Rabobank: Opinion Polls Are Saying Whatever *You* Want Them To Say, To A Tragicomic Degree

Tyler Durden

Thu, 10/29/2020 – 08:26

By Michael Every of Rabobank

Always blindingly obvious

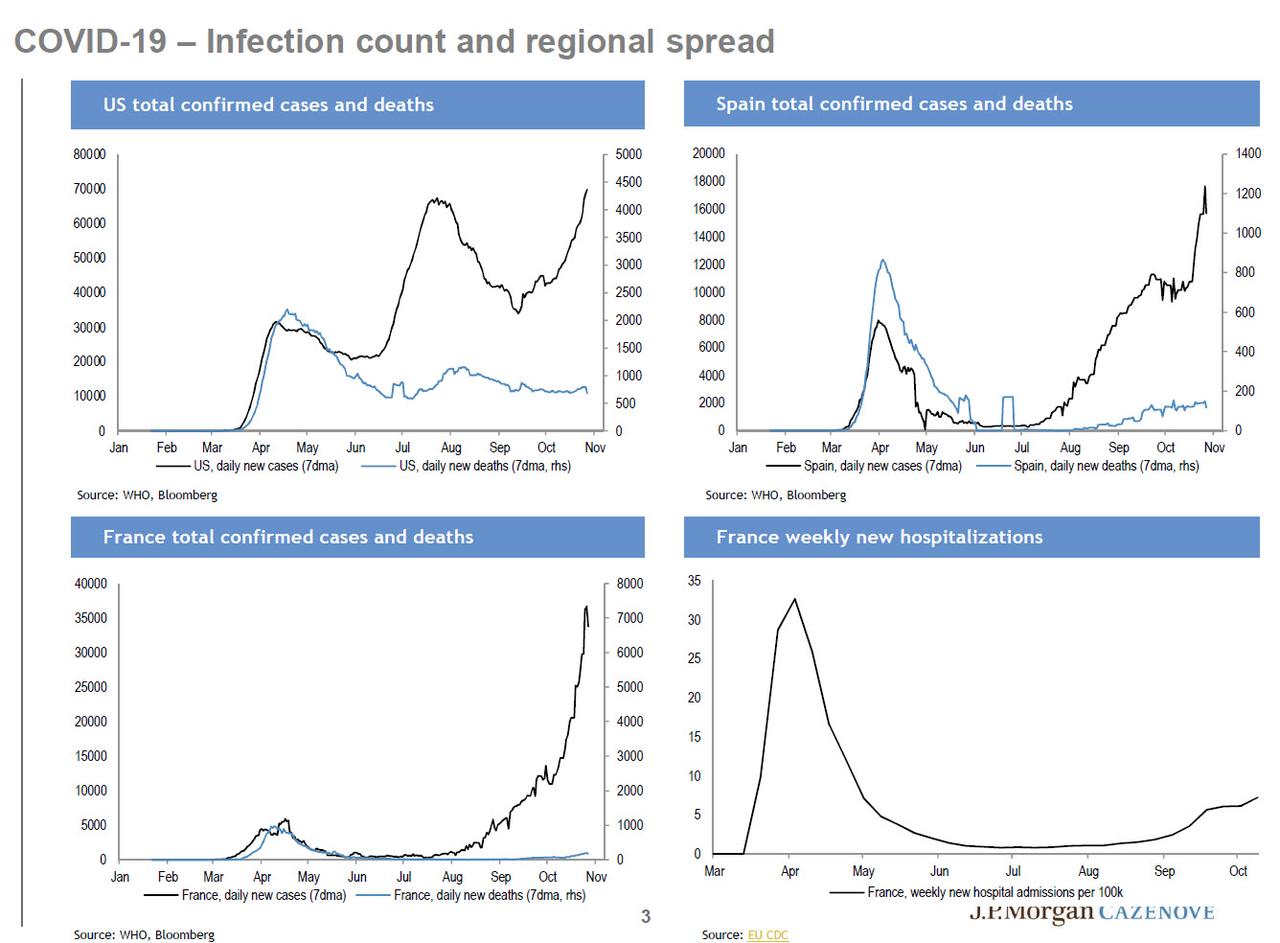

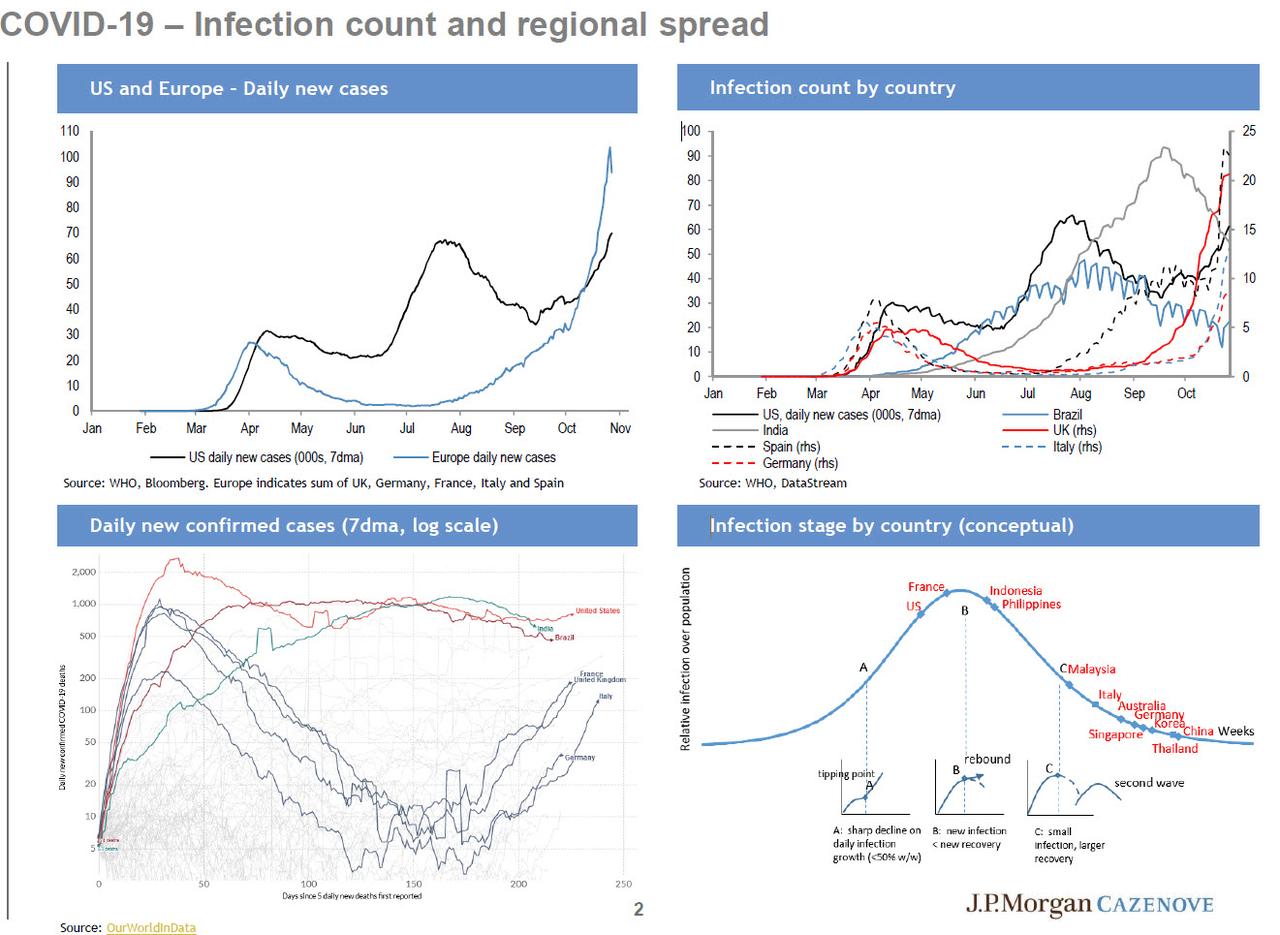

France is partially locked down from tomorrow until 1 December; super-efficient Germany has a limited lockdown for a month too; Italy may follow imminently; and Ireland has had one for a while. In the UK pubs are either open but can’t serve alcohol, or are open if they put a lettuce leaf next to a Cornish pasty on a plate, because that obviously controls the virus completely, or are closed; and the threat is being bandied about that the British police could even come into homes and arrest families over Christmas if more than six people are gathered together for a slice of Xmas pudding. Is it any wonder that the UK’s three virus ‘tiers’ were recently dubbed by its tabloid press as “stuffed”, “nearly stuffed”, and “soon to be stuffed”. Meanwhile, US cases are spiking up again, in the Mid-West this time.

Of course, Covid-19 has been rampaging across swathes of the developing world for months, such as India with its 8m cases. Yet that didn’t seem to matter at all to ebullient markets at all until this week, and yesterday in particular. Suddenly it all does matter, however. I mean, just imagine a European not being able to go to a restaurant on a Wednesday night and having to cook at home! Imagine a skiing holiday being cancelled! Thus risk is now off and sentiment has turned and equities have tumbled.

