“There Is Something Winding Up To Punch The Market In The Mouth”

Tyler Durden

Tue, 11/03/2020 – 05:00

By Mark Orsley, head of Macro Strategy at PrismFP

-

Costanza in November – markets are going into major event risk full of reflation hopes

-

Technical indicators are flashing warning signals that new good news is needed to avert a sharp correction

-

What could be the drivers of a risk asset correction – yields rising reinvigorates our debt cycle talking point

-

Central banks will step in with updated purchase plans in December to stabilize rates market, risk assets – could mean substantial pain to the reflation trade in Nov. but setting up the opportunity to reengage in Dec.

Regular readers will know at year end we do a tongue in cheek, jab at street research in our year end “Costanza” piece. It is meant to push back at consensus and historically the Costanza trades has had a success ratio greater than 70%.

Today’s piece is not supposed to be tongue in cheek but serve as a warning that the market is perhaps too consensus going into a fragile fundamental and technical period for the markets.

To put it succinctly, the market is in a precarious position where the slightest rate of change bad news could mean a substantial correction for reflation. In other words, there better be some good news QUICK.

We hope you have seen that we have been an early call on reflation, both asset price and economic, coming out of the initial COVID scare. We now view that narrative that we have held for many months as too consensus into event risks which could temporarily derail reflation.

The “precarious position” starts with positioning where market participants are fully bought into one or more of the following ideas:

-

The “blue wave” is reflationary

-

There was fiscal failure, but it will come eventually

-

Vaccine news can only be positive

-

COVID is Europe’s problem

-

The strong economic rebound in the US coming out of the spring will continue unabated

Thus, the market has piled into reflation trades and continue to hold them, in some cases to historic extremes:

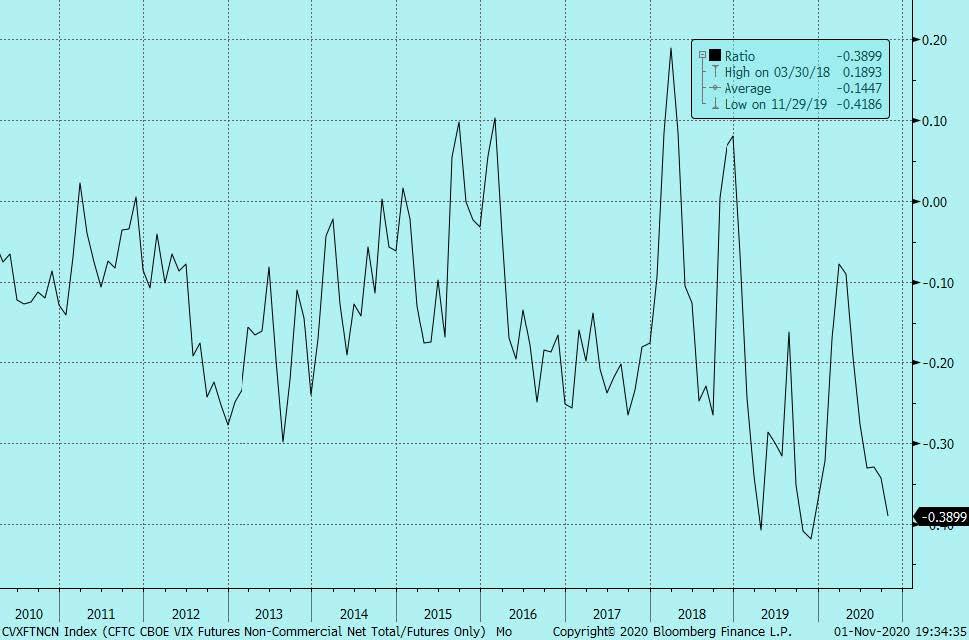

VIX Spec positioning / Aggregate Open Interest – short equity vol is near 10yr extremes…

