Iran, Bitcoin, & The Sanctions That Won’t Be

Tyler Durden

Sat, 10/31/2020 – 10:30

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

Amidst all the posturing, fretting and craziness leading up to the election on Tuesday the thing that jumped out of my Twitter feed was this 2 minute video from PressTV.

Watch it. I’ll wait.

#Iran plans to use #cryptocurrency to evade US sanctions pic.twitter.com/eAZl0nIQWc

— Press TV (@PressTV) October 25, 2020

… Done? Good.

Let’s get started.

This came from Press TV, the Iranian equivalent of the BBC but without so much British Marxism. So, it’s as official as official gets.

Iran will use bitcoin as part of its import settlement system. It will export bitcoins and import things barred to it from the U.S.

Do you really think this policy will stop here?

The video reminds us that Iran has been building this case for the use of bitcoin to evade U.S. sanctions for years. This is a strategic move, not a fly-by-night operation like Venezuela’s Petro.

They could have gone the China or European Union route, push for a Central Bank Digital Currency completely controlled by the government.

You know, the worst possible arrangement, a cryptocurrency run by central bankers, i.e. Ripple.

But that would gain them nothing. Who would use a digital rial when no one wants the current rial?

Instead Iran embraced bitcoin because it had no other choice. The rial has been effectively destroyed by U.S. sanctions and the country is starving for a currency which accretes value to the user rather than steals it.

China and the EU both have pretensions to global power, Iran does not, or at least hasn’t revealed itself to harbor them. Their CBDCs will hit the ground with built-in demand which Iran cannot match nor has the infrastructure to implement.

They are in survival mode here, taking the brunt of the U.S. assault on the forming alliance between it, Russia and China. But it is also a kind of rope-a-dope strategy.

And for that reason bitcoin is the smart choice for the government there to embrace if it has any hope of regaining the confidence of both the people and its trading partners.

Converting bitcoins to dollars on the open market is trivial and something that cannot be tracked by prying Five Eyes.

This move validates the arguments so many in the crypto-community, including myself, have been making against Bitcoin’s detractors, who argue without any justification that if bitcoin were to become important they would just ban it.

How do you ban something you don’t control?

Bitcoin is still ‘illegal’ in Iran just as much as it’s illegal in other places around the world, if not moreso.

And yet? Iran is now openly trading in it.

They will try to keep it from freely circulating. The devil is in the details of what Iran is proposing here. You can mine bitcoin locally and use it to pay for imports but only through the Central Bank.

Of course the government wants to control the flow of bitcoin into and out of the Iranian economy. But this scheme is, like all government attempts at control, meta-stable.

The natural outgrowth of this is bitcoin competing in the open market locally for goods and services, regardless of the legality of it. But this will be a boon for Iran, who can now act as an international clearing house for money the U.S. can’t control.

This is a real-world use case for bitcoins in a world of financial repression and control. It jumps bitcoin from a store of value, where it resides now because of government restrictions on its use through tax policy to a medium of exchange for mediums of exchange.

Iran does this while the IMF is working on a digital SDR — the currency based on its reserves — that will only flow between central banks. This is a clear move to consolidate the financial power of the world in the unelected technocracy.

It’s a small step from here to Iran accepting bitcoins for oil and gas exports, if they aren’t doing so already behind the scenes. And further validates the core values of decentralization and the power of private assets and free markets.

President Trump continues to make the dollar more expensive for people around the world to use. This undermines the dollar’s greatest strength, its universality, liquidity and price.

Only an asset with zero counter-party risk can protect people during the upcoming chaos of The Davos Crowd’s Great Reset, and the global push for financial control.

Watching the monthly closes today we’re seeing bitcoin decoupling from the rest of the financial world. Stocks across the west are down, U.S. treasuries hammered on the long-end of the yield curve.

Oil is signaling the vaunted ‘reflation trade’ is dead closing below $40. The patient just died.

Speaking of patients near their end, Speaker Nancy Pelosi said this at yesterday’s presser

Speaker Pelosi: “I feel very confident that Joe Biden will be elected President on Tuesday. Whatever the end count is on the election that occurs on Tuesday, he will be elected, on January 20th he will be inaugurated President.” pic.twitter.com/NNGAeiKSxP

— The Hill (@thehill) October 29, 2020

This is as clear a warning as you can get that no matter how we vote on Tuesday here in the States the outcome of this election will be determined by the people who hold the commanding heights and not us.

Is this really a recipe for continued faith in the current system? How do the costs for using the dollar go down in a world where pols determine elections and not the voters?

