Schizophrenic Paradox Emerges In S&P, 30Y Bond Futures

Tyler Durden

Mon, 11/02/2020 – 11:50

An apparent paradox is emerging in the world of futures positioning.

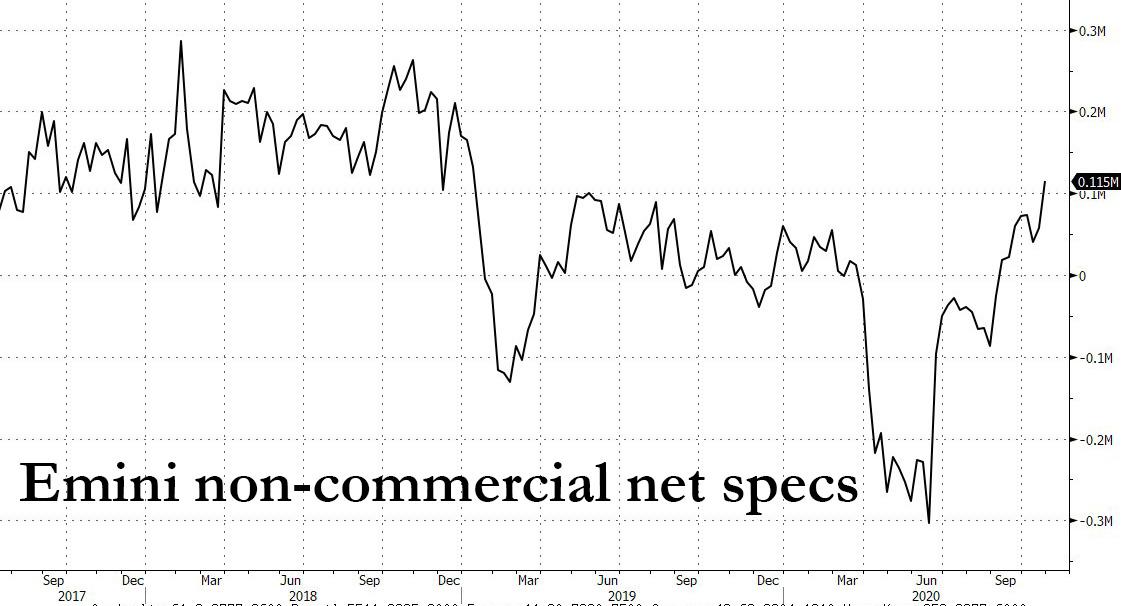

According to the latest CFTC Commitment of Traders data, after being stuck in a tight range for much of 2020, speculative investors boosted bullish wagers on S&P emini futures to the highest level in almost two years, a that most professional investors saw the potential for the S&P 500 index to bounce back from a two-month slump. As Bloomberg notes, net long positions in S&P 500 e-mini futures in the week to Oct. 27 were the most since January 2019.

Unfortunately, as we have discussed in recently, looking at futures positioning has become nothing but noise devoid of any signal, and nowhere is that clearer than in the recent action in Nasdaq futures, where specs turned record short in late September, only to see their position turn slightly bullish by the end of the month, just as the Nasdaq crashed…

The “smart money” are officially idiots: after record shorts a month ago, specs puked into upward momentum and were flat into the worst week for tech since March. This means that NQ will now surge as specs go short again pic.twitter.com/dxcC8NmSkL

— zerohedge (@zerohedge) October 30, 2020

… confirming that even “smart money” investors are nothing more than glorified momentum chasers.

Of course, in a reflexive market, there was an immediate “narrative” validation, with strategists arguing that the S&P 500 can make a run higher from next year, helped by post-election progress on government aid to combat the pandemic’s economic fallout, as well as the introduction of treatments and vaccines. For instance, Bloomberg quotes BTIG LLC chief equity and derivatives strategist Julian Emanuel who wrote in a note that the firm’s base case is “eventual new all-time highs when the correction concludes” possibly in the first quarter of 2021. This incidentally is similar to what JPMorgan admitted over the weekend when it said that the worst the economy gets and the more stringent the lockdowns, the most active the Fed will be and lead to even higher risk prices.

Meanwhile, technical analysts are sounding some notes of caution. Strategists Jason Hunter and Alix Tepper Floman of JPMorgan Chase & Co. said the S&P 500 is revisiting a “cluster of support” surrounding the 3,200 level.

But a bigger warning that those hoping for smooth sailing will be disappointed, comes from the futures market itself, because while investors are now growing increasingly bullish on stocks, they have never been more bearish on 30Y bonds, where for one more week, the combined total of net leveraged fund and speculative futures positions hit a fresh record.

This is, in not so many words, paradoxical if not outright schizophrenic because if the bond futures are right, and 30Y yields explode higher validating the bearish bias, this would crash stocks as there is no way tech names which are a derivative of duration and thrive only in a period of deflation, will survive such a yield spike unscathed.

In short, it is impossible for both Emini and 30Y futures traders to be right at the same time, and in a time when the Fed has taken over the bond market and relegated the bond ‘smart money’ to idiot status, it will be interesting to see just who is right.

via ZeroHedge News https://ift.tt/38377SY Tyler Durden