Futures Tumble, Erase Day’s Gains After Tech Earnings Turmoil

Tyler Durden

Thu, 10/29/2020 – 18:23

After a surprisingly exuberant day in the stock market, filled with hope at all the optimistic awesomeness that the mega-tech hegemons would “told you so” to any naysayers who weren’t already balls-deep long these over-valued and over-hyped names, things have gone just a little bit turbo after hours.

It wasn’t pretty with only GOOGL shares higher…

Twitter sinks in late trading after user growth expectations were off. The company added 20 million new users in Q2. It added just 1 million new users in Q3. Expectations were that Twitter would report growth of 9 million new users in the quarter so this is a definite miss. The company also said there will be a delay in its MAP direct response ad product.

Facebook’s shares are modestly lower. Revenue blew past estimates as the company weathered the ad boycott from big advertisers. Also, user growth over overall exceeded expectations, but the company lost traction in the U.S. and Canada. Also, Facebook said it will be investing heavily on employees and new technology.

Amazon shares are down despite reporting profit and net sales that beat quarterly estimates. The retailer sees up to $121 billion in fourth-quarter sales. Bezos expects an “unprecedented” holiday season. CFO says Covid-related expenses will go up to $4 billion.

Apple sales plunge 29% in China, grow in other regions. IPhone revenue falls short of analysts’ estimates. Lack of revenue forecast dissapoints some observers. Shares fall, dragging suppliers down in late trading.

Alphabet returned to growth in the third quarter after a decline in the previous period, fueled by digital advertising that has rebounded along with the American economy. The shares rose about 6% in extended trading.

All of which sent futures tumbling…

Erasing all the day’s gains in the S&P and Dow…

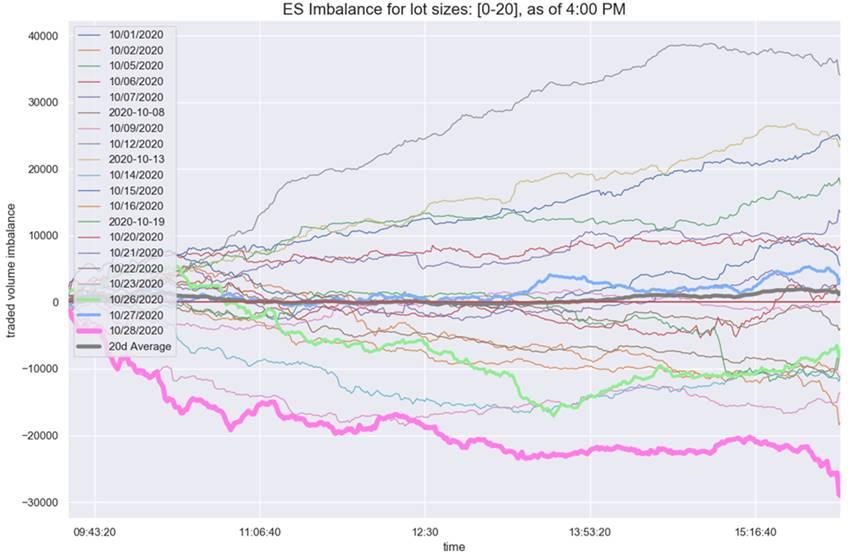

Of course, it’s early yet and we would strongly expect some dip-buyers to charge in. Just bear in mind that “large lot” sellers have been active all week…

Trade accordingly.

via ZeroHedge News https://ift.tt/3kBfvMZ Tyler Durden