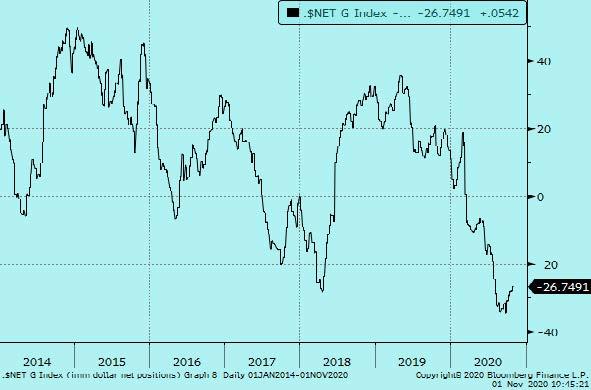

In similar vein, S&P “spec” positioning is going into November’s fragile period at 1yr highs for longs and building…

The net spec $ positioning across the eight most liquid currency futures is still near 5-year shorts…

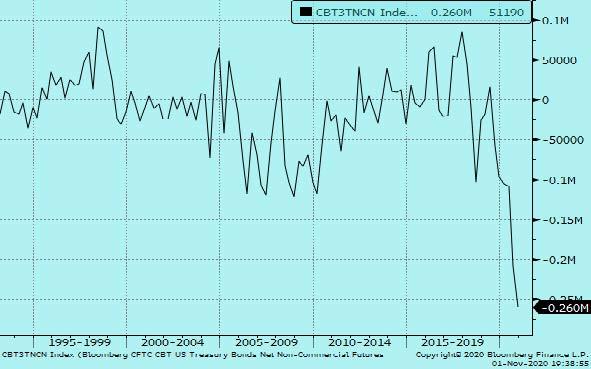

By far the trade du jour for October, shorting the long end of US rate curve, has built into historic short positioning…

(We know the COT data is a few days old and we saw in Fixed Income for example, the largest day of short covering risk since March as well as the largest day of long unwinds on Friday. So, positioning perhaps a bit cleaner but not enough to change the overall picture.)

Bottom line, while not as extreme in some cases as February reflation positioning, the market is very clearly tilted to one side of the proverbial reflation boat. Participants are expecting higher equities, higher rates, lower $, lower vol, and lower vol of vol.

Combining with broad sentiment, the market believes that either (a) there is a ton of positive news coming, and/or (b) we will be able to look through any near-term negative news.

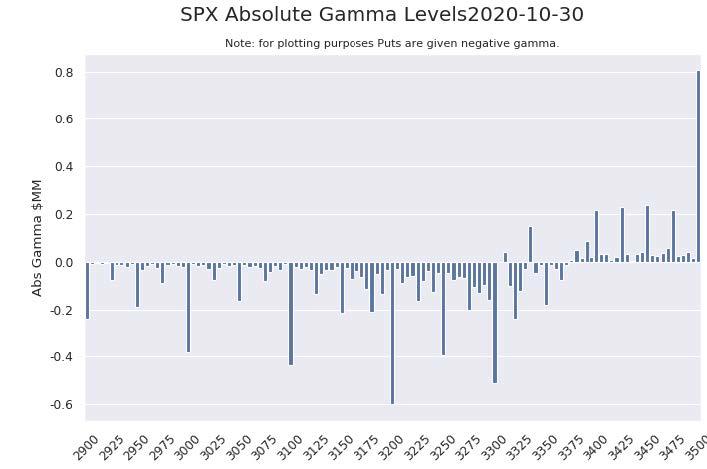

The positioning and sentiment dynamic above can also be noted in the equity gamma landscape. We have made this a major talking point over the last couple weeks as it has done an impressive job predicting short-term market direction.

The main point to consider is the wall of calls at 3500. That is another example of extreme reflationary positioning which will act as a resistance level to the market. Meaning, good news will be capped as delta hedgers sell into the rally. The amount of calls at 3500 is extreme compared to any other strike, whether calls or puts.

