Treasury Announces A Record $122BN Refunding Debt Sale

Tyler Durden

Wed, 11/04/2020 – 09:30

While it will get zero notice in today’s post-election chaos, at 830am, the Treasury issued its quarterly refunding announcement in which it said it will raise its long-term refunding debt sales next week to a fresh record $122 billion, to refund approximately $60.9 billion of Treasury notes maturing on November 15, 2020.

This issuance will raise new cash of approximately $61.1 billion. Here are the details:

- Treasury to sell a 3-year note for $54 billion on Nov 9, up from $52 billion in October.

- Treasury to sell a 10-year note for $41 billion on Nov 11, up from $38 billion last quarter.

- Treasury to sell a 30-year bond for $27 billion, up from $26 billion last quarter.

The total combined sales of a record $122BN for the three maturities compares to $112BN last quarter. As a reminder, the Treasury had nudged up 3-year sales by $2b already in Sept. and Oct.

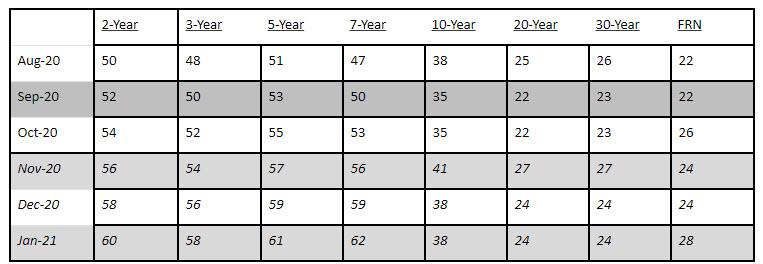

It’s all uphill from there: over the next three months, Treasury anticipates increasing the sizes of the 2-, 3-, and 5-year note auctions by $2 billion per month. As a result, the size of 2-, 3-, and 5-year note auctions will each increase by $6 billion by the end of January 2021. Treasury also anticipates increasing the size of 7-year note auction by $3 billion per month over the next three months. As a result, the size of the 7-year note auction will increase by $9 billion by the end of January 2021.

The Treasury also announced increases of $3 billion to both the new and reopened 10-year note auction sizes, and increases of $1 billion to both the new and reopened 30-year bond auction sizes starting in November.

Meanwhile, with demand for the 20-year nominal bond introduced in May remaining robust and the product enjoying broad support from market participants, the Treasury is also announcing increases of $2 billion to both the new and reopened 20-year bond auction sizes starting in November.

In addition, following the $2 billion increase in the October new-issue FRN auction size, Treasury will increase the November and December FRN reopening sizes by $2 billion (resulting in a $24 billion auction size for each). Treasury anticipates increasing the size of the next new-issue 2-year FRN auction in January by $2 billion to $28 billion.

The table below presents the anticipated auction sizes (in $ billion) for the upcoming November 2020 through January 2021 quarter:

Additionally, the changes in nominal coupon and FRN auction sizes announced today will result in an additional $105 billion of issuance to private investors during the November-January quarter compared to the August-October quarter.

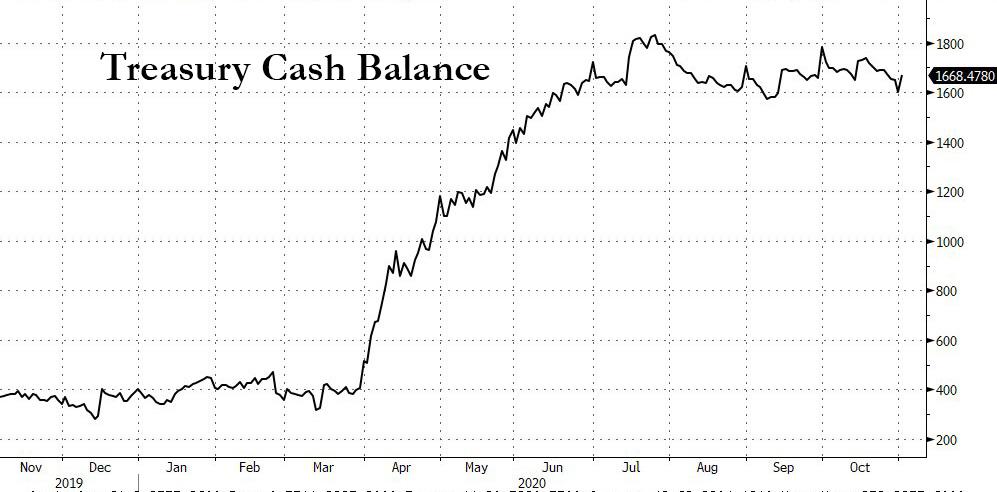

With respect to the record high cash balance projections, the Treasury said that consistent with its guidance in the August refunding statement, it “continues to take a precautionary, risk-management driven approach by maintaining large cash balances in light of the unprecedented size and ongoing uncertainty regarding COVID-19 related outlays.” It also said that while it “expects its cash balance to decline over the upcoming quarter, the extent of the decline will depend on several uncertain factors, including the pace of outflows under current law and the potential for additional legislation.”

On its projections for Bill Financing, the Treasury will continue to supplement its regular benchmark bill financing with a regular cadence of CMBs. Treasury anticipates that weekly issuance of 6- and 17-week CMBs for Thursday settlement and maturity, as well as 15- and 22-week CMBs for Tuesday settlement and maturity will continue at least through the end of January. These CMBs will be announced as part of the regular Tuesday and Thursday bill announcement cycle. These CMBs provide substantial financing flexibility considering the uncertainty of borrowing needs Treasury faces. The Treasury will also continue to evaluate the fiscal outlook and assess the need to make adjustments to auction sizes at the next quarterly refunding announcement.

Finally, the Treasury said that no decision has been made by Treasury regarding potential issuance of an FRN linked to SOFR (or the Secured Overnight Financing Rate). However, Treasury said it “continues to actively explore the possibility of issuing such a product and will provide ample notice to market participants if it chooses to move forward.”

via ZeroHedge News https://ift.tt/3mP1tIk Tyler Durden