Stocks Struggle To Stabilize After Worst Rout Since June

Tyler Durden

Thu, 10/29/2020 – 07:43

US equity futures, European stocks and commodity markets rebounded after Wednesday’s rout which send the S&P lower by 3.5%, the biggest one day drop since June 11, but they struggled to stabilize after a return to national lockdowns in Europe’s biggest economies.

“What I think has changed in the last few days is the significant spikes in the virus in Europe and the U.S, especially the U.S.” said Kempen Capital Management’s Chief Investment Officer Nikesh Patel. As a result, “the W-shaped scenario for the economy has now become consensus in the market” rather than one where economies broadly stabilize.

Global stock markets lost nearly $2 trillion yesterday, with volumes on the New York Stock Exchange up almost 40% to their highest level since September. In addition to 2nd and 3rd covid wave fears, investors are also increasingly wary of a contested U.S. election result that could unleash a wave of risk-asset selling. The VIX surged on Wednesday to its highest level since June and implied currency volatility indicates that a wild ride is expected. Marvell declines after it’s said to near a deal to acquire Inphi for about $10 billion.

“Market sentiment is turning, with investors buffeted by U.S. election uncertainty and now economic worries from rising Covid-19 cases across Europe,” said Kerry Craig, global market strategist at JPMorgan Asset Management. “These short-term forces are well beyond the control of individual investors, underscoring the need to maintain balance through the immediate uncertainty.”

Ahead of today’s ECB meeting, European stocks got an earlier boost after earnings for telecoms firm BT Group, oil producer Royal Dutch Shell Plc and drinks giant Anheuser-Busch InBev all beat expectations, pushing their shares higher while Credit Suisse slipped after profit missed analyst estimates. Hopes that the ECB will signal it has more support to offer helped stemmed the rout that had wiped nearly 5% off European stocks on Wednesday, but the Stoxx 600 remained jittery and faded all early gains, trading unchanged at last check. Frankfurt’s DAX was up 0.5% in early trading, it was firmly on course for an 8% weekly drop which will be the steepest since the initial COVID panic of March.

Earlier in the session, Asian stocks were moderately lower, with the MSCI Asia Pacific Index down 0.3%. MSCI’s index of Asia-Pacific shares ex-Japan fell 0.6%, led by Australia, down 1.6%, and South Korea, down 1%. Japan’s Nikkei fell just 0.3%, while Chinese blue chips rose 0.5% and the yuan led a gentle bounce in Asian currencies against the greenback. Overnight, the Bank of Japan had made no changes to monetary policy settings as expected overnight, though it trimmed its growth forecasts to reflect sluggish services spending during summer.

“Asia is not really partaking in this second or third wave story because it’s got its COVID largely under control,” said Rob Carnell, chief economist in Asia at Dutch bank ING. “As a result, domestic economies look reasonable.”

As if to illustrate, Taiwan, which boasts Asia’s best-performing currency, marked its 200th straight day without local transmission on Thursday, while France and Germany prepared for lockdowns and as the virus sweeps across the U.S. Midwest.

In FX, the U.S. dollar edged up slightly and riskier currencies remained subdued. The Bloomberg Dollar Spot Index rebounded after droppping in the Asia session; the greenback traded mixed against its Group-of-10 peers as sentiment remained fragile, while the euro slipped for a fourth day. The pound strengthened versus the euro as European Union and U.K. negotiators made progress toward resolving some of the biggest disagreements, raising hopes that a Brexit deal could be reached by early November.

Elsewhere, the Aussie held up, despite paring an earlier gain, as local companies continued to buy the currency against the greenback to top up month-end hedging needs. The Norwegian krone swung from a gain to a loss as oil prices resumed their slump. The yen followed the dollar higher in early European trading. The Bank of Japan stood pat though Governor Haruhiko Kuroda said he stands ready to act if needed amid heightened uncertainty over a resurgence in the pandemic, though he still doesn’t see a pressing need to extend or change existing virus-response measures.

The euro hit a 10-day low on the dollar and a hundred-day low on the yen on Wednesday, before recovering slightly. It last traded at 1.1710 against the euro. Investors expect the ECB to similarly hold off on new measures, but to instead hint at action in December, which is likely to keep a lid on the euro.