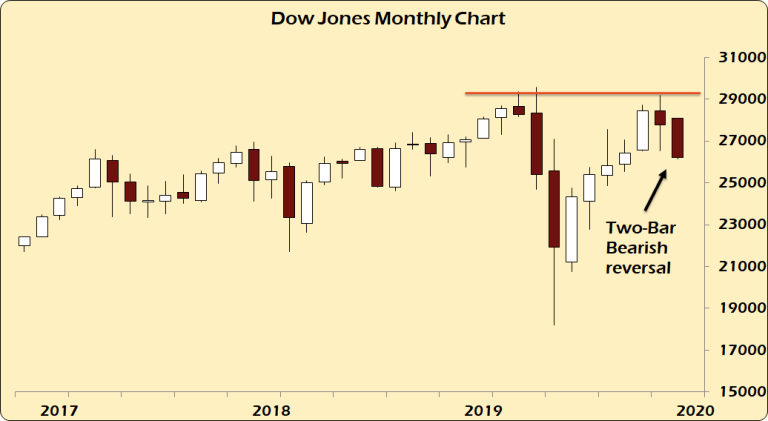

While the Dow Jones is headed for a very bearish monthly close

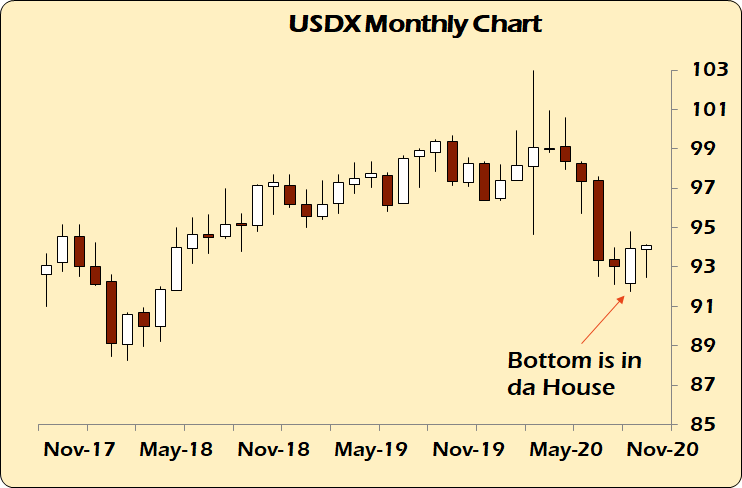

and the dollar is reversing off its lows as well…

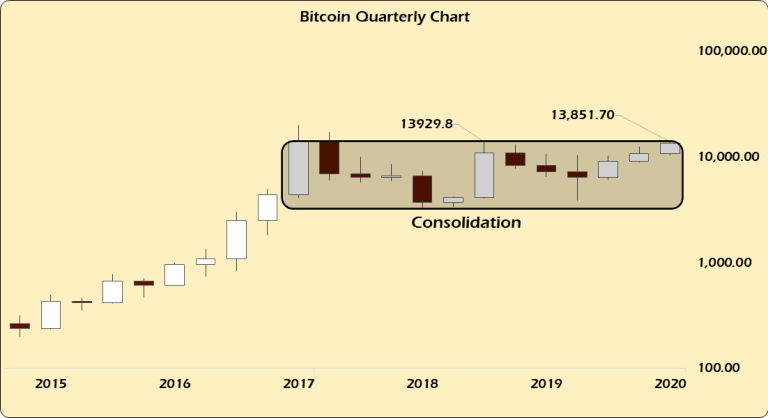

Bitcoin is pushing up against the top of its four-year consolidation range to close out October at $13,550. This will be the second highest monthly close in Bitcoin’s history.

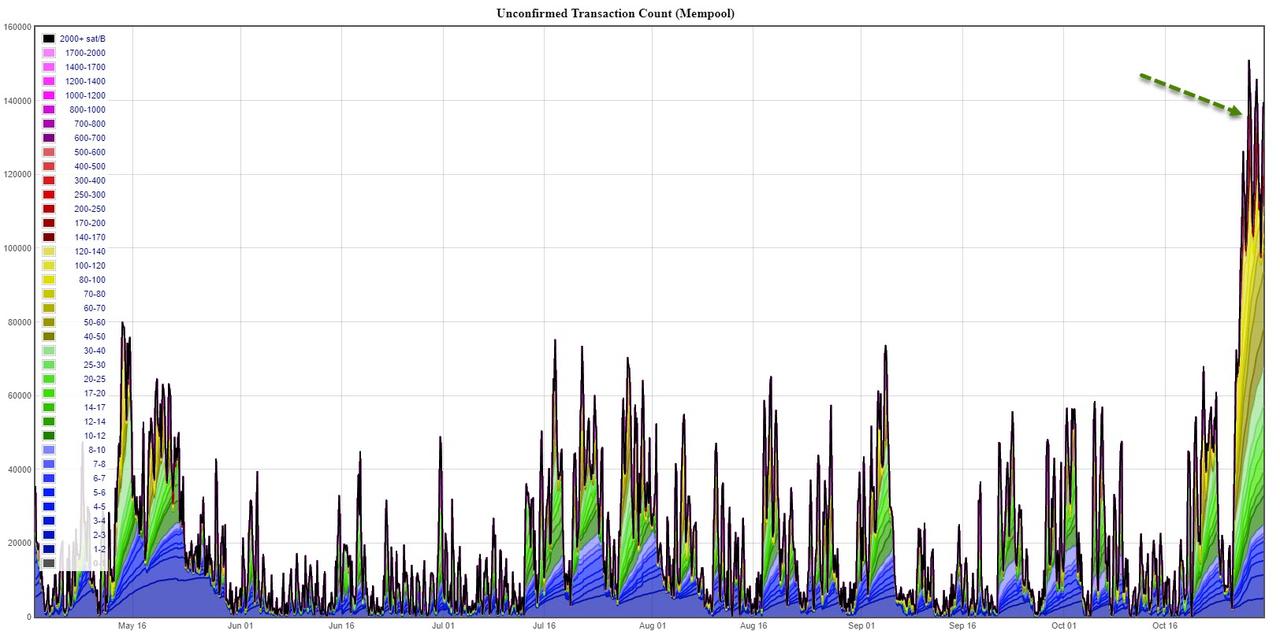

And traffic on the network is at an all-time high.

Source: https://jochen-hoenicke.de/queue/#0,6m

The question I have for you now is, “Who’s the more desperate, the fool or the fool who goes his own way?” Iran needs bitcoin far more than bitcoin needs Iran.

Necessity is the mother of innovation. While everyone in power desperately tries to hold onto it the people always flee from chaos to stability.

* * *

Join my Patreon to join the cool kids club. Install the Brave Browser to make Google cry.

via ZeroHedge News https://ift.tt/2HS470A Tyler Durden