info likely today and tomorrow. For France it was reported that this could be based around a new one-month lockdown starting midnight on Thursday, though it will be more flexible than the initial one from last Spring. We’ll find out more tonight from President Macron’s address to the nation. Meanwhile, German Chancellor Merkel, according to reports out of Germany, is aiming for tough restrictions of her own that will be released to Germany’s 16 state premiers at a meeting tomorrow. While schools and daycares will remain open, restaurants will be shuttered and all major events would be cancelled as of tomorrow if reports on Bloomberg are correct. Germany’s Bild newspaper has confirmed this theme this morning adding that Merkel wants to close fitness studios, casinos, bars and cinemas with restaurants only offering take-outs.

So the virus news doesn’t get much better and I suppose the problem with the second wave is that although we are far better prepared than we were for the first wave the reality is that the first wave occurred late in the traditional flu/cold/virus season. The second wave still hasn’t even hit November or December yet and we’re still seeing cases soar in many places.

More on the virus later but in terms of markets, US equities moved between gains and losses most of yesterday before the S&P 500 settled down -0.30%. Technology stocks gained as chipmaker Advanced Micro Devices announced a $35bn stock deal for competitor Xilinx. The massive deal boosted sentiment across the industry and saw tech (+0.52%) help lead the S&P, though the overall index was not able to overcome losses in the Energy (-1.38%) and Industrials (-2.18%) sectors. With the tech outperformance the Nasdaq rose +0.64%, rebounding after Monday’s large losses. The VIX rose just under one point to 33.25, its highest level since September 3rd.

Asian markets are mixed this morning with the Shanghai Comp (+0.36%) and Kospi (+0.30%) up while the Nikkei (-0.45%) and Hang Seng (-0.18%) are down. Futures on the S&P 500 are also down -0.56%. In FX, the US dollar index is up +0.18%. Elsewhere, WTI crude oil prices are down -2.20% and Microsoft was down -1.74% in after hours trading as forecast for revenue in some divisions fell short of the highest analysts’ projections.

Earlier European equities gave ground for the second straight day as worries over rising case numbers and the ensuing restrictions continued to take hold. The STOXX 600 closed down -0.95% to its lowest level since 29 May. The overall negative sentiment bled through markets and pulled down European Banks (-3.27%), even as HSBC rose +5% initially (+3.37% at the close) after signaling it could resume dividends, while Spain’s Santander initially rose +3.8% (-1.46% at the close) after beating earnings expectations. Other bourses saw deeper loses with the IBEX (-2.14%), CAC 40 (-1.77%), FTSE 100 (-1.09%), and FTSE MIB (-1.53%) falling further.

The fading risk sentiment globally saw sovereign yields decline once more. US 10yr Treasury yields came in -3.3bps while 10yr gilt yields were down -4.3bps and bund yields down -3.5bps. There was a slight amount of widening in peripheral spreads to bunds, except for Italy where the possible passage of a €5bn fiscal stimulus bill may have helped the spread of 10yr BTPs to bunds to tighten (-0.4bps) slightly. Other havens were mixed, as the dollar ticked slightly lower (-0.11%) and gold rallied +0.31% to $1908/oz.

With regards to the election this time next week we will be waking up to the morning after the night before. It is not yet clear that we will have a winner at this time as many State Secretaries and voting commissions are hedging their bets that they will indeed be able to project the winner by next Wednesday morning. We are likely to have some states counted though, particularly from those who are able to process and count mail in ballots ahead of November 3. Former Vice President Biden remains +9.1pts and +7.4pts ahead in the fivethirtyeight and realclearpolitics polling averages respectively, while the former’s model gives him an 88% chance of winning – the highest yet – even if the poll lead has fallen from the recent peaks. Florida is likely one state to pay close attention to next Tuesday night as the state has experience with large numbers of mail ballots, polls close fairly early in the night, and without that state President Trump’s paths to victory dwindle precipitously. Realclearpolitics has the race effectively tied in the state now, with Mr Trump technically edging ahead for the first time by +0.4pp, though fivethirtyeight, which weights polls on quality, has Mr Biden up by +2.0pps.

Rising covid-19 cases continue to be in focus. Russia, which is seeing record highs in newly confirmed cases and deaths in recent days, is not expected to reintroduce new mobility restrictions. However, as of today, mask-wearing will be mandatory in some public places and the country may look to limit restaurant hours. Much of Eastern Europe which largely missed the first wave is currently seeing record numbers of weekly cases per 10k including the Czech Republic (81.3), Romania (15.2), Hungary (14.1) and Bulgaria (13.7). While testing has been a clear differentiator, the latter three still trail the sharp rise seen in parts of Western Europe that are seeing the virus for the second time including Belgium (89.2), France (41.1), Netherlands (39.4), Switzerland (47.2) and the UK (22.9). Meanwhile, France reported 530 fatalities yesterday, the largest one day jump since April 22.

In the US, Covid-19 hospitisations are up at least 10% in the last week in 32 states as the current case spike is translating into hospital visits. Illinois, which has been a hot spot in recent weeks announced that indoor dining will be suspended in Chicago starting Friday, as hospital admissions have doubled in the last month. Similarly positivity rates for tests have doubled since early October there. Denver, Colorado also expanded restrictions by limiting business capacity to 25% as of yesterday, with stay-at-home orders being considered.

We got some vaccine news as Novavax announced they would need to delay their late-stage study of its Covid-19 vaccine until late November. Competitor Pfizer indicated that its late-stage trial had not yet conducted an interim efficacy analysis as fewer than 32 cases of Covid-19 have occurred among the trial’s participants. Once that level is reached, in a trial that currently has over 42,000 patients, the first of four efficacy analysis can be conducted. This pushes back the vaccine timeline slightly as there were hopes we would have their efficacy data this week. There was some talk about it being delayed to avoid it being politicised this close to the election although this was only speculation. The company remains “cautiously optimistic” that the vaccine will work though based on the robust immune response from early trials. Overnight, Pfizer’s CEO has reiterated that the company may know by the end of October whether its vaccine is effective.

There was a slew of US data yesterday that showed that the recovery still had momentum, with most data points beating estimates. The preliminary September durable goods orders outperformed (1.9% vs 0.5% expected) while nondefence capital goods orders ex-air came in above expectation as well (1.0% vs 0.5). It was a good sign for manufacturers who have seen steady recent demand. August’s FHFA house price index was +1.5%, well above the +0.7% expected and July’s +1.0% reading. The Richmond Fed manufacturing index was up to 29 (vs 18 expected), the largest reading for the index since September 2018. Lastly, October’s Conference Board consumer confidence reading just missed at 100.9 (vs 102.0 expected) and down a touch from last month’s 101.3 reading.

Data today will include France’s October consumer confidence as well as the US’s weekly MBA mortgage applications and preliminary September wholesale inventories. From global central banks there will be monetary policy decisions from the Bank of Canada and the Central Bank of Brazil. Earnings season continues, with Visa, Mastercard, United Parcel Service, Amgen, Boeing, GlaxoSmithKline, Ford Motor Company, General Electric and Nomura all reporting.

via ZeroHedge News https://ift.tt/3jCwBso Tyler Durden