“Given what is happening in France and Germany I think the ECB will talk about more stimulus even if they don’t deliver it today,” added Kempen’s Patel, referring to new COVID-19 restrictions announced this week.

In rates, benchmark U.S. 10-year yields had ticked up overnight to 0.7760, fading earlier losses as month-end extension flows may begin to support Treasuries. Treasury yields cheaper by up to 1bp across long-end of the curve, steepening 2s10s, 5s30s by 1.4bp and 0.3bp with front-end trading slightly rich. Treasury auctions conclude with $53b 7-year sale Thursday, after solid results from 2- and 5-year auctions so far this week. German government bonds were still in strong demand, with yields near seven-month lows.

In commodities, the rout continued, as WTI crude extended its decline to the lowest since the middle of June. Futures in New York slid as much as 3.4% to $36.11, the lowest intraday level since June 15. Brent also declined, falling as much as 3.3% to $37.82, also lowest since June. Gold was hammered as the dollar surged continued.

Economic data, including what is expected to be a blockbuster GDP report, and the ECB meeting are the main focus, with gathering uncertainty about Tuesday’s U.S. election also keeping investors on edge. Investors face a busy earnings day, with more than 70 S&P 500 members reporting, including Tech giants Apple, Amazon.com, Facebook and which are all scheduled to post results after the close.

Market Snapshot

- S&P 500 futures up 0.9% to 3,291.50

- STOXX Europe 600 up 0.3% to 343.01

- MXAP down 0.3% to 174.52

- MXAPJ down 0.5% to 577.78

- Nikkei down 0.4% to 23,331.94

- Topix down 0.1% to 1,610.93

- Hang Seng Index down 0.5% to 24,586.60

- Shanghai Composite up 0.1% to 3,272.73

- Sensex down 0.7% to 39,656.97

- Australia S&P/ASX 200 down 1.6% to 5,960.34

- Kospi down 0.8% to 2,326.67

- Brent Futures down 0.7% to $38.85/bbl

- Gold spot up 0.1% to $1,879.06

- U.S. Dollar Index up 0.1% to 93.50

- German 10Y yield rose 0.4 bps to -0.621%

- Euro down 0.1% to $1.1731

- Brent Futures down 0.7% to $38.85/bbl

- Italian 10Y yield rose 6.4 bps to 0.562%

- Spanish 10Y yield rose 2.3 bps to 0.201%

Top Overnight News from Bloomberg

- European Central Bank officials must decide on Thursday whether the renewed wave of coronavirus infections and lockdowns on the continent require an immediate dose of extra monetary support

- Germany and France will clamp down on movement for at least a month — coming close to last spring’s stringent lockdowns — with Germany’s daily caseload surpassing 20,000 for the first time amid a resurgence of Covid-19 across Europe

- Chancellor Angela Merkel defended her decision to once again severely limit movement in Germany, saying the country is in a “dramatic situation” as the rapid spread of the coronavirus stretches health-care services to their limit

- Coronavirus measures in England are failing to control the spread of the disease, scientists warned, adding pressure on U.K. Prime Minister Boris Johnson to introduce another national lockdown

- Italy sold benchmark bonds at the lowest average rate on record as support from the euro zone’s institutions and newfound political stability fueled demand for the securities

- Central banks became gold sellers for the first time since 2010 as some producing nations exploited near-record prices to soften the blow from the coronavirus pandemic

- For fragile oil markets, the outcome of next week’s U.S. election poses yet another risk: the prospect that major producer Iran may regain its role in international trade

