Turkish Bloodbath: Lira Plunges To Record Low After CBRT Hikes Inflation Target

Tyler Durden

Wed, 10/28/2020 – 07:22

Another day, another bloodbath for the Turkish lira.

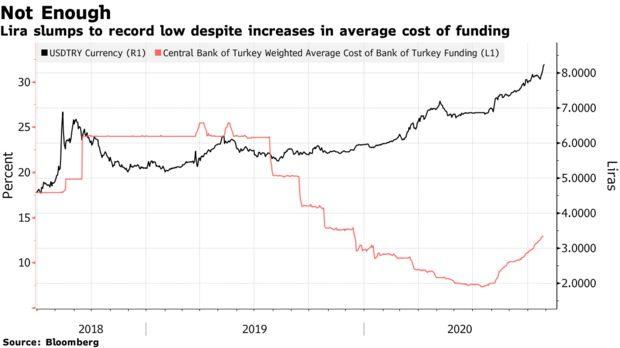

After tumbling to an all time low of 8.20 against the dollar late in Tuesday trading, the Turkish currency plunged to a new all time low this morning sliding 1.4% to 8.302 and extending earlier losses after the Turkish central bank raised its inflation outlook by more than 3% after a series of surprise interest-rate decisions failed to bolster a lira weakened by policy steps and international spats, and strongly hinting that the central bank appears resigned to a much weaker currency .

Consumer-price growth will finish the year at 12.1%, compared with a previous forecast of 8.9%, Governor Murat Uysal said Wednesday in Istanbul as he unveiled the final inflation report of 2020. He added that the central bank will maintain its tight monetary policy until inflation improves, warning that a weak lira poses risks to price stability.

Well, price stability only worsened because the currency extended its drop as the governor spoke…

… as it is now unclear what else the CBRT can do: having first eased monetary policy to boost the currency, then tightening, no matter what the central bank does the Turkish lira remains a one-way trade where any remaining longs get steamrolled on a daily basis.

“In the period ahead, we can take all the necessary steps, including on policy interest rates, to control inflation by monitoring price developments,” Uysal said. The lira is “extremely undervalued,” he said.

Uysal also crushed hopes for a possible central bank after saying that the central bank has no target for the the nominal or real exchange rate but is sensitive to volatility that could jeopardize stability.

Some more highlights of his speech:

- Inflation to decline to 9.4% by the end of 2021, also an upward revision from 6.2%

- End-2020 food inflation estimated at 13.5%, compared with 10.5% previously

- The central bank’s 2020 average oil price forecast remains unchanged at $41.6 per barrel

- Inflation to slow following the first quarter next year

As Bloomberg notes, the central bank’s latest projections suggest an even bleaker outlook for inflation this year than forecast by the government. Treasury and Finance Minister Berat Albayrak raised government forecasts in September to 10.5% at the end of 2020 and 8% the following year. The projections came a week after the central bank delivered a surprise 200-basis-point rate hike that was intended to stem the slide in the currency.

Investors considered it insufficient, however, and the lira continued to fall, buffeted by geopolitical risk as Turkey intervened in conflicts and renewed diplomatic tussles over energy finds in the Mediterranean.

Another unexpected decision followed on Oct. 22, when the central bank held the benchmark while raising the upper bound of its interest-rate corridor. That rattled markets as it signaled the central bank’s once more focused on stealth tightening to support the currency.

“Pressures on inflation and the lira are likely to push the Turkish central bank to being more conventional,” according to VTB Capital analyst Akin Tuzun, who expects an outright rate hike in November.

In devising policy, the governor must weigh market reaction with the demands of President Recep Tayyip Erdogan, who continues to cast a long shadow over monetary policy.

Erdogan handpicked Uysal to replace a governor who had failed to comply with his wishes to cut interest rates. The Turkish leader is a firm believer that high borrowing costs fuel inflation. Most economists and central banks around the world believe the opposite. And now, the Turkish currency which is in absolute collapse, is paying the price for Erdogan’s “monetary unorthodoxy.”

The currency’s slide of over 27% this year has distorted previous central bank inflation projections. Uysal predicted earlier this year that annual price growth would drop to single digits from the second half, only for it to end the third quarter at 11.8%.

The governor also said he expects the exchange rate to normalize in the medium term saying that state banks are active in the currency market from time to time, alas not today with the Turkish population increasingly rushing to converts its worthless lira into something tangible.

Finally, the central banker said reserves are sufficient to meet short-term needs, with Turkey in the final stage of securing new currency swap deals. Unfortunately, the market now appears focused on the medium and long-term needs, and it is there that it sees the all too real possibility the country runs out of FX reserves…

via ZeroHedge News https://ift.tt/3oztNA3 Tyler Durden