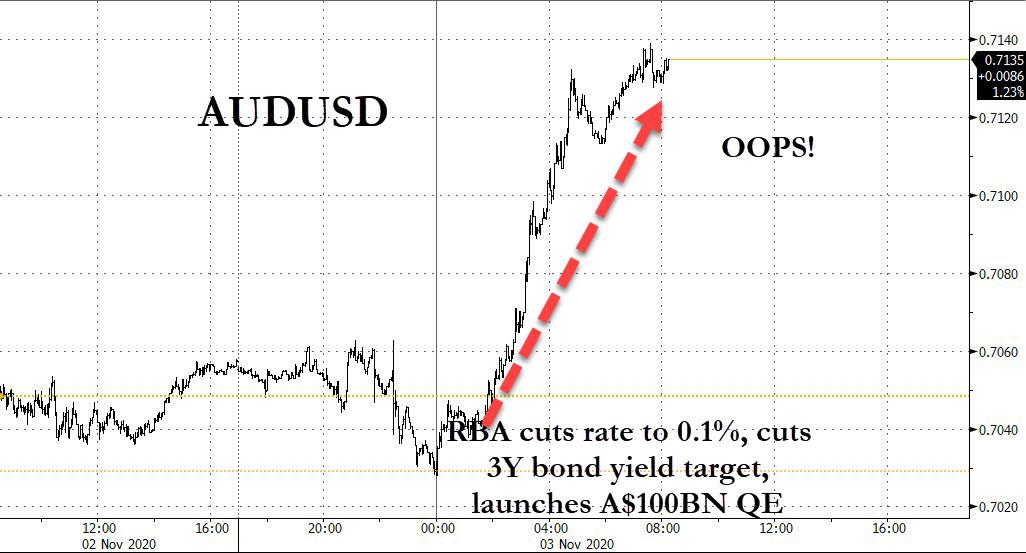

Bizarro World: Australian Dollar Soars After RBA Cuts Rate To Record Low, Launches New A$100Bn QE

Tyler Durden

Tue, 11/03/2020 – 08:21

In the latest episode of global bizarro Japanification, Australia’s central bank trimmed interest rates to near zero on Tuesday and expanded its bond-buying program, as widely expected, in an attempt to ease the country’s worst recession in a generation. As BMO’s Stephen Gallo described it, “the RBA spent three more bullets last night” as follows: i) it cut its overnight rate by 15bps to 0.10% which, it pledged will remain unchanged until inflation is sustainably within its 2-3% target band, ii) cut its 3Y govt bond yield target to 0.10% and iii) launched a new A$100 billion ($70.41 billion) bond purchase program aimed at the 5-10Y segment of the government bond market. That additional QE program was announced to run over the next 6 months.

Australia’s A$2 trillion economy is in its first recession in three decades as the coronavirus pandemic forced businesses to down shutters, leaving hundreds of thousands without work. The jobless rate is hovering near 7%, having risen from around 5% before the COVID-19 pandemic. Economists say the actual level of unemployment would be even higher if those on government support are included.

While Australia has controlled the spread of the virulent disease and opened its economy earlier than expected, domestic and international borders remain closed, business investment is weak and consumer spending is still tepid.

But while boosting the economy was certainly a consideration behind the RBA’s move, the primary motive was to pressure the AUD lower: in his written statement, RBA Governor Lowe stated that one of the key motivations for the moves was “contributing to a lower exchange rate than otherwise” would be the cause for AUD. He reiterated that motivation in his press conference, but said it was only “one factor.”

There was just one problem: while the AUDUSD initially fell from 0.7050 to 0.7028 in the wake of the announcement, it has since soared demonstrating just how bizarro the FX market has become, and just how powerless central banks truly are to achieve their desired outcomes!

As Gallo puts it, “to the extent [the RBA’s actions] were intended to weaken AUD, the RBA didn’t get much bang for spending almost all of their remaining bullets.”

As a result, as CreditorWatch Chief Economist Harley Dale said, “any further support the Australian economy requires will have to come from fiscal policy and quantitative easing.” On its part, Australia’s conservative government has unleashed A$300 billion in emergency stimulus to prop up growth this year, including A$17.8 billion in personal tax cuts approved by parliament last month. However it remains unclear how the AUD – which remains a proxy for the Chinese yuan – will ease if the RBA throwing the kitchen sink at it results in the opposite outcome of what was intended…

via ZeroHedge News https://ift.tt/3oVsr2E Tyler Durden