A quick look across global markets courtesy of NewsSquawk

Asian equity markets traded mostly lower amid jitters following the bloodbath on Wall St where all major indices declined more than 3% and the DJIA fell over 900 points as risk appetite was decimated by concerns regarding lockdowns in France and Germany, whilst heavy losses were also observed in the tech sector. In addition, pre-election caution and comments from NIH’s Fauci that a vaccine won’t be available until January at the earliest added to the downbeat tone, although US stock index futures nursed some losses overnight after encouraging updates from both Regeneron and Eli Lilly regarding their COVID-19 treatment trials and with the US said to provide Huawei a lifeline by allowing more companies to supply the Chinese tech giant with components as long as it is unrelated to 5G. Nonetheless, Asian bourses weakened with tech and commodity-related sectors the underperformers in the ASX 200 (-1.6%) and financials were also pressured after ANZ Bank reported a 42% decline in full-year profit and Westpac reached an agreement to settle a BBSW class action in US. Nikkei 225 (-0.4%) was subdued following weak retail sales data and as participants awaited the BoJ policy announcement, which proved to be a damp squib as the central bank maintained policy settings as expected and continued to signal a lack of urgency for immediate support, although some of the losses have been pared amid mild currency outflows and as earnings supported the likes of Sony and Hitachi, while the KOSPI (-0.8%) suffered after Samsung Electronics failed to benefit from its final Q3 results which despite printing an increase from the prior year, it also flagged a decline in chip and mobile profitability for Q4. Hang Seng (-0.5%) and Shanghai Comp. (+0.1%) were cautious ahead of several blue-chip earnings including the first of the big 4 banks and with participants looking out for details of the 5-year plan when the 4-day plenum concludes today. Finally, 10yr JGBs failed to benefit from the broad risk-aversion and instead tracked the recent declines in T-notes with demand constrained amid the BoJ policy announcement in which the central bank provided a somewhat balanced tone that suggested it was likely to remain on the fence on future measures.

Top Asian News

- BOJ Stands Pat But Paints Gloomier Picture of Economy This FY

- India to Prioritize Covid Vaccine for Front Line Health Workers

- China’s Busiest Earnings Day to Shed Light on Economy

- Takeda to Supply Japan With 50m Doses of Moderna Vaccine

European equities (Eurostoxx 50 flat) have been relatively choppy thus far with regional indices unable to stage any meaningful recovery from yesterday’s heavy losses. Ahead of the cash open, futures at one stage suggested that European equities would look to claw back some of the declines seen yesterday, however, this has failed to materialise thus far as market participants fret over the economic impact of recent nationwide lockdown measures taken by France and Germany. It has been an exceptionally busy morning of earnings in Europe with divergences between different industries mostly a by-product of large-cap corporate updates. Tech has been one of the top performers thus far in the wake of yesterday’s tech-heavy losses on Wall St, with sentiment for the sector also aided by earnings from ASM International (+4.1%) who subsequently raised Q4 guidance amid strong demand. Capping gains for the tech sector is Nokia (-16.6%) after Q3 results fell short of analyst estimates and the Co. cut its FY profit outlook amid declining market shares in certain regions. Despite losses in the crude complex, oil & gas names have seen support throughout the session amid Q3 earnings from Shell (+2.1%) which saw the Co. exceed estimates for adjusted earnings and lift its dividend. Banking names are lower on the session amid losses in Credit Suisse (-6.0%) after Q3 profits missed analyst expectations, overshadowing the Co.’s decision to increase its dividend by 5% for 2020 and schedule CHF 1.5bln of share buybacks for next year. Lloyds (+3.7%) have provided some reprieve for the sector after the Co. beat on Q3 profits and noted a surge in the demand for mortgages. Volkswagen (+3.1%) are higher on the session after Q3 profits were bolstered by increasing auto demand from China, offsetting losses elsewhere. Of note for telecom names, (asides from Nokia who are also in the Stoxx 600 tech index), BT (+5.4%) and Orange (+4.6%) are firmer post-earnings, whilst Telefonica (-4.5%) are a laggard in the sector after Q3 results underwhelmed. Finally, AB Inbev (+2.9%) have acted as a source of support for the food & beverage sector after Q3 revenues beat estimates and the Co. stated that H2 performance will be better than H1.