The good news for the equity market is that, like Fixed Income, there was some position squaring on Friday. Namely, puts between 3250-3500 were closed as the market sold off last week. That takes off a bit of the delta selling pressure of the gamma hole we have spoken about at length recently. In option geek terms, the vol trigger has moved from above the market to below the market (from 3370 to 3265). Thus, the market is neutral right here in terms of gamma.

Bottom line on equity gamma, the gamma hole will not be a major risk over the election (barring substantial new positioning today), but a positive market outcome will be capped by the Nazare Portugal like (for you surfing aficionados) wall of calls (meaning, there is a 100ft wave of calls in front of us).

Those calls coupled with other positioning makes profiting from reflation increasingly difficult.

* * *

Turning to the technicals, simply said, the charts are the clearest indication and warning sign that a reflation hiccup could occur if either (a) good news turns neutral, or (b) bad news develops. Charts foretell that good news better come quick.

Semiconductors – broken uptrend, momentum about to flip negative, and the possible development of the most classic head and shoulder topping pattern you can find. One scenario is perceived positive election outcome forms the right shoulder, and then negative news into crowded positioning causes the flush lower. A strikingly similar setup to March…

John Deere – no this is not a tech chart; this is a construction equipment company founded in 1837 that has a PE multiple of 23. As like tech charts, Deere (as a read through to “value”) has broken its uptrend, potentially forming a classic head and shoulder top, with momentum about to flip negative (historically, Deere doesn’t hold >20 PE for very long)…

Transports – Dow Theorist should be concerned by the uptrend breakdown and another potential head and shoulder topping pattern…

Housing – the darling of the US economy and our leading indicator back in the spring of reflation. Another broken trend and potential head and shoulder top with momentum loss. The chart is telling us the good news in housing is now fully priced until there is a fresh driver…

Momentum (think Tesla) –double top, broken trend, and MACD about to flip negative. 140 MUST hold or momentum equities will break down. Makes sense as these liquidity fueled stocks have lost its fiscal tailwind they “jones” for…

Look, we can go through 100 more charts like these, but the point is there is coordinated signaling across all sectors of potential topping patterns developing.

Bottom line on the charts: all reflation uptrends are over. That means previous fundamental narratives will not drive price action going forward. There needs to be new positive news, or else the slightest rate of change towards negative news means the bearish technicals play out swift and sharp, especially when coupled with positioning indicators.

* * *

The obvious question becomes, what are the potential negative outcomes or less positive news that could cause the positioning unwind that fills the negative technicals above? Besides the unknowns we can’t predict, it would be things like:

-

While Biden winning the presidency may lead to fiscal stimulus in 2021, the market would have to sit through a painful period of (can pod shops with risk managers looking over their shoulders hold out that long?)….

-

1) No fiscal in the lame duck session – phase 4 fiscal failure will be a major policy mistake

-

2) Potential for tax loss selling into year end, especially of tech stocks that are up significantly YTD and facing increased regulatory scrutiny. Even if you think Biden delays tax increases, the probability of higher taxes in 2021 are not zero and thus investors may unwind bullish positioning in December.

-

-

Biden + GOP Senate – the worst election outcome for risk assets. GOP blocks stimulus not only in lame duck but in 2021.

-

The vaccine news that will come soon is delayed and/or negative (no success).

-

COVID (real) wave 2 hits the US causing a spike in hospitalizations and forces shutdowns like we are seeing all over Europe (Spain, Portugal, Greece, Austria, Germany) and the UK – an eventuality in our estimation as the data is already suggesting wave 2 is building in the US.

-

WTI weakness is signaling the COVID risk is increasing

-

This would be the rate of change hit to growth that would pain reflation positioning

-

-

MOST IMPORTANT – YIELDS GO TOO HIGH

-

Risk Parity funds could de-risk if equities aren’t rising concurrently (recall last week’s price action)

-

Higher mortgage yields coupled with increased home prices due to higher demand + input costs would hit the housing market (the leading driver of US growth) – something lumber is signaling to us

-

Economic cycles have been replaced with a debt cycle – a big talking point here, when nominal yields rise above the level of growth; it creates risk asset volatility. Every. Single. Time.

