Uber Slides After Top-Line Misses On Continued Mobility Weakness

Tyler Durden

Thu, 11/05/2020 – 16:31

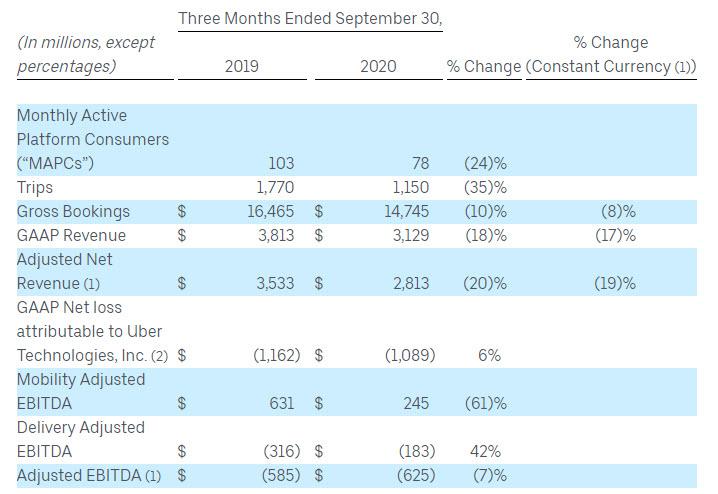

Having soared earlier this week on the back of California’s passage of Prop 22, which saw California residents side with Uber and agreed to make drivers independent contractors, it was time to give back some of the gains, when moments ago the company reported Q3 earnings which while generally coming in line were a bit weak on the top line, driven by continued weakness in the company’s mobility business even as delivery came in stronger than expected again:

- Uber 3Q Adj. Net Rev. $2.81B, missing the Est. $2.82B

- 3Q Loss/Shr 62c, Est. Loss/Shr 61c

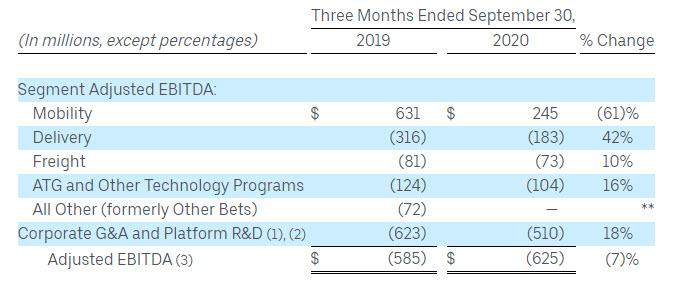

- Adjusted EBITDA loss of $625 million, up $40 million year-over-year, and down $212 million quarter-over-quarter, and 22.2% margin as a percentage of ANR. (Adjusted EBITDA excluded the impact of COVID-19 response initiatives.

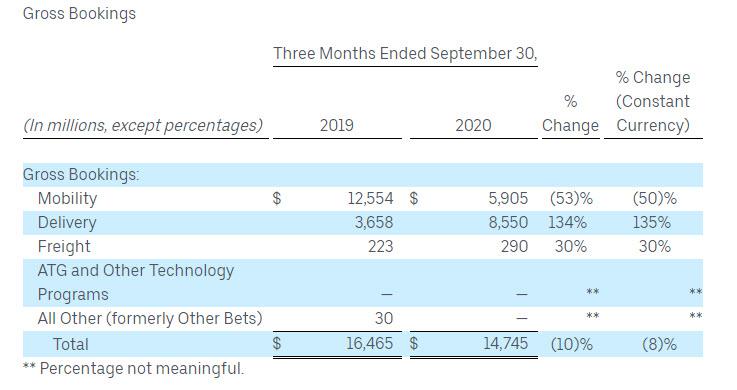

Q3 Gross Bookings of $14.75B, beat the Est. $14.49B, but were down 6% Y/Y:

Revenue from Deliveries topped sales from mobility for the second consecutive quarter; mobility gross bookings fell short of estimates while delivery exceeded predictions. It is this continued mobility shortfall that is is causing investor concern.

- 3Q Mobility Bookings $5.91B, Est. $6.44B

- 3Q Delivery Bookings $8.55B, Est. $7.80B

- Mobility Adjusted EBITDA of $245 million, improved +$195 million quarter-over-quarter (-$386 million year-over-year), and delivered 17.9% margin as a percentage of Mobility ANR.

- Delivery Adjusted EBITDA loss of $(183) million, improved +$49 million quarter-over-quarter (+$133 million year-over-year), and delivered (16.1)% margin as a percentage of Delivery ANR.

As Bloomberg summarizes, “Uber’s gross bookings have topped expectations and revenue is a slight miss, with the food-delivery business doing strongly — all mostly in line with expectations. However, some of the selloff we are seeing now may have to do with the rapid rally in the stock on Wednesday after the Proposition 22 victory.”

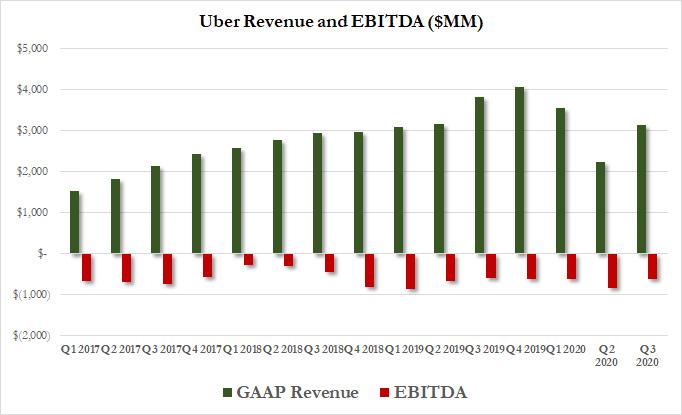

The company reiterated that it it was “confident” it would meet a positive quarterly adjusted EBITDA print before the end of 2021, until then it has a generous cash buffer which was $7.3 billion at the end of the third quarter.

Considering that the company has never had a profitable quarter – and has burned $9.3BN since the start of 2017 – we are just a little skeptical.

“Despite an uneven pandemic response and broader economic uncertainty, our global scope, diversification, and the team’s tireless execution delivered steadily improving results, with total company Gross Bookings down just 6% year-on-year in September,” said Dara Khosrowshahi, CEO. “Mobility Gross Bookings nearly doubled from Q2 levels and Delivery surged again to 135% year-on-year growth thanks to an increasing pace of innovation, which saw us launch new industry-leading safety technology; extend delivery offerings into groceries and prescriptions; bring Uber Green to more than 50 cities; and expand both Uber Pass and Eats Pass membership plans.”

Commenting on its business, the company said operations varied widely by geography, with mobility bookings recovering 94% from the prior period although the U.S. was a laggard only improving 75% quarter on quarter, leaving it down 60% year over year. That said, New York City was a standout as gross bookings doubled. West Coast markets such as San Francisco, Los Angeles and Seattle, were well behind the national average in their recovery.

ACcording to Bloomberg Intelligence analyst Mandeep Singh, “Even with a gross bookings run-rate of over $30 billion, Uber remains unprofitable in its Delivery segment, highlighting its continued reliance on driver incentives and lower take rates in the food delivery business.”

The stock dropped in kneejerk reaction following the modest topline miss, but has since regain much of the intraday loss.

via ZeroHedge News https://ift.tt/2JyxjKY Tyler Durden