Top European News

- Janus Henderson Sees Investor Withdrawals Slow in Third Quarter

- Germany, France Impose Month-Long Curbs to Rein in Virus

- BT Lifts Profit on Pandemic, Sheds Jobs to Cut Costs

- German Pig Backlog May Cram 1.2 Million Extra Hogs on Farms

In FX, far from all change in terms of the general market tone that remains suppressed and highly contingent on daily coronavirus developments, but a comparative air of calm has returned following Wednesday’s FTQ. As such, the so called cyclical, activity or high beta currencies are on a more even keel, albeit still precarious and prone to any headline bearing bad news on the COVID-19 front that could have adverse economic implications on top of the obvious social and human cost. Aud/Usd is modestly firmer and straddling 0.7050, Nzd/Usd is pivoting 0.6650 with some independent traction via improvements in NBNZ business confidence and especially the outlook for activity, while Usd/Cad has pared back from post-BoC highs to rotate around 1.3300 even though crude prices remain depressed. Next up for the Loonie, Canadian average weekly earnings and building permits, while the Aussie might be mindful of a decent 1 bn expiry option in the Aud/Jpy cross at 73.20.

- JPY/GBP/CHF/EUR – All narrowly mixed against the Dollar, as the Yen continues to fend off pressure below 104.50 that coincides with a key Fib level and has capped the pair for the last 2 trading sessions. However, 104.00 remains elusive and Usd/Jpy may remain supported into the round number given expiry interest at the strike in 1.8 bn. For the record, nothing new from the BoJ overnight, but top tier Japanese data looms in the form of CPI, jobs and IP. Elsewhere, Sterling continues to encircle 1.3000 on hopes of a key Brexit breakthrough and the Pound is outperforming vs the Euro just shy of 0.9000 compared to 0.9050 at the other extreme even though latest reports on UK-EU trade talks appear less positive than yesterday. Perhaps the proximity of 1.1 bn expiries between 0.9050-60 are impacting, or the fact that Eur/Usd is treading cautiously into the ECB within a 1.1758-26 range and flanked by expiry interest (1.3 bn from 1.1750-55 and 1.5 bn from 1.1725-15). Meanwhile, the Franc is largely tracking Buck moves on the 0.9100 axis as the DXY meanders from 93.560 to 93.237 in the run up to advance US Q3 GDP, weekly IJC tallies, pending home sales and more heavyweight corp earnings.

- SCANDI/EM – The aforementioned recoil in oil has hit the Nok back below 11.0000 vs the Eur and beyond recent lows, while in contrast the Cnh and Cny are both paring losses after another weaker PBoC midpoint fix and reports of Chinese bank selling of the onshore Yuan against the Greenback in spot and forward terms. However, the Try is struggling again just off sub-8.3200 record lows vs the Dollar and Brl looks set for catch-up declines after the BCB held rates last night, as expected, but acknowledged strong upside inflation pressure in the short term that requires close attention.

In commodities, WTI and Brent front month futures have come under pronounced pressure this morning as the complex was unable to partake in the European-earnings fuelled bounce in the equity futures around the cash equity open on the back of a number of well-received European earnings. As such, throughout the European morning the crude benchmarks have continued to deteriorate moving below the psychological USD 37/bbl & 36/bbl and USD 39/bbl for WTI and Brent respectively; and most recently in proximity to the USD 36/bbl & USD 38/bbl marks. Updates throughout the session explicitly for the crude complex have been sparse after the BSEE report showed further oil outage within the Gulf of Mexico but Storm Zeta is now forecast to continue weakening throughout the day and as such, assuming no damage occurred, platforms should begin returning to service in the near-term. Elsewhere, on the OPEC+ front Energy Intel reports indicate the cartel are considering extending oil output cuts at their current levels through to the end of March; reports which will likely garnering more focus as we approach the next JMMC and full OPEC+ gathering next month. Moving to metals, spot gold is essentially flat on the day perhaps as it struggles to garner clear direction from sentiment this morning which is choppy and diverging somewhat amongst asset classes thus far. Price-wise, the precious metal is little differed on the session around the USD 1875/oz mark.

