10 “Big” Things For Stocks In The Coming Decade

Tyler Durden

Sat, 10/31/2020 – 12:25

In his latest weekly Flow Show, and the last such report before what may be the most important election in history, Bank of America CIO Michael Hartnett writes that according to the latest EPFR data, investors allocated $6.7Bn into bonds, and $0.1Bn into gold, while pulling $2.1Bn out of equities, and $1.5Bn out of cash.

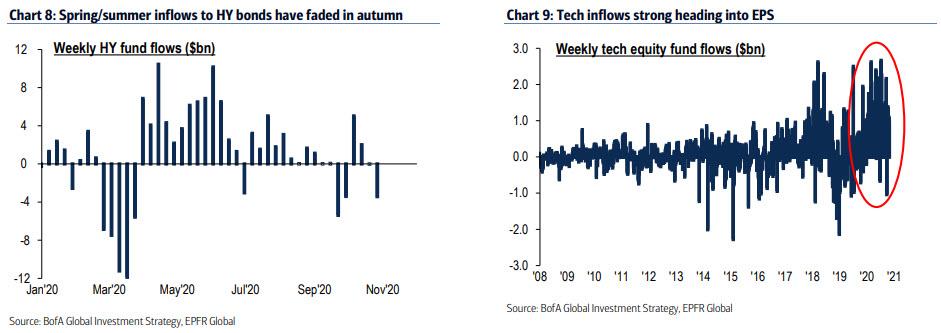

Of note, Hartnett points out that HY bond outflows accelerated to $3.4bn, while tech inflows were a strong $1.0Bn heading into EPS (oops)…

… while the inflows to Japan were largest since Apr’19, $3.5Bn, inflows into EM equities at $2.8BN were the largest in 7 weeks, $2.8bn), while European equities saw the largest outflow in 5 months ($3.4bn) as virus lockdowns returned.

Yet while the weekly flows are informative, we can now definitively conclude that they are nothing more than noise, as the so-called “smart money” idiots merely chase momentum. How do we know this? Because 4 weeks after the Nasdaq 100 mini futures saw a near record number of shorts, those same “valiant” bears promptly covered their positions and even went long the NQ… just in the time for the biggest Nasdaq rout since March. In short: while flows may have had some signal value in the past, it’s now nothing more than noise.

With that said, we do want to point out something else in Harnett’s latest note, namely his list of ten “Big” things every investor should be aware of heading into the election, and hopefully crawling out of in the next few weeks, as they decide how to allocated capital. And so, without further ado, here are 10 big things to watch for:

- Big top: IPOs (Ant $35bn largest ever, IPO ETF +163% since Mar), M&A (Oct’20 acquisition premium 142% vs 23% LTA), record $3.2tn funds raised in IG/HY/bank loans/equity/SPACs), US house prices up 15%, narrow equity leadership (top 5 SPX stocks = 24% of index), greedy IG & tech inflows, technical “double-top”, bearish narratives flipping to bullish (e.g. “blue wave”)…all classic “toppy” signs.

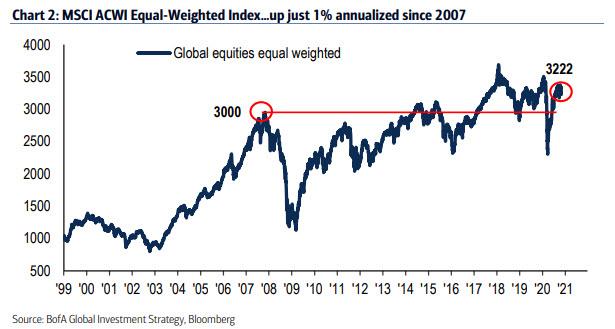

- Big not: strongest case against “top” is Fed not tightening (as it was ‘80, ‘87, ‘94, ‘98, ‘00, ‘08, ‘18); and most stocks not in bull market…annualized gain in global stocks since 2007 is <1% (Chart 2); 1984 of 3042 in MSCI ACWI index in bear market, i.e. are >20% below their all-time highs.

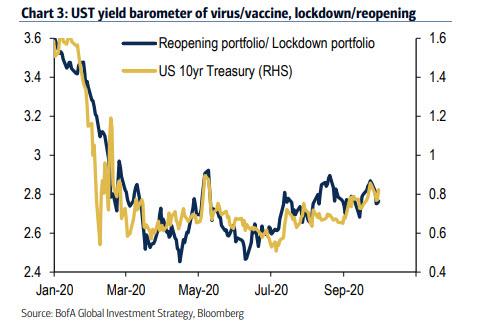

- Big contrarian: most contrarian trade in 2020’s very clearly is “Fight the Fed” because past 13 years central banks have cut rates 972 times, bought $19tn of financial assets via QE, introduced NIRP, ZIRP, YCC, TLTROs, and they are still easing…both BoC & ECB “eased” this week; once again virus fear>vaccine hopes, lockdown assets>reopening assets, Treasury yields fail to break to new high (>1% – Chart 3); big contrarian rotation awaits vaccine/sustained recovery & fiscal panic/MMT.

- Big tells: max bearish signals that it’s time to “Fight the Fed”…

- 1. weak macro causes Treasury yields fall and credit spreads rise (deflation “tell”),

- 2. MMT/digital currency causes Treasury yields rise and US dollar falls (inflation “tell”); investors will buy dips until Fed failure visible.

- Big levels: Q4 tactical SPX trading range of 3300-3600 holding; SPX 3300 floor to hold so long as LQD >$130, HYG >$80, NDX >11000; in coming weeks monetary & fiscal easing + vaccine expectations mean Oct trading sell-off in credit & equity ends.

