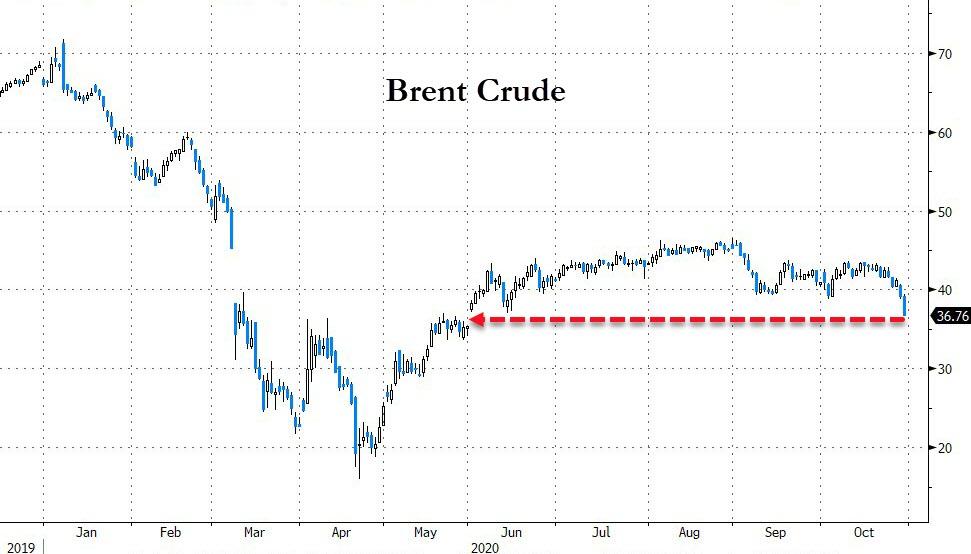

Crude Prices Are Collapsing To 5-Month Lows After Lagarde Comments

Tyler Durden

Thu, 10/29/2020 – 09:48

The last three days have seen a total bloodbath in black gold as WTI plunges to a $34 handle and Brent drops below $37.

“It’s all about the coronavirus still, and the reaction to the rise in cases, especially in Europe,” said John Kilduff, a partner at Again Capital LLC. “These lockdowns are serious and a blow to what’s been seen as good progress in terms of demand coming back.”

Some have blamed this last leg on the ECB:

Lagarde warned that there’s a clear deterioration in the outlook and the recovery in the euro area is “losing momentum more rapidly than expected.”

And that just added to demand woes as oil is also contending with supply issues.

American crude inventories rose the most since July last week, while Libyan output is also gaining rapidly. As a result, the size of expected inventory declines in the fourth quarter is falling rapidly, according to JPMorgan Chase & Co.

“The recovery of oil demand in Europe has stalled in recent weeks,” said Giovanni Staunovo, commodity analyst at UBS Group AG.

“We previously forecast the oil market to be in deficit in 4Q. It now will likely be balanced and might even flip into oversupplied in November and December.”

Four big legs lower have dragged the price of WTI from $42 to $34…

And Brent plunged to a $36 handle – its lowest since May…

Currently, the only bright spot in demand is China, which is expected to sustain solid demand in the fourth quarter and into the start of 2021, Aramco Trading’s Al-Buainain told Gulf Intelligence… but how long will that last if we get a second wave in Asia?

via ZeroHedge News https://ift.tt/3mAZEyK Tyler Durden