Top Overnight News from Bloomberg

- 8:30am: Initial Jobless Claims, est. 770,000, prior 787,000; Continuing Claims, est. 7.78m, prior 8.37m

- 8:30am: GDP Annualized QoQ, est. 32.0%, prior -31.4%

- 8:30am: Personal Consumption, est. 38.9%, prior -33.2%

- 8:30am: GDP Price Index, est. 2.9%, prior -1.8%

- 8:30am: Core PCE QoQ, est. 4.0%, prior -0.8%

- 9:45am: Bloomberg Consumer Comfort, prior 46.6

- 10am: Pending Home Sales MoM, est. 3.0%, prior 8.8%; Pending Home Sales NSA YoY, est. 23.0%, prior 20.5%

DB’s Jim Reid concludes the overnight wrap

Its been a pretty sobering week so far for life as we knew it and for markets even if futures are a little more buoyant this morning. Risk assets buckled yesterday under the weight off fresh restrictions, especially those in the two largest European economies.

As we previewed 24 hours ago German Chancellor Merkel has reached a deal with leaders of the country’s 16 states over a one-month partial lockdown. Starting on Monday, and through to the end of November at least, restaurants, bars and nightclubs will be closed. Leisure facilities such as gyms, event venues, cinemas and amusement parks will also be closed. Residents will only be allowed out with those in their own household and one other, while gatherings will be limited to 10 people. Private travel and visits to relatives are discouraged. However unlike last Spring, schools and day cares shall remain open as well as hairdressers. As we also previewed yesterday French President Macron also announced tougher restrictions including the shuttering of bars and restaurants, banning domestic travel and public gatherings, closing non-essential retailers and encouraging work-from-home if possible. As in Germany, schools will remain in session. The measures are currently in place until at least 1 December which will gives some hope for the Xmas holiday season.

In Germany these restrictions are probably less severe than they could have been and probably sound more extreme than they are but the direction of travel is going to wrong way with perhaps 5 months of the peak flu/cold/virus season still ahead of us unlike the first wave when we only had a month or so of the normal peak period left when it struck. Our German economists expect that the lockdown measures should result in a Q4 GDP decline of at least -0.5% qoq. The hospitality industry and cultural institutions will suffer most again under the new restrictions. That contraction would still be consistent with a -5.6% FY20 GDP drop predicted by our economists, assuming that the upside risks to their Q3 call (+6%) materialises. See here for more of their thoughts and here for the immediate thoughts of our French economist.