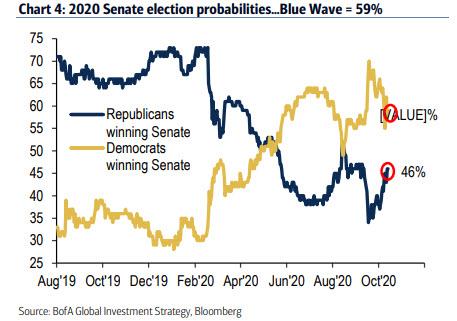

- Big event: likelihood of Democrats winning the Senate now at 59% (was 29% in Jan, 64% in July, 49% end of August – Chart 4); optimal medium-term election outcome for Wall St is “gridlock = goldilocks”; optimal outcome for big rotation = Blue Wave

- Big inflation themes: election won’t change secular themes…“smaller world” (China war, reshoring), “bigger government” (monetary/fiscal/corporate/social/environment intervention), “dollar debasement” (debt/MMT/digital currencies)…all inflation trends.

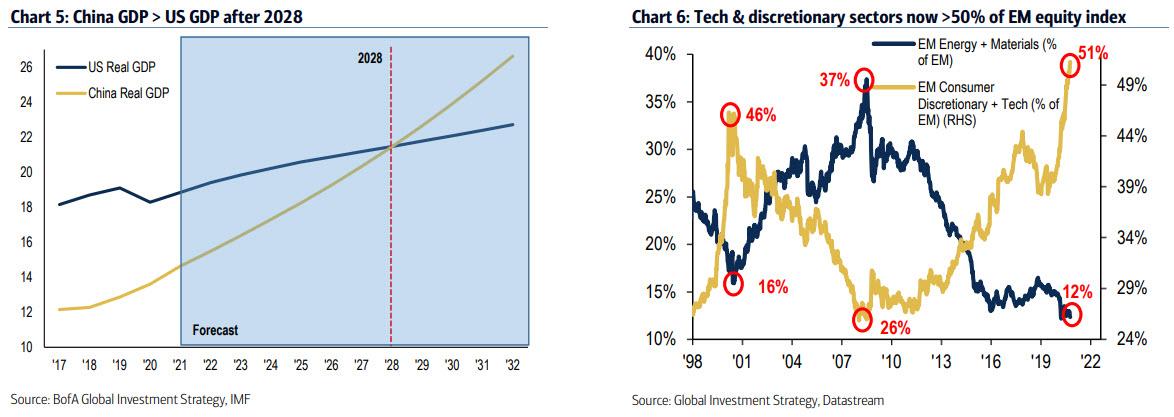

- Big deflation theme: “China tech disruption” (Chart 6 – new 5-year plan for 5% growth driven by tech-led domestic urban consumption/production)…bullish deflationary trend (c/o “new paradigm” US late-90s); note

- a. China FX strength;

- b. China GDP set to surpass US in 2029 (Chart 5 – source IMF);

- c. China’s old plan (weak FX, excess credit, social finance, infrastructure spend) set to become America/Europe’s new plan.

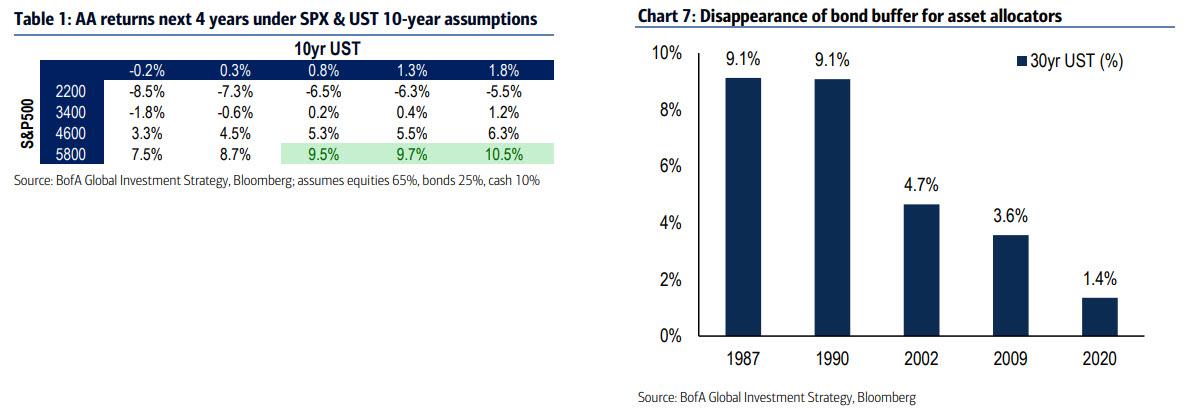

- Big dilemma: AA of 65/25/10 stocks/Treasuries/cash returned 9.4% past 10 years; potential AA returns much lower next 4 years unless SPX @ 5800 and 10-year UST yield <0.8% (Table 1); we say 3-5% asset returns more likely; disappearance of bond buffer for asset allocators (30-year yield was 10% in ’80, 9% in ’90, 6% in ’00, 5%, in ‘10, now 1.5% - Chart 7) means higher volatility on Wall St in 2020s (watch risk parity RPAR ETF as lead indicator).

- Big change: 2020s will be characterized by bigger government, MMT, 99% >1%…central bank digital currencies facilitate “helicopter drops” (instantaneous payments to distribute tax refunds, stimulus, UBI, student loan forgiveness) and make negative interest rates more efficient (adjusting reserves at CB accounts at negative rate dispenses with issue of bank intermediation).

via ZeroHedge News https://ift.tt/323gRZM Tyler Durden