Should we be surprised? After all, whoever said markets were either rational in the short term or moral? They love to ignore the blindingly obvious until it is literally right in their own faces.

This is in no way to underplay the serious economic hardship and real physical and psychological damage that is being wrought in developed economies by Covid-19, which in many ways is only just getting started: how many small businesses and jobs are going to be able to survive another lockdown? How many are going to be able to cope with a potential future of rolling biannual lockdowns? As this report shows, one in seven adults with kids in the US is already going short of food; and nearly one in four renters with kids is behind on rent payments.

However, the suffering in many emerging markets has been very high for a long time too, and is still rising. Scientists made clear a second wave would arrive with autumn. Markets just weren’t that interested. All that supposed economic muscle in EM still pales in comparison to DM when push comes to actual shove, it seems. As does’ following the science’.

So let’s now follow on to scientifically focusing on the travails of some of the richest countries with the best public health systems in the world: yes, it’s ECB day.

As our ECB team note, the Governing Council meets amidst a resurgence of Covid-19 across Europe. Many Council members have expressed their support for new or prolonged easing as the outlook for the economy and inflation remains weak, but there has still been some pushback on the timing. (Could they not wait until inflation is firmly negative y/y, cynics might ask?)

Last week, the team’s view was that considering calm markets and the stimulus still being provided by previous measures, they did not think that the downside risks warranted immediate ECB intervention, but they openly acknowledged there was a substantial risk of an announcement today. Will Europe back in partial lockdown and markets falling this week have changed a few minds? Or will the majority of the ECB still favour the December meeting as more propitious to take the next step on the ongoing journey of not meeting its inflation target?

In terms of policy expectations, they expect interest rates on hold for the foreseeable future. There are only risks of a cut, which would be effective in weakening EUR. However, they think EUR/USD would still need to be closer to 1.20 before the ECB sees it as restrictively strong and acts in that regard. They still foresee a higher tiering multiplier, but expect the ECB to wait until more of the PEPP has been implemented (or a rate cut does materialise). A rate cut, if seen, may also require a tweak in the TLTRO modalities to limit the potential downside. On the once-unthinkable and now life-is-unthinkable-without-them Asset Purchase Programmes, they expect no changes or PEPP just yet, but still call for an extension of PEPP to end-2021 in December, paired with a EUR ~250bn increase in the envelope.

In short, Europe is seemingly heading for a very difficult winter on multiple fronts: and the ECB is not going to be providing much light or heat, just the usual acronyms. The EU’s fiscal-Rubicon-crossing virus spending measures might even need review, one might imagine, before the ink is dry on the document and a single Euro flows out.

Similar sentiments of course apply to Japan, where retail sales dipped 0.1% m/m in September vs. a projected 1.0% rise and are still -8.7% y/y, but where the BOJ did nothing new at its monthly meeting. Apart from raising its forecast for growth next year to 3.6% to 3.3% y/y.

Meanwhile in US news, the opinion polls are still saying whatever *you* want them to, to a quite tragicomic degree – but somebody is going to be tragically wrong, however, and soon; new Supreme Court rulings mean we could indeed have a post-election delay for late-arriving ballots in a few key states after all – or that mail in votes in Pennsylvania could be discarded after Election Day; Tech CEOs testified to Congress again over the contentious Section 230 issue, which included Mark Zuckerberg having to delay because he couldn’t get a decent Wi-Fi Signal(!), and the Twitter CEO’s view being that if they don’t like his communication channel, all 300m users can always use alternatives to get their political messages out; that as Fox News’ Tucker Carlson claimed on TV that important Biden-related documents sent to him by a courier service simply disappeared – a story which, like so many others recently, it is equally worrying if it is or isn’t true.

And regardless of the election, some things don’t seem to change in the US. The Senate has seen a bill introduced “that would prohibit malign Chinese companies — including the parent, subsidiary, affiliate, or a controlling entity — that are listed on the US Department of Commerce Entity List or the US Department of Defence list of Communist Chinese military companies from accessing US capital markets.” It would prohibit such firms listing and trading on a US securities exchange; the use of federal funds to deal with such entities; all investments by insurance companies in them; all IRAs from investing in them; and remove the tax-exempt status for qualified trusts that invest in them. Notably, there is still no reference to stopping US capital flowing into Chinese bonds or Chinese government bonds, but given that a share of public spending in every country goes into the military that this bill rails against, one wonders how long until that loophole is also closed.

Something else for markets not to worry about, no doubt, until the blindingly obvious –like the fact that this Covid second wave would happen in DM too– suddenly looms ahead ad ski-trips have to be postponed.

via ZeroHedge News https://ift.tt/2HAwz7J Tyler Durden