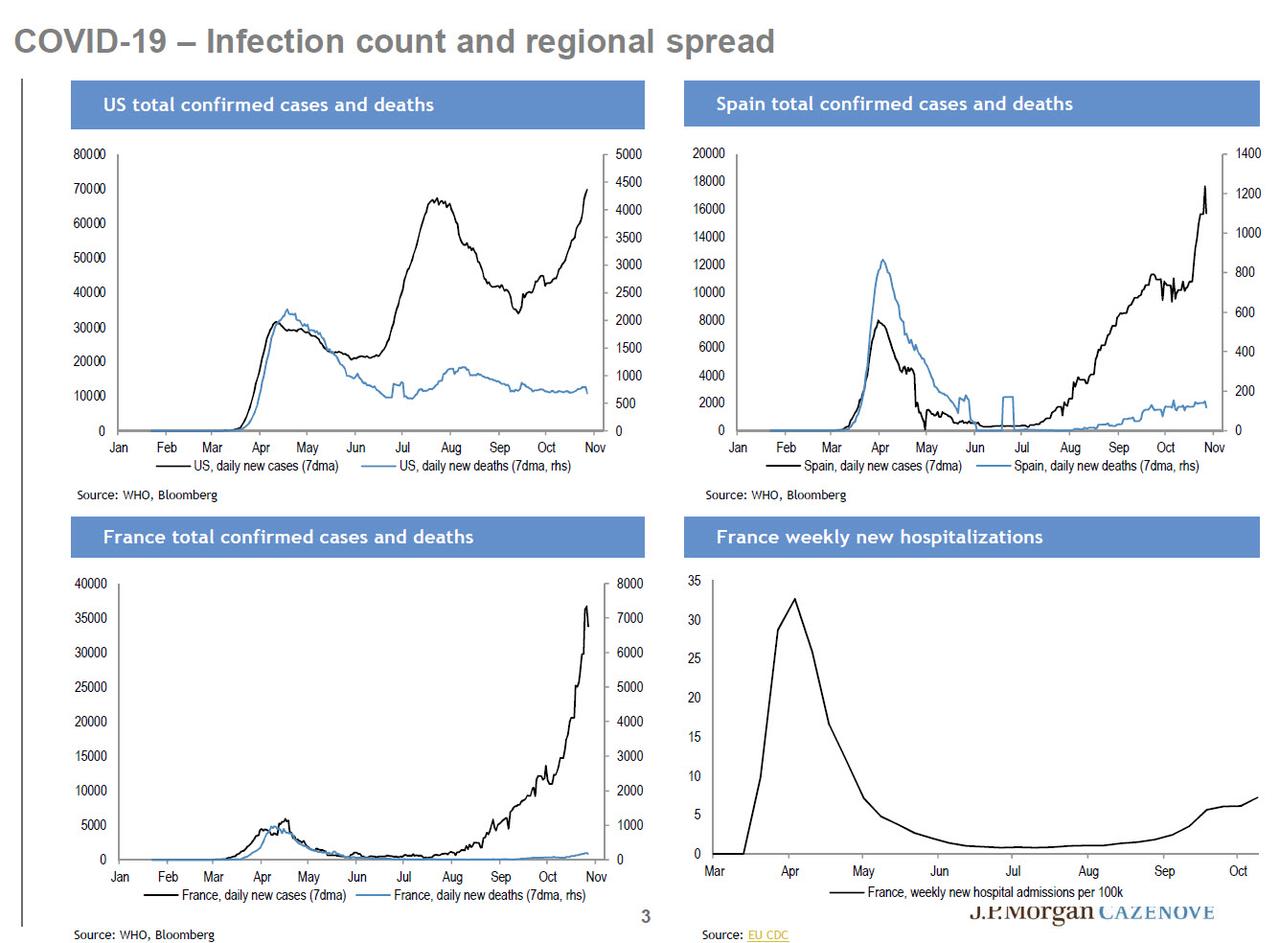

There’s an inevitability that other countries will go down the same path soon. A new study from Imperial College London and Ipsos Mori has indicated that the infections in England are doubling every nine days and an estimated 960,000 people are carrying the virus on any one day. In better news, the Guardian has reported overnight that the UK government has asked local health officials to deploy 30-minute saliva kits for coronavirus testing to accelerate the mass screening plan. The test plan is to cover as many of 10% of England’s population for coronavirus every week. Also overnight, Regeneron Pharmaceuticals said that data from a late stage trial indicated that its antibody cocktail therapy significantly reduces virus levels and the need for further medical care. Lastly, European Union leaders are planning to discuss adopting a singular approach to the practice of rapid antigen tests, which are faster than the PCR counterpart and could therefore allow for a more open economy. For more on how the virus is spreading see the table below.

Given the negative direction of restriction travel, US equities had their worst day since 11 June, with the S&P 500 down -3.53% and the VIX up +6.9pts to over 40 for the first time since the same day. That was when there was the original outbreak of covid-19 cases throughout the US Sunbelt. While the VIX is still considerably lower than we saw during the worst of the pandemic-induced selloff in March of this year, you have to go back to 2015 to see the equity volatility index at this level outside of the pandemic. The selloff was very broad with 97% of the S&P lower and the decline was led by Transportation (-4.86%) Software (-4.47%), Tech hardware (-4.45%) and Energy (-4.22%). The tech losses saw the NASDAQ fall -3.73%, the most since early September. It’s a big day for FANG earnings today with Facebook, Amazon, Apple and Alphabet all reporting.

Asian markets are seeing some respite this morning. The Nikkei (-0.33%), Hang Seng (-0.77%), Shanghai Comp (-0.12%) and Kospi (-1.05%) are mildly lower but with futures on the S&P 500 up +1.11% and those on the Stoxx 50 up +0.58%. Yields on 10y USTs are back up +1.2bps. Elsewhere, the BoJ kept it monetary policy unchanged at today’s meeting even as it further trimmed the growth forecast for the year ending in March to -5.5% yoy (from -4.7% yoy previously). In terms of overnight data, Japan’s September retail sales came in at -8.7% yoy (vs. -7.6% yoy expected).

