WTI Extends Plunge After Big Crude Build, Production Rebound

Tyler Durden

Wed, 10/28/2020 – 10:34

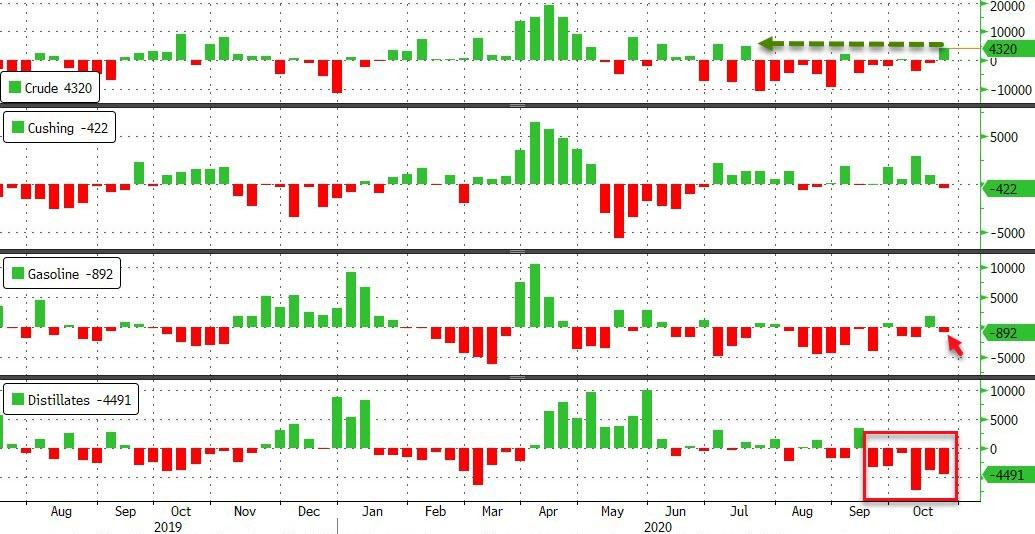

Oil prices were hammered overnight, accelerating after API reported an unexpectedly large crude build

API

-

Crude +4.557mm (+1.2mm) – biggest build since May

-

Cushing +136k

-

Gasoline +2.252mm

-

Distillates -5.333mm

DOE

-

Crude +4.32mm (+1.2mm) – biggest build since May

-

Cushing -422k

-

Gasoline -892k (-400k exp)

-

Distillates -4.491mm (-2mm exp)

Official DoE data confirmed API’s reported larger than expected crude build but Gasoline saw a draw…

Source: Bloomberg

A busy storm season has left production-monitoring a thankless task and Zeta may make next week’s data even worse…

Source: Bloomberg

Another hurricane in the Gulf of Mexico helped produce a rise in prices yesterday, but the reaction appeared to be muted as forecasts began to show the storm would miss major production facilities.

“A resurgence in COVID-19 cases in Europe and North America has stopped the recovery in demand in its tracks,” ANZ Research said in a note.

“If market conditions worsen, (OPEC+) will have no choice but to delay the increase of quotas by a month or two at its meeting on December 1,” ANZ said.

WTI was trading just above $37 ahead of the official EIA data and extended losses on the weak data…

Finally, Bloomberg Intelligence Senior Energy Analyst Vince Piazza notes that “weak demand is still weighing on fundamentals across the energy complex, with no fiscal stimulus to support a shaky economic backdrop as Covid-19 infections rise faster than expected.”

via ZeroHedge News https://ift.tt/3mvwnoZ Tyler Durden