-

More on that last point…

When UST interest payments + entitlements become greater than tax receipts, the US fiscal ponzi situation becomes unsustainable. The level of growth right now (smoothed YoY not QoQ) is unknown but the fiscal phase 4 failure creates a lower growth environment for at least the next quarter to two quarters.

Thus if the market prices in a Blue Wave which forces a Risk Parity liquidation, for example, yields could climb too high in the near-term as there is a liquidity void right now with the Fed on the sideline until December and no fiscal until March 2021 at the earliest that puts growth estimates lower for now.

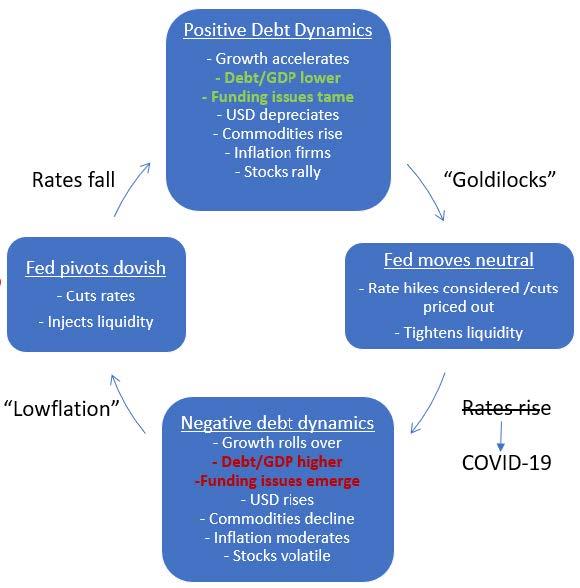

Recall our “economic cycles have been replaced by a debt cycle” flow chart that helps guide us through the various regimes. Right now, we are coming out of “Fed neutral”, COVID risks increasing (like March), which has moved the world into the “Negative debt dynamic” regime. The obvious next step is for the Fed to take easing to the next level (increase purchases and extend WAM).

Thus, November could be extremely poor for risk asset performance if yields climb too high. This would be similar to January 2018 (reflation breaks equity volatility shorts) and December 2018 (Fed hikes breaks equities).

We then believe that the new ECB + Fed actions will stabilize markets in December. That means we should get indications of coming easing policies from Fed officials a few weeks before the blackout period, likely reacting to higher yields.

Putting this all together…

-

Positioning, sentiment, technicals all jibes with the idea that the market is more susceptible to negative news flow/less positive news flow, or a regime change. The old narrative won’t be a driver to additional positive risk asset returns.

-

We highlighted several reasonable fundamental scenarios that could cause a significant reflation correction. The main ones being that fiscal is now put off longer than most can hold positioning for, and the prospects of higher yields which has historically caused equity volatility (which positioning has reached historic levels of shorts).

-

The new positive news needs to come quick as charts are sitting on the proverbial cliff. A surprise Trump win

-

could be the savior to the market as that bring s forward fiscal prospects , and n o new taxes or regulations.

-

Anti-consensus positioning now warranted either as stand-alone trades or hedges (trade idea piece coming tomorrow)

-

We do not think this is March 2.0. Any correction will be shallower as positioning is slightly less extreme (VIX is 35 now vs. 15 in Feb.), central banks are ready to act, and the world is better placed to deal with COVID.

You may be trying to hold onto reflation positioning over the election and into 2021 until fiscal arrives. Seems like a prudent plan.

However, as the great Mike Tyson once said, “everyone has a plan until you get punched in the mouth.”

There is something winding up to punch the market in the mouth. Hopefully this note serves to help duck, dodge, and be ready to throw the counter punch. There is a good reflation setup developing, it just may not be here.

More to come tomorrow….

via ZeroHedge News https://ift.tt/3kOdopb Tyler Durden