In other overnight news, the FT has reported that the US is allowing a growing number of chip companies to supply Huawei with components as long as these are not used for its 5G business. If true, this will likely offer respite to Huawei’s smart phone arm. Separately, the FT has also reported that Tiffany’s board has approved the sale to LVMH at a lower price. Elsewhere, Standard Chartered beat earnings estimates overnight as loan losses eased. The bank also said that it has ample room to fund growth and pay dividends next year, pending approval from regulators. Boeing has said that it will eliminate an additional 7,000 jobs bringing the expected losses from layoffs, retirements and attrition to 30,000 people (19% of the pre-pandemic workforce) by the end of 2021.

Before all this, European equities fell to their lowest level in just over five months yesterday, with the STOXX 600 retreating -2.95% as 97% of the index also trading lower. Here it was led by cyclicals such as Autos (-4.81%), Chemicals (-3.71%) and Banks (-3.56%). The DAX (-4.17%) and CAC 40 (-3.37%) fell further on their shutdown lite news.

Sovereign yields in Europe declined for a third straight day after much of the focus last week was on their recent sharp rise. However the rally was relatively minimal given the large risk off. Gilts were down -1.9bps to 0.21% and 10yr bunds were down -1.0bps to -0.625%, steadily approaching 7 month lows. Whereas US Treasuries yields were actually up +0.3bps to 0.771% as there may have been some deleveraging of positions. Meanwhile the US dollar rallied +0.50%, the most in over a month. This partly led to gold (-1.61%) having its worst day in 2 weeks.

On the US Election, much of the focus remains on the Presidency, where former Vice President Biden remains an 88% to 11% favourite over President Trump in the fivethirtyeight model. The Democrats also remain favourite to gain control of the Senate (75% chance), though the number of seats is more uncertain. Republicans currently control the upper chamber 53-47 and considering that Democrats are very likely to lose a seat in Alabama, Democrats will need to win 4 seats and the Presidency to win control (the Vice President is the tie breaker). Using a mix of polls and past voting behaviour of the states Colorado (84% chance of Democrats winning according to fivethirtyeight) and Arizona (79%) are the Democrats best bets to turn blue. After that it is Maine (61%) and North Carolina (63%), which have tightened in recent days but in Maine the Democratic challenger has not lost a poll in weeks. In NC the challenger has only lost one in the last 3 weeks. After that the attention should be on Iowa (57%) and Georgia (33% and 64%), where the latter has a pair of Senate elections this year, in one of which the Democratic candidate is slightly favoured.

One interesting wrinkle this year is clearly the large number of early and mail-in votes. In states like Florida they have already seen 70% of the number of voters from 2016, Texas is at 91% (with little mail-in), North Carolina at 76.1% and Georgia at 76.8%. If current polling holds or the polling error happens to go in the Democrat’s favour – as happened in 2012 – it could be a quick night with North Carolina and Florida announcing fairly quickly, on the other hand a Trump win in those states and we could be waiting a week to hear the outcome out of the Midwest, namely Pennsylvania, Wisconsin and Michigan.

Given the historically divergent views on economic policy between the two candidates, our chief US economist Matt Luzzetti, considers the implications of the various election outcomes on the economic outlook in a new podcast which you can listen to here. He and his team have also refreshed their 2020 Election chartbook (found here) which contains sections on updated polling, projections, battleground states, and Congressional races.

Today we will hear from the ECB and our European economists (preview here ) expect the policy stance to be left unchanged, but that the ECB will also warn of growing downside risks amid an already weak outlook for inflation. This is likely to open the door to a further easing of policy in December. By then, there’ll be far more information on the status of the pandemic, the effect of the recent spate of shutdowns and the ECB staff will have updated their macroeconomic projections. These include the publication of the first estimates for growth and inflation for 2023.

Outside the ECB, today’s highlight’s include German October unemployment and CPI, along with Italian and Euro Area consumer confidence. In the US there is weekly initial jobless claims, Q3 GDP, personal consumption core PCE, and pending home sales. Lastly we will have Japan’s jobless rate and industrial production. In earnings we have the big ones with Apple, Amazon, Alphabet and Facebook along with Comcast, Sanofi, AB InBev, American Airlines.

via ZeroHedge News https://ift.tt/3kFzUAB Tyler Durden